What Does Our Immediate Annuity Calculator Do?

Use this immediate annuity calculator to estimate how much an annuity would pay out each month. To do so, the calculator needs information such as your age and how much you expect to put down for a premium on the annuity.

To find out how much you could receive from an immediate annuity, simply enter your information in the box above. You’ll need the dollar amount of your premium, which must be paid in a single lump sum.

You’ll also enter your life expectancy, a key element in annuity income calculations. For reference, recent CDC data finds the average life expectancy is roughly 73 years for an American man and 79 years for an American woman.

Key Facts About The Immediate Annuity Calculator

- This immediate annuity calculator can help you estimate how much you could get each month from an annuity with no growth accumulation.

- You can compare different annuity scenarios by plugging in details like the annuity amount, the rate of return and your age.

- Annuity payouts are affected by a number of factors, including the annuitant’s health, age and gender; the type of annuity; and any riders or provisions added to the contract.

To estimate your life expectancy for the calculator, subtract your current age from the average life expectancy for your sex.

How To Calculate Annuity Payments

Calculating annuity payments can be tricky because insurance companies have the authority to set their own rates and contract terms.

To get the best result from an annuity calculator, it helps to know the average annuity rates for the type of annuity you plan to buy. There are several variables that go into calculating annuity payments, including those below.

Annuity Payment Variables

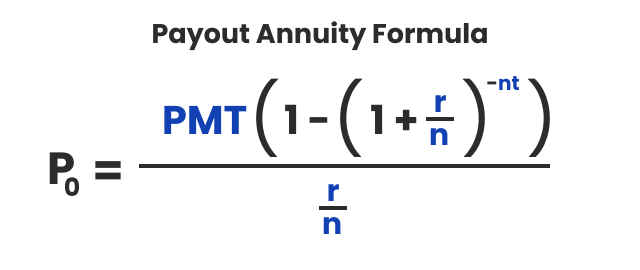

- P0 = Principal

- r = Annual interest rate

- n = Number of payments per year

- t = Number of years of payments

Interest rates will vary depending on the type of annuity and the provider. You can customize the number of payments per year in your contract, but most annuitants receive payouts once per month or 12 times per year.

The formula for calculating an annuity payout looks something like this:

How Much Does an Annuity Typically Pay Out Each Month?

The typical monthly payout of an annuity can vary greatly depending on several factors, including the type of annuity, the amount invested, and the characteristics of the annuitant.

Your annuity’s payout can be affected by how long it has to accumulate growth before the contract annuitizes. This calculator is used for immediate annuities, which do not have an accumulation phase.

The amount invested in the initial premium can also influence the eventual payout of an annuity. The more you can invest in the annuity upfront, the higher your monthly payout will be.

Annuity payouts are calculated based on the annuitant’s life expectancy. Because of this, characteristics of the annuitant such as their age, sex and any health complications can increase or decrease the monthly payout amount. The longer the annuitant is expected to live, the smaller their monthly payout will be.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

I tell many clients that annuities are most useful for filling the gap between your total essential expenses and your other guaranteed sources of income, such as Social Security or a pension. If your essential expenses are greater than your guaranteed income, an annuity can provide dependable and consistent income to cover the difference. This leaves you with less to worry about in the event of a market downturn, since your most important expenses are covered for life.

How Much Income Do I Need To Retire?

When you’re planning for retirement, it’s important to have a good idea of how much income you’ll need while you’re not working and where that money will come from. The first step is making a retirement budget to better understand what your financial needs will look like.

To make a retirement budget, you’ll need to identify what your expenses and income will look like in retirement. After comparing your expenses to your income, you can determine whether you’ll need to adjust your spending or find other sources of retirement income.

This process is like building a normal budget, but there are some other factors to consider when budgeting for retirement. You’ll have to account for things like inflation, which can reduce the purchasing power of your savings, or changes in Social Security benefits.

You should also consider that your expenses now may not be the same as your expenses at retirement. For example, older Americans spend more on health care costs than younger people do. Retirees may also need to pay for long-term care or financially support their adult children or grandchildren.

Will You Be Able To Maintain Your Retirement Lifestyle?

Learn how annuities can:

- Help protect your savings from market volatility

- Guarantee income for life

- Safeguard your family

- Help you plan for long-term care

Speak with a licensed agent about top providers and how much you need to invest.

Frequently Asked Questions About Annuities

An annuity is an insurance product that converts a premium into a stream of guaranteed lifetime income. Annuities provide modest growth along with principal protection and are often used to supplement retirement savings.

To determine how much income you will need in retirement, you’ll need to build a retirement-focused budget. Identify expenses and sources of income and adjust your spending as needed.

Annuity payments vary depending on the interest rates, the size of the premium and the annuitant’s life expectancy. Using an annuity calculator can give you an estimate of what your monthly payments might be.

Annuity payments can be calculated using the following formula:

PMT = r(PV)/ 1 – (1 + r ) -n

where PV= Present value, r = interest rate and n = number of payments per year.