Understanding Annuity Withdrawals

You have the option to withdraw from an annuity at any time before annuitization when the premiums and interest payments on a deferred annuity convert into a series of periodic payments. But withdrawals can be expensive.

Annuities are intended to be a long-term part of your retirement income plan. Both the government and the insurance companies that sell annuities encourage people who purchase them to keep money in them for the long run by imposing high costs for early or frequent withdrawals.

Key Facts About Withdrawing Money from Annuities:

- The federal government imposes a 10% penalty tax if you withdraw money before you reach age 59 ½, which is considered to be near retirement age.

- Surrender charges are normally around 7% of the amount you withdraw before the surrender period ends — but the amount decreases the longer you have the annuity.

- Various annuities allow withdrawals, including fixed, index, long-term care and variable annuities.

- Some annuities, like annuitized contracts, deferred income annuities, immediate annuities and Medicaid annuities, do not allow withdrawals.

- Consider your age, the surrender period, any tax implications and your long-term financial goals when deciding between withdrawing and selling.

Insurance companies enforce surrender charges, which are stiff penalties for withdrawing money before the surrender period ends.

The federal government also imposes a 10% penalty tax if you withdraw money before you reach 59 ½, near retirement age. This encourages you to keep money in the annuity for retirement income.

Surrender fees help insurance companies discourage annuity owners from using deferred annuities as short-term investments for quick cash.

Need to Sell Your Annuity for Cash Immediately?

Considerations When Taking Early Withdrawals

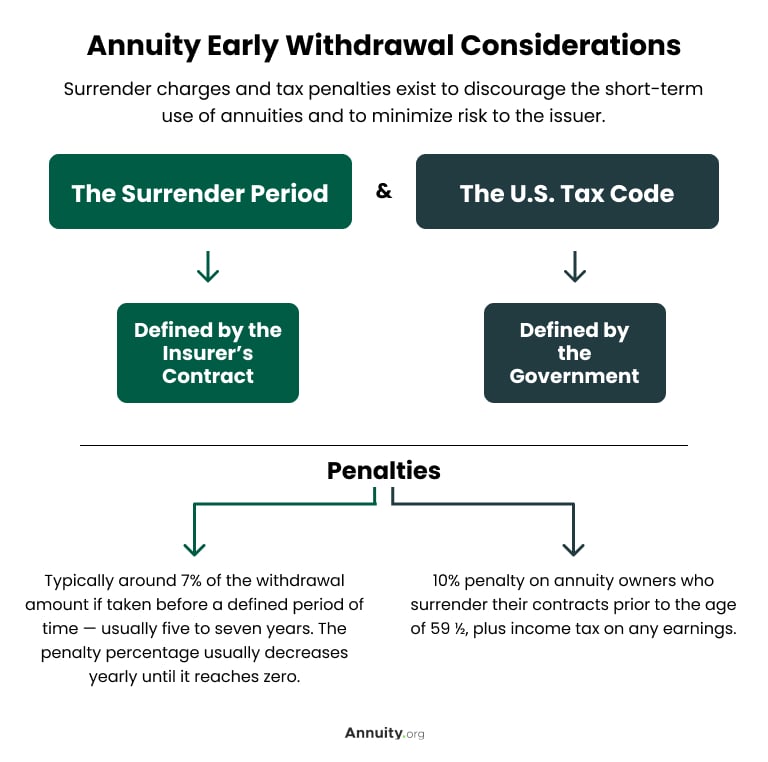

There are two things to keep in mind when considering taking early withdrawals from your annuity.

One is the surrender period stated in your contract and set by the insurance company, and the other is the U.S. tax code. Both set stipulations for your withdrawals, and there are exceptions and provisions that affect the standard penalties for each.

Surrender charges are typically around 7% of the amount you withdraw before your surrender period ends — but the amount decreases year-by-year, the longer you hold the annuity.

If you’re younger than 59 ½, the federal government also charges a penalty of 10% of the withdrawal amount on top of income tax on the earnings.

Surrender periods usually last six to eight years after purchasing an annuity.

Withdrawals During the Surrender Period

Always consider the consequences from the federal government and from the insurance company that issued your annuity before you withdraw any money. If the consequences outweigh the benefits, you might sell a portion of your annuity payments instead.

Many insurance companies allow annuity owners to withdraw up to 10% of their account value each year without paying a surrender charge. However, if you withdraw more than your contract allows, you may still have to pay a penalty even after the surrender period has ended.

And you’ll still face tax consequences for withdrawing before you turn 59 ½. Certain annuity contracts include crisis waivers for special situations, such as nursing home confinement or terminal illness, which suspend surrender charges in these types of circumstances. If you expect to need to withdraw early, ask about a waiver when first buying your annuity.

