Key Takeaways

- Your 20s are critical for improving financial literacy and securing financial health.

- Understanding financial literacy in your 20s involves focusing on essential components crucial for navigating this life stage effectively, including education funding.

- Overcoming limited income is a surmountable challenge with strategic budgeting, income optimization and prioritizing financial goals.

- Students can actively influence their education by advocating for enhanced financial literacy programs in schools, recognizing the importance of financial stability for their peers.

The Financial Literacy Gap

Financial knowledge is significantly linked to financial outcomes. However, the overall level of financial knowledge in the United States leaves much to be desired. On average, only 32 percent of U.S. adults possess high financial knowledge. High financial knowledge is defined as correctly answering at least four of five financial knowledge assessment questions. This distribution includes approximately 47 percent of Asian American and Pacific Islander (AAPI) adults, 36 percent of white adults, 23 percent of Hispanic adults and 14 percent of Black adults, which highlights the demographic disparities that exist.

A 2023 study commissioned by Next Gen Personal Finance (NGPF) and led by Dr. Carly Urban examined course catalogs from over 12,000 public high schools across the United States, serving over 12 million high school students. The research underscores concerning racial and income disparities in states where personal finance courses are not mandated for graduation, leaving the decision to local school districts.

In states without a mandatory personal finance course, predominantly minority high schools face a mere 7% likelihood of having a local graduation requirement for such a course. In contrast, primarily white high schools are more than twice as likely, with a 14.2% chance of having a local graduation requirement.

The disparities persist when considering high school income levels. Predominantly affluent schools are over twice as likely as predominantly low-income schools to have a local school district graduation requirement for a personal finance course (11.4% compared to 4.6%, respectively).

This research sheds light on the need for equitable access to financial education, revealing disparities that disproportionately impact minority and low-income students in states without mandatory personal finance graduation requirements, which can affect a student’s ability to achieve their money goals and fund their college education.

I have first-hand experience of the lack of knowledge young people have about financial literacy. My daughter recently started her first job post-college. We spent hours, thankfully upon her request, discussing the foundation of financial planning, which included budgeting, tracking spending, emergency savings, investing and saving for retirement – just to name a few of the topics that were addressed. She is blessed to attend a high-performing school that has been repeatedly ranked as one of the top schools in the country and a very selective university. She wondered why this financial literacy was not discussed in high school, even in college.

Funding Your Education

In the complex landscape of educational funding, diverse aid options cater to individual needs. From need-based scholarships addressing financial constraints to merit-based ones recognizing achievements, students navigate a spectrum of support. Direct Government Loans, comprising subsidized, unsubsidized and PLUS Loans, offer structured financial assistance, while private loans provide an alternative, demanding careful consideration. Crafting a comprehensive financial plan involves a balanced mix of scholarships, grants and loans tailored to each student’s unique circumstances.

Need-Based Scholarships

Need-based scholarships are a crucial resource for students facing financial constraints. These scholarships consider an individual’s financial need, often determined by factors such as family income, to provide financial assistance for education. Organizations, institutions and government programs may offer need-based scholarships to ensure deserving students can access educational opportunities.

Merit-Based Scholarships

Merit-based scholarships reward students for exceptional academic, extracurricular or leadership achievements. These scholarships focus on recognizing and supporting outstanding individuals, regardless of their financial need. Academic institutions, private organizations and foundations frequently offer merit-based scholarships to encourage and invest in the educational pursuits of high-achieving students.

Direct Government Loans

Direct Government Loans are awarded by completing the FAFSA and come in three primary forms.

Types of Direct Government Loans

- Subsidized Loans

- Subsidized loans are a type of federal student loan where the government covers the interest while the borrower is in school, during the grace period and authorized deferment periods. These loans are need-based, providing additional financial support for students with demonstrated financial need.

- Unsubsidized Loans

- Unsubsidized loans, also federal student loans, accrue interest while the borrower is in school. Unlike subsidized loans, the government does not cover the interest during certain periods. Both undergraduate and graduate students can qualify for unsubsidized loans, regardless of financial need.

- PLUS Loans

- Parent PLUS Loans and Grad PLUS Loans are federal loans available to parents and graduate students, respectively. These loans cover educational expenses not met by other financial aid. PLUS Loans are credit-based, and the borrower is responsible for repaying the loan and any accrued interest.

Private Loans

In addition to federal loans, students may consider private loans offered by financial institutions. These loans are not government-backed and often require a credit check. While they provide an alternative funding source, it’s essential to carefully review the terms and interest rates, as they may vary among private lenders.

Navigating education funding options requires careful consideration of individual circumstances, financial goals and eligibility criteria. Students are encouraged to explore a combination of scholarships, grants and loans to create a well-rounded financial plan for their education.

