Half of U.S. households are at risk of not having enough income to maintain their standard of living in retirement, according to the Center for Retirement Research at Boston College.

Americans nearing retirement face uniquely different challenges than past generations.

Most people can no longer rely on the pensions many workers in prior decades enjoyed. At the same time, stagnate wages and job insecurity have grown more common.

“Especially since 2000, we’ve seen a shift in the economic environment,” said Christian Weller, a professor of public policy at the University of Massachusetts Boston and a senior fellow at the Center for American Progress. “The cost and risks of planning for retirement are now the employee’s responsibility.”

Volatility in housing prices and the stock market as well as unequal access to employer-sponsored retirement plans have made the tasks of saving and long-term financial planning daunting.

“People are living longer and have better health care than in the past,” Weller told Annuity.org. “But this means retirees need to pay for more health care for longer. Just because people live longer doesn’t mean they can work longer.”

These and other factors — including meager Social Security benefits and inadequate savings — paint a worrisome picture for millions of Americans set to retire in coming years.

How Often Do Americans Run Out of Money in Retirement?

About 40 percent of all U.S. households where the head of the household is between 35 and 64 are expected to run short of money in retirement, according to a 2019 report by the Employee Benefit Research Institute.

It’s only a projection but studies on current retirees reveal similar results.

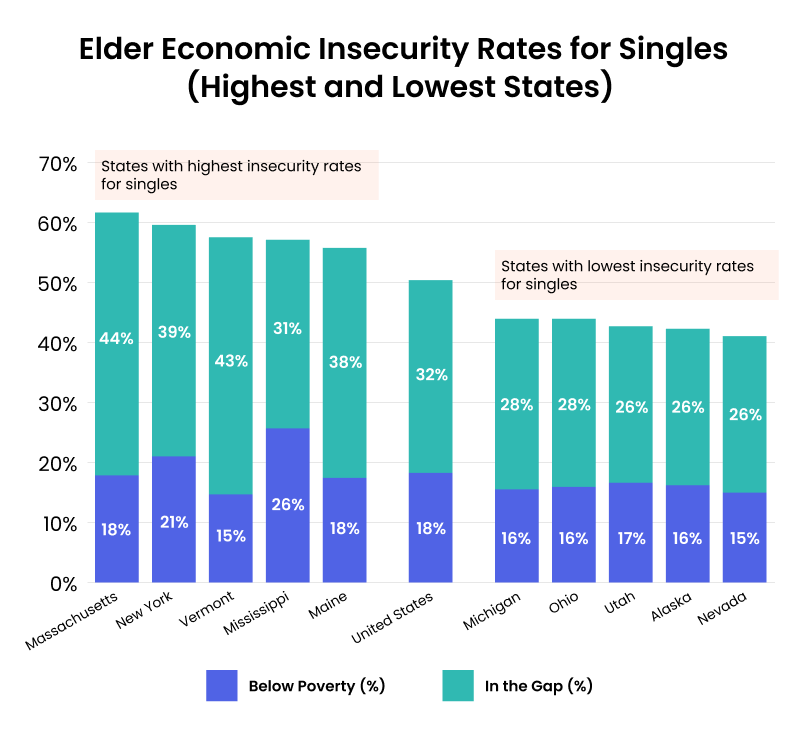

Half of Americans over age 65 who live alone lack the resources to maintain independence and meet their daily living costs, according to a 2019 report from researchers at the University of Massachusetts Boston.

The report draws data from The Elder Index, an ongoing research project that measures the income older adults require to cover their basic needs.

While some seniors may escape the traditional definition of poverty, the 2019 study illustrates how many still grapple to make ends meet.

Researchers found that while 18.2 percent of older single adults had incomes below the federal poverty line, another 32.1 percent “live above the poverty level yet still have income less than what is required to live with economic security.”

“The ‘circle of concern’ cannot be limited to impoverished older adults. A large proportion of every state’s independent older adults lack incomes that would allow them to escape the threat of poverty, to remain independent and to age in their own homes.”

— “Living Below the Line: Economic Insecurity and Older Americans, Insecurity in the States 2019,” a 2019 report from the Gerontology Institute at the University of Massachusetts Boston.

Retirees in this gap often have too much money to qualify for government assistance programs, yet not enough money to be able to cover their essential needs sustainably and with dignity.

The Difference Between ‘Running Low’ and ‘Running Out’

Running out of money in retirement implies someone has tapped all their retirement savings and home equity.

Running low on money in retirement, on the other hand, can mean a reduction to your current standard of living — but not necessarily a descent into full-on poverty.

Americans can rely on at least one source of guaranteed income in later life: Social Security.

About 90 percent of U.S. retirees receive Social Security benefits, which often serve as a stopgap to elder indigency. In fact, Social Security lifts more Americans above the poverty line than any other program, according to the Center on Budget and Policy Priorities.

“The good news is Social Security is a very stable source of income,” said Christine Benz, director of personal finance at Morningstar. “The bad news is it’s just not enough for many households to make do on.”

DID YOU KNOW?

