Key Takeaways

- Savings accounts are a basic financial product that allow you to collect interest while saving money in a bank account.

- A savings account is a convenient way to create an emergency fund or for saving toward a short-term financial need or goal.

- Savings accounts can be insured for up to $250,000 per account owner if your savings account is in an FDIC-insured institution.

- Different types of savings accounts can address different saving goals you may have.

- Savings accounts can be an important tool in your personal finance strategy, but they may not be the best choice for everyone or every goal.

What Are Savings Accounts?

Savings accounts allow you to collect interest while saving money in a bank account. A savings account can be used to put money aside for use at a later date while keeping your cash separate from the money you spend for routine expenses.

Because you can quickly access the cash in a savings account, they are convenient for an emergency fund or for saving toward a short-term financial need or goal.

Savings accounts in banks are insured for up to $250,000 per account owner by the Federal Deposit Insurance Corporation (FDIC) if it’s in an FDIC-insured institution. Similarly, the National Credit Union Administration (NCUA) insures savings accounts up to the same amount if your account is in an NCUA-insured credit union.

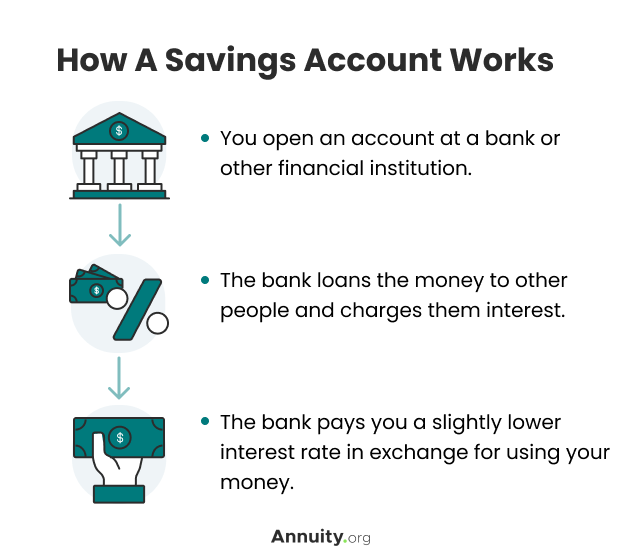

How Savings Accounts Work

Savings accounts allow you to save for a goal while a bank or other institution pays you interest to use your money to make money. Refer to the image below.

The longer you leave money in your savings account, the greater the benefit you gain from compound interest. The bank then pays you based on the interest you’ve earned.

Savings Accounts are a good way to stash away cash safely. Be aware that their main purpose is for storing funds, and not growing funds by accruing interest.

Types of Savings Accounts

Different types of savings accounts can address different saving goals you may have. It’s important to compare these when deciding to open a savings account.

- Traditional savings account

- These are the standard and most common savings accounts. Traditional savings accounts are best suited for people who want to save money that they can easily access when they need it and don’t care about the interest they’re earning. They are easy to open at a bank, credit union or online. But fees and low interest rates may end up costing you.

- High-yield savings account

- These offer competitive interest rates and lower fees. High-yield savings accounts are typically available online. Like traditional savings accounts, high-yield savings accounts are federally insured through the FDIC or NCUA. They pay you a higher interest rate and you’re less likely to have a minimum deposit or maintenance fee. But you may not be able to access your savings as quickly as through a brick-and-mortar bank.

- Speciality savings account

- A specialty savings account is designed to help you save for a specific goal — such as your kids’ college education. These can include a 529 college savings plan or Coverdell savings accounts. Specialty accounts also include Christmas club accounts or home down payment accounts. You can open several, each saving for a specific goal. But some may have strict tax rules and penalties for early withdrawals.

Types of Savings Accounts

Alternatives to Savings Accounts

There are other types of accounts that allow you to save money. These alternatives may allow you to earn higher returns, but you may not have the same quick access to your money.

These include certificates of deposit, money market accounts and cash management accounts.

Certificates of Deposit

Certificates of deposit — also known as CDs — can provide higher returns if you won’t need the money for at least a year or two.

One- and two-year certificates of deposit offer higher interest rates than traditional — and even some high-yield — interest rates. But you can purchase CDs with terms as low as 30 days or as long as five years.

In exchange for the higher returns, you will pay steep penalties if you take out the money from your CD before the term is up.

Money Market Accounts

Money market accounts give you higher interest rates but more options for accessing your money. These combine elements of both savings and checking accounts.

