With a multi-year guaranteed annuity (MYGA), you sign a contract with an insurance company. In exchange for your premium payments, the insurance company provides a guaranteed fixed interest rate on your contribution for a specified period of time. The term can be three years, five years, 10 years or any number of years in between.

Key Facts About MYGAs

- A MYGA guarantees a fixed interest rate for a specified period of time, typically three to 10 years.

- MYGAs carry low risk because they are not subject to market fluctuations.

- Taxes are deferred until you start making withdrawals.

- You’ll have to pay a surrender charge if you withdraw money before the accumulation period ends.

How Do MYGAs Work?

A MYGA works by tying up a lump sum of money to allow it to accumulate interest. If you need to withdraw funds from an annuity before the accumulation period is over, you may have to pay fees called surrender charges.

At the end of the accumulation period, you can receive the premium and interest earned, or you may be able to renew the contract. If you choose to renew the contract, the interest rate may differ from the one you had originally agreed to.

Another option is to transfer the funds into a different type of annuity. You can do so without facing a tax penalty by using a 1035 exchange.

Many of my clients seeking short-term investments are purchasing MYGA, especially in the three- to five-year time frame. They can defer their taxes while still employed and not in need of additional taxable income. Given the current high interest rates, MYGA has become a significant component of retirement financial planning. With the likelihood of interest rate decreases, the fixed-rate nature of MYGA for a set number of years is highly appealing to my clients.

Case Study Example

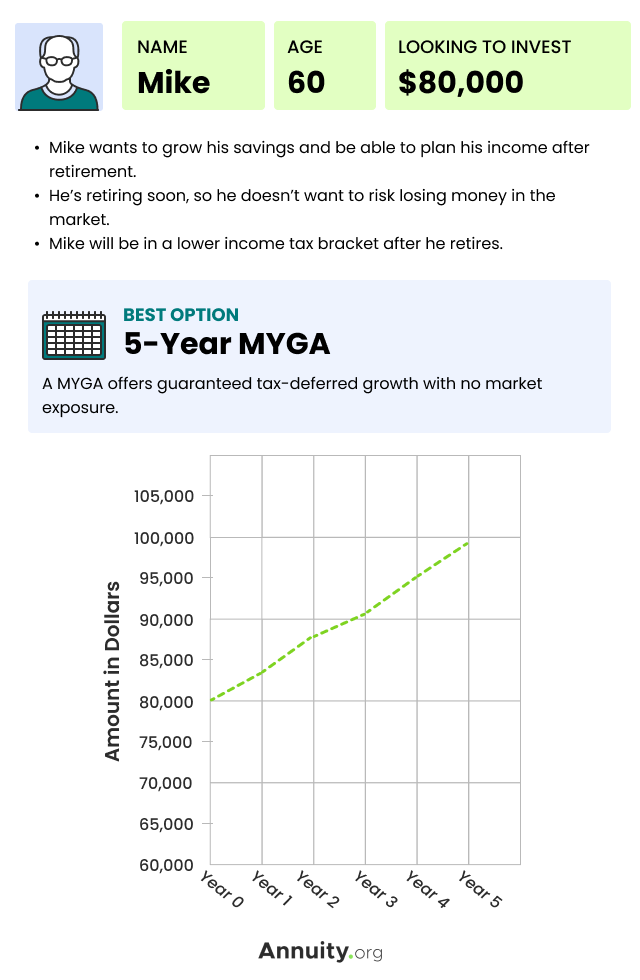

To better understand how an individual nearing retirement might benefit from a MYGA, let’s look at a case study example.

MYGA purchasers typically seek a risk-free avenue to bolster their savings in anticipation of retirement. These individuals, as noted by Annuity.org expert contributor Stephen Kates, CFP®, often fall into two categories: those nearing retirement and those bridging the gap into retirement.

According to Kates, the typical MYGA customer is someone who prefers to avoid market risks as they approach retirement but still aims to augment their savings for post-retirement income.

Moreover, MYGAs offer the advantage of precise income planning, as their interest rates remain constant throughout the annuity’s term.

MYGA Rates

Current MYGA rates change daily and vary slightly from carrier to carrier. MYGA rates are usually higher than CD rates, and they are tax deferred which further improves their return. A contract with more limiting withdrawal provisions may have higher rates.

Today’s Best MYGA Rates

| Term | Rate | Provider | Product | AM Best Rating |

|---|---|---|---|---|

| 1 Year | 6.74% | Corebridge Financial | American Pathway Fixed 7 Annuity | A |

| 2 Years | 5.55% | Axonic Insurance Services | Skyline MYGA | A- |

| 3 Years | 6.10% | Wichita National Life Insurance | Security 3 MYGA | B+ |

| 4 Years | 5.50% | Nassau Life and Annuity Company | Simple Annuity | B++ |

| 5 Years | 6.35% | Knighthead Life | Staysail | A- |

| 6 Years | 6.20% | Atlantic Coast Life | Safe Harbor Bonus Guarantee | B+ |

| 7 Years | 6.60% | Knighthead Life | Staysail | A- |

| 8 Years | 5.65% | EquiTrust Life Insurance Company | Certainty Select | B++ |

| 9 Years | 5.40% | Clear Spring Life and Annuity Company | Preserve Multi-Year Guaranteed Annuity | A- |

| 10 Years | 7.05% | Atlantic Coast Life | Safe Harbor Bonus Guarantee | B+ |

Withdrawal Provisions

Many annuity providers offer penalty-free withdrawal provisions that allow you to access some of the money from an annuity before the surrender period — the time frame during which surrender charges for early withdrawals applies — ends without having to pay fees. Some contracts, for example, allow you to withdraw up to 10% starting in the first year.

