Section 1035 of the Internal Revenue Code governs annuity exchanges. This section also applies to life insurance policy exchanges. It allows the exchange of a life insurance policy for an annuity but not the exchange of an annuity for a life insurance policy.

Key Facts About the 1035 Exchange Provision

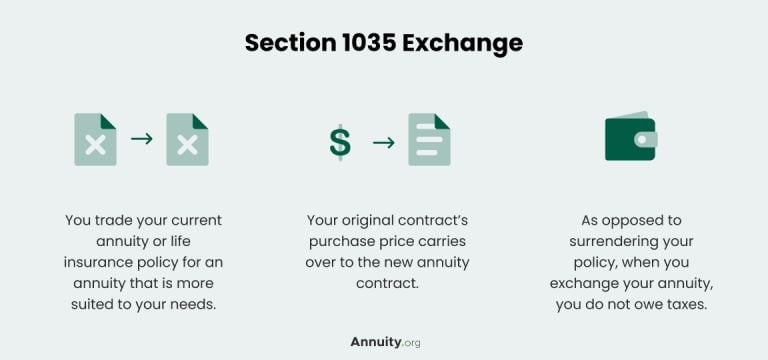

- The 1035 exchange provision allows tax-free exchanges of nonqualified annuities.

- While income taxes can be avoided, surrender charges may still apply.

- The provision only covers direct annuity exchanges; cashing out an annuity to purchase another annuity will result in tax liability.

If you purchase an annuity and later find another annuity with better terms, there is a provision in the law that permits exchanging one annuity for another — as long as the person who holds the contract does not change.

This exchange provides flexibility for investors, allowing for the direct exchange of contracts without tax consequences.

Federal Tax Law and Annuity Exchanges

The IRS permits the exchange of multiple annuity contracts for a single contract, one contract for multiple contracts and a portion of an annuity for an alternate annuity. If you follow the rules outlined in Section 1035, you can take advantage of the tax benefits and the carryover of the cost basis of your existing annuity to the new contract.

Inherited annuities may also qualify for a 1035 exchange if all the rules for inherited annuities are followed.

Surrendering your annuity early can be costly. Surrender charges generally range up to 7%, and you could also be hit with a 10% tax penalty if you’re not 59 ½ years old yet. Plus, you will owe income tax on any profit — or annual return — you have made on the annuity. However, with a 1035 exchange, you can at least avoid the tax consequences.

Benefits and Limitations of 1035 Exchanges

There are several legitimate reasons for making a 1035 exchange. For instance, a new annuity contract may come with a premium, or bonus, toward the value of your contract, ranging from 1% to 5% of purchase payments. New features are becoming available, particularly with variable annuities. For example, the contracts may cost less or the death and life benefits may be better.

However, FINRA warns that 1035 exchanges may not be a good idea for everyone. Often, bonuses or premiums can be offset by other charges added to the contract. The new agreement might additionally prolong the surrender period, which could have already lapsed or be nearing its end in the existing annuity contract.

A 1035 exchange offers several benefits:

- Preservation of the cost basis: The cost basis, which is the principal amount invested in the annuity, is transferred to the new contract. This allows investors to avoid paying taxes on the transferred amount when they withdraw funds.

- Potential bonuses or improved contract terms: The new annuity contract may come with a premium or bonus toward its value, ranging from 1% to 5% of the purchase payments.

- Flexibility and suitability: Investors can switch to an annuity contract that better aligns with their investment goals. In many cases, this means improved investment options, lower costs or a financially stronger annuity provider. In some cases, it could mean transitioning to a fixed annuity.

However, there are limitations and considerations to keep in mind:

- Offsetting charges: Some bonuses or premiums may be offset by other charges added to the new annuity contract.

- Extended surrender period: The new contract may extend the surrender period, which could affect access to funds.

- Higher fees and unnecessary features: The new contract may come with higher annual fees or additional features that may not be needed, leading to increased costs.

- Broker commissions: The new contract could entail costly commissions that compensate the sell-side broker but may not be in your best interest.