Rates are higher than traditional savings accounts — though not as high as CDs. You may be able to write checks from your money market account — or use an ATM or debit card — but your bank may charge you steep fees if you withdraw money more than six times a year.

Banks may require a minimum deposit to open a money market account and the interest may be tiered. That means, as your balance drops, you are paid less interest on your deposit. You may also have to pay monthly fees.

Cash Management Accounts

A cash management account isn’t designed specifically for saving, but it allows you to have cash readily available to invest in a retirement plan or brokerage account.

Some robo-advisors and online brokerages offer cash management accounts to their clients. They hold your cash and pay interest to you — sometimes at higher rates than you’ll get at a bank. If they are partnered with a bank, then your account may have higher-than-normal FDIC coverage. But some accounts are not FDIC-insured, so ask before you open an account.

You should compare interest rates because you may get a better return with a high-yield savings account.

Pros and Cons to Opening a Savings Account

Savings accounts can be an important tool in your personal finance strategy, but they may not be a good choice for everyone.

You should compare the pros and cons of a savings account when planning a savings strategy.

Pros of a Savings Account

- You earn interest while saving for a goal

- FDIC- or NCUA-insured in most cases

- Money in your account is easy to access when needed

- Small deposit to open

- Relatively low risk

- Easy to open

Cons of a Savings Account

- Typically lower returns than alternative investments or accounts

- Maintenance, early withdrawal, minimum balance and other fees

- May restrict access to your savings

- No tax benefits

- Some accounts may not be FDIC- or NCUA-insured

How Much Should You Keep in a Savings Account?

Typically, you need six months’ worth of income in a savings account. That can cover most emergencies you may face — including getting through six months of unemployment.

Aside from emergencies, savings accounts can be used for financial goals where you may want quick access to your cash within the next couple of years. This could include saving for a home or car down payment, a vacation or other big-ticket items.

On the other hand, putting too much money into your savings account can end up hurting your finances because you’ll lose out on money you could be making. For example, if money is sitting in a savings account, it isn’t earning as much as it could in your retirement plan or other investments.

Let’s Talk About Your Financial Goals.

How To Maximize Your Savings Account Earnings

There are several strategies to get the most out of your savings account. You may have to shop around to find the best bargain — or consider alternatives to maximize your savings account earnings. The key is to get the most out of your interest rate and the interest it earns for you.

- Go with a high-interest-rate savings account

- The higher the interest rate, the more money your savings account will earn.

- Try a money market account or CD

- Money market accounts or certificates of deposit also offer higher interest rates than traditional savings accounts. If you don’t need immediate or regular access to your savings, these can build your savings faster.

- Set up a CD ladder

- Laddering is a strategy of dividing your savings among several CDs. With a CD ladder, you purchase multiple CDs, spacing them out every month or quarter. This way, you take advantage of changes in interest rates and have relatively quick access to cashing out a CD as it matures.

- Check with your local credit union

- Credit unions are owned by the people who hold accounts in them. They aren’t profit-driven, so the union’s earnings go right back to the account holders — after administrative costs, salaries and other basic expenses. This makes it possible for some credit unions to offer higher interest rates than some banks.

- Consider a fixed annuity

- Fixed annuities pay out based on a fixed interest rate. If you shop for a fixed annuity when interest rates are high, you can lock in that guaranteed interest rate for however many years you sign up for. This is an alternative to a savings account if you are looking for long-term savings.

- Look into a rewards checking account or credit card

- Some banks and credit card companies offer cash-back rewards. You can automate many of these to have your cash-back payments deposited into your savings account. Over time, it can grow your balance.

- See if your bank offers bonuses

- Banks may offer a cash bonus to new customers or existing customers who open a new account. You may have to leave a minimum deposit in the bank for a fixed amount of time, but it’s extra cash that begins earning interest.

7 Ways To Maximize Savings Account Earnings

How To Open a Savings Account

Savings accounts are one of the most common bank accounts around. They are also one of the simplest and easiest to open.

Where To Open an Account

The secret to finding the best savings account for your needs and goals is to shop around for the best rates, lowest fees and most convenience. Compare different savings accounts from different banks, credit unions and other financial institutions.

- Traditional Banks

- These are the old, established brick-and-mortar names like Bank of America, Wells Fargo or TD. Community banks and other local financial institutions like credit unions typically offer savings accounts.

- Online Banks

- Traditional banks have online services in which you can open a savings account. But online-only banks like Ally, SoFi or Lending Club Bank may offer higher interest rates.

Where To Find Savings Accounts

Typically, traditional banks have higher overhead than online banks. That allows online-only banks to pass along some of their savings to customers in the form of higher interest rates.

