What is an Immediate Annuity ?

An immediate annuity is a contract between you and an insurance company designed to create predictable income. Immediate annuities are also known as single premium immediate annuities or SPIAs.

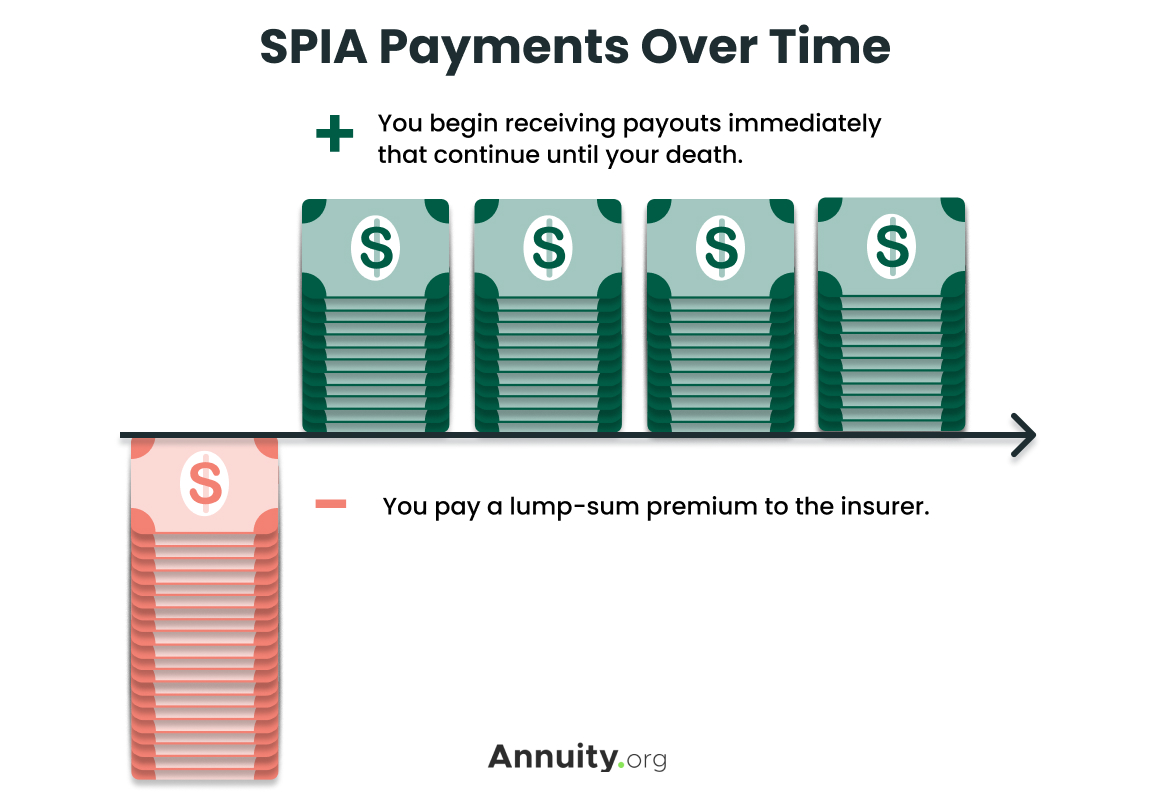

SPIAs are essentially the opposite of a deferred annuity, where you would pay a recurring premium to build up the value of an annuity over time. When you opt for a SPIA, you exchange a single lump-sum premium for immediate payments that will begin within a year.

Key Facts About Immediate Annuities

- A higher interest rate environment makes immediate annuities an attractive option, especially if you’re looking for a bridge until you begin claiming Social Security benefits

- Sometimes, immediate annuities come with an optional inflation protection rider, increasing your payout from 3% to 5% each year.

- If you’re looking to supplement your retirement savings with immediate annuities, be sure to shop around and compare your options so you can zero in on the ideal product for your situation.

They offer a strong opportunity to take an existing nest egg and convert it into predictable payments. Rob Williams, managing director at the Schwab Center for Financial Research, compared it to buying a pension.

