An annuity is a long-term financial product designed to provide guaranteed income, often for life. Offered by insurance companies, annuities can help individuals grow their savings tax-deferred, safeguard their retirement funds from market downturns, and ensure they don’t outlive their money. While annuities are not backed by the federal government, they are supported by the financial strength and claims-paying ability of the issuing insurance company.

Key Facts About Buying an Annuity

- Evaluate your current financial situation and goals to focus your research.

- Compare and contrast the various products that can provide income and growth.

- Narrow down the type of annuity that will satisfy your needs and goals without exceeding your risk tolerance.

- Analyze the products and companies that are best rated and provide the best returns on your investment.

- Collaborate with an agent or advisor who can help you complete your purchase.

Recently, annuities have surged in popularity. Amid stock market volatility, investors are increasingly turning to annuities as a source of stable income. In fact, total annuity sales in the first half of 2023 increased 28% to reach $182.7 billion.

How To Buy an Annuity in 5 Easy Steps

If you’re new to annuities or haven’t considered them before, now is a great time to learn more. In this guide, we’ll walk you through the process of purchasing an annuity step by step. It may be easier than you think.

1. Understand Your Financial Goals

The first step to building any retirement income plan is understanding the goals you want to achieve. This may include cash flow, risk tolerance and financial capacity for risk. If you are planning with a spouse or partner, discussing these ideas with one another is essential to ensure your retirement goals and vision are aligned.

More important than the assets you have accumulated, your ability to turn those assets into income is paramount to your success. When you evaluate your cash flow, it is vital to consider both the sources of income you have already and the amount of income you will need over time. Most retirees need to supplement their Social Security with other sources of guaranteed income to ensure their essential needs are reliably covered.

Risk tolerance and risk capacity are similar, but the risk of loss is viewed differently. Risk tolerance is your ability to emotionally stomach market or income volatility. Risk capacity is your financial ability to handle those changes. These are not necessarily the same.

The more precarious your financial situation, the less risk capacity you have. Annuities can provide much-needed protection for investors who become anxious about investing in the market or endanger their retirement plan with only minimal market losses.

Questions To Consider

- What is my vision for how I will live in retirement?

- What is my current plan to replace my paycheck while living in retirement?

- How much are my essential expenses?

2. Evaluate Your Options

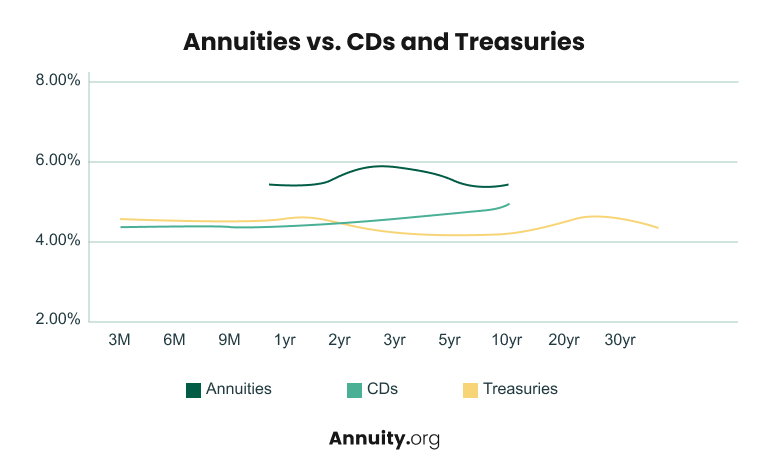

Annuities are one of many options available for secure and reliable retirement growth or income. Options like CDs, treasuries, corporate bonds or bond funds can offer low-risk performance, but each option has benefits and drawbacks. Choosing between annuities and other fixed-income options will depend on your goals and comfort level with each product.

| Product | Pros | Cons |

| Annuities |  Guaranteed tax-deferred growth and income that can last for life Guaranteed tax-deferred growth and income that can last for life |  Limitations on certain withdrawals and complex applications Limitations on certain withdrawals and complex applications |

| Certificate of Deposit |  FDIC-insured growth over a predictable term FDIC-insured growth over a predictable term |  Limitations on withdrawals Limitations on withdrawals |

| Treasury Bills, Notes & Bonds |  Flexible terms and explicit U.S. government guarantee on interest Flexible terms and explicit U.S. government guarantee on interest |  Lower rates than comparable products. Selling before maturity may cause losses. Lower rates than comparable products. Selling before maturity may cause losses. |

