A fixed annuity is a financial product sold through insurance companies that provides a safe place for cash to accumulate tax-deferred interest.

Key Facts About Fixed Annuities

- Fixed annuities grow at a fixed interest rate determined by the annuity company. They are not indexed to market performance.

- Fixed annuities are straightforward and predictable, but their fixed rate offers no protection from inflation. Plus, they are less liquid than some alternatives.

- A fixed annuity can be paid immediately or via deferred payments. You can even structure the payouts to provide income for the rest of your life.

Fixed annuities are the most straightforward type of annuity. They also provide the most predictable and reliable income stream, usually with the lowest fees.

You pay for a steady stream of income, and, in exchange, the insurance company guarantees your principal plus a minimum interest rate. The contract you sign for the annuity will define how the money in the product grows.

Depending on your contract, you can receive payments for a set number of years or the rest of your life.

Fixed annuities are a great product for conservative investors. The tax deferral over the deferment period is an added bonus, allowing for greater compounding. Another significant advantage is their allowance for rollover at the end of the term to another annuity, further deferring taxes.

Accumulation and Payout of Fixed Annuities

A fixed deferred annuity consists of two distinct phases: accumulation and payout.

After you decide to buy a fixed annuity, the insurance company sets an agreement to pay you a minimum interest rate while your account grows. This is known as the accumulation phase.

During this phase, the current interest rate is applied. This annuity rate is guaranteed for that period. The earned interest in your account grows tax-deferred during the accumulation phase.

The payout phase starts when you begin receiving guaranteed income from your annuity.

There are numerous fixed annuity payout options to choose from. Payouts can be immediate — starting within a year of purchase — or deferred until a later date. Deferred annuities typically begin paying out in retirement.

You can guarantee income payments from a fixed annuity for life, commonly called a life annuity or single-life annuity. You can also choose a period certain annuity to receive payments for a set number of years.

You may also elect to receive annuity income benefits as a lump sum.

How Are Fixed Annuity Rates Determined

Unlike variable annuities and fixed index annuities, fixed annuities are not linked to stock market performance. Instead, your money grows at a guaranteed interest rate determined by the annuity company.

Your fixed annuity contract will include a minimum guaranteed rate. The guarantee from the annuity company is that the interest on your fixed annuity will not dip below that rate. The company also guarantees the principal investment.

Some fixed annuities, such as multi-year guaranteed annuities (MYGAs), lock in the same rate for your entire contract. Others may adjust the interest rate after a certain time.

Some fixed annuities provide a higher interest rate at the beginning of the contract, known as a bonus rate.

After the set period ends, another interest rate, called the renewal rate, applies. You can ask your agent or broker for a renewal rate table to give you an idea of what to expect. However, even if the interest rate adjusts over time, it cannot fall below the guaranteed minimum rate specified in your contract.

Today’s Best Fixed Annuity Rates

| Term | Rate | Provider | Product | AM Best Rating |

|---|---|---|---|---|

| 1 Year | 6.74% | Corebridge Financial | American Pathway Fixed 7 Annuity | A |

| 2 Years | 5.55% | Axonic Insurance Services | Skyline MYGA | A- |

| 3 Years | 6.10% | Wichita National Life Insurance | Security 3 MYGA | B+ |

| 4 Years | 5.50% | Nassau Life and Annuity Company | Simple Annuity | B++ |

| 5 Years | 6.35% | Knighthead Life | Staysail | A- |

| 6 Years | 6.20% | Atlantic Coast Life | Safe Harbor Bonus Guarantee | B+ |

| 7 Years | 6.60% | Knighthead Life | Staysail | A- |

| 8 Years | 5.65% | EquiTrust Life Insurance Company | Certainty Select | B++ |

| 9 Years | 5.40% | Clear Spring Life and Annuity Company | Preserve Multi-Year Guaranteed Annuity | A- |

| 10 Years | 7.05% | Atlantic Coast Life | Safe Harbor Bonus Guarantee | B+ |

How Are Fixed Annuities Treated for Tax Purposes?

Fixed annuities are tax-deferred products, meaning you won’t owe any taxes on your annuity during the accumulation period. The tax-deferred feature allows your interest to grow unimpeded throughout the contract’s term.

If you have a qualified fixed annuity — funded from a retirement account like a 401(k) or IRA — you’ll owe taxes on the total amount of your annuity withdrawals.

Fixed annuity owners who withdraw money from their contracts early may face a tax penalty. Withdrawals before the age of 59 1/2 typically incur a 10% penalty on the taxable portion of the annuity withdrawal.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Types of Fixed Annuities

Fixed annuities have two main types: traditional fixed and multi-year guaranteed. Immediate annuities, a separate type of annuity, also operate as fixed products.

Traditional Fixed

Traditional fixed annuities accumulate money based on a fixed interest rate set at the beginning of your contract.

Current interest rates determine the initial rate for fixed-income investments.

Insurance companies may increase or decrease the interest rate after a specified period, such as two years. The new interest rate cannot fall below the minimum rate stated in your contract.

When shopping for a traditional fixed annuity, finding one that offers a competitive interest rate is essential.

