Key Takeaways

- A high-yield savings account earns interest at a considerably higher rate than a regular savings account, as much as 10 times or more.

- High-yield savings accounts are typically offered by online-only banks or credit unions, which have lower operating costs and can use their savings to offer higher rates.

- The benefits of high-yield savings accounts include higher interest rates, compound interest and easy access to money when needed.

- The risks include losing money to inflation if the inflation rate is higher than the APY on the account.

Understanding High-Yield Savings Accounts

A high-yield savings account is much the same as a regular savings account, except that it earns interest at a considerably higher rate — as much as 10 times higher or more.

The rate of return on a savings account is measured in annual percentage yield, or APY. It is expressed as a percentage of your deposit. The APY tells you the total you will earn on your deposit, including all compound interest, in one year.

As of 2025, the average interest rate for traditional savings accounts in the U.S. was 0.40%, according to CNBC.

The rate for high-yield online savings accounts at the same time reached as high as 5% APY. But high-yield interest rates can vary widely.

High-Yield Savings Accounts are a great way to store money safely, earn interest and have easy access to funds.

How Do High-Yield Savings Accounts Work?

High-yield savings accounts have similarities to other types of savings accounts. They allow you to make regular deposits and withdrawals — though the number of withdrawals may be limited. You can also transfer money between accounts.

High-yield savings accounts are typically provided through online-only banks or credit unions. These institutions have lower operating costs than traditional brick-and-mortar banks and can use their savings to offer higher rates.

The bank may require a minimum deposit of $100 or more to open a high-yield savings account. But if you shop around, you can also find banks that do not charge fees on maintenance, low balance or transfers.

High-Yield Savings Accounts vs. Other Savings Accounts

The chief difference between a high-yield savings account and a more traditional savings account is the higher interest rate offered by the high-yield account.

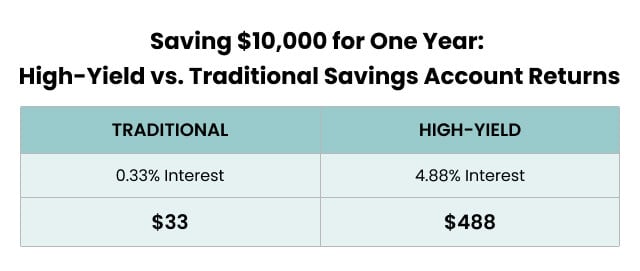

As an example of the rate difference, compare the returns you can expect between a traditional savings account and a high-yield savings account:

If you put $10,000 into a traditional savings account, after one year, you’d have earned $33 in interest.

But, if you put $10,000 into a high-yield savings account with 4.88% APY, you would have earned $488 in interest over the year.

Benefits of High-Yield Savings Accounts

High-yield savings accounts are low-risk investments that offer several benefits including higher interest rates, compound interest and easy access to your money when you need it.

- High Interest Rates

- Rates are substantially higher than traditional savings accounts, allowing you to build substantial interest earnings.

- Compound Interest

- Because interest is compounded, you earn interest on your interest, building your savings more quickly.

- Access to Cash

- There is no minimum time your money must be deposited for you to access it. But you may be limited to the number of withdrawals you make in a month or year.

- Easy Transfers to Another Account

- You can easily transfer money between your high-yield account and other bank accounts.

Benefits of High-Yield Savings Accounts

Risks of High-Yield Savings Accounts

The most serious risk of high-yield savings accounts is that you can lose money to inflation if the inflation rate is higher than the APY on your savings account.

This can make high-yield accounts less than ideal for long-term savings — such as saving for retirement. Other savings or investment options may offer a better hedge against long-term inflation.

Variable interest rates on your high-yield savings account can also mean your interest rate will drop if the Federal Reserve lowers the benchmark interest rate.

If you save with an internet-only bank, make sure your deposit is covered by the FDIC (or by the National Credit Union Administration if it’s an online credit union).

If an FDIC- or NCUA-insured institution fails, your assets — up to a total of $250,000 in all accounts — are guaranteed. This is true whether your account is with a brick-and-mortar or an online-only institution.

Some companies, such as Credit Karma and Betterment, offer high-yield savings accounts by partnering with FDIC-insured banks to hold your money and provide you with FDIC insurance coverage on your deposits.

In addition, some high-yield savings accounts have teaser rates — a high rate to get you to deposit but drops considerably after a set period of time.

