Registered index-linked annuities (RILAs) offer a balanced approach to retirement planning, combining market growth potential with controlled risk. With customizable gain and loss limits, they provide a middle ground between fixed-index and variable annuities, giving you more flexibility in your financial strategy.

Key Facts About Registered Index-Linked Annuities (RILA)

- RILAs are linked to an index like the S&P 500, and the return is credited to your contract based on the index performance.

- RILAs are like variable annuities in that their performance is allowed to fluctuate with the underlying investment it is linked to; however, they are not as volatile.

- A RILA is like a fixed-index annuity because your gains and losses are capped.

- Benefits of a RILA include potential gains from market growth, low cost and limited risk.

Understanding how RILAs work is key to maximizing their benefits. Let’s dive deeper into their mechanics and explore how you can tailor a RILA to fit your retirement goals.

What Is a RILA?

A relatively new entry in the retirement market, a RILA is a deferred annuity that shares some characteristics with fixed index and variable annuities.

RILAs, also known as buffered or structured annuities, offer investment growth opportunities with limited downside risk. Because of their potential for loss, they are riskier than fixed index annuities that typically carry a minimum return guarantee.

In an economic crisis, like the market downturn resulting from the coronavirus pandemic, RILAs, with their restricted loss potential, can provide superior protection compared to a variable annuity.

Compared to fixed-rate annuities, RILAs carry a potential for greater returns and may be an option for people who have previously looked to fixed index annuities.

RILAs have seen a surge in popularity in recent years as they have offered customers a new way to split the difference between a fixed index annuity and variable annuity.

According to insurance industry group LIMRA, RILA sales surpassed variable annuity sales for the first time ever in the fourth quarter of 2023.

An interesting use of RILAs is as a proxy for a more volatile asset class, like international or emerging market equities. For example, if you have $100k to invest in equities and your desired allocation is 75% US and 25% international. You can invest $75k in US stocks and purchase a $25k RILA indexed to International with a floor or a buffer.

How RILAs Work

Traditional fixed index annuities limit your upside potential by setting maximum caps on your annuity performance but often have a minimum guaranteed return that is above zero. For example, if the index increases by 8%, you will receive only 6% if your cap is set at that rate.

However, you may also have a guaranteed minimum rate of 2%. The minimum guaranteed return ensures you’d never lose money.

A RILA is different because it allows you to participate in more of the market gain through a higher cap, but the tradeoff is that you must accept some of the downside risk as well.

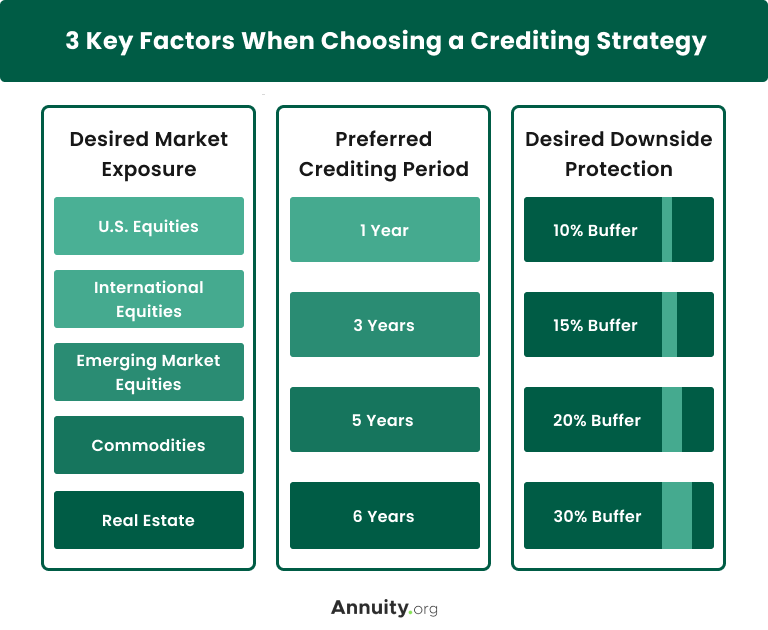

With a RILA, you determine your exposure to risk and your return by choosing your gain and loss limit percentage. You also decide whether your loss limit will be implemented as either a floor or a buffer.

