An annuity can provide financial security for both the owner and their loved ones. If the annuity includes a death benefit, a designated beneficiary may receive a payout based on the contract terms. Ensure a smooth transfer of assets by understanding how these options work.

Key Facts About What Happens to an Annuity When You Die

- Upon the death of an annuity’s owner or annuitant, the annuity’s beneficiary receives a death benefit.

- Beneficiaries typically have three options for receiving an inherited annuity: taking a lump sum, receiving payments based on life expectancy or making incremental withdrawals over five years.

- When selecting a beneficiary, annuity owners should consider factors such as the beneficiary’s age, relationship to the owner and whether they receive government benefits.

In general, annuity payments end when the owner dies. However, if a death benefit is included, the payout amount depends on the contract and may be a guaranteed minimum amount, the remaining contract value or the greater of the two.

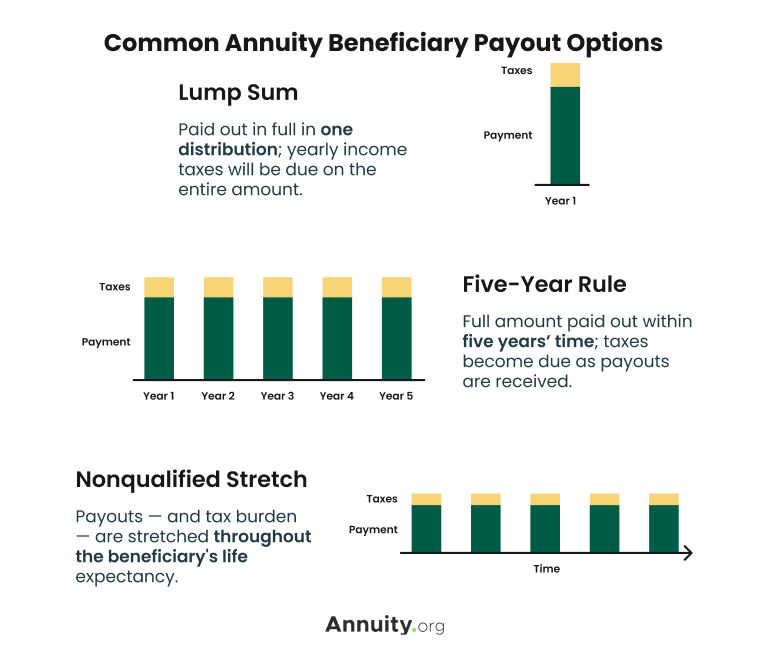

Inherited Annuity Payout Options

Beneficiaries inheriting an annuity typically have three options for how to receive annuity payments after the contract owner’s death.

“It is important to name a beneficiary on your annuity so that the remainder can go to whom you would like it to at your death,” Kendall Meade, Certified Financial Planner® professional at SoFi, told Annuity.org. “Sometimes your monthly amount will continue to your beneficiary for their life, sometimes it may be for a specific amount of time and other times they may get a lump sum.”

- Lump-Sum Distribution

- A lump-sum distribution allows the beneficiary to receive the entire remaining value of the contract in one payment.

- Non-Qualified Stretch Provision

- When a non-qualified stretch provision is included in the contract, the beneficiary receives payments based on his or her life expectancy.

- Five-Year Rule

- The five-year rule allows beneficiaries to withdraw incremental amounts during a five-year period or withdraw the entire sum in the fifth year.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Considerations for Annuity Owners

When thinking about what will happen to your annuity after you die, consider your options for controlling how the funds will be distributed.

For example, you might prefer that your beneficiary receives a stream of income from your annuity rather than a lump-sum payout. In that case, you might consider a period certain annuity, which the Wisconsin Office of the Commission of Insurance explained guarantees payments for a certain number of years. If you pass away before the guarantee period elapses, your beneficiary receives payments for the remaining years.

Most importantly, you’ll have to consider who to name as your annuity’s beneficiary. Keep in mind that minors cannot access the funds in an annuity until they turn 18.

Additionally, if your beneficiary receives government benefits, the income they inherit from an annuity might disqualify them from receiving those benefits.

Your beneficiary’s relationship to you also affects how they can receive the inherited annuity. Spouses who are named as the beneficiary on an annuity have more privileges and options for what to do with the annuity than non-spouse beneficiaries have.

Spousal beneficiaries can choose to put the annuity contract in their name and become the new annuitant. This change-over is called spousal continuation. Since non-spouse beneficiaries don’t have a continuation option, they can only receive the death benefit payout, be it as a lump sum or an income stream.

I sold an annuity to a married couple last year and the annuity was jointly owned by both spouses. The husband died recently, and the wife assumed full single ownership of the annuity contract. The insurance company knew about it before she could tell them and sent her the paperwork to sign. In the case of an individually owned annuity, the beneficiary would get the proceeds. If it is an IRA, then the spouse could assume the contract as well.

Case Study

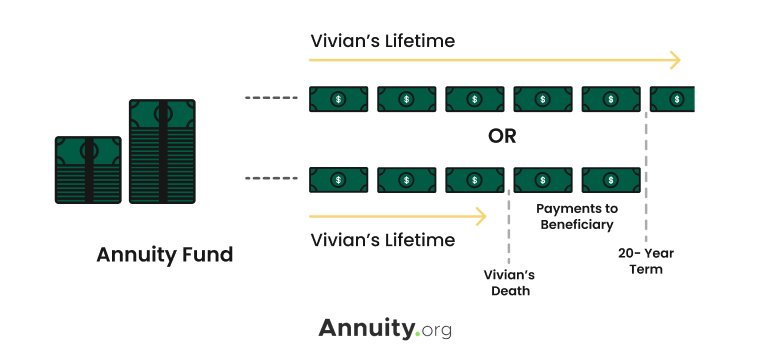

Here is an example of how an annuity might pass on income to a beneficiary after the owner’s death.

Name: Vivian

Age: 70

Looking to Invest: $100,000

- Vivian wants guaranteed income that she won’t outlive.

- She wants the remainder of her savings to go to her daughter after her passing.

- Vivian wants her daughter’s inheritance to be distributed as regular payments rather than a lump sum.

Best Option: Immediate Life Annuity with 20-Year Period Certain

Vivian will receive guaranteed payments for the rest of her lifetime. If she passes away before the 20-year term is up, her beneficiary will receive however many years of payments are left.

Purchasing an annuity with a period certain rider is one way to leave income payments to a beneficiary while setting yourself up for guaranteed lifetime income.

“You’re defining a certain number of years of payments taking place,” said Stephen Kates, Annuity.org expert contributor and Certified Financial Planner™ professional. “If you outlive that, then you get lifetime payments. But if you don’t outlive that, your beneficiaries will receive the difference between how long you were alive and the end of that period.”

In the case study above, Vivian is looking for a way to turn her savings into guaranteed income for life. She also wants to leave some income for her beneficiary.

If in this scenario, Vivian passes away after 12 years of receiving payments, her daughter will receive the remaining eight years of annuity payments.

Editor Ashley Donohoe contributed to this article.