Key Facts About Annuities vs. CDs

- Multi-year guaranteed annuities (MYGAs) are financial contracts usually issued by insurance companies, and certificates of deposit are savings accounts issued by banks and credit unions.

- MYGAs are long-term vehicles popular for optimizing retirement plans, while investors typically use CDs to generate near-term income on excess cash.

- MYGAs are more complex than CDs. They also offer more flexibility and the potential for higher returns.

Most often, an annuity is a financial contract between an individual (the annuitant) and an insurance company (the issuer). From the annuitant’s perspective, it entails converting a lump sum into a series of immediate or deferred income distributions, which they can customize in terms of size, timing, variability and duration.

Multi-year guaranteed annuities (MYGAs), a type of fixed annuity, are most similar to CDs. When you purchase a MYGA, you lock in a guaranteed interest rate for the annuity’s term, which usually ranges between three and 10 years.

A certificate of deposit (CD) is a type of savings account offered by banks and credit unions. It provides a guaranteed rate of interest in exchange for a commitment to leave your money on deposit for a specified term. However, early withdrawal will cause a loss-of-interest penalty, which usually equates to a certain number of months of interest.

MYGA vs CD Features: A Comparison

Before purchasing an annuity or a CD, make sure you understand the way each instrument works. Comparing their similarities and differences is a sensible way to educate yourself.

Comparing MYGAs and CDs

| Multi-Year Guaranteed Annuities | Certificates of Deposit | |

|---|---|---|

| Primary Purpose | Retirement income | Incremental interest income |

| Tax Treatment | Tax-deferred growth of principal | Interest income taxed annually |

| Safety | Backed by issuing insurer and state guaranty associations | Backed by the FDIC or NCUA |

| Customizable Features | Yes | No |

CDs and annuities both provide safe, secure options for conservative investors. CDs are more beneficial for short-term savings or emergency funds that might be needed within 1-3 years and should not be subject to retirement account rules. Annuities are best for longer-term savings goals and, due to their tax-deferred status and requirements for withdrawal only after 59.5 years old, meant primarily for retirement savings.

Similarities Between MYGAs and CDs

Both CDs and MYGAs require an investor to lock up his or her money for a specified period, while interest income accumulates in a risk-free fashion. At the end of the accumulation period, the investor receives the principal and accrued interest.

Experts consider both CDs and MYGAs extremely safe products for growing your savings. They both offer principal protection, so the main risk for each product is the unlikely event that the issuer becomes insolvent and cannot meet its obligations.

Because the interest rates on MYGAs and CDs are guaranteed for the product’s term, they both make it easy to predict exactly what your return will be.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Differences Between MYGAs and CDs

CDs and MYGAs are both secure investments. However, CDs are more flexible with shorter terms and lower withdrawal penalties. MYGAs generally offer higher interest rates and provide periodic payments, while CDs pay a lump sum at maturity.

Another significant difference pertains to the degree to which these instruments can be customized. MYGAs are highly customizable, offering investors an array of optional add-on features commonly referred to as annuity riders. CDs offer no such optionality.

Below are a handful of other notable differences between multi-year guaranteed annuities and CDs.

