What Is an Annuity?

An annuityAnnuityAn insurance product that earns interest and generates periodic payments over a specified period of time, typically with the purpose of providing income in retirement. is a contract between you and an insurance company that turns your savings into future income. You pay either a lump sum or a series of payments, and in return, the insurer agrees to provide income either immediately or at a later date — often for the rest of your life.

People commonly use annuities for retirement income, tax-deferred growth and protection against outliving their savings.

Simple Explanation: Think of an annuity as a way to create your own pension. You give an insurance company money, and they promise to pay you back in predictable income — sometimes for life.

Why Annuities Matter

Lifetime income. One of the greatest fears people have going into retirement is running out of money. Annuities directly address this concern by offering payments that can last as long as you live. With a lifetime income annuity, you can create a financial safety net for essentials such as housing, groceries, and healthcare.

Protection from market losses. Unlike investments that fluctuate with the stock market, certain annuities offer a reliable income stream even when markets decline. This insulation from volatility can help preserve your retirement lifestyle, particularly if you don’t want to risk losing savings at a stage of life when recovery time is limited.

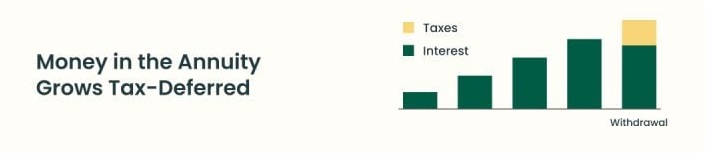

Tax-deferred growth. While you wait to begin taking income, many annuities allow your money to grow on a tax-deferred basis. This means you won’t pay taxes until you start receiving payments, allowing your savings to compound more efficiently over time.

Options for your family. Retirement planning isn’t just about you — it’s also about those you love. Many annuities include death benefits or beneficiary provisions that ensure a spouse, children, or other heirs receive income from the remaining value of the contract after your passing. This legacy feature can be especially meaningful for people who want their savings to provide support beyond their own lifetime.

Types of Annuities

Different types of annuities are designed for various needs, and the “right” option for you often depends on your risk tolerance, retirement timeline and the type of lifestyle you want to support. These are some of the types of annuities available for your retirement.

Fixed

Annuities

provide reliable growth by offering a guaranteed rate of return for a set period.

Indexed Annuities

tie growth to a market index, giving you the chance for higher returns while protecting against losses.

Variable Annuities

invest in underlying funds, offering flexible growth potential along with greater risk.

Choosing can feel overwhelming, but seeing how real people in similar situations use annuities can make the decision more straightforward.

When Different Types of Annuities Make Sense

Each story highlights the emotional trigger, the practical fit, and the peace of mind payoff, so you can quickly see which option may align with your retirement strategy.

Linda, 68 – Retired teacher

Fear: “I’m terrified one market crash will wipe out my retirement savings.“

Linda feels relieved knowing she won’t lose money in a downturn. She can finally give herself permission to enjoy retirement.

Marcus, 60 – Small business owner

Fear: “If the market drops just before I retire, I won’t have time to recover.“

Marcus can participate in market gains but still sleep at night, knowing he won’t wake up to devastating losses just before his retirement begins.

Emily, 55 – Corporate executive

Fear: “I hate the thought of not protecting my savings from the market’s volatility.“

Emily likes knowing she can still aim for higher returns, but she has a safety net to ensure her retirement lifestyle won’t collapse if markets underperform.

Annuities can be a great tool to help you generate retirement income or reach other financial goals, but there are many kinds of annuities. It’s important that you understand how they work to know if one is right for you.

Quick Annuity Comparison

See how each annuity type compares at a glance — from risk and growth potential to when payments begin.

| Type | Best For | Risk Level | Growth Potential | When Payments Start |

|---|---|---|---|---|

| Fixed | Conservative savers | Low | Steady, guaranteed | Future |

| Indexed | Growth and protection | Low-Medium | Moderate | Future |

| Variable | Higher risk investors | Medium-High | High | Future |

How Annuities Work

At their core, annuities take the money you contribute, known as a premium, and turn it into a reliable stream of income. This process happens in two main phases: the accumulation phase and the payout phase. Understanding how each phase works can help you see why annuities are often used as a foundation for retirement security.

