An inflation-adjusted annuity helps protect against inflation’s impact on everyday costs. By using the Consumer Price Index (CPI) for cost-of-living adjustments, this annuity ensures your purchasing power stays strong even as prices rise.

Key Facts About Inflation-Adjusted Annuities

- Rapid cost-of-living increases can deplete retirees’ savings faster, especially if they rely on fixed incomes.

- Inflation-adjusted annuities offer a solution by providing built-in cost-of-living adjustments.

- These annuities ensure stable real rates of return, safeguarding retirees against rising prices and ensuring financial stability.

Inflation-adjusted annuities can offer crucial protection against rising costs in retirement, but it’s important to weigh the higher costs. If you’re considering ways to secure a stable income in the face of inflation, the next step is understanding what it is and how these annuities compare to other options, such as variable or index annuities.

What Is an Inflation-Adjusted Annuity?

An inflation-adjusted annuity is a type of annuity that provides a payment stream that adjusts with inflation. This variable cash flow is a special feature that regular fixed annuities do not offer.

Often referred to as an inflation-protected annuity, an inflation-adjusted annuity guarantees a real rate of return that matches or exceeds the rate of inflation. According to the U.S. Securities and Exchange Commission (SEC), the real rate is the true economic benefit offered by an investment after taking into account taxes and inflation. On a pre-tax basis, the real rate of return is expressed as follows:

Real Rate of Return = Stated Rate of Return of Investment – Rate of Inflation

We all experience inflation throughout our lives, and annuity contracts are not exempt from this challenge. Many individuals worry that current interest rates and guaranteed income annuities may not keep pace with inflation rates, potentially impacting their retirement savings plans. This concern is valid, which is why there are annuity products designed to adjust for inflation. Opting for one of these products could be a wise decision, albeit at an additional cost.

What Is Inflation and Why Does It Matter?

Inflation is the increase in the price of something that happens over a set period of time. In the United States, inflation is most frequently and broadly measured by changes in the Consumer Price Index (CPI), a weighted average of the prices paid for a basket of commonly used consumer goods and services.

A moderate and consistent level of inflation is generally considered a sign of economic health, but rapid price increases can have a destabilizing effect on an economy — and can jeopardize hard-earned retirement savings.

Retirement savings are affected by rapid inflation because retirement portfolios generally have a large allocation of fixed income investments, such as bonds and annuities. While much less volatile than stocks, these types of investments are vulnerable to inflation, which lowers the purchasing power of fixed payment streams.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Example of Inflation Risk

Imagine a situation where you head into retirement with a fairly tight budget. Things look good initially, but as time progresses, all of your major living expenses — housing costs, food prices, energy bills and medical expenses — go up, while your income remains the same. Over a sustained period of time, the result could be devastating, both financially and emotionally.

Let’s take a closer look with some numbers. Consider the following scenario:

- Beginning at age 65, John, an owner of a regular, fixed annuity, expects to receive an income stream of $4,000 per month ($48,000 per year) for the rest of his life.

- John lives a budget-conscious lifestyle and expects to limit his expenses to $3,000 per month ($36,000 per year).

- He feels good about his budget and plans to save the money left over each year to cover unexpected life events and allow for some travel with his family.

On the surface, John’s plan looks solid. Unfortunately, his plan fails to consider the impact inflation will have on his expenses over time.

Although inflation stayed between 1% to 2.3% from 2012 to 2020, annual inflation rates skyrocketed in 2021, rising to 7%. Since then, inflation has steadily decreased in 2024.

The personal consumption expenditure (PCE) inflation rates are at 2.7% as of the first quarter of 2025. PCE inflation covers the rising costs of goods and services.