Among elderly Social Security beneficiaries, about 45 percent of single adults and 21 percent of married couples rely on Social Security for 90 percent or more of their income.

Source: Social Security Administration

Because modest benefits alone are unlikely to keep you afloat, some retirees take on a part-time job to supplement income. Others naturally slow spending as resources dwindle.

“People recognize the need to make course corrections to what they’re spending and what their reality is,” Benz told Annuity.org. “That certainly carries over into retirement.”

A September 2020 report by the Defined Contribution Institutional Investment Association suggests that people tend to “right size” their spending — at least in early retirement — to preserve resources.

“While the households with the lowest initial funded ratios had the largest drop in consumption, all groups exhibited reductions in real spending.”

— “Right-Sizing Retirement: Exploring the Retirement Consumption Gap in Early Retirement,” a 2020 report from the Defined Contribution Institutional Investment Association.

But the report has its limitations. The poorest U.S. households weren’t represented. And co-authors David Blanchett and Warren Cormier admit that it’s still unclear if people reduce consumption in early retirement because they want to — or because they have to.

Many Americans may not go completely broke in retirement, but the fear of running out is real.

According to a February 2021 research report by the National Institute on Retirement Security, 56 percent of respondents said they are concerned about achieving a financially secure retirement.

Nearly two-thirds — 68 percent — of Americans said the average worker can’t save enough on their own to ensure a stable retirement.

“It’s a common fear certainly, but it doesn’t always square with the actual situation,” Benz said.

Running out of money in retirement is a big concern for obvious reasons. However, there’s a lot of variation. For example, someone who runs out of money at 95 but has 90% of their expenses covered by guaranteed income sources like Social Security, pensions and annuities is a lot better off than someone who runs out of money at 70 with only 50% of their living expenses covered by guaranteed income.

What Causes People to Run Out of Money?

People face numerous risks in retirement. People with limited resources are especially susceptible to these risks.

A July 2020 study from the Center for Retirement Research at Boston College identified several of the biggest factors that cause people to run out of money in later life.

Shifting from Pensions to 401(k)s

Dramatic changes in the U.S. retirement landscape have shifted the responsibility of saving for retirement from employers to individual workers.

Pensions, once common at millions of jobs, are increasingly rare.

From 1980 to 2008, the percentage of private wage and salary workers participating in defined-benefit pension plans fell from 38 percent to 20 percent, according to Department of Labor data.

By 2020, just 15 percent of private employers offered pensions to workers.

Some products, such as annuities, can replicate the fixed nature of pension income payments. But by and large, defined contribution accounts — such as 401(k)s — have taken the place of pensions.

Defined contribution accounts have their drawbacks. Research shows that workers often fail to participate, do not contribute enough money, experience too much stock market volatility and withdraw too much from defined contribution plans during their working years.

If the markets drop or 401(k) investments underperform, employees can lose money — with no guarantee from an employer to fall back on.

Another major issue is unequal access.

In 2020, about 33 percent of private industry workers had no access to any employer-provided retirement plan.

“It’s not that lower wage workers don’t want to sign up. They may not have access.”

— Christian Weller, professor of public policy at the University of Massachusetts Boston and senior fellow at the Center for American Progress.

The disparity was especially striking across income levels: 88 percent of the highest wage earners had access to a retirement plan, while just 42 percent of workers earning the lowest 25 percent of wages had access to a plan.

“It’s not that lower wage workers don’t want to sign up,” Weller said. “They may not have access. Or they simply have more demands on their money and more outside obligations that make it challenging to put money aside.”

DID YOU KNOW?

In 2020, just 55 percent of American workers participated in either a defined-benefit or defined-contribution plan at work.

Source: Congressional Research Service

People can still open their own individual retirement account (IRA) even if their employer doesn’t offer a 401(k).

But the reality is “very few people do — only about 10 percent,” Weller said.

It’s not because people are lazy or unconcerned about saving money.

“It’s complex if you don’t have any investing experience,” he said. “People are more likely to sign up for a 401(k) at work because their employer takes care of everything.”

Claiming Social Security Early

Increases to the Social Security retirement age have also translated to income cuts for Americans who opt to receive these government benefits before their full retirement age.

Workers can claim Social Security benefits at age 62, but payouts are permanently reduced for those who do.

Americans born in 1960 and later who opt to receive benefits at age 62 will face a 30 percent lifetime reduction in their Social Security checks. Those who retire at age 65 will face a 13 1/3 percent reduction.

While Social Security penalizes people who claim early, the program incentivizes those who delay signing up.

Payouts increase by a certain percentage each month you wait to claim Social Security past full retirement age. The additional benefit maxes out at age 70.

For those born in 1960, Social Security benefits increase 24 percent between 67 and 70.

This means Americans born in 1960 or later who claim Social Security at age 62 will receive 54 percent less money per month than workers who wait until age 70.

DID YOU KNOW?

In 2021, the average Social Security retirement benefit is $1,544 a month, or $18,528 a year.

Source: Social Security Administration

Despite the financial boost of delaying, 33 percent of newly retired workers in 2019 claimed Social Security as soon as possible at age 62. It’s by far the most popular age to sign up.

