What Is a Surrender Charge?

Most annuity contracts include surrender charges. They exist to protect the interests of the insurer who, by issuing an annuity contract, assumes the risk that the owner will outlive their retirement savings.

Key Facts About Annuity Surrender Charges:

- Surrender charges act as penalties for selling or withdrawing money from an annuity before it matures.

- The annuity surrender period usually lasts six to eight years after purchase.

- Surrender charges reduce the overall value and returns of your annuity.

When an annuity owner treats their annuity as it was designed to be used, the insurer stands to profit from investing the premium it collected when it sold the annuity. In return, the annuity owner gains the peace of mind that they will receive a guaranteed income stream in retirement.

But when an annuity owner withdraws funds or terminates the contract prematurely, the insurance company loses its potential profit. Surrender charges deter the annuity owner from withdrawing funds early by penalizing them for doing so.

Because variable annuities, unlike fixed annuities, are considered securities and regulated by the Securities and Exchange Commission, their surrender charges are sometimes called “contingent deferred sales charges.”

When you purchase an annuity, you agree to a surrender period. This is the length of time that your funds are inaccessible. The surrender period can be as long as 10 years and, many times, as short as three years. Paying a surrender charge is only an issue if the surrender period on your annuity contract has not ended.

The surrender charge decreases with each year that passes until it eventually reaches 0%.

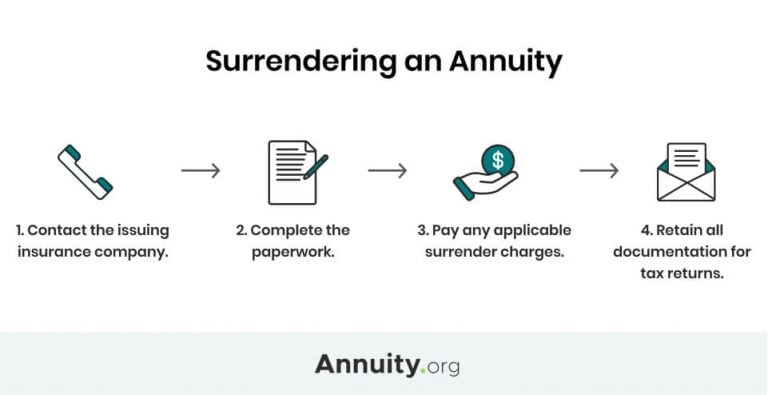

Surrendering an Annuity

Surrendering an annuity is essentially canceling your contract. To initiate a surrender, you’ll contact the issuing insurance company. They will walk you through the process, directing you to the proper forms and explaining any additional documentation or actions required by the company.

Your specific annuity contract dictates the actual surrender charge you’ll pay, along with any other requirements.

Surrendering an annuity can be a very expensive process. According to the Financial Industry Regulatory Authority, it may not be wise to do so if you have immediate or short-term expenses.

On top of potential surrender charges, you’ll also trigger the income tax that has been deferred until that point. The IRS expects you to pay the taxes on these funds in the year you receive them, so it’s important that you fully understand the tax consequences of surrendering your annuity before doing so.

Full Surrender vs. Partial Surrender

You have several options when you decide to surrender an annuity, including opting for a full or partial surrender.

A full surrender occurs when you cancel your annuity contract completely. But you can choose a partial surrender and withdraw only a portion of your contract value. This allows you to keep the benefit of the annuity’s tax-deferred growth while also accessing some cash immediately.

A partial surrender also reduces the amount you’ll pay in surrender charges.

Need to Sell Your Annuity for Cash Immediately?

How a Surrender Charge Reduces the Cash Value of Your Annuity

Your annuity’s value is essentially the dollar amount you would receive if you were to liquidate it. This amount will always be less than you would get by waiting to take income payments from your annuity during its distribution stage.

To illustrate the cash value of an annuity when a surrender charge is assessed, imagine you paid a single lump-sum premium of $50,000 for a qualified annuity 18 months ago. The surrender charge is 7% of your withdrawal amount during the first year and decreases by one percentage point each year after.