For example, some insurers may offer a renewal rate slightly above the contractually guaranteed minimum. A relatively low interest rate may cause your annuity to struggle to keep up with inflation.

Make sure to carefully compare contract details before selecting a traditional fixed annuity.

Multi-Year Guaranteed Annuity (MYGA)

A multi-year guaranteed annuity, or MYGA, is another type of fixed annuity. MYGAs are similar to traditional fixed annuities, with the only real difference being the length of the guaranteed rate.

MYGAs guarantee the interest rate for the entire contract term. For example, if you purchase a five-year MYGA, the rate you receive at the start of your contract is locked in for the full five years. This reduces the risk of the insurance company changing the rate as your money grows.

Comparing Fixed Annuities

| Traditional Fixed | MYGA | |

| Rate of Return | Fixed for a set period, but the renewal rate may increase or decrease, subject to the guaranteed minimum. | Locked in for the duration of the contract. |

| Risks | Rates can change — and potentially drop — after the specified period and may not keep up with inflation. | Rates may not keep up with inflation over time. |

| Tax-Deferred Growth | Yes | Yes |

| Beneficial For | Conservative investors and those planning for retirement. | Those looking for a safe and stable long-term income stream with little risk. |

Who Should Buy a Fixed Annuity?

Annuity.org expert contributor Chip Stapleton finds that predictability is one of the most significant advantages of fixed annuities. It makes them particularly well-suited for risk-averse investors who are about to retire or are in their first few years of retirement.

“They’re very safe products that generate a small amount of return, but it’s guaranteed,” said Stapleton, a FINRA Series 7 and Series 66 license holder. “There’s no risk involved.”

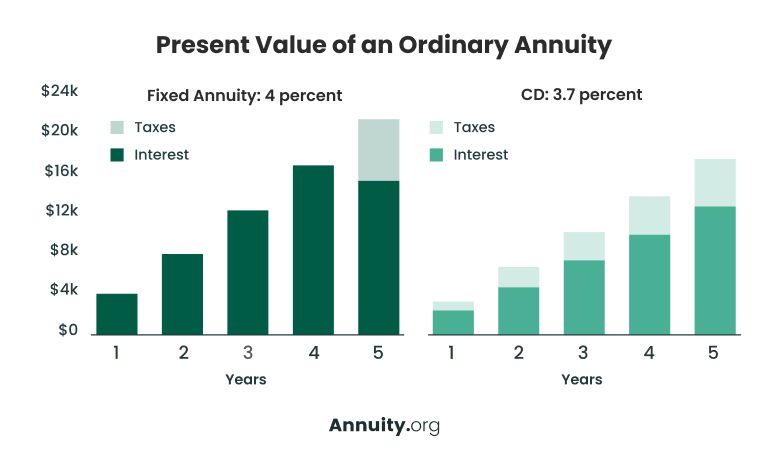

Take a look at the case study below to get an idea of how a fixed annuity might benefit retirement planning.

Name: Kathy

Age: 55

Looking to invest: $100,000

- Kathy wants to find a safe method to grow her money

- She finds a five-year fixed annuity returning 4%

- Her bank is offering a 3.37% rate for a five-year certificate of deposit (CD)

Best option: Fixed Annuity

A fixed annuity will offer tax-deferred growth that a CD will not.

Fixed annuities can be an attractive option for conservative investors planning for retirement like Kathy since they offer a predictable income stream.

The predictable returns of fixed annuities make them ideal for creating a retirement budget. You will know exactly how much money you are due without worrying about market performance impacting that figure.

That predictability can also make them valuable tools for creating bridges to other retirement income sources.

“I’m hoping to hold out until at least 67, possibly 70, before I take Social Security, so what I’ve basically done is gotten this fixed rate 10-year certain annuity essentially as a bridge between now and when I actually take Social Security,” Annuity.org customer Tracy Neill said.

A fixed annuity is also a strong choice for conservative investors who want to preserve their principal but want their money to grow faster than offered by a savings account or a CD.

Additionally, investors in high tax brackets will have even more incentive to choose the fixed annuity over other taxable options like a CD due to the annuity’s tax-deferred compounding. For someone with a 20% effective tax rate, a CD would need to yield a pre-tax 5% to equal the same return as the tax-deferred fixed annuity offering 4% each year.

Stapleton said that a younger person might want a fixed annuity if they’re distrustful of the market and want a risk-free way to grow their money for retirement.

“But mostly, it’s going to be retirees and late retirees who are really stressing capital preservation,” said Stapleton.

Calculate Your Returns Based on Today’s Best Rates

Pros and Cons of Fixed Annuities

Pros

- Guaranteed minimum interest rate

- Premium protection

- Tax-deferred accumulation

- Income for life

Cons

- Inflation risk

- Penalties for early withdrawals

- Lack of liquidity

A big pro of fixed annuities is that they are considered the safest of all annuity types. They offer premium protection and the option to set up a stream of income that you can never outlive.

Fixed annuities are also simple and predictable, making them attractive to conservative investors.