Tapping Social Security early can create ongoing financial woes for retirees — especially those with lower incomes.

“By taking early Social Security, you are compromising that monthly payment,” said Kimberly Zimmerman Rand, an accredited financial counselor and principal at Dragonfly Financial Solutions in Boston. “If you don’t have income from other sources, like a pension or 401(k), then it really limits your monthly finances.”

However, not everyone has the luxury of waiting. Some workers are forced into early retirement due to poor health or job loss.

“They may not really have a choice,” Zimmerman Rand told Annuity.org.

Rising Health Care and Other Costs

As the onus of retirement planning has shifted from employers to workers, Americans are facing rising costs.

Housing, health care and long-term care expenses continue to increase, often outpacing inflation.

According to research from Fidelity Investments, the average retired couple turning 65 in 2021 will need $300,000 after taxes to cover health care costs for the rest of their lives.

Medicare covers some — but not all — health care costs in retirement. And the federal health insurance program available to adults age 65 and older isn’t free. Monthly premiums, copays at the doctor’s office and other out-of-pocket expenses can quickly add up to thousands of dollars a year.

DID YOU KNOW?

Older adults on Medicare spent an average of 14 percent of their income on health expenses in 2016 — more than double that of non-Medicare households.

Source: Kaiser Family Foundation

Trying to budget for future health care costs is challenging. Financial experts suggest focusing on saving money and managing the expenses within your control.

“Because future health care spending is such a nebulous goal, try to shore up your other cash flow needs to make the rest of your personal finances as solid as possible,” Zimmerman Rand said. “At least that way you’re walking into retirement with your eyes open.”

Who Is Most Likely to Run Out of Money in Later Life?

How poverty is distributed among the elderly varies, disproportionately affecting some groups more than others.

Subgroups Most Likely to Experience Poverty in Older Age

- Women

- Older women are more likely to live in poverty than older men for several reasons. First, women live longer than men on average, making women more vulnerable to inflation and longevity risk. Second, women tend to earn less than men during their careers and often take time out of the workforce for caregiving. This can result in lower Social Security and employer-sponsored retirement benefits.

- Retirees Age 80 and Older

- The oldest group of retirees — people age 80 and older — have higher poverty rates than their younger counterparts. Research suggests that this group may be more vulnerable because they are less likely to work, more susceptible to fraud and face higher medical expenses.

- Single People

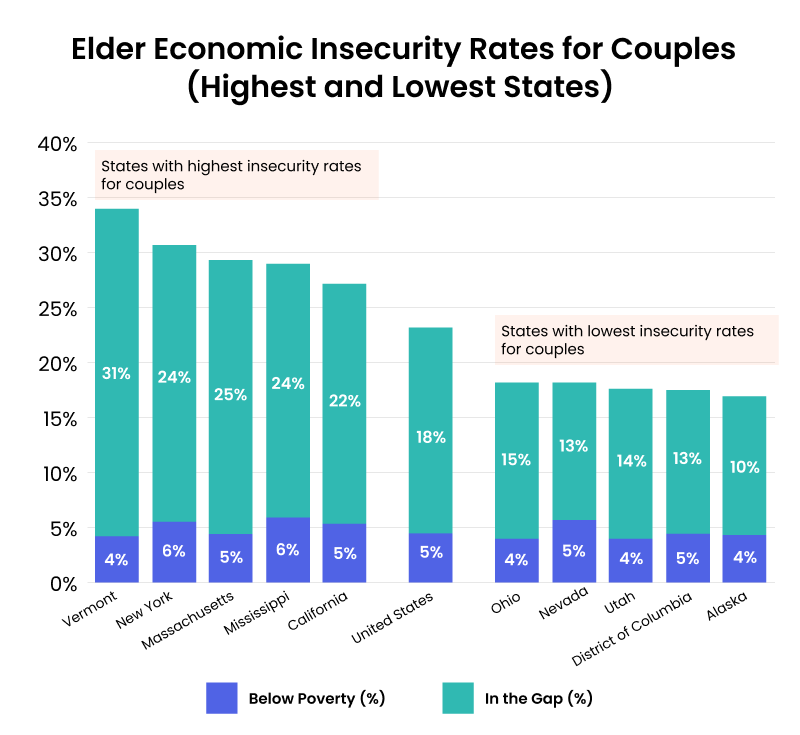

- Married couples typically have much lower poverty rates than nonmarried retirees. Widowed and divorced women age 65 and older are more likely to be impoverished than their male counterparts. However, poverty rates are also relatively high among never-married men.

- Black and Hispanic Retirees

- In 2019, the poverty rate among the elderly Black population (18 percent) was nearly three times higher than the rate among the elderly white population (6.7 percent), according to U.S. Census Bureau data. Research also shows that African American and Hispanic households are much less likely to have a retirement account or pension at work than white households.