Interested in Selling Annuity or Structured Settlement Payments?

Making Annuity Withdrawals After 59 ½

Even though the insurance company may allow you to withdraw money from your annuity if you are under the age of 59 ½, the IRS will charge you a 10% penalty tax.

According to IRS Publication 575, “Most distributions (both periodic and nonperiodic) from qualified retirement plans and nonqualified annuity contracts made to you before you reach age 59 ½ are subject to an additional tax of 10%.”

How the IRS Taxes Penalties for Early Withdrawals

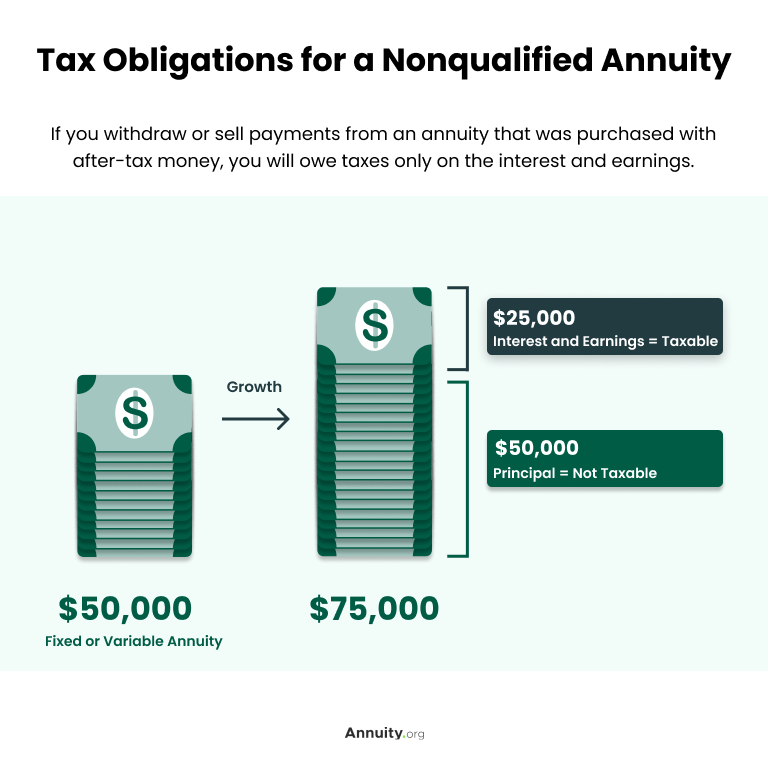

On a nonqualified annuity — one purchased with after-tax money — you will only pay the 10% penalty taxes on the interest and earnings on the portion you withdraw or sell. The principle is not taxable.

The major advantage of withdrawing money from an annuity after age 59 ½ is that you can avoid the IRS penalty tax.

You may still have to pay a surrender charge if your annuity is within its surrender period. Either way, the options for withdrawing money from an annuity are the same.

Note that only certain types of annuities allow you to withdraw money. These rules apply regardless of age.

- Fixed Annuities

- Annuities in which the payment amount and period of distribution are fixed.

- Indexed Annuities

- A fixed annuity that bases its earnings — in part — on an outside market index, such as the S&P 500.

- Long-Term Care Annuities

- A deferred annuity that features a long-term care rider.

- Variable Annuities

- An annuity in which the earnings depend on how its underlying investments perform.

Types of Annuities Generally Allowing Withdrawals

Not every contract allows you to make free withdrawals. Review your contract and speak with someone from your insurance company if you have questions.

If your contract is too restrictive on withdrawals and you need cash immediately, you still have the option of selling your payments to a company that purchases annuity and structured settlement payments.

- Annuitized Contracts

- Annuities in which the premiums and interest on a deferred annuity have been converted into a stream of periodic payments.

- Deferred Income Annuities

- A deferred annuity that converts all or part of your savings into a guaranteed income stream.

- Immediate Annuities

- Any annuity that converts premiums into an income stream within a year.

- Medicaid-Compliant Annuities

- A fixed immediate annuity that allows you to meet Medicaid’s asset threshold requirements and get Medicaid benefits such as long-term care.

- Qualified Longevity Annuity Contract (QLAC)

- Funded with assets from a qualified retirement plan such as a traditional 401(k) or IRA.

Types of Annuities Generally Not Allowing Withdrawals

Withdrawing vs. Selling Annuity Payments

Selling future annuity payments is an alternative to withdrawing from your annuity. But determining the best alternative varies from person to person depending on your financial circumstances. You should compare your options and consider several factors when deciding between the two.

