Every annuity contract has four involved parties: the owner, the annuitant, the beneficiary and the insurer who issues the contract.

The annuity’s owner and the annuitant are not always the same person. The owner purchases the annuity, creates the annuity terms with the insurance company and has automatic rights over the agreement. The owner can designate beneficiaries and can sell or exchange the annuity.

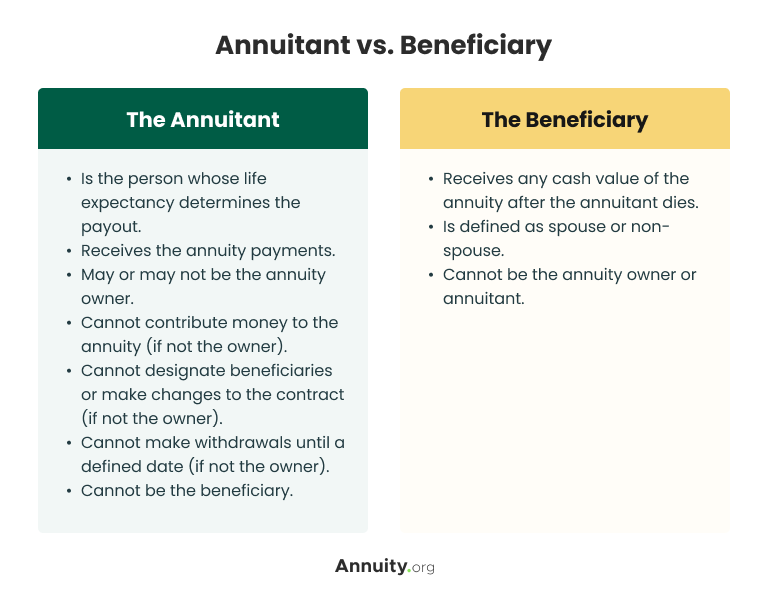

While establishing the terms of the annuity agreement, the owner has the option to name a third party as the annuitant. The annuitant is the person on whose life expectancy the contract is based. It is common for the annuity owner to name themself as the annuitant.

However, sometimes an annuity owner elects to name a younger representative as the annuitant to stretch out payments and extend the tax liability.

A beneficiary is a person who receives the death benefit, usually the remaining contract value (the amount of premiums minus any withdrawals) or a guaranteed minimum, upon the annuitant’s death. An owner cannot be their own beneficiary.

Annuity owners work with insurers to design contracts specifying payouts and beneficiaries. After the owner or annuitant passes, any remaining funds are given to beneficiaries as a lump sum or in installments. If the annuitant dies before the annuity begins, the beneficiary typically receives a lump sum. If they die after, they will usually continue receiving the annuity payments.

If an existing annuity lacks a beneficiary, the remaining funds will be surrendered to the issuing bank or financial institution.

Types of Beneficiaries

The type of beneficiary an annuity owner chooses affects what the beneficiary can do with their inherited annuity and how the proceeds will be taxed. Spouses receive the most privileges as annuity beneficiaries.

Spouse vs. Non-Spouse Beneficiaries

Many contracts permit a spouse to determine what to do with the annuity after the owner dies. A spouse can change the annuity contract into their name, assuming all rules and rights to the initial agreement and delaying immediate tax consequences. They can collect all remaining payments and any death benefits and choose beneficiaries. The spouse then becomes the new annuitant.

When a spouse becomes the annuitant, they take over the stream of payments. Known as spousal continuation, this clause allows the surviving spouse to maintain a tax-deferred status and secure long-term financial stability. Joint and survivor annuities also allow a named beneficiary to take over the contract in a stream of payments, rather than a lump sum.

A non-spouse can also become a beneficiary; however, they cannot change the annuity contract terms. A non-spouse can only access the designated funds from the annuity owner’s initial agreement.

Non-Designated Beneficiaries

In estate planning, a “non-designated beneficiary” refers to a non-person entity that can still be named a beneficiary. These include trusts, charities and other organizations.

Annuity owners can choose to designate a trust as their beneficiary. Doing so can help control the distribution of assets, but there can be tax complications when placing an annuity in a trust.

You can also name a charitable organization as your annuity’s beneficiary. Doing so can provide benefits like at least partially tax-free payouts, per the IRS.

Multiple Beneficiaries

Some annuity contracts may allow you to designate more than one beneficiary. If you have multiple beneficiaries, the death benefit may be split evenly among all parties listed as beneficiaries.

You may also be able to name a primary and a contingent beneficiary. These distinctions designate which beneficiary will receive the entire death benefit. If the annuity owner or annuitant passes away and the primary beneficiary is still alive, the primary beneficiary receives the death benefit.

However, if the primary beneficiary predeceases the annuity owner or annuitant, the death benefit will go to the contingent annuitant when the owner or annuitant dies.