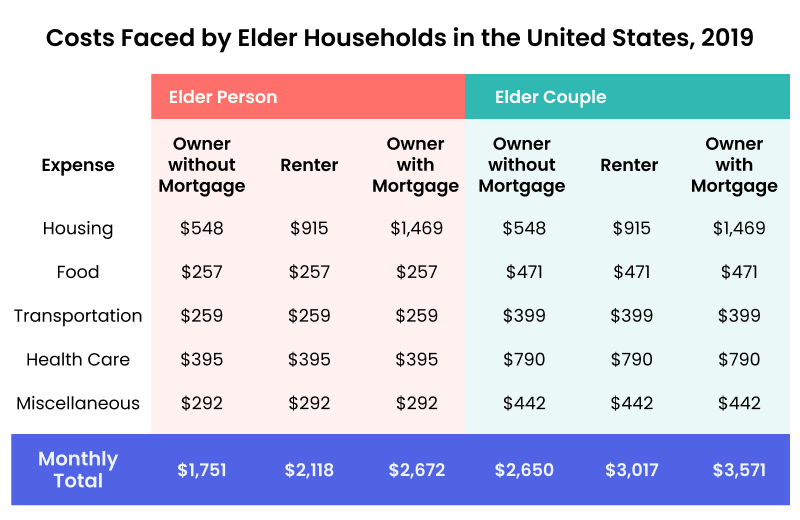

Costs in retirement also differ by geographic location.

For example, a 2019 study by the University of Massachusetts Boston found that the cost of living independently for a single retiree ranges from a low of $21,504 in Alabama to a high of $33,060 in Washington, D.C.

Meanwhile, the cost of living for couples who rent is highest in Massachusetts at $45,252 a year and is lowest in Nevada at $31,836.

From the Experts: How to Retire Happily Without Going Broke

Summer Red is an accredited financial counselor and education manager at the nonprofit Association for Financial Counseling & Planning Education (AFCPE). She has also served as a financial literacy educator at several nonprofit organizations in Montana and Oregon, including Coalition for Kids and Rural Dynamics Incorporated.

- Start making a post-retirement budget five to 10 years before you retire.

When you get that close to retirement, it’s time to start thinking about what you want to do. At that point, you’re close enough to start putting together a tentative budget and thinking about the lifestyle you want.

Or if you’re off track, maybe the lifestyle that will at least make you content, even if it’s not those crazy dreams you might have had of jet skiing around the Mediterranean.

You can also start saving more. If you’re looking at reducing your income in retirement by more than what you’re used to, this can be a good time to start learning to live on a little less. It will allow you to save more and also help you prepare for what your retirement years will look like.

- Be proactive — not afraid.

In my experience, people tend to be better off than they think.

Oftentimes costs aren’t quite as high in retirement. A lot of times, people plan really high travel costs and those tend to decrease over time.

Also, many times, people have read all these articles about how you need $1 million to retire — and they get terrified. And a lot of times, they don’t need that.

A lot of people have no idea how much money they’ll have coming from Social Security. Many times, people don’t realize that by delaying retirement just a little bit, they can increase how much they make.

There’s a lot of ways you can improve the situation without it being the end of the world.

- You don’t have to draw Social Security the day you stop working.

You can stop working at age 62, live on your savings and start drawing benefits at age 70.

This way you can maximize your guaranteed income stream and save it for later. Plus, Social Security adjusts for inflation — your savings don’t.

- Keep at least two years’ worth of expenses in liquid cash.

Consider keeping a couple years’ worth of expenses in cash or a very safe account.

This can help protect you against market crashes so that you’re not taking your money out of investments after they’ve dropped by 25 percent.

You can think of it as an expanded emergency savings fund. Normally when you’re working, they tell you it’s good to have six months’ worth of expenses saved in case you lose your job. But in retirement, the goal is not to work again unless you want to.

How to Prevent Running Out: Calculate How Much Money You Need to Retire

One of the biggest challenges of retirement planning is calculating how much money you will need. The truth is even financial experts can’t agree on a “perfect” number.

A million dollars is often floated as the ideal retirement nest egg.

Another common adage is setting aside anywhere from six to 10 times your income by age 65. This means hitting other, earlier benchmarks, like banking three or four times your salary by 40.

But depending on your lifestyle, expenses and income in retirement, a $1 million goal may be excessive.

Yes, you’ll face new expenses, like health care or home repairs. But other costs — such as daily commuting or child care — will likely disappear.

“If you’re on the lower half of the earnings spectrum and you’re used to living on less, then you aren’t going to need to save $1 million the way an upper income earner will,” Zimmerman Rand said.

On the flip side, if you’re a high-wage earner, you may need to shoot for a nest egg of $2 million or more, especially if you plan on leaving money to heirs or charity — or living a lavish lifestyle.

Most financial experts say you can expect your expenses to be about 70 percent to 80 percent of what they were before you retired.

But in reality, the amount you need to save is a uniquely personal calculation.

Experts say there are three ways you can calculate your retirement number.

Ways to Calculate How Much Money You Need to Retire

- Fill out a post-retirement budget worksheet and run the numbers yourself.

- Use an online calculator tool to help you run the numbers.

- Speak with a financial advisor who can run the numbers for you.