- A RILA floor caps your loss. It is the maximum percentage loss you are willing to absorb during a down market. Any losses greater than the floor are absorbed by the RILA provider.

- A RILA buffer is a percentage of loss that the annuity issuer will absorb. You are exposed to losses to the extent that the linked market index losses exceed the buffer.

Your upside gain cap is related to your floor or buffer limit. Accepting more downside risk means you can participate in more of the upside growth potential.

Floor Example

In this example, a RILA is linked to the S&P 500 index, which tracks the price movements of the 500 listed stocks with the largest capitalizations. When you buy this RILA, you are not investing in the underlying stocks in the index. Rather, the index merely indicates percentage gain or loss.

You can set a floor to limit the maximum amount of loss you are willing to accept. For example, suppose you set the RILA floor at 10%.

- If the index loses 8%, then you also lose 8% because you didn’t reach the floor.

- If the linked index falls 15%, your loss is only 10%.

A floor makes sense if you are unwilling to accept any losses beyond a certain point, even if that prevents you from gaining beyond the cap.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Buffer Example

A buffer protects you from a percentage of loss. For example, suppose you set a buffer of 10%. The insurance company will absorb any loss less than 10%. If the index declines 15% your loss is only 5% because the first 10% was buffered.

You might prefer a buffer to a floor if you are willing to accept more risk. A buffer exposes you to potentially higher risk but also larger returns.

Registered Index-Linked Annuities in 2025

RILAs have skyrocketed in popularity recently, boasting five consecutive years of record-breaking sales totals. LIMRA predicts that in traditional variable annuities (VA) and RILA sales will grow in 2025. Customers will prioritize inflation and try to find annuity investments that can keep up with it through 2027. According to LIMRA, 2025 RILA sales will remain at or slightly exceed the record levels set in 2024 and fall in the $62 billion and $66 billion range.

What Are the Benefits of a Registered Index-Linked Annuity?

RILAs can help you accumulate money for retirement and other long-term needs. In addition to offering protection and growth options, this type of annuity allows you to accumulate growth without paying taxes and fees until you make a withdrawal. You also have the option to convert the annuity into a stream of income payments in retirement.

Potential for Market Growth

RILAs allow you to benefit from market growth. However, that growth is limited in two ways:

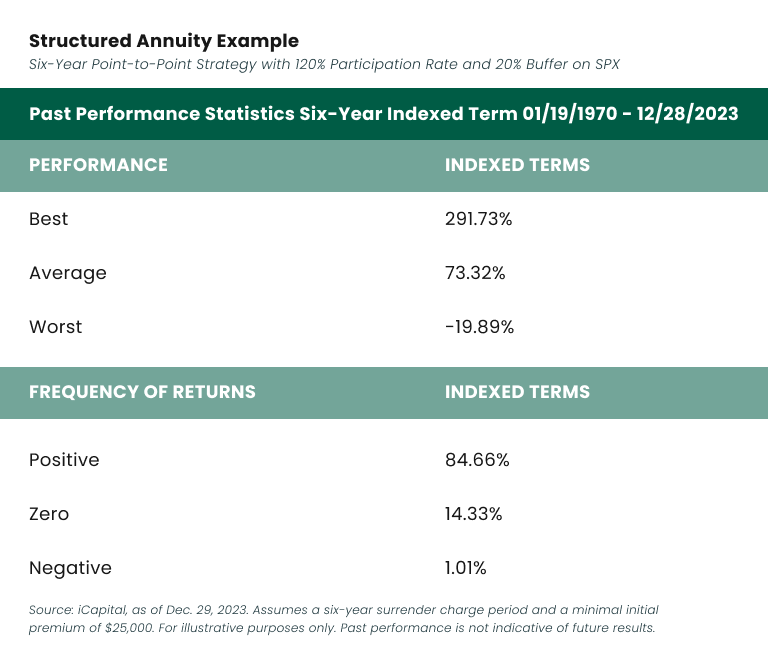

- Like other annuities, RILAs have a participation rate. This is the amount of index growth you participate in. If your participation rate is 50%, then your annuity is credited with half of the growth in the index. If your participation rate is 100% then you receive the full amount of the index return.

