Key Takeaways

- Immigrants and first-generation Americans face many barriers to financial literacy, including language and cultural differences.

- When coming to the United States, immigrants must understand the basics of banking, establishing good credit, filing taxes and gaining eligibility for Social Security benefits.

- Resources and support for financial literacy can be found online and in community groups.

What Is Financial Literacy?

Financial literacy means understanding and using personal finance principles and skills. These skills are essential to achieve financial wellness — which is the ability to live a healthy financial life.

Key components of financial literacy include:

- Budgeting

- Saving money

- Managing debt

- Maintaining a good credit score

- Using credit responsibly

- Planning for retirement

How Language and Cultural Barriers Impact Financial Literacy

For immigrants and first-generation Americans, speaking a different language or coming from another culture can impact their ability to gain financial literacy. Everything from opening a bank account to filing your taxes and saving for retirement can be a struggle for those who are unfamiliar with the American financial system, the English language or both.

“Different cultures have different attitudes toward money,” Isabel Pak, MBA, an immigrant and operations manager for the Law Offices of Jezic & Moyse, told Annuity.org. “I grew up thinking that I need to save my way for retirement because investing is too risky.” Cultural assumptions can heavily influence how immigrants approach finances and may restrict their ability to adjust to a new economic system in America.

Language can also pose a significant challenge to financial literacy. According to the Consumer Financial Protection Bureau, one in 12 people over the age of five in the U.S. have limited proficiency with the English language and many of these people have trouble accessing products and services from banks and lenders.

Besides reading financial documents (which can be difficult for even skilled English speakers to understand) those with limited English proficiency may also struggle with completing forms, managing accounts, resolving issues with their financial products and accessing financial education.

Understanding Personal Finance

Personal finance describes managing your finances over the short term and long term. Principles of personal finance overlap with the principles of financial literacy, including budgeting, spending responsibly, managing debt, investing and retirement planning.

Many immigrants and first-generation Americans come to the country in difficult financial situations and may have to build up their personal finances from very humble beginnings. First-generation Americans may also feel a responsibility to help friends and family back home once they get on their feet in the U.S.

Understanding and applying personal finance concepts can help immigrants set themselves up for working towards a prosperous financial future.

Budgeting and Saving Money

Creating a budget is an essential part of personal finance for anyone, not just immigrants and first-generation Americans. When you make a budget, you’re planning where your money is going to go — from the highest priority to the lowest.

The first step to creating a budget is determining how much money you make each month. Once you know your income, you can start tracking your expenses. For one month, write down every amount of money you spend and what you’re spending it on.

Once you’ve gathered data on how much money you make and spend, you can set up a budget with realistic goals for how much you need to spend on essentials like rent, gas and groceries; how much to spend on “wants” like restaurants, entertainment and travel; and how much to put into savings each month.

If you’re not sure how much to assign to each part of your budget, you can research different budgeting strategies from financial experts to help guide your budgeting decisions. A popular budget principle is the 50/30/20 rule, which proposes budgeting 50% of your monthly income for essential expenses, 30% of your income for nonessential expenses and putting the remaining 20% into savings.

Emergency Funds

The first big personal finance goal many experts recommend is building an emergency fund. An emergency fund contains a significant amount of cash savings that you can tap into in the event of financial turmoil, like losing your job or being hospitalized.

Most experts recommend keeping an emergency fund worth at least six times your monthly income. A six-month cash supply gives most people enough time to recover from a financial shock, and it’s not so much money as to be unattainable for many people.

Even a fund of a few hundred dollars can make a difference if you live with financial instability. The Financial Industry Regulatory Authority reports that simply having $100 to $250 of savings increased the likelihood of financial stability in low-income households.

What Is Banking?

Opening a bank account can be an important first step to establishing your finances in a new country. “The bank is one of the first places to gain financial literacy,” Sheilla Vidal, an immigrant from the Philippines and an insurance broker, told Annuity.org.

When you put your money in a bank, your cash is protected from theft or natural disasters and insured by the federal government. Banks also offer convenient access to your money as well as other financial products like credit cards, loans, lines of credit or certificates of deposit (CDs).

Types of Bank Accounts

Most people have more than one bank account. Different accounts are designed for different purposes. Some people find it easier to manage their money by having several accounts for different financial goals.

- Checking Account

- A checking account is used to easily access your money on a regular basis. You can withdraw funds at any time with no restrictions, and usually the account comes with a debit card for purchases or withdrawals.