Key Differences Between Withdrawing and Selling

The key difference between withdrawing money from an annuity and selling one is the effect on your future income from the annuity.

Withdrawing money from an annuity typically involves taking a lump-sum payout or periodic distributions from your annuity’s accumulated value. This reduces the overall value of the annuity, potentially affecting your future income from it.

Selling future annuity payments involves transferring your right to receive future income for a lump sum payment. Selling allows you to access a larger sum upfront, but it gives up the guaranteed payment stream provided by the annuity.

Let’s Talk About Your Financial Goals.

Factors To Consider When Deciding Between Withdrawing and Selling

The main things to consider when deciding between withdrawing from your annuity or selling it deal with costs now and how the choice will affect your future income.

Top Questions To Ask Yourself

- Are you 59 ½ or older and able to avoid the 10% penalty tax on withdrawals?

- Is your annuity outside its surrender period, allowing you to avoid a surrender charge?

- What are your tax implications for withdrawing and selling?

It’s important to consider your financial needs, long-term income requirements, tax implications and the overall impact on your retirement goals when deciding between the two options.

Each of the options may present different benefits and disadvantages depending on your needs and long-term goals.

Withdrawing Funds vs. Selling Payments

| Withdrawing & Surrendering | Selling Payments | |

| Taxes on money received? | ✓ | ✓ |

| Surrender period (Six to eight years)? | ✓ | |

| Surrender charge? | ✓ | |

| Discount applied? | ✓ | |

| Early withdrawal tax penalty (10%)? | ✓ |

Consult a financial advisor or a tax advisor who will provide you with personalized guidance.

How To Get Money Out of Your Annuity Without Penalty

Two options allow penalty-free withdrawals: withdrawal of original premium and withdrawal of account value. Some, but not all, annuity contracts offer these options. Each option is best suited for different situations.

- Penalty-Free Withdrawal of Original Premium

- Many annuities allow for penalty-free withdrawal of the amount you initially invested, also called the original premium. This means you can withdraw up to 10% of the amount of the premiums you have paid without paying a penalty to the insurer. You can make such a withdrawal each year.

- Penalty-Free Withdrawal of Account Value

- Some annuities offer a penalty-free withdrawal provision based on the current account value. This allows you to withdraw up to 10% of the current value of your annuity each year without penalty from the provider.

Penalty-Free Withdrawal Options

Original Premium vs. Account Value

The account value option is a better choice if you plan to withdraw only occasionally during the deferral period because your account value could go up despite the withdrawals.

The original premium option is the more suitable choice if you plan on annual withdrawals. This is because it makes long-term retirement income planning easier and more predictable.

Review your annuity contract carefully to understand the specific terms and conditions governing withdrawals. Keep in mind that any withdrawals beyond these penalty-free allowances may still be subject to surrender charges or early withdrawal penalties.

Avoiding Penalties With a Systematic Withdrawal Schedule

The IRS also imposes required minimum distributions (RMDs) after you turn 73. If you don’t withdraw that minimum amount each year, you face a penalty for what the IRS calls excess accumulation. The penalty is equal to 25% of what your RMD should be.

You can be ahead of the IRS and the insurance company by setting up a systematic withdrawal schedule. Effectively, these are automatic distributions from your annuity to yourself ahead of the yearly deadline for RMDs.

You can set systematic withdrawal schedules of yearly, semi-annually, quarterly or monthly withdrawals while meeting your annual RMD.

Join Thousands of Other Personal Finance Enthusiasts

Frequently Asked Questions About Withdrawing Funds From an Annuity

You can take your money out of an annuity at any time, but you will only be taking a portion of the full contract value. Whether you withdraw your funds or opt for a partial or lump-sum sale, you must account for any taxes, surrender charges and discount rates.

The time it takes to cash out an annuity depends on the type of annuity you have. Typically, it takes around 30 days, but annuities associated with structured settlements may take 45 to 90 days since a court must approve the sale.

To avoid an early withdrawal penalty tax from the IRS, wait until you turn 59 ½. After you turn 73, the IRS requires you to take a required minimum distribution each year. These vary based on the value of your annuity. Failure to take the distribution will trigger a penalty equal to 25% of what your RMD would have been.

If you have a nonqualified annuity paid for with after-tax dollars, you’ll incur a 10% early withdrawal penalty on the interest, but not the principal, of any withdrawal before you turn 59 ½.

Qualified annuity payments are taxed as ordinary income, not as capital gains, at distribution or withdrawal. If you take your money out of your annuity before you reach age 59 ½, you will owe an additional 10% early withdrawal penalty to the IRS. Multiply the amount of interest by 10% to determine your tax liability.