Once you get your number, you have a starting point. You can figure out how much money you need to save and invest to reduce your risk of running out.

You can explore financial tools such as retirement accounts, HSAs and annuities to help you prepare a sound financial strategy.

And finally, even the best laid plans can’t account for everything. Being aware of safety net options and available resources, in case you need them, can help prepare you for whatever the future holds.

Creating a Retirement Budget

Creating a retirement budget is a smart idea for everyone. Sitting down and taking a hard look at the numbers will give you the clearest picture of your needs and expenses once you stop working.

A budget details:

- How much money you earn

- How you spend your money

The first step is identifying all your sources of income in retirement. This includes Social Security, pensions, annuities, retirement savings, real estate income and other investments.

If you plan to work part-time or freelance in retirement, get an estimate of your take-home pay.

If you switched jobs and forgot to roll over a 401(k), you may have money sitting in an account with a previous employer. Call your past employer or the plan administrator to check.

Next, get a handle on your current spending. Where does the money go?

You may know some numbers by heart, such as your mortgage payment or average electric bill. But we often underestimate what we spend on things like food, clothing, entertainment and travel.

To get realistic averages, look over your last three months of credit card and bank statements.

Make sure to group costs into different categories:

- Essential and nonessential spending

- Reoccurring, periodic and one-time expenses

Your essential spending isn’t likely to change much after retirement. However, it’s important to consider new expenses you may encounter.

Retirement Expenses to Consider

- How many years are left on your mortgage?

- Do you plan to move or downsize in retirement? If so, consider the cost of hiring movers and other expenses.

- Will your Medicare premiums be higher than your current health care plan?

- What other out-of-pocket medical costs might you face?

- Do you plan to spend more on travel, entertainment or hobbies in early retirement?

- What will your tax rate be?

- How much financial support will you provide for your children and grandchildren?

Get organized. It will take some time to get all the numbers together, but a little effort now will literally pay off later.

Finally, start plugging numbers into a post-retirement budget worksheet, like ours.

Download Our Free Retirement Budget Planning Sheet

Use this worksheet to help determine how much you’ll need to budget to cover your basic needs and expenses in retirement.

Use your budget as a roadmap. Refer back to it and adjust it over time.

Using a Retirement Calculator

Online calculators are one of the easiest and fastest ways to estimate how much money you need for retirement.

Red said these online tools can give people a snapshot of what to expect.

“But not all retirement calculators are created equal,” Red told Annuity.org.

Different calculators measure different things. Some calculate how many years your money will last while others measure how much you need to save.

Some are complex while others keep it simple.

A pitfall all retirement calculators share is using estimates and assumptions. No one knows how long they’ll live, the exact rate of return on their investments or what inflation might look like in the future.

This can lead to very different outcomes.

“One calculator said I would die with $10 million and another said I would be penniless after 10 years,” Red said.

But Red still supports using these tools as a starting point. She recommends trying five or six calculators.

“Then pick the result from the middle or higher-end,” she said.

In other words, don’t just go with the number that makes you sound the best.

Another expert tip: Use worst-case-scenario numbers in your calculations. For example, estimate higher inflation and tax rates.

You can start by using our simple retirement income calculator.

Next, explore other calculators to get a more holistic look.

Here is a brief list to get you started.

Retirement Calculator Resources

- AARP Retirement Calculator

- This online calculator from AARP helps you determine the amount of money you need to retire. You’ll input factors such as household status, salary and retirement savings from your IRA or 401(k) plan.

- Social Security Retirement Estimator

- This tool from the Social Security Administration estimates the size of your monthly checks based on your actual Social Security earnings record. Keep in mind that you won’t know your exact benefit amount until you apply for Social Security.

- Columbia University Retirement Calculator Resource Page

- This resource page from Columbia University includes links to different types of retirement calculators, including ones that estimate your retirement nest egg, income and health care costs.

Hiring a Professional

If the thought of crunching the numbers yourself makes you cringe, get a professional to help.

A financial advisor is an umbrella term for any professional who gives financial advice. There are several designations and types, each with its own certification process and regulation requirements.

Four Types of Financial Advisors and Professionals

- 1. Certified Financial Planner (CFPⓇ)

- A Certified Financial Planner™ professional helps you create and maintain a long-term financial plan based on your specific goals. They must have several years of experience, pass a stringent exam and adhere to a strict code of ethics. They are certified to advise you on everything from taxes to investments to estate planning. Most professionals are fee-only, meaning you’ll pay an upfront-cost for their advice, but they won’t profit off any recommendations they give you.

- 2. Insurance Agents and Brokers

- An insurance agent is a professional who represents one or more insurance companies. They can help you explore life, health, disability or property insurance policies, along with other insurance products, such as annuities. An insurance broker is a professional who represents consumers, not insurance companies, in their search for the best policy. Both agents and brokers make a commission from products they sell.

- 3. Financial or Money Coach

- A money coach focuses on the foundation of financial literacy, including managing debt and creating a budget. The goal of a financial coach is to help clients build positive, long-lasting money habits. Most money coaches are accredited financial counselors. They charge lower fees than a CFP but can’t recommend specific investments, analyze your tax situation nor manage your portfolio.