Step 1: Paying the Premium

When you buy an annuity, you start by paying a premium to the insurance company. This can be done as a single lump-sum payment, such as rolling over a portion of your 401(k) balance, or as a series of payments made over time.

Step 2: Accumulation Phase

Once your money is invested in the annuity, it enters the accumulation phase, where it grows on a tax-deferred basis. That means you won’t pay taxes on the growth until you start taking money out, giving your savings more room to compound compared to taxable products such as CDs or brokerage accounts.

Step 3: Choosing How To Get Paid

When you’re ready to turn your savings into income, you can annuitize the contract by converting it into guaranteed payments, or you can make systematic withdrawals. Payments can begin right away with an immediate annuity or at a future date using a deferred annuity.

You also choose the structure of your payout, with three different options:

- Monthly income for life

- Payments for a set number of years

- Income that covers you and a spouse

Your choice will affect both the size of your payments and the level of protection for your family.

Step 4: Income Starts

Once the payout phase begins, the insurer assumes the most significant risks you face in retirement, market risk and longevity risk (the possibility of outliving your money). In exchange, you agree to the terms of the contract, which may include fees or place limits on liquidity.

Why This Matters

- Tax-deferred growth gives your money a chance to compound faster, which can make a noticeable difference over long time horizons.

- Risk transfer means you don’t have to shoulder the burden of unpredictable markets or worry about running out of income if you live longer than expected.

How Do Annuities Pay Out?

With annuities, you choose how income is paid out, whether it is for a set period, your entire lifetime or the lifetimes of you and your spouse.

| Option | What You Get | Best For | Trade-Off |

|---|---|---|---|

| Period Certain | Payments for 5-20 years | Covering near-term expenses | Payments stop after the term |

| Single Life | Lifetime income | Maximizing monthly income | No survivor benefits |

| Life w/Period Certain | Lifetime income with minimum years guaranteed | Balancing lifetime income & legacy | Lower payment than straight life |

| Joint & Survivor | Income while either spouse is alive | Spousal protection | Lower payment than single life |

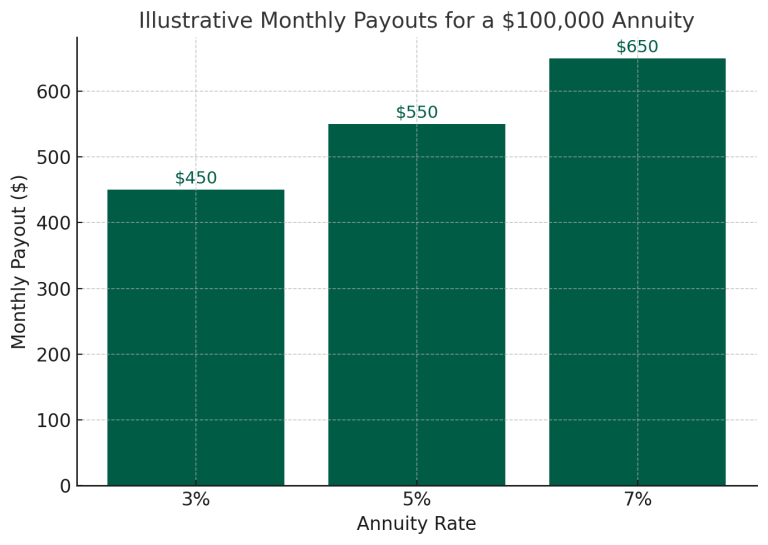

How Annuity Rates Impact Payout

Annuity rates play a direct role in how much income you receive.

- Higher rates = bigger monthly checks. When prevailing interest rates are higher, insurance companies can invest your premium more profitably, which allows them to pay you more income.

- Lower rates = smaller payouts. In low-rate environments, your monthly income will be lower because the insurer earns less from its investments.

Timing also matters. Locking in an annuity when rates are rising often results in better payouts than buying when rates are near historic lows.

