Potential Sources of Income

It’s easy to identify the origin of some payment streams, such as Social Security benefits or disability checks.

Others may not be so clear, especially if you’ve maintained a variety of investments throughout your life or are overseeing a complex estate after the death of a loved one.

Key Facts About Payment Streams:

- Depending on the type of payment stream you have, there are different selling rules, tax consequences and benefits to consider.

- The NAIC has a Life Insurance Policy Locator Service that can help you find a lost annuity policy.

- Make sure you understand your annuity or structured settlement contract before selling to avoid unnecessary fees or financial risk.

Some payment streams, including annuities, guarantee money for retirement. A structured settlement can also provide you with a lifetime of scheduled payments. In both cases, future payments can be sold if your financial circumstances change, and you need the cash now.

Before you can sell, you must first determine the origin of your income and examine associated documents and paperwork.

Structured Settlements

A structured settlement provides a stream of payments, often issued to an injured party. Settlement payments are typically intended to pay for damages or injuries stemming from legal cases.

You could be unknowingly receiving structured settlement payments, even if you weren’t the injured party. It’s legal for a claimant of a structured settlement to transfer their payment rights to another individual, according to The Florida Legislature. You could also be listed as a beneficiary under the structured settlement if the claimant were to pass away.

If you find your income stream is from a structured settlement, then the selling process will require court approval.

Structured settlements are a type of court settlement paid out as an annuity and are subject to strict regulations. While the regulations are intended to protect the injured party, the complex process can make it confusing to match the payments to the issuer.

Some of the confusion stems from the way structured settlements are set up, which includes multiple entities and transactions, starting with the defendant’s transfer of the financial obligation to a subsidiary of an insurance company.

The subsidiary, referred to as an “assignment company,” receives the settlement money from the defendant and buys an annuity to fund the payments to the injured party as specified in the agreement.

Therefore, if you or a family member negotiated a structured settlement, the payments likely originate from a large life insurance company or its subsidiary — not, as you might assume, from the company responsible for the injury or its property and casualty insurer.

Need to Sell Your Annuity for Cash Immediately?

Annuities

Annuities are insurance products that provide a tax-deferred fixed income. People usually buy them to guarantee money in retirement. However, even if you haven’t purchased an annuity yourself, you could still be receiving payments.

Most annuities have designated beneficiaries. Once the annuity owner passes away, the beneficiary will inherit the annuity and receive the remaining annuity payments.

Annuities can be a dependable, relatively low-risk income option. However, situations change, and these financial products may no longer suit your needs. If you’ve inherited an annuity, you do have the option to cash it out. If that’s the case, you’ll need to know which insurance company issued the annuity and the terms of the contract.

Unlike structured settlements, annuities purchased for future income are not owned by a third-party assignment company. Still, it may be difficult to identify the source of income if you’re not the original owner.