- 4. Certified Public Accountant (CPA)

- Most people interact with accountants at tax time. But certified public accountants can also help you navigate complex situations in retirement, such as starting or selling a small business, managing income from real estate and minimizing tax for your heirs during estate planning.

If you’re considering using a financial advisor, do your homework. Make sure they’re up to date on their designations, professional service groups and other regulatory requirements.

Ask for references. Look for an advisor who specializes in retirement planning and don’t be afraid to ask how they make money.

Using Financial Tools and Products to Help You Prepare

Once you know how much money you need for retirement, start taking steps to turn your goal into a reality.

Certain savings vehicles, insurance products and investment options can get you there.

Retirement Plans 101

You want to start contributing to a retirement account as soon as possible. The longer you wait, the more you’ll have to play catch-up later.

Retirement savings accounts, also known as defined-contribution plans, are better than traditional savings accounts for many reasons. They invest your money, so it grows over time. They also come with special tax advantages. .

How your money grows inside the account will depend on the investments you select, the rate of return on those investments and the overall economy.

The two main types of retirement accounts are:

The traditional version of both accounts are tax-deferred, meaning you won’t owe any tax on earnings inside your account until you withdraw funds.

Traditional 401(k)s and IRAs also lower your taxable income in the year you make contributions.

Both types of accounts allow you to start taking withdrawals penalty-free at age 59 1/2. The government requires you to start making withdrawals once you hit 72.

“You can also make larger catch-up contributions to these accounts once you turn 50,” Red said. “People should try to take advantage of this, especially if they need to boost their savings before retirement.”

Both 401(k) and IRA plans have Roth versions.

Roth 401(k)s and Roth IRAs are taxed differently than their traditional counterparts. Instead of all your dollars going into the account with a tax bite on the backend when you withdraw funds, a Roth account withholds taxes when you deposit money at the beginning but offers you tax-free withdrawals on the backend.

However, you won’t get a break on your yearly tax bill the way you do with traditional 401(k) or IRA plans.

Roth IRAs come with a couple unique perks. You won’t face a 10 percent penalty from the IRS if you withdraw contributions before age 59 1/2. You also don’t have to take required minimum distributions (RMDs) from Roth IRAs. (Withdrawal penalties and RMDs still apply to Roth 401(k)s.)

DID YOU KNOW?

In 2021, you can’t contribute to a Roth IRA if your modified adjusted gross income exceeds $140,000 for a single filer or $208,000 for a married couple. However, there are no income limits to participate in a Roth 401(k).

Source: Internal Revenue Service

Some experts suggest picking a Roth account if you expect your income to be higher in retirement and a traditional account if you expect your income to be lower in retirement.

Other experts argue that a Roth account can be good for lower income retirees, too.

“Tax rates are relatively low right now — and there’s no way to know how high they’ll be in the future,” Red said. “If you’re on a fixed budget, paying taxes on withdrawals isn’t ideal.”

Red suggests that if you don’t need the break on your current taxes offered by traditional accounts, you might want to explore investing in a Roth account.

Annuities: A Pension Alternative

An annuity is a contract between you and an insurance company. You deposit a sum of money, typically $50,000 or more, and the insurer makes regular payments to you for the rest of your life, or for a certain period.

In a way, annuities are like a pension you purchase for yourself.

As employers shift away from defined-benefit pensions, annuities are a way for investors to recreate that guaranteed monthly payout on their own. And like a pension, once you start receiving money from an annuity, you don’t need to worry about withdrawing too much too quickly. The insurance company guarantees the money lasts.

Some financial experts, including academics, see annuities as a tool to help offset longevity risk.

“Most people don’t think of annuities correctly,” said Gal Wettstein, a senior research economist at the Center for Retirement Research at Boston College. “They think of them as investments, when really they’re insurance. They insure you against running out of money, specifically the risk of living too long.”

How much income you receive from an annuity depends on many factors.

Factors that Impact the Size of Annuity Payments

- How much money you give the insurance company

- Your age

- Your health and lifestyle

- Annuity rates at the time of purchase

- Whether you want payments to last the rest of your life or a certain period

- Whether you want the money to increase each year to offset inflation

- Whether you want the annuity to provide income for someone after you die, such as your spouse

Annual rates of return range anywhere from 2 percent to 6 percent, depending on the type of annuity.

You can invest in a 401(k) and fund an annuity at the same time. In fact, you can hold an annuity contract in your 401(k) account, the same as target date funds or mutual funds.

Guaranteed income in later life is one of the biggest selling points of annuities. But a consumer’s ability to customize the timing of guaranteed payments makes annuities useful tools to achieve other financial goals.

“Most people don’t think of annuities correctly. They think of them as investments, when really they’re insurance. They insure you against running out of money, specifically the risk of living too long.”

— Gal Wettstein, senior research economist at the Center for Retirement Research at Boston College

Wettstein and fellow researchers at Boston College published a paper in 2021 exploring how retirees can delay claiming Social Security until the maximum benefit peaks at age 70 by instead drawing on 401(k) savings or an immediate annuity after they stop working at age 62 or 65.