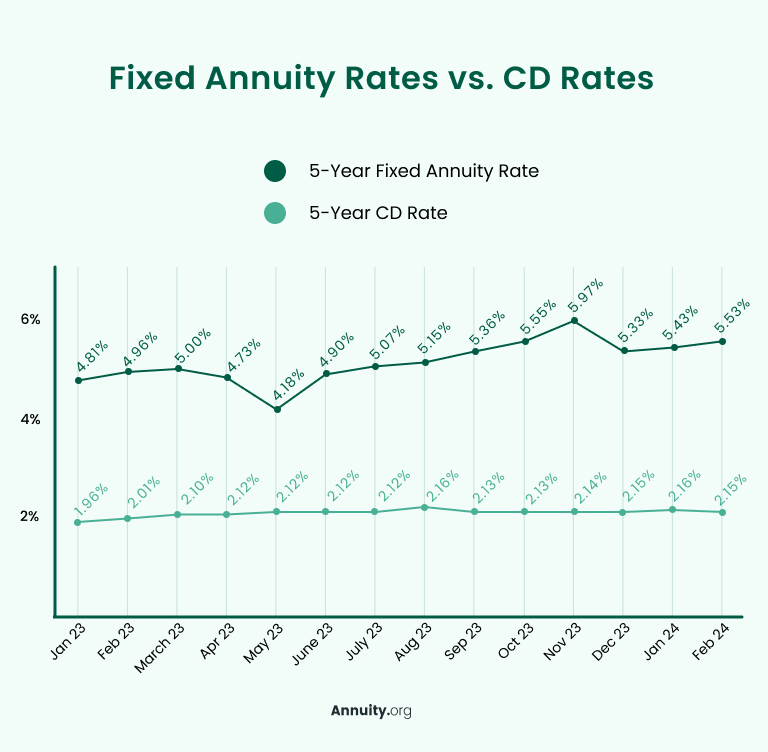

Interest Rates

The interest rates offered on CDs are generally lower than the interest rates available from annuities. Over long periods of time, even a 1% or 2% differential can make a huge difference in terms of accumulating wealth.

Lifetime Income Option

As a type of annuity, MYGAs offer a specific benefit that CDs don’t: the option to create a lifetime income stream. When your MYGA matures, you can choose to receive your principal and interest as a stream of payments. You can elect for that income stream to last for a set number of years, for your entire life, or even for yourself and your spouse’s life.

CDs do not provide lifetime income streams. You can ladder CDs with smaller amounts of money to pay out annually over a number of years, but you will always receive the principal and interest from a CD as a lump sum.

Safety

In terms of safety, CDs are near the top of the list of all investable assets. They exhibit zero volatility and, if structured properly, are insured up to $250,000 for individual accounts and $500,000 for joint accounts. The Federal Deposit Insurance Corporation (FDIC) insures CDs issued by banks, and the National Credit Union Administration (NCUA) insures CDs issued by credit unions.

Because the federal government does not insure annuities, they are not as safe as CDs. However, as long as a financially sound insurance company issues them, the backing of various state guaranty associations still makes annuities much safer than bonds, stocks and alternative assets in general.