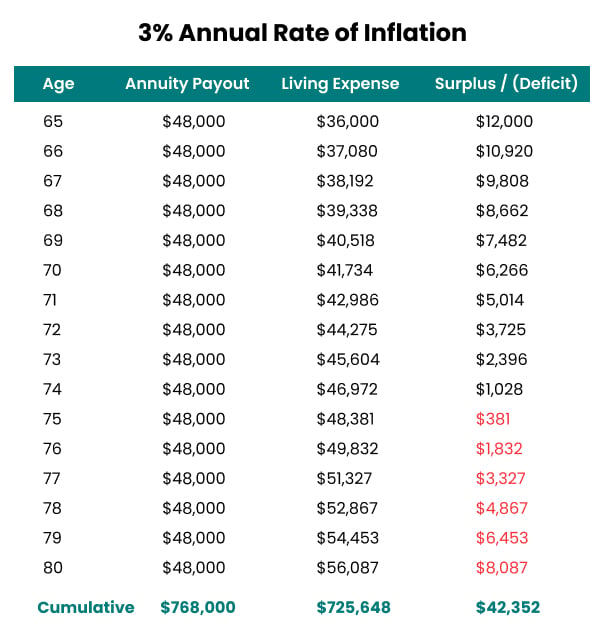

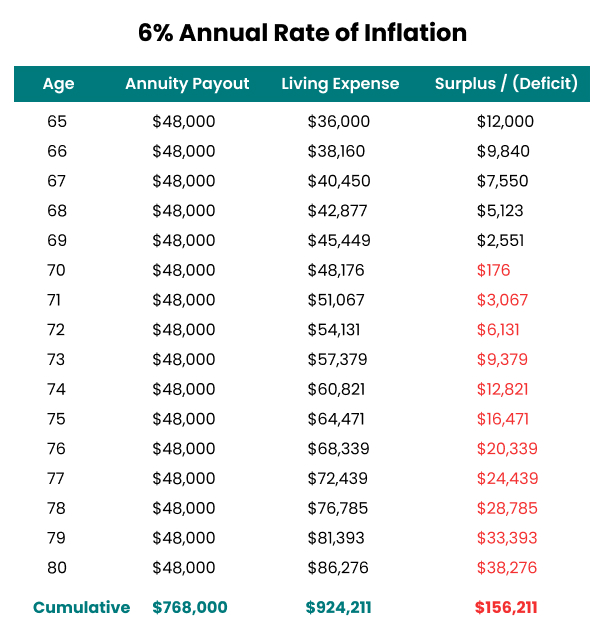

The first chart below shows how John’s living expenses may increase over time with an inflation rate of 3%. In the second chart, the inflation rate is doubled to 6%.

Even with an estimated inflation rate of 3% (the first chart), John will experience a budget deficit during his lifetime. As highlighted in red, the deficit begins at age 75 with an inflation rate of 3%. With a more aggressive inflation rate of 6% (the second chart), the deficit happens much sooner — at age 70.

While simplistic, this illustration highlights the negative effect inflation can have on even a seemingly smart financial plan. It also emphasizes how much of an effect inflation can have on a fixed stream of income.

All of this factors into a decision about whether an inflation-adjusted annuity is a sensible way to protect your purchasing power in retirement.

Overwhelmed by Safe Retirement Options?

How Does an Inflation-Adjusted Annuity Work?

An inflation-adjusted annuity generates payments for life or for a specified number of years, just like a regular, fixed annuity. However, with an inflation-adjusted annuity, the payments are adjusted to reflect increases in the CPI, usually up to a specified maximum annual rate, which is referred to as a cap.

Although payments may decrease in response to a decline in the CPI, the majority of inflation-protected annuity contracts establish a minimum threshold to ensure that annual payments do not drop below a certain level. That said, it’s not unusual to see terms in the contract that apply negative CPI changes against future CPI increases. Essentially, this limits your future annual payment increases.

Read More: What Is a Variable Annuity?

Potential Drawback

The safety offered by an inflation-protected annuity sounds really appealing, but you will end up paying for this feature. The cost will be the difference between the payment you could get with a regular annuity and the lower amount you’ll undoubtedly receive with inflation protection.

The differential will vary from issuer to issuer, but it can easily exceed 25%. The gap tends to shrink as the annuity issuer shifts more inflation risk to you. Normally, this is achieved by lowering the annual inflation adjustment cap.

Next Step: Find the Right Annuity Company

Inflation-Adjusted Annuities Frequently Asked Questions

An inflation-adjusted annuity is a type of annuity that provides a payment stream adjusting with inflation, unlike regular fixed annuities. It offers a built-in cost-of-living adjustment based on the Consumer Price Index (CPI), ensuring a real rate of return that matches or exceeds the rate of inflation.

Inflation, measured by changes in the CPI, can significantly impact retirees’ purchasing power over time. While moderate inflation is a sign of economic health, rapid increases can destabilize economies and erode fixed income streams, such as those provided by retirement savings, including annuities.

An inflation-adjusted annuity provides payments for life or a specified period, similar to regular fixed annuities, but with adjustments tied to CPI increases, typically up to a specified maximum annual rate (cap). While payments may fall due to CPI declines, most contracts set a minimum to prevent payment decreases below a certain level, albeit with limits on future increases. However, this feature comes at a cost, often resulting in lower initial payments compared to regular annuities, with the difference being the price paid for inflation protection.