Others may have balance caps. These only pay the higher rate on a limited amount of money — say, up to $500 in your account. Or they may limit your interest earnings to $25 or $50 per year.

RMDs: The Retirement Advantage You Can’t Afford to Miss

Popular High-Yield Savings Accounts

You may be able to find a high-yield savings account where you conduct your traditional banking. Often, though, high-yield savings accounts are offered by internet-only banks.

While the fund transfer process is as easy as it would be with a traditional bank, it may take longer for the money to be transferred from savings to checking since it is being moved between different institutions.

The best high-yield savings account APYs can change from month to month and are affected by several market conditions.

Examples of 2025 High-Interest Savings Account Rates

| Firm | APY Rate | Notes |

|---|---|---|

| UFB Direct | 4.01% | High APY with no monthly or excessive transaction fees, no minimum balance or maximum transaction fees. |

| Lending Club | 4.40% | High APY with no maintenance fee and no minimum balance requirement after $100 to open your account. To get the maximum APY, it requires a $250 monthly deposit. |

| Synchrony | 4.00% | High APY with no monthly or excessive transaction fees, no minimum balance or maximum transaction fees. Limit of six free withdrawals or transfers per statement cycle. |

| Marcus | 3.75% | High APY with no monthly or excessive transaction fees, no minimum balance or maximum transaction fees. Minimum $1 deposit to earn interest. |

| Ally | 3.60% | High APY with no monthly maintenance or minimum balance fees. It charges $25 overdraft fees and $10 per transaction if you make more than six withdrawals or transfers per statement cycle. |

People tend to set up savings accounts with the same financial institution where they have an existing checking account — typically out of convenience, since you can quickly and easily move money between accounts when needed.

But, you can still set up electronic transfers between your checking account with your regular bank and an online-only bank’s high-yield savings account to simplify moving your money while taking advantage of a higher percentage yield.

It helps to shop for the latest bargains or incentives when opening a high-yield savings account. For example, new customers are sometimes given a much higher rate if they agree to certain terms and conditions.

Does a High-Yield Savings Account Make Sense for You?

Deciding whether a high-yield savings account is right for you depends on several factors, including how you plan to use it, how much money you plan to put into it and how liquid you want that money to be.

- Emergency Fund

- Having an emergency fund is a basic part of a personal finance plan. Many experts advise that the fund should be a cash reserve totaling three to six months of your income that you can tap into in case of a financial emergency, such as finding yourself unemployed. If the money is parked in a high-yield savings account, it will earn more interest than a traditional account but remain readily available.

- Saving for a Large Purchase

- A high-yield savings account will provide extra money toward a long-term goal such as saving up to buy a house or car. The best bang for your buck is typically if you are saving for a purchase within the next five years. If you are saving for longer than that, you may want to consider a longer-term investment with a higher possible rate of return.

- Saving Excess Income

- If your checking account is filling up with money, you can put it to work at the end of the month by moving it to a high-yield savings account. This way, your extra income is earning extra interest with little extra effort on your part.

Uses for a High-Yield Savings Account

Qualities To Look For In a High-Yield Savings Account

Shop carefully for your high-yield savings account to make sure you are getting the best interest rate, but also look out for elements that can cost you money if you’re not careful.

There are seven qualities of any high-yield savings account you should look at and compare with other high-yield accounts you are considering.

- Interest Rate

- Interest rates fluctuate frequently, and the best rates may be available for a limited time only. Be sure to check the terms and conditions to see if your rate will change dramatically — and know how soon it may happen.

- Access to Your Money (Liquidity and Linking to Other Accounts)

- Make sure you know how to withdraw your money when you want or need it and know how long it may take. Also make sure you can link your high-yield savings account with your checking or investment accounts, so you can easily transfer money between them when needed.

- Compounding

- Understand if your bank is compounding your interest daily, monthly, quarterly or annually. This can affect exactly how much your deposit will earn, with more frequent compounding possibly increasing your return. If you evaluate the APY instead of the interest rate, this will simplify the math regardless of how often the bank compounds your interest.

- Fees

- Banks can have fees if your account drops below a certain balance, whether you make too many withdrawals per month or for countless other reasons. Make sure you are aware of any fees applicable to your account and how you can avoid having to pay them. Online-only banks may offer better terms and fee structures than brick-and-mortar institutions.