How To Find a Lost Annuity Policy

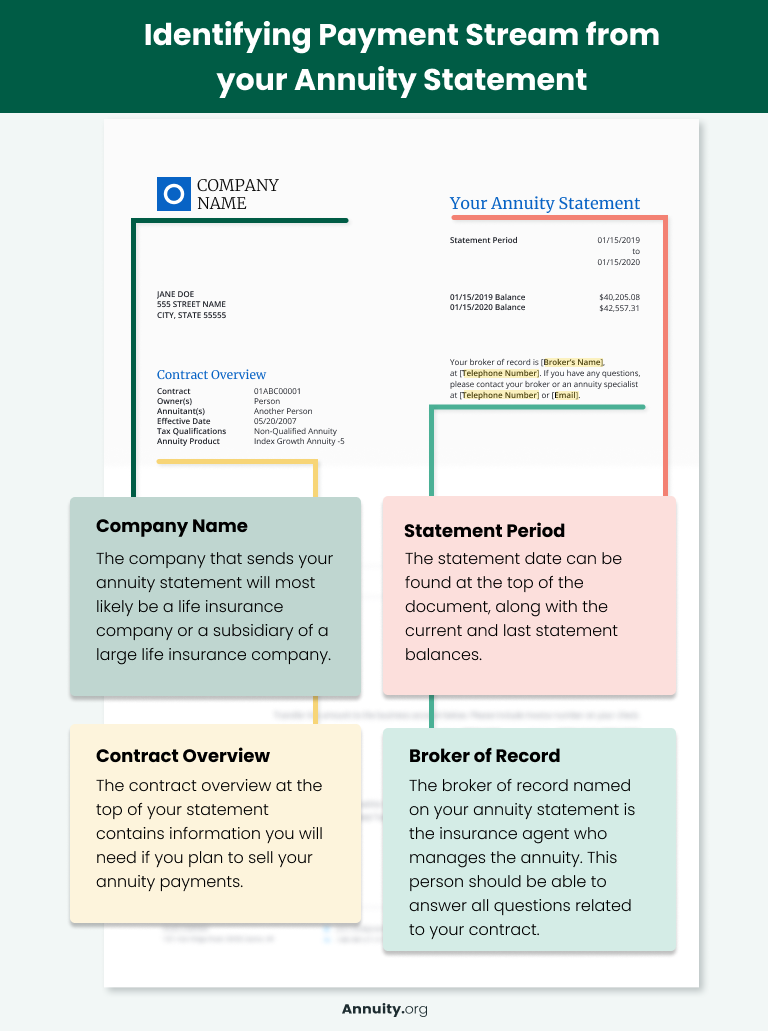

Once you determine the type of payment stream you have, you’ll need to do more digging to find the annuity policy details before starting the selling process. Check online resources, files, safety deposit boxes and storage units for insurance-related documents.

Documents To Review To Help You Find a Lost Annuity

- Statements

- Bank records

- Premium payment confirmations

- Terms and conditions documents

Reviewing these documents can help you determine if your annuity was sold by an insurance company, agent or broker, or if the annuity was purchased through an employer, union or association.

The National Association of Insurance Commissioners (NAIC) also has a free Life Insurance Policy Locator Service that can help you find your lost annuity policy. The tool allows users to access and search for collective records overseen by the NAIC.

According to the NAIC, once a request is made, the organization contacts participating companies to search their records. If anything turns up, the insurance company will alert you.

The policy locator is a useful tool — but it isn’t perfect. Insurance companies participate on a voluntary basis, and even if a policy or annuity contract is located, it may take up to 90 business days before the company contacts you.

If you’re searching on behalf of an elderly or deceased relative, check address books or online contacts for lawyers, business associates, estate planners or financial advisors who may have information.

You Found Your Annuity Policy, Now What?

Finding your annuity documentation was an important first step, but if your objective is to sell or withdraw your payments, there are a few more steps to complete.

Understanding your contract and statement is essential to figuring out the type of annuity you own and your options for managing this income.

Your contract should clearly state all fees associated with selling payments. Keep in mind that if you withdraw money from an annuity too soon after purchasing it, you may face a surrender charge from the insurance company.

Interested in Selling Annuity or Structured Settlement Payments?

Understanding Your Annuity Statement

It’s vital to understand the difference between surrender fees and selling payments. You face surrender fees when you withdraw more money from your annuity than your contract allows.

When you sell payments, you do not pay a surrender charge. Instead, the factoring company that buys your payments deduct a discount rate from the amount they give you.

According to MassMutual, some contracts permit you to pull out money annually, usually up to 10%, without a surrender charge. Surrender fees generally range from 7% to 15% of the amount you plan to withdraw.

Deferred annuities let you withdraw funds early, though you’ll face a surrender charge if you take out more than 10% of your total annuity. Immediate annuities, on the other hand, are less likely to allow free withdrawals, according to a Nasdaq article.

- Accumulated Current Value

- Accumulated value, also known as current value, tells you how much your account is worth. This includes all premium payments plus accumulated interest earnings.

- Surrender Value

- This is how much you can transfer or withdraw from your account prior to the end of the contract term.

- Surrender Period

- The period during which you face a penalty for withdrawing money from your annuity. This period usually lasts seven to 10 years after purchase. Some surrender periods are based on when premiums are paid and are adjusted yearly.

- Penalty-Free Withdrawal Value

- This is the amount available to you without additional fees. Different types of annuities offer different amounts of penalty-free withdrawals. It may be expressed as a percentage, such as 5% or 10% each contract year. Or it may apply only to the interest earned during a contract year.

- Additional Help

- Your annuity statement or policy should contain the 800 number for the issuing carrier. Give this number a call if you need policy specifics or help with general questions concerning your annuity.

Other Important Statement Details

Selling your Payments

If your payment stream is an annuity or structured settlement, you can sell your remaining payments if you need cash now.

However, the lump sum you’d receive will be less than what you would have originally received in scheduled payments. Additionally, there are different rules to selling annuity payments versus selling structured settlement payments.

There are also potential tax implications, commissions and fees to consider. Consult with a licensed financial advisor to help you determine if it’s a good idea to sell your future payments.

Let’s Talk About Your Financial Goals.

Frequently Asked Questions Annuity and Structured Settlement Payment Streams

Contact the insurance company that issued your structured settlement for your contract details.

An annuity statement breaks down your annuity’s performance, contract details, how much money remains, interest you’ve earned and fees charged to your account.

You can cash out your structured settlement if you have sound financial reasoning with a court’s approval.