Federal Student Loans vs. Private Student Loans by the Numbers

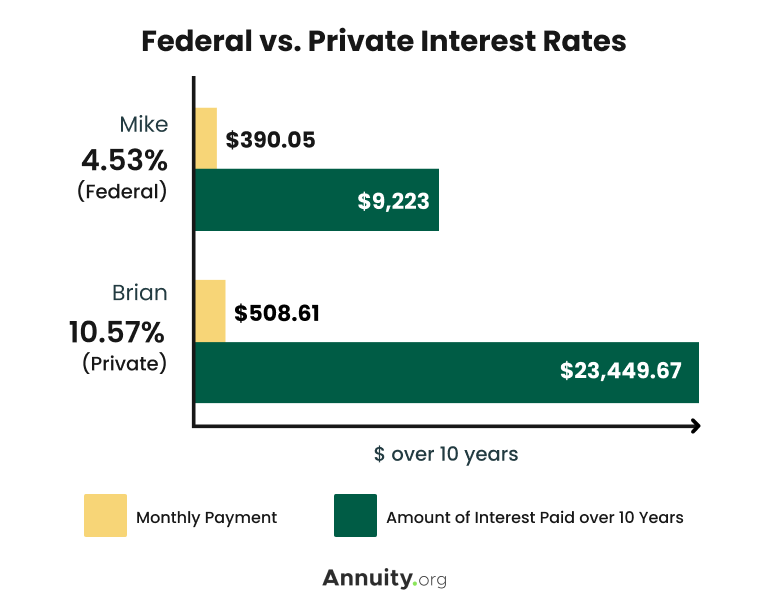

Take these two students, Mike and Brian. Both attended the same school and accepted loans for $37,584 each, the average amount borrowed by students in 2020.

7 out of 10 college students will graduate with student loan debt , which can have a long-term impact.

Mike took out a loan with the average interest rate offered by Federal Stafford Loans, 4.53%, and deferred interest until graduation. After college, it will take him ten years of making monthly payments of $390.05 to pay off the loan amount. In the end, Mike will have paid $9,223 in interest. Mappingyourfuture.org estimates that he will need an annual salary of at least $58,508 to afford those loan payments comfortably.

Now, let’s take Brian. He’s paying an interest rate of 10.57%, a rate that’s on the high end for private loans but not unheard of. It will take him ten years of making monthly payments of $508.61 to pay off the total amount of the loan. In sum, Brian will have paid $23,449.67 in interest — more than double what Mike paid.

Alt text: Graph showing the difference between federal and private student loans

And there’s more bad news for Brian. Finaid.org estimations say that Brian would need to make at least $76,292.09 per year to make those payments comfortably — and the average starting salary for a 2023 college graduate is $55,260.

Investing in Financial Literacy in Your 20s

Your 20s mark a crucial period for shaping your financial future. This decade is about navigating the transition into adulthood and laying the groundwork for financial success. In your 20s, you’re not just starting a career or pursuing further education; you’re building the foundations of your financial house. Every decision you make has a ripple effect on your future financial well-being.

Your 20s also offer a unique advantage for taking calculated risks with your life and investment decisions. This time is all about flexibility and experimentation, finding your way and figuring out what you want to do in life, often without some additional responsibilities like taking care of a family that may make safety and stability your primary goal. From an investing and money perspective, starting early also gives you the advantage of easily weathering market fluctuations and potentially benefiting from higher-risk, higher-reward investment opportunities.

Key Components of Financial Literacy

As a CERTIFIED FINANCIAL PLANNER™ professional and a dedicated money coach for young adults, I’ve developed the MUSICAL Method™ for Financial Success, a comprehensive framework designed to guide those in their 20s through various aspects of their finances.

Money Mindset

Understanding Your Cash Flows

Securing Your Financial Foundation

Investing for Your Future

Credit Building

Adulthood’s

Life Stages

Money Mindset

Understanding your relationship with money is the foundational step in achieving financial literacy. Explore your beliefs, attitudes and habits related to money. A positive money mindset sets the stage for making informed and empowering financial decisions.

Understanding Your Cash Flows

Creating a comprehensive budget or spending plan is critical to understanding your income and expenses. This clarity is crucial for making informed financial decisions and avoiding unnecessary debt.

Transitioning from an in-school budget to a post-grad budget involves several adjustments to accommodate new financial responsibilities and lifestyle changes. From changes in income to budgeting for student loan repayment, changes in housing expenses (especially if moving to a new city for work), getting your own health insurance, balancing socialization with friends and colleagues and creating room for important financial goals like saving and retirement can be a challenge. However, proper planning, a relentless focus on prioritizing your financial goals and a spirit of adaptability to new economic realities will all contribute to a successful and sustainable financial transition.

