Annuities and life insurance policies aren’t interchangeable. They are designed to accomplish opposing objectives.

Key Facts About Annuities and Life Insurance

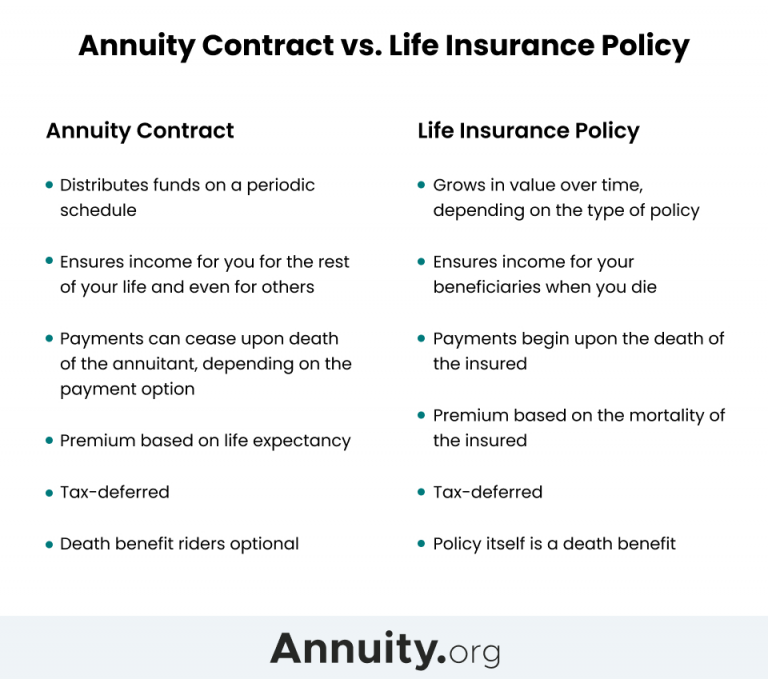

- Annuities and life insurance policies are both tax-advantaged financial contracts issued by insurance companies, but they serve very different purposes.

- An annuity is designed to provide guaranteed income in the event you live longer than expected.

- A life insurance policy is designed to create income for your heirs or beneficiaries in the event of your untimely death.

- In many cases, owning both annuities and life insurance is an effective way to achieve your financial objectives.

The difference between annuities and life insurance can be described as the difference between life and death. While the point of life insurance is to create income for your heirs or beneficiaries when you die, annuities are intended to supply you with a guaranteed income if you live longer than anticipated.

Annuities and life insurance both provide you and your family with financial protection, but on opposite ends of the longevity spectrum. Life insurance protects your family due to death, while annuities protect you if you live longer than expected.

Which Solution Is Right for You?

When it comes to optimizing your finances, choosing between buying an annuity or buying life insurance is not always sensible. In many cases, implementing a financial strategy that includes both annuities and life insurance is the best way to achieve your near-term objectives and enhance your retirement plan.

To assess your individual circumstances and formulate an ideal plan, the experts at Annuity.org recommend leveraging a fiduciary financial advisor. To facilitate the conversation, we offer some context on various types of annuities and life insurance policies below.

Types of Annuities

There are two types of annuities — immediate and deferred. With an immediate annuity, you begin receiving income distributions within a year of purchase. With the latter, you begin receiving income distributions after a specified accumulation period that usually lasts between six and 10 years.

Within the deferred annuity category, there are three distinct groups of products – fixed, fixed index and variable annuities, all of which offer investors the benefit of tax-deferred growth.

- Fixed annuities are the safest type of instrument, offering a guaranteed rate of interest.

- Fixed index annuities are a little riskier than fixed annuities because their returns can fluctuate. However, they usually provide downside protection.

- Variable annuities are the riskiest type of annuity because they entail investment positions in volatile assets, like bonds and stocks, which can lose value.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Types of Life Insurance

Just as there are two basic types of annuities, there are two primary types of life insurance — term and permanent. The former is a relatively inexpensive risk management tool that provides financial protection for your beneficiaries. The latter is more costly but also more versatile, providing a means to achieve various financial goals in a tax-advantaged manner.

Term Life Insurance

Term life insurance provides coverage for a specific period, usually between 10 and 30 years. If the policyholder dies during this period, their beneficiaries receive a tax-free death benefit payout, assuming the policy’s premium payments are current. If the policyholder outlives the term, the insurance coverage expires and no death benefit is paid.

Term policies may be annually renewable with increasing premiums or have level premiums for a stated period. Regardless, the cost of both structures increases significantly as you age.

Term policies are most popular with people who have minimal discretionary income but wish to provide a certain level of financial protection to their loved ones. This type of insurance is very affordable compared to permanent life insurance.

Permanent Life Insurance

Permanent life insurance provides coverage for the policyholder’s entire life, and the money paid into it funds two components – a death benefit and a cash value reserve. The death benefit provides a tax-free payout to named beneficiaries upon the policyholder’s death (just like a term life policy), and the cash value reserve gives the policyholder an equity stake in the policy.

Like annuities, the funds comprising the cash value reserve can be invested in fixed- or variable-rate assets and are allowed to grow on a tax-deferred basis. Once the reserve is large enough, the money can be temporarily or permanently withdrawn. However, permanent withdrawals typically result in a reduction of the policy’s death benefit.

Using a 1035 Exchange To Convert a Life Insurance Policy to an Annuity

While it can make sense to hold both life insurance and annuity contracts, there may come a time when you no longer need life insurance. In this situation, there is an exchange mechanism endorsed by the Internal Revenue Service (IRS) that may interest you – the Section 1035 exchange.

A Section 1035 exchange allows the tax-free exchange of an annuity for another annuity, a life insurance policy for another life insurance policy or a life insurance policy for an annuity. It does not, however, allow for an annuity to be exchanged for a life insurance policy.

The reason the IRS permits tax-free Section 1035 exchanges is because they do not result in any income streams or capital gains, which are taxable. Generally, taxable events arise from cash distributions.

Worried About Your Retirement Savings?

Frequently Asked Questions

Investing in an annuity can be sensible for conservative, hands-off investors that want to generate a consistent stream of income. However, before investing in an annuity (especially, a deferred annuity), make sure you have ample near-term liquidity.

Term life insurance makes the most sense for people looking to provide financial protection to loved ones in the event of their untimely death. Permanent life insurance is more suitable for higher-earning individuals looking to protect their loved ones, while sheltering their income from relatively high tax rates.

Editor Kristen Coates contributed to this article.