- Savings Account

- A savings account is a place to store extra cash you don’t plan on accessing right away. Savings accounts typically earn higher interest than checking accounts but they may have limits on how often you can withdraw funds.

- Money Market Account

- A money market account is a type of savings account that gives owners more freedom to withdraw money. You still earn interest on a money market account, but you can also write checks or use a debit card.

Types of Bank Accounts

Building Credit and Managing Debt

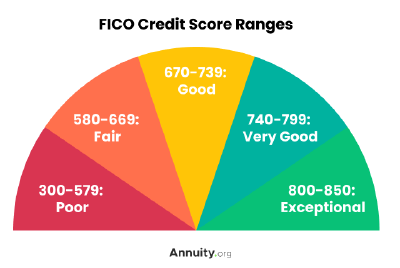

Establishing good credit is vital to achieving financial wellness. Your credit score affects your ability to qualify for credit cards, mortgages, loans and other forms of credit. Simply renting an apartment or getting a job can be more difficult for those with poor credit scores.

Credit Score and Credit Reports

Your credit score is a number that expresses how trustworthy you are to lenders. Scores are calculated based on your history of paying bills on time and paying back debts, how much of your available credit you use and how recently you applied for credit.

You can build your credit score by paying your bills on time and making regular payments on any loans or outstanding debts. If you have credit cards, keeping your balance below 30% of your credit limit is also a good way to improve your credit score. The length of your credit history also impacts your score, so keeping up good credit habits over time will eventually boost your score.

Your credit history is listed on your credit report, which lenders will sometimes use alongside your credit score to approve you for new credit. You can request a copy of your credit report for free from each of the major credit bureaus — Equifax, Experian and TransUnion — once a year by visiting AnnualCreditReport.com.

If you do decide to view your credit report, be sure to check it for accuracy. Credit reporting mistakes are not unheard of and they can seriously hurt your credit if not corrected. Any inaccuracies on your report will require you to submit a dispute letter to the credit bureau so they can investigate it.

The FICO score is one of the most popular brands of credit score and ranges from 300 to 850. A “good” FICO score is generally anything above 670. A FICO score between 740 and 799 is “very good,” and any score over 800 is considered to be “exceptional.”

Managing Debt

Some people believe that going into debt is always a bad thing, but there are cases where taking out a loan or making a purchase on credit can be beneficial to your personal finances.

Essentially, there are “good” or “bad” debts. A good debt might be something like taking out a mortgage so you can purchase real estate or getting an auto loan to help you get reliable transportation for work.

Debt becomes problematic when it’s caused by spending more money than you make. If you’re struggling to pay your bills and manage your finances from month to month, that could be a sign that you have too much debt.

If you have too much debt, you can start to get out of it by budgeting and altering your spending habits. You can reduce your spending so that you take on less debt and have more money to put towards paying down the debt you already owe.

There are also products and services designed to help people get out of debt. These include balance-transfer credit cards, debt consolidation loans and debt settlement services.

Learn More: Common Mistakes To Avoid If You’re New to Credit

Understanding Tax Planning and Filing

Filing your taxes for the first time is a major adjustment for many immigrants and first-generation Americans. “My first shock was to realize that in the U.S., you are responsible for your own taxes,” Pak said.

Pak explained that in many other countries, the taxes you owe are simply billed to you by the government. “This is why tax planning for immigrants is crucial when trying to minimize tax liabilities,” Pak said.

For more information on how the American tax system works, check out Annuity.org’s resources:

- Taxes

- Tax Brackets

- Tax Deductions

- Tax Exemptions

- Average Tax Refund and How To Invest It

- Residency Requirements by State

Types of Taxes

There are a few different types of taxes levied by the U.S. government. In addition to federal taxes, the state or city you live in may also impose taxes.

- Income Tax

- Income taxes are applied to a percentage of your income and can vary based on how much money you make. The federal government collects income tax, as do many states and municipalities.

- OASDI Tax

- The OASDI tax is one portion of federal income tax. This tax is collected to pay for Social Security, disability and survivor benefits.

- Property Tax

- Property taxes are collected by state and local governments based on the value of your home or real estate. These taxes are used for local public services like schools, parks and road maintenance.

- Capital Gains Tax

- This is a tax imposed on the profit someone makes when they sell a stock, mutual fund, real estate or other taxable asset.

- Estate Tax

- Estate tax is paid on the property that’s transferred to your heirs after your death.