Securing Your Financial Foundation

A solid financial foundation involves establishing an emergency or rainy day fund and securing appropriate insurance coverage. An emergency fund provides a safety net for unexpected expenses, while insurance protects you from potential financial setbacks.

For a new college graduate, embarking on a financial independence journey involves strategic and practical approaches to saving. Begin by establishing SMART financial goals to provide you with a clear direction and action plan. Consider setting up automatic monthly transfers to a dedicated savings account to ensure consistency. Additionally, explore high-yield savings accounts to make your money work harder.

Additionally, it’s crucial to include careful planning for managing and addressing any existing debts as part of your overall financial strategy. Begin by fully understanding your outstanding obligations, including student loans, credit cards and anything else you might owe. Prioritize tackling high-interest rate debt first, as this minimizes the money you’ll pay in interest over time. Leverage available student loan flexibilities, such as income-driven repayment plans, to align payments with your financial capacity. Explore various repayment plans and choose one that best suits your income level and future goals. Consider consolidating or refinancing loans to potentially secure lower interest rates. Also, allocate a portion of your budget for debt repayment, ensuring consistent progress.

Engaging with financial professionals or utilizing online tools can provide valuable insights and guidance. By devising a well-informed plan and following it diligently, you can efficiently manage and reduce your debt burden while laying the groundwork for a financially sound future.

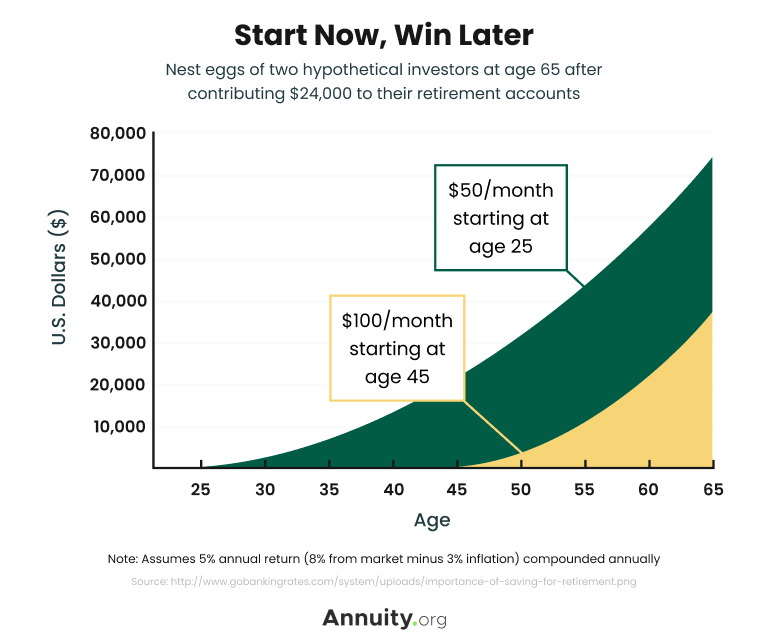

Investing for Your Future

In my early 20s, I faced the challenge of limited income but recognized the importance of investing for the future. I embraced a disciplined savings approach and started with small, consistent contributions to a retirement account. Over just a few years, these initial investments grew substantially, showcasing the power of early and consistent financial planning. Investing can seem intimidating at times. However, you only need a little money and knowledge to get started. The earlier you start, the more you can benefit from the compounding of returns.

Explore various retirement savings options tailored for college graduates in their 20s:

- If your job offers a 401(k), aim to contribute from day one. If you receive raises or bonuses, set a goal of putting a portion of that raise toward your 401(k). That way, you’ll never miss the money.

- Depending on your personal goals, you may choose to purchase an annuity to secure your income in retirement. Although most annuity buyers are older, a variable annuity could offer you retirement income and the opportunity to grow your money.

- Roth IRAs are another worthy option if your company doesn’t offer an employer-sponsored retirement plan. This account can open up investment options like index funds and mutual funds that you might use to grow your money.

Credit Building

Understand the significance of a good credit score. Establish and maintain healthy credit habits to open doors to favorable interest rates on loans and credit cards. Regularly monitor your credit report to ensure accuracy and address any discrepancies promptly.

During college, many individuals receive credit card offers in the mail, tempting them with the promise of “free money” and various benefits. Nevertheless, it’s essential to keep a few factors in mind:

- Credit card companies report late payments to the credit bureau, which can negatively impact your credit before you even begin your career.

- Missed or late credit card payments can impact the interest rates you qualify for on significant future purchases, like a car or a home.

While credit cards can be crucial for building credit, they can also result in costly mistakes. Credit card companies charge a type of interest called APR, or annual percentage rate.