Choosing a Beneficiary

Only an owner can designate beneficiaries, and only the owner or annuitant’s death can trigger any beneficiary action. The owner can change beneficiaries at any time, as long as the contract does not require an irrevocable beneficiary to be named.

According to expert contributor, Aamir M. Chalisa, “it’s important to understand the significance of designating a beneficiary, as selecting the wrong beneficiary can have serious consequences. Many of our clients choose to name their underage children as beneficiaries, often as the primary beneficiaries in the absence of a spouse. However, this can create issues, as insurance companies typically cannot issue a settlement check to a minor.”

Choosing a beneficiary for an annuity is unique for each person. On one hand, it can be a great strategy for a client who is worried about the well-being of their partner; obtaining an annuity will ensure the spouse has enough lifetime living expenses. On the other hand, if a client needs to provide for a special needs child who may not be able to manage their own money, a trust can be added as a beneficiary, allowing the trustee to manage the distributions.

Beneficiaries can be people or organizations.

Naming a beneficiary ensures that the designated people and organizations receive the specified amount or percentage of the annuity contract. It eliminates confusion about where the contract’s value should go if you pass away.

It is important to name a beneficiary on your annuity so that the remainder can go to whom you would like it to at your death.

Additionally, having a beneficiary can simplify transferring your assets to your heirs. You can protect your heirs from going through probate if you name them as beneficiaries on your annuity contract.

Probate is the costly and time-consuming legal process of distributing a deceased person’s estate. It involves identifying and appraising the deceased person’s property, proving in court that their will is valid and paying any debts or taxes owed.

When owners fail to name beneficiaries, the annuity can go through probate and assets may be forfeited to the issuing insurance company. Owners who are married should not assume their annuity automatically passes to their spouse. Often, they go through probate first.

See How Much You Could Earn With Today’s Best Rates

Factors To Consider When Choosing Beneficiaries

When choosing a beneficiary, consider factors such as your relationship with the person, their age and how inheriting your annuity might affect their financial situation.

Different types of annuity beneficiaries are treated differently by estate and tax law. The beneficiary’s relationship to the annuitant usually determines the rules they follow. For example, a spousal beneficiary has more options for dealing with an inherited annuity and is treated more leniently with taxation than a non-spouse beneficiary, such as a child or other family member.

Suppose the owner does decide to name a child or grandchild as a beneficiary to their annuity. In that case, they should know that minors designated as beneficiaries can’t access their inherited annuity until they reach the age of majority (18).

Understand the financial circumstances the beneficiary is in and how inheriting an annuity will affect them. For example, an annuity owner probably doesn’t want to name someone who receives government benefits as a direct beneficiary since the annuity proceeds might be enough to exclude them from receiving those benefits.

Naming annuity beneficiaries ensures that your money is distributed correctly; the way you want it to be. If your annuity provides retirement income and you have a spouse, ensuring proper beneficiary designation may prevent disruption to their income when you pass.

You might also think about what should happen if your beneficiary dies before you do. If your contract allows you to name a contingent beneficiary, consider who you might choose for that role.

Depending on the insurer’s rules, you might also be able to place a per stirpes designation on your beneficiary. According to the U.S. Office of Personnel Management, a per stirpes designation specifies that, should your beneficiary die before you do, the beneficiary’s descendants (children, grandchildren, et cetera) will receive the death benefit.

Updating and Reviewing Beneficiaries

After you’ve selected and named your beneficiary or beneficiaries, continue to review your selections at least once a year. Keeping your designations up to date can ensure that your annuity will be handled according to your wishes should you pass away unexpectedly.

Besides an annual review, major life events can prompt annuity owners to take another look at their beneficiary selections.

“Someone might want to update the beneficiary designation on their annuity if their life circumstances change, such as getting married or divorced, having children, or experiencing a death in the family,” Mark Stewart, CPA at Step By Step Business, told Annuity.org.

To change your beneficiary designation, you must reach out to the broker or agent who manages your contract or the annuity provider itself. Usually, there’s a simple form to fill out to change the beneficiary’s information on the annuity contract.

As with any financial product, seeking the help of a financial advisor can be beneficial. A financial planner can guide you through annuity management processes, including the methods for updating your contract’s beneficiary.

Secure Your Retirement Today

Frequently Asked Questions About Annuity Beneficiaries

If no beneficiary is named, the payout of an annuity’s death benefit goes to the estate of the annuity holder. It then becomes the estate’s responsibility to distribute the funds through probate.

If the annuity owner has designated a beneficiary, the contract’s value can be passed to that beneficiary without going through probate.

If you believe the annuitant’s choice of beneficiary shouldn’t be honored due to undue influence or possible fraud, you can contest in a court of law, according to Bill Ryze, ChFC.