- Sales Tax

- Sales tax is applied automatically when you purchase a good or service from a retail business. The sales tax rate can vary by state and municipality.

Types of Taxes

Tax Preparing and Filing

It’s important to understand that even if you are not a U.S. citizen, you still need to pay taxes. Once you obtain a green card, you are considered a U.S. tax resident for income tax purposes. This means that if you work and earn income, you must pay taxes on that income to the IRS.

U.S. tax residents must also pay estate and gift taxes. The federal law also requires U.S. tax residents to report all foreign income, including income from trusts, banks or securities accounts in other countries.

Planning for Your Financial Future

Once you establish basic financial security with a bank account and a line of credit, you can take the next steps toward planning for your financial future. This includes things such as getting set up to start working and planning for retirement.

Work & Social Security Benefits

When it comes to legally working in the United States, “petitions are the first part of advocacy,” Belia Peña, a Texas-based immigration attorney, told Annuity.org. Once the petition is submitted, Peña explained, the immigrant can apply for a work permit.

When applying for a work permit, also consider applying for a Social Security number (SSN). This identifying number is required to begin accumulating Social Security work credits, Peña said.

Social Security is a public benefit system for disabled and retired workers. During your working life, a Social Security tax is deducted from your paychecks by the federal government.

When you retire, or if you become disabled and can no longer work, you’ll receive monthly cash benefits based on the amount of money you earned during your working years. The more money you earned and paid the Social Security tax on, the greater your benefit will be.

Social Security benefits are a major component of many Americans’ retirement plans. Without it, many people may find it difficult to continue paying their bills once they can no longer work. Getting a Social Security number should be a top financial priority for immigrants and first-generation Americans, so that way you can start earning work credits

Retirement Accounts

Though Social Security is essential to most Americans’ retirement, it isn’t the only source of income for most retirees. In addition to paying Social Security taxes, many American workers contribute to some kind of retirement account.

When you contribute to a retirement account, the money you put in the account is invested into assets such as stocks, bonds, mutual funds and exchange-traded funds. By investing your money instead of saving it, you can potentially grow your savings over your working life so you’ll have enough money to retire.

The two main types of retirement accounts are employer-sponsored accounts and individual retirement accounts (IRAs). An employer-sponsored retirement account is one you contribute to through an employer. An IRA account can be opened at a brokerage firm or bank and is managed by the individual who opened it.

You can learn more about retirement accounts by visiting Annuity.org’s retirement section:

- Retirement

- Planning for Retirement

- The Four Percent Rule

- Retirement Risks

- Retirement Annuity

- 401(k) Plan

- 403(b) Plan

- Individual Retirement Account (IRA)

Resources for Financial Literacy and Support

Immigrants and first-generation Americans can find an abundance of information and resources to help them navigate the American financial system. Some great resources can be found with non-profit organizations and specialized financial and legal professionals.

Financial Advisors

Consulting with a financial advisor can be a huge help for anyone who wants to improve their financial stability and understanding of personal finance concepts. If you’re an immigrant or first-generation American, you may want to seek out an advisor who specializes in helping people in similar circumstances get on their feet in a new country.

Financial advising services custom-made for immigrants include:

- Immigrant FinanceTM

- Immigrant Finance offers financial education services for new immigrants from an immigration lawyer and Accredited Financial Counselor.

- International Rescue Committee Financial Coaching

- The IRC provides services to refugees, asylees and other immigrants, including free financial coaching from volunteers.

Support Organizations

In communities with a large immigrant population, you can usually find organizations that provide support to new immigrants and first-generation Americans. Many state and local advocacy groups offer services including legal assistance, civic engagement, language lessons and community care resources.

A few major support organizations for immigrant communities include:

- CASA

- First Friends of New Jersey and New York

- Florida Immigrant Coalition

- Immigrants Rising

- New York Immigration Coalition

- RAICES Texas

- The Coalition for Humane Immigrant Rights

Nationwide and Online Financial Literacy Resources

No matter what community you live in, you can access financial literacy resources from anywhere in the country using the internet. Here are some helpful online resources for learning about personal finance topics.

Online Financial Literacy Resources

- America Saves

- Consumer Financial Protection Bureau

- Employee Benefits Security Administration

- Federal Trade Commission Consumer Advice

- Financial Industry Regulatory Authority

- MyCreditUnion.gov

- MyMoney.gov

- Operation Hope

- U.S. Securities and Exchange Commission

- La Raza Financial Empowerment Program

Editor Malori Malone contributed to this article.