- Making Deposits

- Know your options for making deposits to your account — you can usually make direct deposits, use phone apps, access online dashboards or set up automatic transfers from your checking account. Find the option that works best for you.

- Minimum Balance

- Fees for falling below a minimum balance can cause you to lose money on your deposit over time. Make sure you know the rules for any minimum balance requirements on your account.

- Minimum Deposit

- To get the best rates on a high-yield savings account, you may have to put down a minimum initial deposit. Make sure you take this into consideration and see how that may work with any minimum balance requirements from your bank.

7 Things To Consider in a High-Yield Savings Account

Once you have settled on the best high-yield savings account for your needs, you may want to consider other high-yield banking products that may better meet your savings goals.

Let’s Talk About Your Financial Goals.

Alternatives to High-Yield Savings Accounts

High-yield savings accounts are a good option to maximize the interest you earn while having quick and easy access to your savings.

But other options may trade balance convenience and earnings in other ways to be a better option for your financial goals.

- Money Market Accounts

- Money market accounts can have competitive interest rates with high-yield savings accounts. Money market accounts may offer easier access to your money, but high-yield savings accounts may not have minimum balance requirements that are common with money market accounts.

- CDs

- CDs offer higher interest rates, but you must pay steep penalties if you withdraw money before the CD matures — typically a term is three months to five years.

- Cash Management Accounts

- Cash management accounts allow you to put money aside to invest later. These accounts — typically offered through a brokerage — allow you to earn interest on that money until you are ready to invest it.

- Investment Accounts

- Investment accounts can earn a much higher rate of return than high-yield savings accounts over the long term. But they gain and lose money based on market fluctuations. So, in some years, you may lose money while gaining money in other years.

Alternatives to High-Yield Savings Accounts

Tips for Maximizing Returns on High-Yield Savings Accounts

While higher interest rates may attract you to a high-yield savings account, there are several steps you can take to squeeze even more money out of your savings. You’ll need to compare certain features of different accounts before choosing one, and remember to regularly feed your account to get the most out of it.

- Shop around.

- Compare both the interest rates and fees of different high-yield savings accounts. You’ll want to find one that offers the highest rate with the lowest fees.

- Automate savings.

- Set up direct deposit to put part of each paycheck in your high-yield savings account. Or set up automatic transfers from your checking account to your high-yield savings account each month. This can create a savings habit while you earn more interest over time.

- Limit withdrawals.

- Many high-yield savings accounts limit the number of withdrawals or transfers you can make each month. You can avoid fees if you avoid unnecessary withdrawals.

- Look for promotional offers.

- Some banks may offer promotional rates or bonuses for new account holders. While this can mean free money for your savings, read the terms and conditions to make sure the promotion is worth it.

- Maintain a high balance.

- Many high-yield savings accounts offer tiered interest rates based on your account balance. The higher your balance, the higher the interest rate you may earn.

- Take advantage of compounding interest.

- Interest earned on your high-yield savings account can compound over time, meaning you earn interest on your interest. Make sure your account is set up to reinvest your earnings for maximum returns.

6 Tips To Maximize Returns on High-Yield Savings Account

Also, be sure to keep an eye on interest rates, since high-yield savings accounts have variable interest rates. They can change over time and are affected by changes to the Fed’s benchmark interest rate. If your account’s interest rate drops, it may be worth moving your money to a different account or an alternative savings option.

Frequently Asked Questions About High-Yield Savings Accounts

If the bank holding your account is FDIC-insured — or NCUA-insured if it’s a credit union — your accounts at the institution will be insured up to a total of $250,000 if the bank fails.

In February 2023, Primis Bank became the first bank since 2008 to offer a 5% APY on a high-yield savings account. The highest interest rates for high-yield savings accounts fluctuate with changes in the Fed’s benchmark interest rate.

You can access money in a high-yield savings account anytime you want to. But you may be limited on how many transactions you can make within a month or year without having to pay fees. And you may be required to maintain a minimum balance to avoid fees.

The rate on high-yield savings accounts is not guaranteed forever. High-yield savings accounts have variable interest rates, meaning they fluctuate and can change at any time. They may rise or fall in reaction to the Fed’s benchmark interest rate. The rates may also be set high for a limited time or for a maximum deposit amount to attract depositors.

Editor Chase Campbell contributed to this article.