“You basically need a new stream of income to bridge that gap between when you retire and when you claim Social Security,” Wettstein told Annuity.org. “One way to do it is to buy an annuity certain.”

An annuity certain — better known as a period certain annuity — can be structured to last just a specific number of years.

“In this case, it could be the five years between when you retire at 62 and when you want to claim benefits at 67,” Wettstein said. “You would pay whatever the [annuity] premium is and receive a stream of payments for that time.”

Structuring an annuity this way can be easier than drawing on 401(k) savings because you don’t have to figure out how much to withdraw on your own.

Interested in Buying an Annuity?

Other Things You Can Customize in an Annuity Contract

- How often you want to receive payments (monthly, quarterly, semiannually or annually)

- If payments will be made over one life or two lives (you and your spouse, for example)

- If you want a stepped-up death benefit for a beneficiary

- If you want extra benefits, called riders, that can allow you to tap funds early for long-term care costs

Unlike pensions — which are guaranteed by the government — annuities are guaranteed by the insurance company that sells them.

Major insurance companies are extremely unlikely to go broke, but consumers should still research companies and look for one with a high independent rating from a company such as Fitch, AM Best or Moody’s.

Be aware that annuities come with fees and withdrawal penalties. Because you’re paying an insurance company to grow and protect your money, insurers charge fees for investment management, contract riders, commissions and other administrative costs.

Most annuity contracts also impose surrender periods during which you can’t withdraw money from the account without facing a fee.

HSAs and Financial Tools for Health Care

Everyone knows health care costs rise with age.

If you can start preparing for these expenses now, you’ll thank yourself later.

HSAs

If you’re still working and your employer offers a health savings account (HSA), consider enrolling and contributing to it.

An HSA allows you to store up money pre-taxed — and possibly collect employer contributions.

If you spend HSA funds on qualified medical expenses — which you’re likely to have more of in retirement — you’ll never pay tax on those costs.

One strategy experts recommend is opening an HSA now and funding it with extra income — while continuing to pay for your current medical expenses out-of-pocket.

This way, you can save the money in your HSA for when you need it later in retirement and don’t have as much income to cover health care.

You can think of an HSA as a special retirement savings plan — a 401(k) for your health.

HSAs can also serve as a bridge to Medicare if you’re forced to retire before age 65 due to health issues.

DID YOU KNOW?

You can no longer contribute to your HSA account once you have enrolled in Medicare. However, you can keep making withdrawals from a an already-funded HSA.

Source: Internal Revenue Service

You can use HSA funds for any reason once you turn 65. At that age, you won’t face a penalty for spending money on nonmedical expenses.

And like retirement accounts, you can also invest your HSA savings in mutual funds, stocks and other securities. This way your money grows over time. Your HSA provider can give you a list of available funds and securities to choose from.

Paying for Long-Term Care

Regular health insurance doesn’t cover long-term care, including nursing homes, assisted living facilities and adult day care. Medicare doesn’t cover it either.

Long-term care is expensive. The national cost for a semi-private room at a nursing home averaged $7,756 a month in 2020, according to Genworth Financial.

DID YOU KNOW?

At least 60 percent of people will need some form of long-term care during their lives.

Source: LongTermCare.gov

Buying long-term care insurance is one way to hedge against these high out-of-pocket costs.

Long-term care insurance reimburses you a daily amount, up to a certain limit, for services that assist with activities of daily living such as bathing, eating or dressing.

You can’t qualify for a traditional long-term care policy if you already have a debilitating condition because policies require strict medical underwriting.

Cost is one of the biggest drawbacks of traditional long-term care policies. According to 2021 data from the American Association for Long-Term Care Insurance, a 65-year-old woman can expect to pay an average of $2,700 a year on premiums.

Spending thousands of dollars a year on something you may never use isn’t practical for many retirees.

Several alternatives to traditional long-term care insurance have emerged in the industry.

Two Alternatives to Traditional Long-Term Care Insurance

- Hybrid LTC Policy

- This policy combines life insurance with long-term care coverage. If you don’t exhaust the long-term care benefit, the remaining value is passed down as a tax-free death benefit to your family. Most people pay a lump-sum for coverage. It’s usually more expensive than a traditional policy, but the added perk of passing money to a beneficiary makes it worth it for some people

- Annuity with a Long-Term Care Rider

- Adding a long-term care rider to a fixed annuity can help provide a lifetime income stream that doubles your monthly payout for a certain period if you need long-term care. Medical underwriting requirements are much less stringent. In fact, you will likely get a bigger annuity payment if you’re in poor health than if you’re in good health. These riders typically add a 1 percent fee to your annuity contract.

What Happens If I Run Out of Money?

You worked hard your entire life, but still came up short.

If the money really does run out in retirement, it’s important to understand your options.

The road ahead may be filled with difficult, even painful, decisions. Making them won’t be easy. But ignoring them may no longer be an option.