“A deferred annuity is usually an annuity that you’ve purchased to grow savings for retirement in an efficient way,” he told Annuity.org. “An immediate annuity is when you have a lump sum and you purchase it so you take the income immediately.”

Total annuity sales are projected to fall in the $364 to $410 billion range in 2025.

Immediate annuities are one of the simplest and most consumer-friendly annuity options available. They don’t contain the complexity of other annuity types and tend to not have as many fees.

According to the latest figures from the Insurance Information Institute, 2023 saw approximately $286.6 billion in sales of fixed immediate annuities.

Why Immediate Annuities Are So Popular Among Retirees

Part of the popularity of immediate annuities is because they solve two common complaints consumers have with annuities: The complexity and amount of fees.

Immediate annuities can be remarkably simple products while serving to guarantee income. Unlike other types of annuities that may involve extended payments or be tied to the performance of investments, immediate annuities can be as simple as handing over a lump-sum premium and converting it into predictable payments.

There also tend to be fewer fees connected to immediate annuities when compared to other common types of annuities like variable or indexed options. Fees often grow with the complexity of the product, so a simple annuity can translate into lower fees.

Popular Immediate Annuity Features

- Simple product

- Fewer fees

- Immediate payments

Immediate annuities also offer the option to make large contributions without the limitations imposed on 401(k)s, IRAs and other popular retirement plans.

They can enable retirees to supplement Social Security income and pension plans, which might not provide enough to cover their retirement living expenses. In fact, retiring employees can roll their 401(k) plans into a SPIA to create meaningful income for retirement.

“Typically, the average person that’s buying an immediate income annuity is in retirement or about to retire,” Annuity.org expert contributor Stephen Kates, CFP®, explained.

Our client was concerned about the current market volatility and the potential impact of her hereditary health risks. After building her financial plan, we concluded that a portion of her tax-deferred IRA could roll into a SPIA. In doing this, we mitigated her risk by reducing market exposure and introducing a constant stream of income. Because of the higher interest rates we are seeing today, her current monthly payments will not only keep up with inflation but slightly beat it in the next few years as inflation returns to the status quo.

Case Study

Let’s look at a hypothetical example of a typical immediate annuity customer to understand the type of person best suited for the product.

Charlotte is 65 years old, one year away from retirement and is looking to invest $100,000. Like many soon-to-be retirees, she’s worried about running out of money once she’s no longer working.

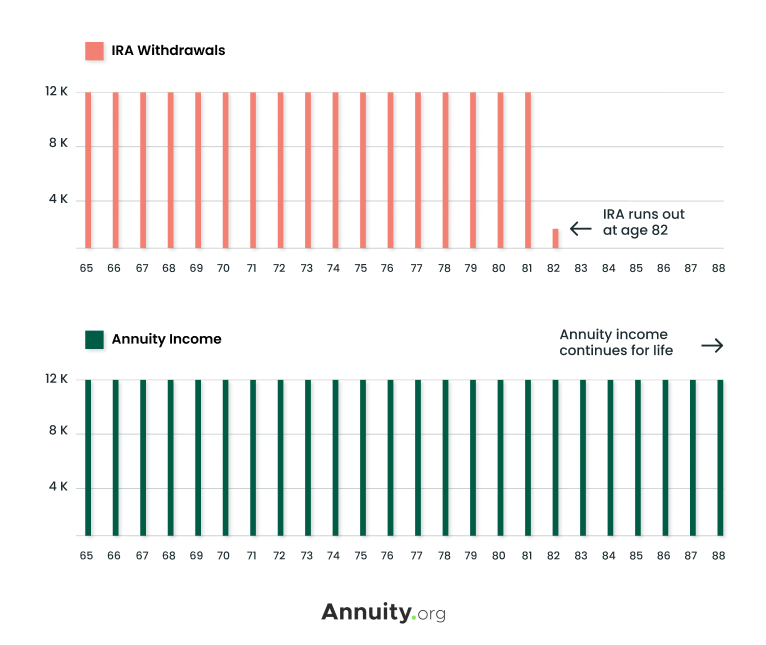

Her best option could be a SPIA, which would guarantee her income for the rest of her life. If she invested in a conservatively-invested IRA annually, the funds could be depleted by the time she is 82. Annuity payments would continue for her whole life.

