How Do Income Annuities Work?

An income annuity works by converting a large sum of cash into a stream of regular payments. You give the money to an insurance company, and in exchange, the insurer agrees to pay you for a certain length of time — or for the rest of your life.

Depending on your agreement, you might receive these payments monthly, quarterly or annually. You can also customize your income annuity contract so that payments begin right away or at a later date.

Key Facts About Income Annuities

- Lifetime income annuities can provide a hedge against outliving your savings.

- The two types of income annuity are immediate annuities and deferred income annuities; immediate annuities convert the premium into income immediately, while deferred income annuities don’t start paying out for a number of years.

- Withdrawing early from an income annuity can trigger penalties and surrender charges.

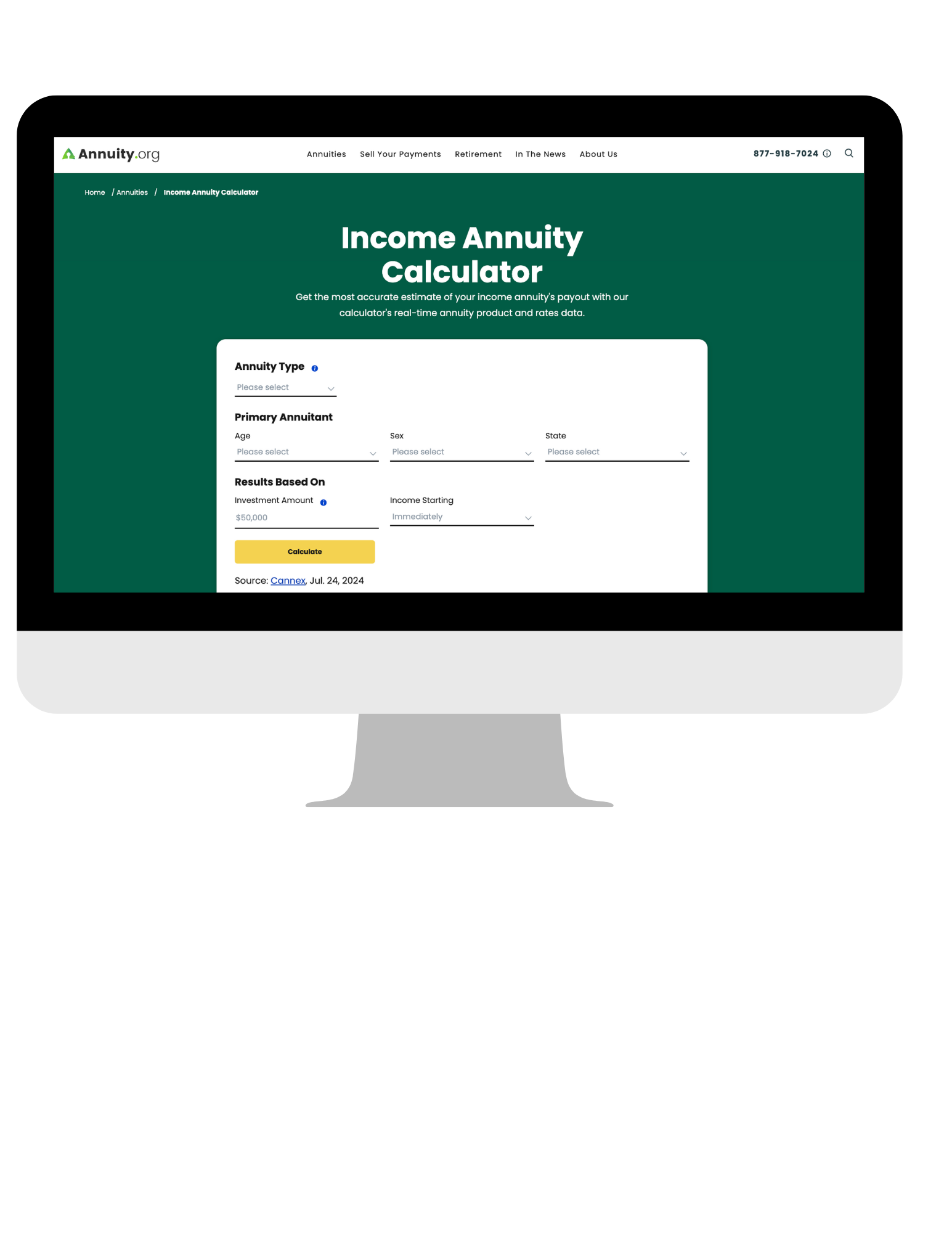

Calculate Your Annuity Payout Instantly

Like all annuities, income annuities offer tax deferral, meaning you pay ordinary income taxes only when you receive payments.

“The most common [income] annuity used is called a SPIA, or single premium immediate annuity,” Matt Lewis, Certified Long-Term Care Specialist and vice president of insurance at Carson Group, told Annuity.org. “Once the lump-sum [premium] is paid, the SPIA will begin making the income payments to the annuitant.”

- Immediate Income Annuity

- Income payments will begin within a year of purchasing the annuity.

- Deferred Income Annuity

- Income payments will begin one year or more after purchase.

Immediate and Deferred Income Annuities

Income annuities aim to offer guaranteed income, not to accumulate retirement savings. Unlike other types of annuities, they annuitize immediately regardless of when your payments actually begin. This differentiates them from accumulation annuities, which may never annuitize.