Check to make sure that the online bank you are considering is FDIC-insured since not all of them are.

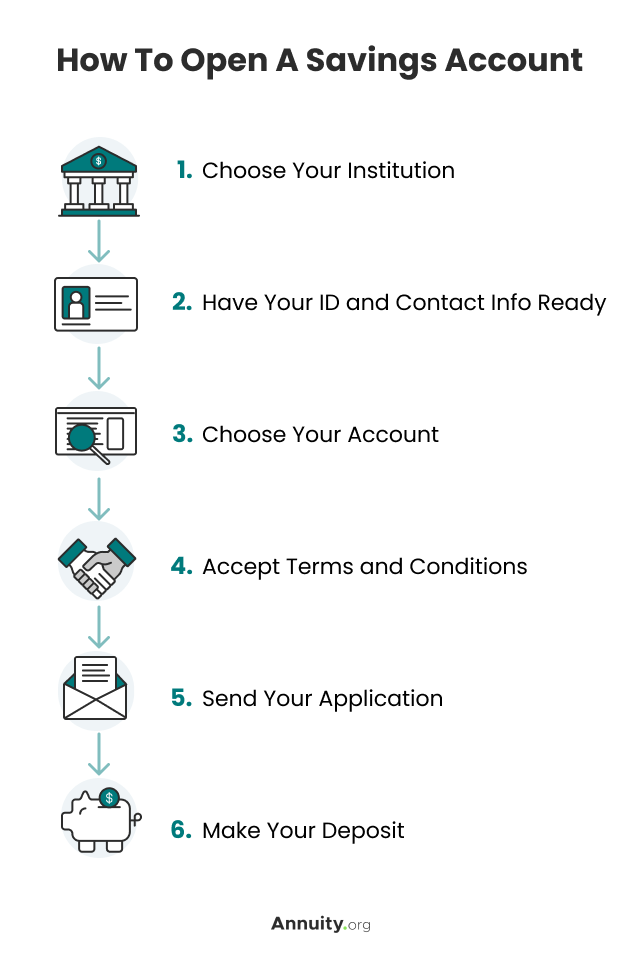

5 Steps To Open a Savings Account

Opening an account is simple. You just need to choose your account and institution, have your ID and contact information ready, as well as the money to deposit.

First, choose your institution. This can be a bank, credit union, online bank or some other type of financial institution offering savings accounts. Compare before selecting.

Second, you’ll need government-issued photo identification — a driver’s license, passport or something similar. The institution will need your Social Security number and date of birth. You’ll also need to provide the institution with up-to-date contact information, such as your address and phone number. Typically, you must be inside the United States to open a U.S. bank account.

Third, choose the type of account you want. Typically, this means a single or joint account — depending on whether you are opening it for yourself or with someone. You may also have a choice of different types of savings accounts like rewards, high-yield or other savings accounts.

Fourth, agree to the fine print. You’ll have to accept the institution’s terms and conditions. Be sure to read through these to understand if there are penalties and fees involved.

Fifth, apply for your account. This may mean signing on the bottom line at a brick-and-mortar bank, but it can be a quick process if you sign up online.

Finally, make your first deposit. You can typically make a small initial deposit — $100 or less. Making a deposit right away rather than waiting can help you avoid fees or penalties. You can usually transfer money from some other existing account.

Join Thousands of Other Personal Finance Enthusiasts

Frequently Asked Questions About Savings Accounts

If the account is insured, you won’t lose the money you saved — so long as it is less than $250,000 per account. Low interest rates, high fees and a low balance can eat up your account’s earning potential. If inflation continues growing faster than your account’s interest rate, your savings can lose buying power. Having an account with a higher interest rate minimizes that risk.

There is no limit to how many savings accounts you should have. Banks typically allow you to have as many savings accounts as you want. But paying fees on multiple accounts may cost you more than putting all your money in one account. If you have more than $250,000 in savings, you should split it into multiple accounts to make sure all your savings are FDIC-insured.

Not all savings accounts are FDIC-insured. Only deposits in FDIC-insured banks are covered. Always check to see if your brick-and-mortar or online bank is FDIC-insured. Savings accounts in credit unions are insured by the National Credit Union Administration (NCUA) up to $250,000.

High-yield savings tend to be the main type of traditional savings account that earns the most. They are typically available through online banks and credit unions, or other online institutions. While they tend to offer higher interest rates for savings accounts, they may not offer rates higher than other savings instruments such as CDs.

Editor Chase Campbell contributed to this article.