What You Can Do If You Exhaust Your Resources in Retirement

- Sell your home to raise funds. Then downsize to a more affordable place or move in with family.

- Take in a renter or roommate to generate income.

- Research and consider a reverse mortgage.

- Sell off items.

- Pick up a part-time job or freelance gig.

- See if the utility, phone or internet company provides any discounts for low-income seniors.

- Find soup kitchens and food pantries in your local area.

- Ask your family, friends and community for help.

- Explore and utilize federal, state and local assistance programs.

If cash and other assets are dwindling, it may be time to ask family and friends for help.

It can be a tense and uncomfortable conversation, especially if you live far away or don’t have a close relationship with certain family members. But the price of silence is high — and will likely hurt you more in the long run.

Ignoring a worsening financial situation until it becomes a crisis can lead to stress, mistrust and resentment. If you avoid the problem too long, your children may no longer be able to help you, leaving you with few options and painful decisions.

Not everyone is fortunate enough to have friends or family to rely on. The term “elder orphan” refers to seniors with no children, parents or financial assets.

These older adults risk becoming a ward of their state or county. In this situation, the state assigns a guardian to you and that person makes decisions about your living situation, health care and finances.

State and Federal Assistance Programs

Social Security and Medicare aren’t the only safety nets available to older America. Other government programs can help fill the gaps.

Most well-known programs for people with low incomes are administered at the state level.

“Where you live is going to be a really big component in how much assistance is available to you,” Red said. “Your benefits are almost double in Oregon than they would be in Montana, for example.”

State and Federal Assistance Programs

- Medicaid

- Medicaid is a joint program by federal and state governments. It covers medical costs for people with limited incomes and resources. It tends to cover services, like long-term care, that Medicare doesn’t cover. Providers tend to be more limited. Each state determines its own eligibility rules.

- TANF

- Temporary Assistance for Needy Families (TANF), also known as cash welfare, is a federally funded, state-run benefits program. You can see if you’re eligible for TANF benefits in your state by filling out an eligibility tool on Benefits.gov.

- SNAP

- The Supplemental Nutritional Assistance Program (SNAP) is more commonly known as food stamps. It provides a monthly stipend for food to those who qualify. Each state has its own eligibility requirements. You can visit the USDA SNAP website for a list of office locations and links to online applications.

- HUD Programs

- The U.S. Department of Housing and Urban Development (HUD) administers the Home Choice Program. Also known as Section 8, the program is based on agreements between the federal government and private property owners who agree to provide low-income housing. Tenants give a portion of their income to pay rent and the government picks up the rest. The demand for Section 8 housing is high and waiting lists are often long. Other HUD programs include Section 202, which funds nonprofit organizations that develop housing for low-income adults age 62 and older. The Section 504 Home Repair Program provides a grant of up to $7,500 for senior homeowners to pay for major home repairs.

- Veteran Benefits

- The U.S. Department of Veterans Affairs (VA) offers numerous programs and resources for veterans and their spouses, especially nursing homes, assisted living and home health care. Check with your local VA office to see what you may qualify for.

Nonprofits and Local Organizations

Most communities have at least one organization that can offer multiple services in a single location to people with low incomes. But the size and scope of these organizations varies, depending on local and state funding.

Your local Area Agency on Aging is the best place to start. The name of these offices differs depending on where you live, but they all share the common goal of helping people age 60 and older, their family and their caregivers access community services.

Trained professionals can walk you through program eligibility rules and help you fill out applications.

Area Agencies on Aging often offer other valuable resources, such as free health insurance counseling, legal assistance and elder abuse prevention.

Nonprofit organizations can also help older adults pay for housing and find affordable options.

Many communities have lower-cost housing specifically for seniors. Check with your city or county housing or community development department to see what’s available.

Other programs and grants, such as Rebuilding Together, can assist with repairs and home modifications.

Not sure where to start exploring your housing options? HUD supports housing counseling agencies which provide free or low-cost advice on buying a home, renting, default, foreclosure and reverse mortgages.

You can search online for a HUD-certified housing counseling service or call 800-569-4287.

Additional Resources for Low-Income Seniors

- BenefitsCheckUp.org

- BenefitsCheckUp.org is a free service from the National Council on Aging. Fill out a brief questionnaire and the online tool will search over 2,500 federal, state and private benefit programs to see if you qualify.

- Eldercare Locator

- Eldercare Locator is a public resource of the U.S. Administration on Aging that connects people to local services for older adults and their families. Type in your zip code or city to find a list of available resources. You can also chat online with an information specialist or call 800-677-1116.

- State Health Insurance Assistance Program (SHIP)

- Each state receives federal funding to maintain a network of trained volunteers who help older adults navigate Medicare, Medicaid and other health care options. Your local State Health Insurance Assistance Program may go by a different acronym, such as SHINE or SHIBA.

- The Senior Community Service Employment Program (SCSEP)

- If you’re looking for additional income, the Senior Community Service Employment Program (SCSEP) pays people age 55 and older minimum wage to work at government or community agencies. SCSEP also provides training. You must have a family income of no more than 125 percent of the federal poverty level to qualify.