Use the Financial Industry Regulatory Authority’s free background research tool to find a financial professional who can help determine if an income annuity fits your needs.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Income Annuities in 2024

Income annuities grew in popularity in 2024, according to the insurance industry group LIMRA. The organization reported that sales of immediate annuities totaled $3.6 billion in Q1 of 2024, a 6% increase from the previous year’s first quarter.

Sales of deferred income annuities showed even greater year-over-year growth, with total sales of $1.2 billion in 2024’s first quarter, up 40% from Q1 of 2023. LIMRA forecasted even more growth throughout the rest of the year and into the next, with expected sales of $15 billion in 2024 and $18 billion in 2025.

LIMRA attributed the continued popularity of income annuities to sustained favorable interest rate environments throughout 2023 and into 2024. The organization also pointed out that more than 3 million Americans will reach the typical age for purchasing a SPIA in the next two years, further contributing to the expected growth of these products.

By offering built-in guarantees and providing lifetime income, income annuities offer reassurance to individuals concerned about outliving their savings. In later years, the peace of mind, absence of investment risk and predictable income provided by these annuities contribute to a comfortable retirement lifestyle.

What Are the Pros and Cons of Income Annuities?

Pros

- Protection from outliving your savings (risk protection)

- Customizable contract details

- Tax-deferred growth

- Payments continue even after you’ve recovered your principal and earnings

- Fluctuations in the stock market have no effect on income payments

Cons

- May not provide money for your heirs

- Funds are not easily convertible into cash

- Penalties and surrender charges may apply to early withdrawals

One advantage of income annuities is their customizability. As a spokesperson for Athene Holding told Annuity.org, “Income annuities offer a wide variety of options for payments, allowing policyholders the flexibility to choose the payment type that works best for them, whether it’s payments for life, payments during a guaranteed period or another timeline.”

The biggest benefit of income annuities — specifically lifetime income annuities — is their insurance against outliving your retirement savings. The provider company guarantees your payments, even if your account balance reaches zero.

This stability can be especially beneficial for those concerned about the risk of investing directly in the market. As insurance products, income annuities aren’t subject to market volatility. You can count on receiving the same amount of income on a regular basis.

However, this fixed income might also be a drawback if your payouts remain consistent as living costs rise, reducing your purchasing power. Some insurers offer optional riders that increase your income payments to help keep pace with inflation, but this perk comes at an extra cost.

And, like other types of annuities, income annuities lack cash liquidity. Because of this, an income annuity may not be right for someone without a robust emergency fund.

How Much Money Can You Expect To Receive From an Income Annuity?

The amount you’ll receive from an income annuity depends on factors like initial investment amount, how many payments will be made and the interest rate environment.

You will receive larger individual monthly payments if you structure payouts to only last the annuitant’s lifetime. Under this arrangement, the rest of your money stays with the insurance company should you die prematurely.

However, for a slightly lower monthly payment, you might structure your income annuity to provide lifetime payouts to both you and your spouse, or to another beneficiary after you die.

For example, a 65-year-old woman purchasing a $100,000 immediate income annuity could expect to receive $608 a month for a single life payout. A 65-year-old couple purchasing the same annuity might only receive $567 a month in payments, according to data from the Institute of Business & Finance.

Although income annuities don’t provide a fixed rate of return as certificates of deposit (CDs) do, the interest rate environment in which you purchase an income annuity can have an effect on your payouts.

Insurance companies make money from annuities by investing the premium amounts into predictable low-risk investments like corporate bonds. The interest those bonds earn is used to fund annuity payouts.

This correlation means that annuity payouts tend to be higher when bond interest rates are higher. When you purchase an income annuity during a period of high interest rates, you can lock in a higher guaranteed payment amount than you might have if you purchased when rates were low.

Check your annuity contract for the specific terms of your agreement.

Income annuities are a great way to provide a consistent, stable form of income during retirement as a compliment to other retirement assets.

Longevity Risk Protection

Insurance companies can provide longevity insurance thanks to so-called “mortality credits” — a unique characteristic of lifetime income annuities.

Here’s how mortality credits work: when you buy an income annuity, the insurance company adds your premium to the pool of premiums it has collected from other annuity owners. The insurance company bases lifetime income annuity payments, in part, on the average life expectancy of the annuitants in the pool.

Some annuity owners will live longer than the number of years expected, but some will die earlier, leaving behind their share of income payments. These remaining payments are the mortality credits distributed to the surviving annuity holders from the pool.

If you die before you receive all your planned income annuity payments and you haven’t purchased a rider to allow for beneficiaries, the insurer will pool your remaining payments for the annuitants who live beyond their life expectancy.

Income Annuity Frequently Asked Questions

If you did not purchase a rider with your income annuity, the insurance company will keep your remaining account balance.

There is no legal limit on age restrictions. However, some carriers will cap the maximum age, usually between age 75-95.

The two main types of income annuities are immediate income annuities, which begin paying out right away, and deferred income annuities, which delay payouts. Many variable and indexed annuities also have income riders which can provide lifetime income.

Annuity contracts are legal documents. If you have questions about the terms of your contract, make sure you get answers before you sign. Ask about the financial stability of the annuity company, commissions and fees, surrender charges and the free look period.

Editor Anna Baluch contributed to this article.