| Treasury Inflation-Protected Securities (TIPS) |  Explicit U.S. government guarantee with inflation-protection Explicit U.S. government guarantee with inflation-protection |  Maturities of 5, 10 or 30 years only and lower yields than comparable products Maturities of 5, 10 or 30 years only and lower yields than comparable products |

| Municipal Bonds |  Federal and state tax-exempt in the state you reside Federal and state tax-exempt in the state you reside |  Higher default risk than other government bonds and usually include call provisions Higher default risk than other government bonds and usually include call provisions |

| Corporate Bonds |  Flexible terms and guaranteed by the issuing company. Flexible terms and guaranteed by the issuing company. |  High minimums and time-consuming research process High minimums and time-consuming research process |

| Bond Funds |  Simple to create a diversified bond portfolio with low minimums and low costs Simple to create a diversified bond portfolio with low minimums and low costs |  Susceptible to losses based on interest rate changes Susceptible to losses based on interest rate changes |

There is no reason for any investor to select only one type of fixed-income securities. Different investments have different allowable terms, yields and liquidity options. Choose the right types for your specific goals to create a well-rounded portfolio that can offer protection through the short- and long-term.

Questions To Consider

- How comfortable am I with my income changing with market fluctuations (up or down)?

- How much time and effort do I want to spend monitoring and maintaining my portfolio?

- How long are my assets expected to last based on the lifestyle I want to live in retirement?

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

3. Determine the Type of Annuity That Fits Your Goals

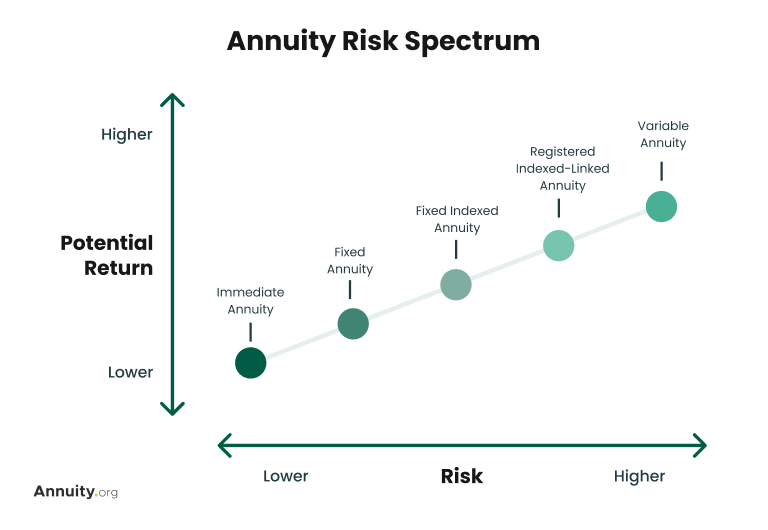

Choosing the right annuity type depends on a few factors: Your comfort level with risk, your expected returns and when you potentially want to receive income.

Immediate Annuities

Immediate annuities are designed to pay income within 12 months of the contract completion. These annuities offer a fixed, guaranteed monthly income payment for either a predetermined length of time or the length of the annuitant’s life. Immediate income annuities are considered a way to achieve longevity insurance and offer the benefit of reliable income that cannot run out.

Deferred Annuities

Deferred income annuities are income annuities that are scheduled to begin income payouts more than 12 months after the completion of the contract. They offer the same lifetime guaranteed income that immediate income annuities provide, but they also have a built-in growth rate on the investment principal, which increases the value of the contract until the income payments begin.

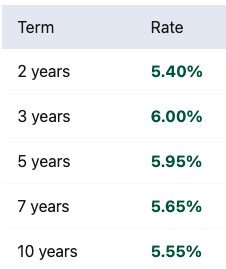

Multi-year guaranteed annuities (MYGAs) are fixed deferred annuities that offer a guaranteed rate of return or a predetermined period. Unlike some fixed annuities, MYGAs offer guarantees that last for the entire contract term. MYGAs are common alternatives to CDs or bonds.

Fixed index annuities offer the combined benefits of a fixed annuity and the upside potential of market index-linked crediting. Fixed index annuities provide complete market loss protection in exchange for a cap on the growth of the contract on an annual or multi-year basis. Optional riders can be purchased for added guarantees or guaranteed income.

Registered index-linked annuities (RILAs, also called structured or buffered annuities) are a newer type of annuity that limits downside risk but does not eliminate it. Using higher caps, RILAs have greater upside potential than fixed index annuities. However, they carry more risk than fixed-index annuities and are regulated as securities. Optional riders can offer added benefits, protection, or income guarantees.