“Annuities provide guaranteed returns, which leaves out the guessing and risk,” Steve Azoury, a Chartered Financial Consultant® and owner of Azoury Financial told Annuity.org. “They also provide a guaranteed income which does not fluctuate due to stock market swings.”

Regardless of how the insurer’s investments perform, a fixed annuity will never earn less than its guaranteed interest rate. The guaranteed rate helps you easily predict how much income you’ll receive from your fixed annuity.

Despite their benefits, fixed annuities have drawbacks.

One is that the product’s simplicity and predictability can come at the expense of having less growth potential than other, more complicated annuities. Fixed index annuities, for example, offer a safe and conservative way to still participate in real market gains.

Because fixed annuities grow at a guaranteed rate, they also cannot adjust for inflation, so their actual value may decline over time. The money withdrawn from any annuity is taxed as ordinary income, as it does not benefit from capital gains tax rates.

Finally, there may be better choices than an annuity for a customer who values liquidity. Money tied up in an annuity cannot be withdrawn without penalties or surrender charges.

“Fixed annuities typically have bigger penalties for cashing out early than CDs and treasuries do,” Singer said.

Factors To Consider When Choosing a Fixed Annuity

If you are trying to determine whether a fixed annuity is the right choice for you, ask yourself several questions such as:

- How much money am I planning to place in an annuity?

- How soon will I need annuity payments to start?

- How do I plan to pay for this annuity?

- How likely am I to need the money in my annuity contract before it matures?

These questions, along with the following actions, can help you narrow down product choices and find the option that makes the most sense for you.

Understand the Contract and Your Options

When comparing products, check the fine print of annuity contracts for things like fees, surrender charges and rider costs. Find out which riders (add-on protections) the annuity provider offers and determine whether you would like to add any to your annuity.

Fixed annuities earn interest based on a guaranteed rate, so consider factors like how long that rate is guaranteed and how frequently the interest compounds.

Research the Insurance Company

An annuity is only as safe as the insurance company that sells it. While it is extremely unlikely an insurance company will go bankrupt, it’s important to select an insurer with an A rating from one of the major credit rating agencies, such as Fitch or AM Best.

Some annuity agents will not even work with companies that hold a rating below A.

Work With a State-Licensed Annuity Professional

FINRA advises anyone shopping for annuities to contact their state insurance commissioner to ensure that their broker is registered and authorized to sell annuities in the state. It also offers a free resource called BrokerCheck where you can find brokers and learn about their registration and licensing status, experience and complaint history.

Additionally, you should research your state’s guaranty association that will protect you if your insurer becomes insolvent and can’t pay out.

As with any investment or insurance product, working with a financial advisor can be beneficial. Your financial advisor can provide fixed annuity recommendations based on your unique goals and risk tolerance.

Fixed Annuities in 2025

While total annuity sales saw a 12% increase in 2024, dropping interest rates in the latter half of the year contributed to an overall decline in fixed deferred annuities. The insurance industry group Limra reported that fixed deferred annuity sales totaled $29.4 billion in the fourth quarter of 2024, down a staggering 50% from the prior year.

With so much uncertainty in the economy and its future direction, it’s still unclear how fixed annuity purchases will perform in 2025 and beyond. Expected sales for fixed annuity products may fall between 15% and 25% over the next year, according to Limra’s recent projections, but three dueling factors may swing the tide of the industry: declining interest rates, rising inflation and an aging population.

Declining Interest Rates

Since insurers use current interest rates to help set fixed annuity rates, declining rates can make these products less favorable for investors looking for steady growth. Limra predicts that this will negatively impact sales performance.

Rising Inflation

Rising inflation may increase interest rates, but remember, one downside of fixed annuities is that they can’t keep up with inflation and cost-of-living surges. This means their value can diminish over time, thus reducing their reliability as a stream of income in retirement years.

Aging Population

Through 2027, over 4.1 million people will turn 65 each year. Despite the copious economic uncertainties, this expanding aging population may turn to fixed annuity products for their guaranteed income and growth.

Frequently Asked Questions About Fixed Annuities

Fixed annuity rates are set by insurance companies and take into account specific factors, including the premium amounts, current interest rates, the annuitant’s age and life expectancy and the annuitant’s sex.

Some of the highest-paying fixed annuity rates are offering rates that are near or exceed 6%. Keep in mind that the best rates are typically offered by less reputable companies.

You won’t lose money in a fixed annuity as long as you hold the contract to maturity and don’t withdraw early. Withdrawing too much money too soon can result in penalties and fees.

Many annuity contracts allow you to withdraw up to 10% of your contract’s value each year during the accumulation period without a penalty.

If your annuity contract has a beneficiary, the fixed annuity will pay out a death benefit to that individual when you die. In the case of no beneficiary, the contract’s value is returned to the annuity provider.

Fixed annuities are the least expensive type of annuities. Carriers charge commissions and may charge administrative fees, transfer charges or underwriting fees. Be sure to read your contract carefully and ask about all fees and commissions.

The payout of a $100,000 fixed annuity can be calculated based on your age, your annuity’s accumulated value and current interest rate, your payment timeline and other factors.

Editor Tori Roughley contributed to this article.