What Is a Cost of Living Rider?

Cost of living adjustment (COLA) riders are an option for annuity contract holders who want to ensure their annual payments are adjusted upward each year to help offset the impact of inflation.

Depending on the contract, the rider can be added at the time you initially purchase the annuity or at a later date.

Key Facts About Cost of Living Riders

- A cost of living rider is an add-on to your annuity that serves as a method to combat inflation.

- When you opt for a COLA rider, your annuity payment increases each year – either by a set percentage or based on the consumer price index (CPI) – thereby protecting your money from losing its purchasing power.

- The trade-off of a COLA rider is that it usually results in a smaller initial benefit.

When you add a cost of living rider, the insurance company will lower the amount of the monthly benefit and then calculate the annual cost of living adjustment off of that lower base amount.

View the annuity contract in the context of your overall retirement income plan to see if the rider is right for you.

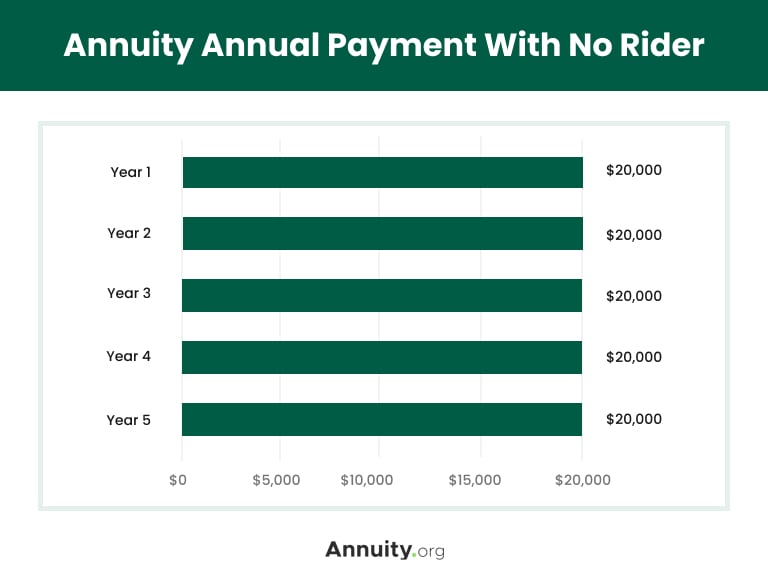

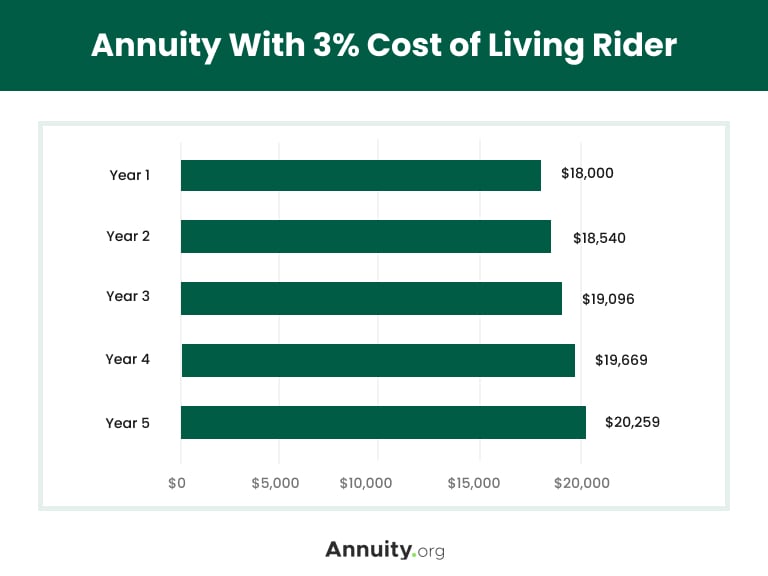

Example of a Cost of Living Rider

Cost of living riders allow your annuity payment to increase each year, thereby helping combat inflation. If you do not opt for a rider, your payment will remain level and could lose value if inflation grows.

The tradeoff for opting for a COLA rider is that your initial benefit amount will be reduced. However, depending on your unique circumstances, this could pay off in the long run as your payment increases over the duration of the payout period, helping you to maintain your spending power and combat inflation.

Over time, the real value of your annuity payments may fall and leave you with less purchasing power due to inflation. A cost of living rider offers you protection, but it does come with a cost.

Who Is Eligible for a Cost of Living Rider?

If you are eligible for an annuity, then you should be eligible to add a cost of living rider. Remember that the available riders can vary with the type of annuity and the insurance company offering them.

If you know you are interested in adding a cost of living rider, make sure the company or product you are focused on offers this option.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

What Are the Different Types of Cost of Living Riders

The main difference in varying types of cost of living riders is how the cost of living adjustment for your payments will be calculated.

There are generally two methods of calculating the cost of living increase for an annuity rider. Payments may increase either by a level percentage or based on annual increases in the consumer price index.