Variable annuities invest directly in the market through sub-accounts and carry no inherent risk limitations, unlike fixed index or registered index-linked annuities. While optional riders can offer additional protection or income guarantees, the basic variable annuity contract is primarily an investment vehicle.

Annuity Fees and Costs

The format and amount of fees and costs on annuities will vary depending on the type of annuity you buy and the optional riders you may add to the contract. Immediate and deferred income annuities do not have overt costs. Instead, the monthly income is calculated with the costs already accounted for.

Deferred annuities have product costs that are a percentage of the invested principal. These include administrative and mortality fees. Optional riders will have their own separate costs. When investing directly in the market, expense ratio charges will also apply. The total amount of fees will depend on the particular contract details.

| Product | Surrender Charges | Administrative Fees | Mortality Expenses | Riders (optional) | Expense Ratios |

| Income Annuities |  |  |  | ⭕ |  |

| Deferred Income Annuities |  |  |  | ⭕ |  |

| MYGAs |  |  |  |  |  |

| Fixed Index Annuities |  | ⭕ | ⭕ |  |  |

| RILAs |  |  |  |  |  |

| Variable Annuities |  |  |  |  |  |

| Legend |  Always Included Always Included | ⭕ Sometimes included |  Not included Not included |

Most annuities can include optional riders for more protection, income guarantees or death benefits. Most optional riders will have a separate annual cost in addition to any existing product costs. Evaluate all riders individually and in conjunction with all total annual fees.

Questions to Consider

- How important is it for my assets to grow and maintain my lifestyle over a multi-decade retirement?

- How has my investment experience influenced my plan for managing my money in retirement?

- How do I prioritize the following: flexibility, growth and guarantees?

4. Research Annuity Companies and Products

Finding the right insurance company or annuity product can be like shopping for a car. The difference between two SUVs can be measured in various ways, including features, cost, driving experience and personal style. Annuity products from different insurers are rarely carbon copies of one another and typically offer different ratings, features, riders and minimums. The more complex the contract, the more important company and product comparisons become.

Our best companies page focuses on which company shines the most in many of the most common focus areas consumers search for, including financial strength or specific products. If you already know which product is right for you, our best annuities guide may offer you the answers you seek.

For rate shoppers, our fixed annuity rates and income annuity calculator can help you find the right interest or income amount to meet your needs.

Questions to Consider

- Do I prefer to work with a single provider or an independent agent who can offer me various products and services to compare?

- What are the characteristics of the company that I value most?

- What are the characteristics of the product that I value most?

Calculate Your Returns Based on Today’s Best Rates

5. Purchase Your Annuity

The final and most crucial step in your annuity journey is the funding and completion of your annuity contract. Here, you will work with a licensed agent or financial advisor to do the heavy lifting on the application and arrange funding for the annuity contract.

Some insurance companies only sell their products through their own agents, referred to as captive agents. These agents do not offer any other products but their own. Alternatively, independent agents work with multiple insurance companies and can offer various companies’ products. Both types of agents will be able to help walk you through an application and facilitate the movement of money for funding.

Annuities can be funded from banks, brokerages or retirement accounts. The taxability of the proceeds will depend on how the contract is funded. Our annuity taxation page explains this in detail.

If you want an independent agent licensed in your state to offer support and education, please contact our Annuity.org team. We have built a team of agents and consumer support representatives focused on helping investors understand their options and find the best option, whether an annuity or not. Our team is independent of any single insurer and is not limited to any company or product.

Questions to Consider

- How well do I understand the details of this product contract?

- Could I explain the results of my best- and worst-case scenarios?

Q&A With an Annuity Customer

Annuity.org spoke with annuity owner Ron Thompson about his annuity purchase experience.

- What financial circumstances led you to consider purchasing an annuity?

My wife and I had sold off some investment property as part of our financial strategy at that time. As we’re both nearing retirement, it was like, okay, so how should we invest this? What’s the next form of investment for that investment we just converted to cash? So that became the starting point for how we ended up approaching the topic of annuities.

- What was the most surprising part of the annuity purchasing process?

I think the biggest thing is just going from what you read about annuities to the offerings. You know, how they’re packaged by different providers and the options and riders and everything else that different providers will have in their packages. So regardless of how good they were and how well they explained things, the next big step is talking to providers and their complexities in their own products.

- How long did it take to purchase your annuity?

Wanting to make the optimal decision, we felt obliged to consider all the options. So that took a couple of months of just talking back and forth and exploring all these product offerings before we were comfortable with who, when and which of their products we’d be using.

Editor Sierra Campbell contributed to this article.