The name ‘1035 exchange’ might make it sound like a complex tax strategy but it is essentially a value transfer between ‘like-kind’ products that maintain the same owner in a direct transfer between products. If you have moved money between annuities before, you have completed a 1035 exchange. Real estate investors may be familiar with the similar 1031 exchange rules which apply to swapping investment properties without incurring taxes on a sale.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Using a 1035 Exchange for Health Care Costs as an Alternative to LTCI

Many U.S. adults purchase long-term care insurance (LTCI) to help cover long-term care costs as they age, but premiums can be costly.

To help pay for these premiums, some individuals use the 1035 exchange process to swap their non-qualified annuities to pay for LTCI. This allows annuity owners to exchange an annuity for LTCI if they believe it is a better fit for their needs, and they can still avoid having to pay taxes on the annuity’s earnings. It is important to note that you must meet certain qualifications to make this exchange, so it is best to consult with a financial advisor before moving forward.

Is a Section 1035 Exchange Right for You?

To determine if a 1035 exchange is the right choice for you, it’s essential to carefully evaluate your individual circumstances. Read all the documents associated with the transaction and ask questions about the total cost, changes in terms and new features offered.

- Total Cost

- Before proceeding with a 1035 exchange, assess the overall cost associated with the new annuity contract. Consider any fees, surrender charges, and potential trade-offs in terms of benefits and features.

- Changes in Terms and Surrender Period

- Understand how the exchange may affect the surrender period or other terms of the annuity contract. If the new contract extends the surrender period, it could limit your access to funds or impose additional charges.

- New Features Offered

- Familiarize yourself with the new features and benefits of the proposed annuity contract. Determine whether these features align with your financial goals and whether they justify any increase in costs.

- Commissions

- Inquire about the commission structure associated with the new annuity contract. Ensure that your broker’s recommendation is not driven solely by their financial incentives, but rather by your specific needs and objectives.

Consider the following factors:

By carefully considering these aspects and discussing them with your financial advisor, you can make an informed decision about whether a 1035 exchange is suitable for your circumstances.

How To Make a 1035 Exchange

To make a 1035 exchange, contact both annuity companies — your present company and the company offering the alternate contract. They will handle the transaction moving forward once you have signed and submitted the appropriate paperwork.

When initiating a 1035 annuity exchange, you must follow the proper procedure to maintain the tax-free status of the transaction.

- Contact the New Annuity Provider

- Begin by reaching out to the annuity provider from whom you intend to purchase the new annuity contract. They will provide you with the necessary paperwork, including an application for the new annuity and any compliance forms required.

- Inform the Current Annuity Provider

- Notify your current annuity provider about your intention to initiate a 1035 exchange. The new annuity provider will typically provide you with a letter to send to your current provider, facilitating the transfer process.

- Complete the Required Paperwork

- Fill out and sign all the paperwork provided by both the new and current annuity providers. Ensure accuracy and thoroughness to prevent any delays in the exchange process.

- Transaction Execution

- After submitting the completed paperwork, the two annuity companies will handle the transaction on your behalf. The funds from your existing annuity will be transferred to the new annuity contract in a tax-free manner.

How To Make a 1035 Annuity Exchange

A 1035 annuity exchange provides investors with a valuable opportunity to switch to a more suitable annuity contract without incurring income tax consequences. By understanding the benefits, limitations, and considerations associated with a 1035 exchange, you can make an informed decision about whether it aligns with your financial goals and needs.

Working closely with a financial advisor can ensure that you navigate the exchange process effectively and maximize the potential benefits while avoiding any pitfalls.

Remember to carefully evaluate the costs, changes in terms, new features, and commissions involved in the exchange. By doing so, you can make a well-informed decision and potentially optimize your annuity holdings.

Overwhelmed by Safe Retirement Options?

Frequently Asked Questions about 1035 Annuity Exchanges

You may still have to pay a surrender charge or other penalty, but the 1035 transfer rule in the Internal Revenue Code allows you to transfer the funds from one annuity to another without having to pay income tax on the annuity.

The 1035 exchange provision applies to specific insurance policies, encompassing annuities and life insurance. This rule facilitates the tax-free swap of a life insurance policy for an annuity, one annuity for another or one life insurance policy for a different one.

When you exchange one annuity for another, you may have to pay a surrender charge. However, if you exchange one non-qualified annuity for another using the 1035 exchange rule, you can avoid paying income tax on the annuity.

Editor Lena Borrelli contributed to this article.