Your contract may also allow you to take money out for emergencies. For example, if you need money to pay a hospital bill, you may be able to take it out of your MYGA. This may be better than getting a 401(k) loan or withdrawing funds from an IRA.

Withdrawal provisions are spelled out in your MYGA contract.

But before pulling money out of your annuity early, remember that one of the major benefits of a MYGAs is that they grow tax-deferred. Once you start withdrawing funds, you’ll be subject to taxes.

Taxes

A MYGA offers tax deferral of interest that is compounded on an annual basis. This can create additional wealth exponentially because the tax occurs only when you take the money out. It’s like investing in an IRA or 401(k) — but without the contribution limits.

This tax benefit is not unique to MYGAs. It exists with traditional fixed annuities as well.

Qualified vs. Nonqualified MYGAs

The tax rules change slightly depending on the type of funds you use to purchase the annuity:

- If you purchase a MYGA with qualified funds, such as through an IRA or other tax-advantaged account, you pay income tax on the principal and interest when you take out money, according to CNN Money.

- If you purchase a MYGA with nonqualified funds, the amount you pay in taxes depends on your principal investment, interest earnings, annuity term length and life expectancy. This is called an “exclusion ratio.”

This tax benefit is not unique to MYGAs. It exists with traditional fixed annuities as well.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

MYGAs vs. Traditional Fixed Annuities

MYGAs are a type of fixed annuity. The main difference between traditional fixed annuities and MYGAs is how long the contracts guarantee the fixed interest rate.

MYGAs guarantee the interest rate for the entire duration of the contract, which could be, for example, 10 years. Traditional fixed annuities may guarantee the interest rate only for a portion of the term of the contract. So, you may buy an annuity with a seven-year term but the rate may be guaranteed only for the first three years.

Read More: What Is a Fixed Index Annuity?

MYGAs vs. CDs

When people speak of MYGAs, they usually liken them to CDs. Both offer guaranteed rates of return and guaranties on the principal.

A MYGA works very similarly to a CD: You deposit a lump sum of cash and receive a fixed interest rate for a specific period of time. Compared to investments like stocks, CDs and MYGAs are safer, but the rate of return is lower.

They do have their differences, however.

6 Differences Between MYGAs and CDs

- A CD is issued by a bank or a broker; a MYGA is a contract with an insurance company.

- A CD is insured by the FDIC; a MYGA is not insured by the federal government, but insurance companies must belong to their state’s guaranty association.

- A CD typically imposes a penalty for withdrawing money prior to maturity; a MYGA may allow you to take out some of the money annually without incurring fees.

- A CD may have a lower interest rate than a MYGA; a MYGA may have more fees than a CD.

- A CD’s interest rate is taxed each year; a MYGA offers tax-deferred growth.

- CDs may be made available to creditors and liens; MYGAs are protected against them.

You could use a MYGA as a substitute for a CD, or you could incorporate both into your financial plan.

Read More: What Is a Variable Annuity?

Is a MYGA Right for You?

As with any financial product, you need to see what your financial goals are prior to purchasing a MYGA.

You’re Close to Retirement and Want To Avoid Risk

Given the conservative nature of MYGAs, they might be more appropriate for consumers closer to retirement or those who prefer not to be subjected to market volatility.

“I turn 62 this year and I really want some sort of a fixed rate as opposed to worrying about what the stock market’s going to do in the next 10 years,” Annuity.org customer Tracy Neill said.

If you are looking for a solution to replace your income upon retirement, other types of annuities may make more sense for your financial goals. Moreover, other types of annuities have the potential for higher reward, but the risk is higher, too.

You’re Looking for Long-Term Growth

While potentially suitable for a risk-averse investor, a MYGA may not be suitable for a younger investor interested in growth.

MYGAs offer steady, guaranteed growth, but their fixed interest rates typically don’t generate as high of returns as other investment products. This may not appeal to younger investors looking for long-term growth.

You’re Worried About Inflation

For those who are looking to outpace inflation, a MYGA might not be the best financial strategy to meet that objective. Because MYGA interest rates are fixed for the contract term, they don’t adjust to cost-of-living increases, meaning their value may diminish over time.

How To Buy a MYGA

Because interest rates are set by insurance companies that sell annuities, it’s important to do your research before signing a contract.

- The first step is to consult a financial advisor and determine how much you would like to invest in an annuity.

- Then, it’s time for comparison shopping: Look at various highly rated insurance companies to see the MYGA rates they offer.

Frequently Asked Questions About MYGAs

Multi-year guaranteed annuities are a type of fixed annuity that offer guaranteed rates of return without the risk of stock market volatility. Though they offer modest returns, they are a safe and reliable investment option.

A market value adjustment (MVA) is a feature an annuity issuer may include to protect itself against losses in the bond market. With an MVA, the insurer can offer you a higher rate of return but can also pass along part or all of its market loss to you under certain circumstances.

Once the guaranteed period ends, you have several options. You can renew the annuity contract with a new, possibly higher rate and no surrender fees. You can roll the MYGA over into a new one with new rates and surrender fees. Or you can annuitize the contract, converting the MYGA into an annuity paying a steady income stream.