Level Percentage Increase

A COLA rider based on a level percentage increase means that the payment will increase by a level (or set) percentage each year. Generally, this percentage will range from 1% to 6%. The level percentage increase can be calculated on a simple or compound basis.

With a level percentage increase calculated on a simple basis, your annuity payments will rise by the annual percentage increase you’ve chosen regardless of what inflation does. For example, if the annual percentage increase is 4%, your payments for the next year will increase by that amount. If you receive monthly payments, this increase will be reflected in those payments.

When the level percentage increase is calculated on a compound basis, the annual percentage increase will exceed that offered via simple interest. The compound basis offers a return that more appropriately reflects the time value of money.

Regardless of the calculation method, the level percentage increase tends to be a better deal for contract holders during periods of moderate to low inflation.

CPI-Based Increases

This type of COLA rider is based on the annual increases in the consumer price index (CPI). The CPI is what is generally quoted when we hear about the level of general price inflation in the news. While the CPI isn’t perfect — for example, it uses only prices from urban areas, therefore excluding rural price developments — it is a good indicator of the general rate of inflation in the economy.

What Else Can Influence a Cost of Living Rider?

Your cost of living rider will largely be influenced depending on the type of calculation method you select.

While it is used to combat inflation, keep in mind that a cost of living rider responds directly to inflation only when increases are based on the CPI (or another reputable measure of inflation).

If you opt for a level percentage increase COLA rider, then your payment increases will not be directly based on the rate of inflation. This can be beneficial in years when the set percentage increase exceeds the rate of inflation, but can be disadvantageous in years when inflation outpaces it.

What Are the Pros and Cons of Cost of Living Riders?

There are several factors to consider when deciding whether to add a cost of living rider to your annuity. Key considerations include inflation, the cost of the rider and your other retirement assets.

Pros & Cons

Pros

- Protection against inflation

- Peace of mind

Cons

- Decreased starting payments

Pros

A major pro of opting for a cost of living rider is protection against inflation. Inflation is perhaps the number one enemy of retirees. Even a seemingly small level of inflation – 2% to 3% – can erode a retiree’s purchasing power in a relatively short period. A COLA rider can help offset the ravages of inflation on your annuity payments.

Another benefit of adding a COLA rider is the peace of mind that comes with it. Knowing you are set to see a guaranteed increase in your payments each year can help put you at ease and prevent fears of running out of money or losing your purchasing power and standard of living.

Cons

While inflation protection is important, the benefits must be weighed against the cost of the rider. No direct payment is made to the insurance company, but the provider reduces the amount of your initial payment after the rider takes effect.

To be clear, the reduction in the initial benefit amount is a cost. In deciding whether to go with the rider, understanding the amount of the reduction in the payment is critical.

With this reduction, you will want to see how long it will take for the payments with the COLA rider to meet and exceed the level of your payments before taking the rider. Ask your financial advisor to calculate the payments over several periods both ways. With a CPI-based rider, some assumptions may need to be made. From this analysis, you can determine if the COLA rider is a good deal for you.

Other Retirement Assets

When weighing the pros and cons of a cost of living rider, consider your overall retirement income plan. What other types of investment accounts or streams of payments do you have to support your retirement lifestyle? These might include individual retirement accounts (IRAs) and other retirement accounts, as well as taxable investment accounts.

How are these various sources of income set to deal with the impact of inflation in retirement? Find out how this money is invested. How much is invested in stocks? How much is invested in bonds? Do you have alternative investments?

With regard to streams of payments, they generally include Social Security and sometimes a pension from an employer. Social Security offers COLA adjustments, but a pension from a private sector employer typically does not. Some public sector pensions offer this benefit.

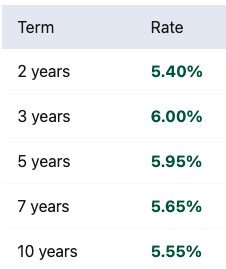

Calculate Your Returns Based on Today’s Best Rates

Are There Alternatives to Cost of Living Riders To Protect Against Inflation?

One alternative way to protect your retirement savings against inflation is to wait as long as possible to take Social Security. Each year you wait until full retirement age, you will be in line for a significant increase in your benefit. While Social Security’s COLA increases may not always perfectly keep up with inflation, the increases are meaningful.

Continuing to grow your portfolio in retirement and investing in assets that offer returns in excess of the historical rate of inflation is another way to stave off the impact of rising costs.Another method to combat inflation comes down to lifestyle choices. Spending less earlier in retirement can preserve your savings for periods when inflation is high.

Frequently Asked Questions About Cost of Living Riders

A cost of living rider includes an adjustable benefit, which increases your payments each year to help counteract the effects of inflation.

Yes. While cost of living riders can ensure your payments increase by a percentage each year, during deflationary environments, they could result in reduced payouts.

It depends on your personal situation. It makes sense to weigh how much your initial benefit amount will decrease if you opt for the rider, alongside how much of a threat inflation poses to your savings.

This could depend on how your adjustment is calculated. Some COLA riders include a set increase each year, while others are based on rises in the CPI.

Editor Malori Malone contributed to this article.