Like Charlotte in the example above, many retirees face the risk of running out of money once they stop working. By purchasing an immediate annuity, Charlotte can guarantee she’ll receive regular income payments for as long as she lives.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

How Immediate Annuities Pay Out

As the term “immediate annuity” implies, the great benefit of SPIAs is that they pay out immediately by converting a lump sum into a stream of payments that you will receive each month, quarter or year.

When you purchase an immediate annuity, you can customize your income stream with different payout options. You can also structure payments over a specific period, such as 10 years, which is known as a period certain annuity. Period certain immediate annuities are less popular than other alternatives but can be beneficial in certain situations.

With a fixed immediate annuity, each payment to the annuity owner will be the same. On the other hand, if the annuity is variable, the amount of each check will be different because the subaccounts will fluctuate.

Let’s say you’re 65 years old and want a guaranteed income stream once you retire in a few months. You decide to open an immediate annuity with a $100,000 investment. In this scenario, you can estimate a monthly payout of $629 a month or $7,546 a year. Note that this example assumes a single-life policy with no death benefit or premium payments to your beneficiaries.

How To Calculate Your Immediate Annuity Payments

There are several factors that go into calculating your immediate annuity payments. This includes factors such as your age and life expectancy, the amount you wish to invest, and how frequently you would want to receive payments.

With this information, you can create a snapshot of what your immediate annuity payments would likely be worth.

Calculate Your Returns Based on Today’s Best Rates

How Immediate Annuity Rates Are Determined

The interest rate on an immediate annuity can be:

- Fixed

- Annually adjusted for inflation

- Variable, with earnings based on the performance of its subaccounts

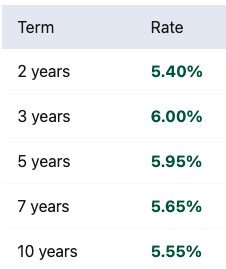

Each annuity interest rate option has its benefits and drawbacks. Fixed-rate immediate annuities are more reliable and their rates are often more favorable than certificates of deposit (CDs) and U.S. Department of the Treasury rates. However, receiving the same amount of money each year means your payments likely won’t keep up with inflation.

Immediate annuities with variable rates are more likely to hedge against inflation as their payments can change based on market performance. But the changing payment amounts make the income from these annuities less predictable.

Buying an Immediate Annuity: Pre-Tax vs. After-Tax Funding

Annuities are insurance products, not investments. This means that the IRS considers the payment streams they generate to be income, so the payments are subject to income taxes. But the tax treatment of those income payments is determined by the type of premium used to fund the annuity.

Taxation of your immediate annuity payments depends on where the funds you purchased the annuity with came from. If you buy an immediate annuity in a state that levies a state premium tax on annuities, you’ll pay the premium tax at the time of purchase.

If you fund your annuity with after-tax dollars, you own a nonqualified annuity. This means that when you receive disbursements, the IRS considers a portion of every payment to be a return of principal and that portion is not taxed.

The portion of your payment that is generated by interest earned is still taxable.

If you purchase your annuity with pre-tax money, your annuity is qualified, and the entire amount of each payment is subject to ordinary income tax rates. Funds for qualified immediate annuities come from retirement plans like IRAs, 401(k)s, SEP plans and corporate-sponsored defined contribution plans.

Moreover, if your immediate annuity purchase is made from a Roth IRA, then you will be able to enjoy the benefit of tax-free income for the rest of your life.

Since immediate annuity annuitize immediately, your premium is instantly converted to a stream of regular payments. If that is not your goal — for example, you already have another form of reliable retirement income, or you would prefer having a lump sum of cash accessible — a SPIA is not the right product for you.

Pros and Cons of Immediate Annuities

As with any financial product, there are trade-offs when you opt for an immediate annuity. In exchange for a guaranteed stream of payments that can last the rest of your life and begin right away, you are giving up a significant lump-sum payment, as well as the liquidity of that cash.

