Key Takeaways

- A period certain annuity guarantees income payments for a fixed number of years, with payments going to a beneficiary if the annuitant dies before the period elapses.

- Period certain annuities can be used strategically to fund early retirement or delay claiming Social Security benefits.

- Because they stop paying out after the guaranteed period even if the annuitant is still alive, period certain annuities aren’t as suited to protecting you from outliving your savings.

What Is a Period Certain Annuity?

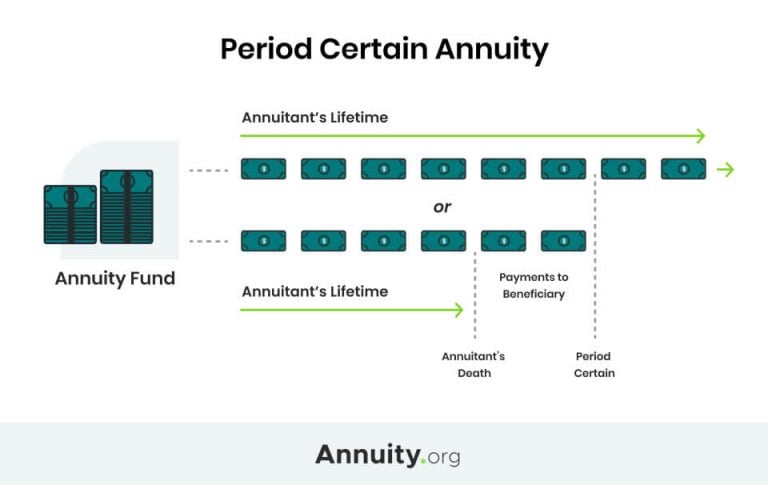

Period certain annuities, also known as fixed-period annuities, pay out guaranteed income for a specified period of time — typically 10 to 20 years — regardless of whether the annuitant lives that long. Even if the annuitant dies, a period certain annuity will continue providing income payments to a beneficiary named in the contract until the specified number of years elapses.

Payments for period certain annuities are calculated to ensure that the entire value of the contract is paid out within the period. If the annuitant is still alive when the fixed period ends, the contract ceases payments.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Benefits of a Period Certain Payout

The inability to accurately estimate their return deters many people from buying annuities. This uncertainty is due to the fact that none of us knows how long we will live.

But with a period certain annuity, you know how long your payments will last. You set your payment schedule. You’ll know exactly how many payments you and your beneficiary will receive and the amount of the payments.

In addition, in instances where the period certain is less than the life expectancy of the measuring life, the payments will be larger than payments from a single life annuity.

The defined timeframe of period certain annuities makes them ideal for bridging the gap between other sources of retirement income. For example, you might want steady income for a few years so you can retire early or delay taking Social Security payments. A period certain annuity can fit into that retirement plan, making sure you continue to receive regular income throughout your retirement.

A client received an inheritance and wanted to use it to pay off their mortgage, which had 10 years left. Instead of paying the lump sum to pay it off now, they used a 10-year period certain annuity, which required a smaller upfront payment, then used the income generated by the annuity to make the mortgage payments.

Drawbacks of a Period Certain Payout

The period certain annuity structure guarantees income for a specific time period, regardless of whether the annuitant lives that long. This is advantageous if you die prematurely, but if you live beyond the period certain, you won’t have the security of regular income payments for the rest of your life.

Michael Kitces of Buckingham Wealth Partners emphasizes the value of mortality credits for annuity owners who live past their life expectancy and explains that “trying to protect against an annuity loss in the event of early death, and protect heirs, actually eliminates much of the benefit that annuities are meant to provide in the first place.”

This protection is the ultimate goal of a period certain annuity or a life annuity with period certain. Annuity holders who choose this payout option are choosing to forfeit the additional payments they would receive if they lived longer than other annuitants in the insurer’s pool.

Overwhelmed by Safe Retirement Options?

Frequently Asked Questions About Period Certain Annuities

Once the specific time period defined in the annuity contract ends, payments from the annuity stop. But if you die before that time, your annuity beneficiary continues receiving the payments for the rest of the period.

For a period certain annuity, the guaranteed payout is the expected payout. Because there are a specific number of payments of a guaranteed amount, you can multiply the two together to find your exact payout.

Period certain annuities appeal to those who want both a guaranteed income stream and the peace of mind that they’ll leave the balance of their annuity to a beneficiary if they don’t outlive the contract.

Still have questions?