Tax Treatment

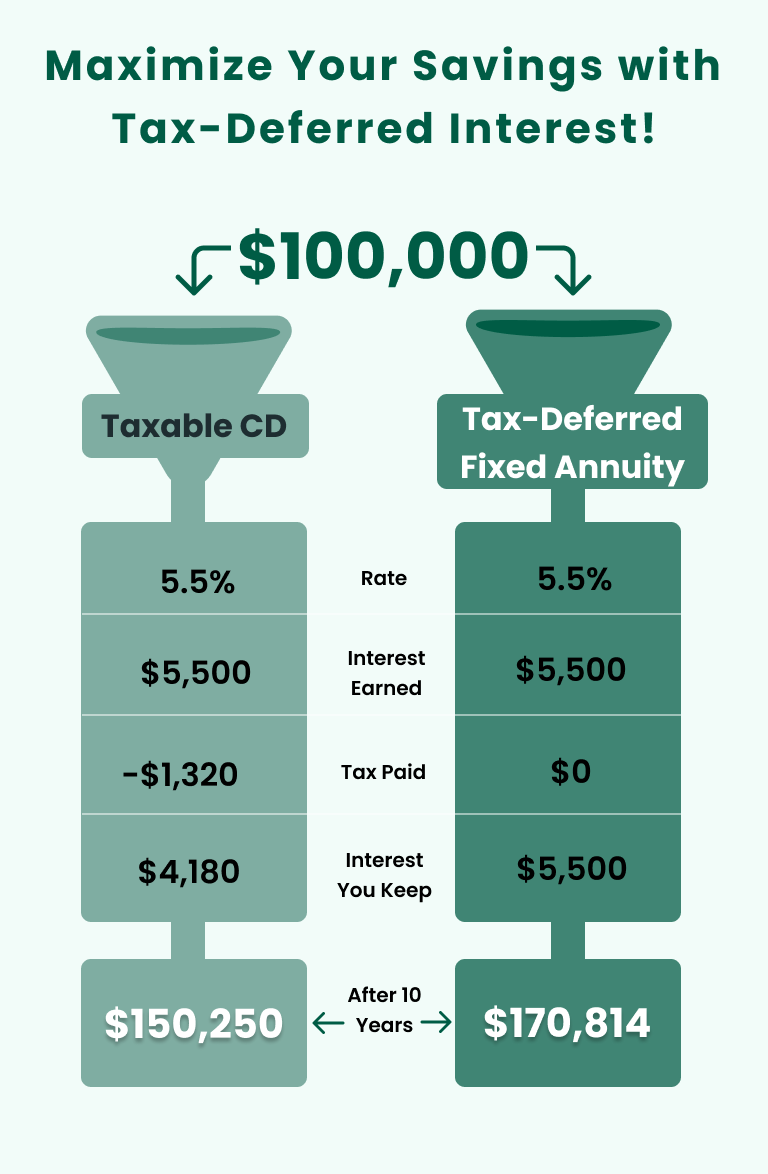

The IRS allows nonqualified annuities — those paid for with after-tax funds — to grow on a tax-deferred basis. They do not grant CDs the same advantage.

The IRS requires annual taxation of the earnings on CDs (except those held in tax-advantaged retirement accounts). This goes for coupon-paying and zero-coupon CDs. Unfortunately for zero-coupon CD holders, this results in an adverse mismatch of cash flows.

The tax-deferred growth of MYGAs allows them to further outpace the returns on CDs. Even after the MYGA’s interest is taxed, a fixed annuity can still come out on top because more money is left in the annuity over time, allowing interest to compound.

Liquidity and Penalties

Given their longer terms, multi-year guaranteed annuities are generally less liquid than CDs. Moreover, the contractual penalties for withdrawing money prematurely from multi-year guaranteed annuities are usually much greater than those for CDs.

Withdrawing funds from a MYGA during its accumulation phase typically results in a penalty of 10% of the value of your investment. Additionally, if the withdrawal is made by an annuitant under the age of 59½, the IRS will impose an additional 10% penalty.

Conversely, if you redeem a CD prior to maturity, the penalty usually amounts to the loss of a few months of interest, but no forfeiture of the principal.

Beneficiaries

The money invested in both MYGAs and CDs can be passed on to heirs. However, the process is more straightforward with MYGAs.

In the event of an annuity owner’s death, named beneficiaries are not required to go through probate court to claim their benefits. Conversely, if a CD does not have a payable-on-death beneficiary and is not part of a living trust, irrevocable trust, or joint account, a deceased’s heirs must go through probate to obtain the inheritance.

Calculate Your Returns Based on Today’s Best Rates

How To Choose Between a MYGA and a CD

When deciding whether to put your money in a MYGA or a CD, you must carefully consider your circumstances and investment objectives. Also consider your tolerance for risk, which depends largely on your time horizon.

If you plan to use the money invested to generate a predictable stream of income for retirement, a multi-year guaranteed annuity is the appropriate choice. However, if you are just looking to produce some extra income on your excess cash, a CD is the better option.

Other considerations that will help you make an optimal decision include:

- Are you intent on having your investment insured by the federal government? Or, are you comfortable having it backed by a reputable insurance company?

- How long are you willing to lock up your money?

- Are there specific annuity riders that appeal to you?

- How diverse is your investment portfolio and which of these vehicles best complements your holistic strategy? Does investing some money in both instruments make sense?

As you evaluate these ideas, enlist the help of a fiduciary financial advisor. He or she can provide invaluable guidance regarding investment selection decisions and a myriad of other matters.

Secure Retirement Without Hidden Fees

Frequently Asked Questions about MYGAs vs. CDs

CDs and annuities are both safe investments. However, given their federally insured nature, CDs are generally considered to be safer than annuities. That said, annuities issued by financially sound insurance companies are among the safest instruments in which you can invest.

Some CDs make periodic interest payments throughout their terms. However, zero-coupon CDs do not make any interest payments. Rather, at maturity, these instruments compensate investors by paying out more than the initial investment.

Editor Malori Malone contributed to this article.