As of August 2023, The Federal Reserve reported that the average credit card interest rate in the U.S. for accounts with assessed interest was 22.77%. To put it into perspective, if you charge $1,000, you could end up spending $227.70 in interest over the course of a year if you carry that balance.

On the flip side, there’s a potential payoff in building your credit early. Up to 15% of your credit score is determined by the length of your credit history. A recommended strategy for managing your credit card is to make a few monthly charges, such as your Netflix and Spotify subscriptions, and set up autopay to ensure the balance is paid off each month.

Adulthood’s and Life Stages

Recognize that adulthood has different life stages, each requiring specific financial considerations. Whether entering the workforce, pursuing further education, starting a business or starting a family, adapt your financial strategy to align with your current life stage.

Working With Limited Income

It’s common for students and recent graduates in their 20s to face financial constraints, whether due to student loans, entry-level salaries or other challenges. While the road may seem tough, don’t let a limited income keep you from progressing. Focus on optimizing your spending plan, finding additional income streams, seeking financial education opportunities and prioritizing financial goals.

Strategic Budgeting

When working with a low income, it’s important to identify and prioritize essential expenses, such as rent, utilities and groceries. In this stage, it’s okay to evaluate discretionary spending ruthlessly. Where possible, opt for cost-effective alternatives without compromising your lifestyle.

Find Additional Income Streams

Leverage your skills and hobbies for additional income. Explore part-time job opportunities or freelance work that, ideally, is related to your field of study. Whether it’s graphic design, writing or tutoring, there are platforms where you can monetize your talents. For example, online platforms offer various gigs that can complement your income.

As a student, juggling a job with schoolwork can be challenging. Still, the additional income can significantly impact your financial situation.

Educational Opportunities

Embrace the mindset of continuous learning. Take advantage of free online courses to enhance your skills and employability. Explore resources at your local library or university. Books, workshops, seminars and even carefully curated and fact-checked social media content can also provide valuable insights at no cost.

Prioritizing Financial Goals

As young adults, we often want to conquer the world in a day and have various goals we wish to achieve simultaneously. However, it’s essential to prioritize. Break down your financial goals into manageable steps. Small achievements lead to significant progress, whether building an emergency fund or paying off a credit card.

Remember, progress is progress, no matter how small. Celebrate your achievements, seek support when needed and embrace the journey toward financial well-being.

Advocating for Financial Literacy in Schools

Financial stability is a significant challenge for some students, particularly those from underrepresented communities. In a 2020 study, 74% of college students reported feeling stressed about their personal finances. In a separate study, 86% of respondents agreed or strongly agreed that their institution should be more involved in helping them understand personal finance. Most college students want their colleges to offer financial literacy and wellness programs.

As a student, you can play a role in advocating for better financial education in schools. Voice your concerns to teachers and administrators, join or form a financial literacy club, organize awareness campaigns, leverage social media or school publications, collaborate with student government, start a petition or collaborate with alum networks.

By actively engaging in the conversation, you contribute to improving financial literacy programs for yourself and future students.

Negotiating a higher salary as a recent graduate involves preparation and confidence—research industry salary standards for your position and location to establish a reasonable baseline. Emphasize your skills, achievements and relevant internships or experiences during the negotiation. Practice articulating your value proposition and be prepared to discuss how your skills align with the employer’s needs. Negotiation is a standard part of the hiring process, and a well-presented case can lead to a more favorable salary.

The ideal savings account for a student or recent graduate often includes features like low fees, accessibility and a competitive interest rate. Look for accounts with no monthly maintenance fees and easy online access. Consider online banks, credit unions or financial institutions that offer student-friendly accounts with perks like mobile banking, low minimum balances and ATM access. Compare options to find an account that aligns with your financial needs and provides a platform for building your savings effectively.

While a good credit score typically falls in the 700+ range, it’s very common for students to start below this mark as they establish credit for the first time and build their scores. To develop and maintain a positive credit score over time, focus on timely bill payments, keeping credit card balances low and avoiding excessive new credit applications.

Building a positive credit history quickly involves a combination of responsible financial habits. Consider obtaining a credit card, such as a secured or student-targeted credit card, and using it responsibly by making timely payments and keeping balances low. You could also become an authorized user on a family member’s account to benefit from their positive credit history, though this does come with risks. Regularly check your credit report for accuracy and address any discrepancies promptly. Consider diverse credit types, such as installment loans, to showcase responsible credit management. Building credit takes time, so be patient and consistent in your efforts.

According to the Education Data Initiative, the average federal student loan debt in 2023 is $37,338 per borrower. Private student loan debt averages $54,921 per borrower. However, these numbers can significantly differ based on the type of degree, the institution attended and individual financial circumstances. It’s crucial to be mindful of your borrowing and explore options such as scholarships, grants and work-study programs to minimize reliance on student loans.