- Cap rates are the maximum return you may be credited with during a given period. The more downside risk you accept, the greater your cap rate will be.

Limitation of Downside Risk

You set the amount of downside protection you require. You have the option of setting a floor or a buffer. As described above, both offer downside protection, albeit in different ways.

Tax Advantages

You only pay taxes when you receive distributions from a RILA. The remainder of the RILA continues to grow tax-deferred.

You can choose to annuitize a RILA and select one of several payout options.

- Fixed Period

- You receive an income stream for a selected period of time. The shorter the period, the larger the periodic payout.

- Life

- Payments continue for the remainder of your life. You cannot outlive the annuity.

- Life With a Minimum Fixed Period

- Acts like a life payout option, except a certain amount is guaranteed to be paid out even if you die shortly after purchasing the RILA.

- Joint-and-Survivor

- Payments continue for the remainder of your life and the life of the named survivor, typically a spouse. Typical survivor options include 100%, 75% or 50% of the original payment.

Payout Options

How Is a RILA Different From a Fixed-Rate Annuity?

While both fixed-rate annuities and RILAs can be used to supplement income in retirement, the two types of annuities carry different levels of risk.

A fixed annuity is a low-risk product that guarantees a fixed interest rate on contributions to the annuity over a specified period of time. This type of annuity is not linked to the performance of a portfolio or another investment and can be a good option if you want a predictable and reliable income stream with low fees.

Unlike a fixed annuity, RILAs expose you to some market risk and let you participate in market gains. Because you can select a RILA’s risk/reward characteristics, you can choose the combination that suits you and your needs best.

To help you select the right product for your individual needs, it’s important to review how the different types of annuities align with your risk tolerance.

- Fixed Annuity

- You receive a guaranteed interest rate over the time period specified by the payout option.

- Fixed Index Annuity

- You receive a guaranteed interest rate as well as additional returns if the linked index increases in value. Payments continue over the time period specified by the payout option.

- Registered Index-Linked Annuity

- Returns are not guaranteed, but rather are linked to a stock market index with capped gains and limited losses.

- Variable Annuity

- Gains and losses are tied directly to the underlying investment portfolio, which can be equity and/or fixed-income funds. You have no protection from downside loss, no cap on upside gain and no guaranteed return, unless you purchase a rider, such as a guaranteed minimum income benefit (GMIB) rider. Upon annuitization, payments continue over the time period specified by the payout option.

Annuity Types in Ascending Order of Risk

A qualified professional can help you identify the annuity that best fits your wealth plan and provides the greatest strategic benefits.

Overwhelmed by Safe Retirement Options?

How Are RILAs Regulated?

RILAs, like other annuities, are insurance contracts, so they are subject to state insurance commission regulations. The states have overarching governance and standardization from the National Association of Insurance Commissioners (NAIC). These regulations are in place to protect consumers, and to ensure annuity providers are only issuing products that meet clients’ financial goals.

The NAIC has a Life Actuarial (A) Task Force that was formed to “identify, investigate and develop solutions to actuarial problems in the life insurance industry,” according to the NAIC. A new subgroup of this task force, the Index-Linked Variable (A) Annuity Subgroup, was created in 2021 to provide recommendations specifically for these annuities, but it was disbanded in 2023.

Frequently Asked Questions About RILAs

RILAs are best suited for risk-tolerant investors seeking long-term investment options. Because they come with risks to both the principal and earnings due to market volatility, they are not well-suited for short-term or risk-averse investors.

The pros of registered index-linked annuities are potential gains from market growth, limited risk in a downturn, low cost and deferred taxes. Cons include higher fees and commissions on the annuity you buy and caps that limit your gains when the market goes up.

RILAs are best suited for risk-tolerant people who are looking to take advantage of gains when the market performs well and for a level of protection if there’s a market downturn.