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8+ |

| Surrender Charge | 7% | 6% | 5% | 4% | 3% | 2% | 1% | 0% |

You need $30,000 to pay for unexpected medical bills, but you have only $10,000 in emergency savings. You decide to get the additional $20,000 from your annuity.

Because you’ve owned your annuity for a year and a half, your current surrender fee is 6%.

Your contract also states that you may withdraw up to 10% of the annuity’s current value without paying a surrender charge. This means that $5,000 of your withdrawal is penalty free, and the insurer will assess the 6% surrender charge for the other $15,000. Your surrender charge will be $15,000 × 0.06 = $900. You’ll pay $900 to get access to the $20,000 you need.

In this example, we calculate the surrender charge as a percentage of your withdrawal amount. An insurance company could also determine the charge in other ways, such as a percentage of the value of the contract or of the premiums you’ve paid.

Understand how your surrender charge will be calculated to avoid any surprises.

Penalties & Tax Obligations

Besides ordinary income tax, you may owe additional taxes imposed by the IRS. The IRS enforces strict rules on retirement plans to discourage the use of these funds for anything other than “normal retirement,” and qualified annuities are no exception.

The agency assesses a 10% penalty fee on annuity owners who surrender their contracts prior to the age of 59 ½. This is distinct from the insurer’s surrender charge. So, using our example above, besides the $900 surrender charge from the insurer you would owe ordinary income tax on the $20,000 plus another $2,000 fee to the IRS.

Tips for Avoiding Surrender Charges

Avoiding paying surrender charges is difficult depending on the terms of your annuity contract. If you opt to take money out of your annuity before the surrender period has ended, you will likely face a penalty.

One way to potentially avoid the fee if you are in the very early stages of your annuity is through the free look period. This feature lasts 10 to 30 days at the start of a contract and gives buyers the opportunity to get out of their contract without incurring a surrender charge.

Otherwise, some annuity contracts might include exceptions for things like death benefits, nursing home admissions or terminal illnesses. Carefully review your contract to determine if you have a rider or other provision that requires the insurer to waive your surrender charge.

Selling Your Payments

If your annuity carries steep surrender fees, you still have options. An alternative to surrendering your annuity may be to sell your annuity payments to a third-party purchasing company, or factoring company.

When you sell an annuity or structured settlement, you have some flexibility in how to structure your sale. The freedom to decide between a partial and a lump-sum sale offers benefits beyond the ability to avoid a surrender charge.

Note, however, that your sale will not be without its costs. Factoring companies apply what is called a discount rate to the sale amount. Some companies will also charge legal fees. Make sure you know the net cost before making a decision.

Surrendering vs. Selling

There are many factors to consider when weighing whether surrendering or selling your annuity is the right choice for you. Your goal is to minimize your costs while maximizing your cash on hand, and which option best achieves that goal will vary based on your personal circumstances.

To assess your situation, consider the following questions:

- How old is your annuity?

- What is the surrender charge?

- Will your heirs have to pay a surrender charge?

- Are there exceptional circumstances that would require the insurer to waive the surrender charge?

- What are your reasons for selling or surrendering?

- How much money do you need?

- How urgent is your need for cash?

- What other retirement savings do you have?

These questions are only a starting point. It’s important to review your contract carefully with a financial advisor, ask questions about things that are unclear and avoid liquidating the retirement asset if possible.

Interested in Selling Annuity or Structured Settlement Payments?

Frequently Asked Questions Regarding Surrendering an Annuity

No, some companies offer annuities without surrender charges. And some contracts include bail-out provisions that take effect under specific, predetermined circumstances.

Yes, the IRS allows 1035 annuity transfers, but you must follow strict rules to avoid tax penalties. Consult the company that issued your annuity regarding surrender charges for transfers. However, 1035 transfers are still subject to any surrender charges.

You can sell your annuity payments to a factoring company that will pay you a lump sum in exchange for the rights to your future payments. The factoring company you select will walk you through the process of selling payments.