Other factors apply, too. Your age, sex, premium amount, and payout type all interact with rates. For example, even with a modest rate, starting at an older age generally produces higher monthly payments because the insurer expects to pay for fewer years.

In short, annuity rates dictate the size of your guaranteed income. The higher the rate at the time you purchase, the more you’ll receive each month for the same premium.

See How Much You Could Earn With Today’s Best Rates

Annuities vs. Other Products

When deciding where to keep your money, it helps to compare annuities to other common savings tools. The chart below highlights the key differences in interest rates, terms, taxes, and withdrawal rules when comparing fixed annuities, savings accounts, and certificates of deposit (CDs).

Disadvantages of Annuities

No financial product is perfect, and annuities are no exception. While they can provide lifetime income and peace of mind, they also come with trade-offs that may not fit every retiree’s needs. Before you commit, it’s essential to understand the potential downsides.

1. Limited Liquidity

Once you invest money in an annuity, it can be hard to access without penalties. Most contracts restrict how much you can withdraw each year, and early withdrawals often trigger surrender charges. If you withdraw more than the allowed amount, especially within the first 5 to 10 years, you may face significant fees that reduce your payout.

2. Fees and Costs

Variable and indexed annuities often carry several fees, including administrative fees, mortality and expense charges, and optional rider costs. These fees can eat into your returns if not carefully considered.

3. Complexity

Annuities can be hard to understand. The variety of products, riders, and payout options means it takes time to make a fully informed choice. Professional guidance can be extremely helpful, enabling you to make a more informed decision.

4. Potentially Lower Returns

Compared with investing directly in stocks or mutual funds, annuities may deliver lower long-term growth. The trade-off is security and guaranteed income versus higher growth potential with more risk.

5. Tax Treatment on Withdrawals

While growth is tax-deferred, withdrawals are taxed as ordinary income, which means they do not share the lower rates of capital gains. That can result in a bigger tax bill for some investors.

6. Inflation Risk

Unless you add an inflation rider (often at extra cost), fixed payments can lose purchasing power over time as the cost of living rises.

Could an Annuity Strengthen Your Retirement Plan?

Annuities aren’t right for everyone, but for many retirees they can provide peace of mind and protection with guaranteed income. Our Annuity.org calculator can help you determine if an annuity can strengthen your retirement plan.

Is An Annuity Right For You?

Q&A With Scott Saffe, Senior Annuity Specialist at Annuity.org

With over 28 years of experience in the annuity industry, Scott brings a well-rounded perspective to Annuity.org. He understands our customers in a way that enables deep and meaningful connections to develop over time.

- How do I decide between a lump-sum payout and lifetime income?

It depends on your goals. A lump sum provides immediate access to your entire balance, which can be useful for paying off debt or covering large expenses. However, it puts the responsibility on you to manage the money so it lasts. A lifetime income option, on the other hand, guarantees steady payments for life, removing the risk of outliving your savings. Many retirees choose lifetime income for peace of mind and use other assets for liquidity.

- What happens to my annuity if the insurance company has financial trouble?

Annuities are backed by the issuing insurer, so choosing a financially strong company is critical. Independent ratings agencies like AM Best and Standard & Poor’s evaluate insurers’ financial strength. In addition, every U.S. state has a guaranty association that provides a safety net (up to certain limits) if an insurer fails. Working with a licensed specialist ensures you understand both the company’s strength and the protections in your state.

- Can I lose money with an annuity?

With a fixed annuity, your principal is protected, so you won’t lose money due to market declines. Indexed annuities protect against losses but cap your growth potential. Variable annuities carry investment risk — your returns depend on the performance of subaccounts, and you could lose value. It’s important to match the annuity type to your risk tolerance and financial needs.

- How do fees affect my annuity payout?

Fees can significantly impact returns, especially with variable and indexed annuities. Common charges include administrative fees, mortality and expense (M&E) fees, and rider costs for benefits like guaranteed withdrawals or long-term care coverage. While these features can be valuable, they reduce your net growth. Always compare fee structures and ask your agent to show you the impact of fees on projected payouts.