You should weigh both the pros and cons of the product carefully before determining if an immediate annuity is the best fit for your situation.

Pros

- Guaranteed and Immediate Income

When you purchase an immediate annuity, you transfer risk to an insurance company that, in turn, begins paying you within the first year of your contract.

- Fewer Fees

Immediate annuities rarely have any account management or account maintenance charges.

- Simplicity

Purchasers appreciate the easy and reliable payment stream afforded by immediate annuities. Once established, an immediate annuity requires no maintenance or work.

- Plan for Retirement

Many people use immediate annuities to fund their retirement. Often, retirees prefer the product’s reliability to the volatility of the stock market.

- COLA

For an added cost, you can purchase a cost-of-living adjustment (COLA) rider for your immediate annuity, which will increase your annuity payments over time depending on how the rate of inflation has increased. However, it’s important to evaluate this option carefully with a financial advisor because this feature typically produces substantially lower beginning payments.

- One-Time Withdrawal

Some insurance companies offer one-time cash advance options for annuitants who have an immediate need for cash. Otherwise, you cannot change your annuity, and it will only pay the set amount on the disbursement schedule.

- Mortality Credits

Risk pooling, or the spreading of risk across many accounts, allows premiums from annuity owners who die prematurely to be used to pay benefits for those who live beyond their life expectancy. These so-called “mortality credits” can increase your returns above those of other options and, by choosing a lifetime benefit option, you can hedge against ever outliving your available assets.

- Legacy Options

There is some misconception that immediate annuities will not pay benefits to your heirs when you pass. While it is possible to elect a payment optimized for the highest income that contains no death benefits (sometimes referred to as a straight life annuity), most SPIAs sold contain death benefits.

Cons

- Loss of Control

The most significant drawback of immediate annuities is that they are irrevocable. Once you exchange your lump-sum payment for periodic distributions, you no longer have control or access to your money.

- Loss of Purchasing Power

If your immediate annuity does not contain an inflation adjustment feature, your payment may not be keeping pace with inflationary trends.

- Variable Annuity Risk

Most immediate annuities purchased today are fixed immediate annuities. If your immediate annuity is variable, which means it contains market risk, then your payment stream could decline based on changes to subaccounts invested in risk-based assets.

Secure Retirement Without Hidden Fees

How To Choose an Immediate Annuity

There isn’t one specific immediate annuity option that is the best fit for everyone. The choice that makes the most sense for you will depend on your personal circumstances.

A good place to start is by determining what your goals are and what you hope to achieve from the annuity. Will this purchase only benefit you or also a spouse? Do you need income for life or just for a bridge period, such as until you take Social Security?

Answering these questions can help you nail down which type of immediate annuity — and which available features — will best benefit you.

Comparing different issuers’ offerings is also huge. Different companies may offer different rates and features.

“When shopping for an immediate annuity, it’s most important to look at how competitive the payout rate is, and different annuity companies will offer higher or lower ones. They’re all competing in the marketplace,” Williams said.

“All else equal, getting the higher payout rate is better because that means that someone there at the annuity company is saying ‘Hey, we may accept less profit on it or we think we can invest in a way that will make us some money.’”

Frequently Asked Questions About Immediate Annuities

Immediate annuities are set up for a lifetime stream of income that requires that you annuitize the payments, thus giving up control of your principal. This is a very important decision not to take lightly.

If you elect to defer your income payments until later to create a higher lifetime income stream, then this is referred to as a DIA (Deferred Income Annuity).

In the case of a 10-, 20- or 30-year period certain, you are electing to have the income payments continue for a specific number of years, even if you die early. For example, if you selected a 20-year period certain option with lifetime income and died after 15 years of payments, your designated beneficiary would receive the remaining 5 years of the period certain.

When funding a SPIA or a DIA, you have the option to choose a cash refund feature. This means that if you die before exhausting your initial premium, the remaining balance will be refunded to your beneficiaries.

Writer Anna Baluch contributed to this article.