The Racial Wealth Gap

Distribution of wealth has always been a major issue in the U.S., and there are few communities that have been impacted by its adverse effects more than the Black community.

According to the Brookings Institution, Black Americans would hold $12.68 trillion in household wealth if the nation’s wealth was distributed by population size. Instead, Black households held just $2.54 trillion in 2020.

The racial wealth gap that exists today has been buoyed by centuries of historical injustices. While slavery ended over 150 years ago, systemic inequality, employment discrimination and other key issues have persisted into modern times and helped build a massive barrier between Black Americans and access to wealth.

Closing the racial wealth gap in the U.S. is a complex issue with no one-size-fits-all solution, and there is only so much that can be done on an individual level. But expanding financial literacy, promoting education and providing a better understanding of what has led to the growth of the wealth gap can help to make a difference.

The median white household’s net worth is 10 times the size of the median Black household’s net worth.

According to experts in the field, one way to combat the wealth gap is to begin talking more about it.

Lawrence Gonzalez, who is an auditor for the U.S. Department of Treasury Office of Inspector General in Washington D.C., says healthy conversations about personal finance often don’t exist in Black culture.

“People never wanted to discuss money, understand it or grow it,” Gonzalez told Annuity.org. “There’s almost a mysticism around it because not enough people understand the concepts.”

Raised in Port-au-Prince, Haiti with Brazilian roots, Gonzalez excelled at math at an early age. He came to the United States when he was 11 years old and graduated with a degree in accounting from the Florida State University.

After starting his career, Gonzalez wanted to give back to the Black community. In 2018, he started a financial literacy platform called the Neighborhood Finance Guy to share practical knowledge about eliminating debt and building personal wealth.

Gonzalez says leveraging experiences common to Black culture can help break down barriers to financial literacy.

“My friends love basketball, so I use that as a metaphor to explain investing,” he said. “You try to use anything to trigger an idea, a concept that clicks and stays with people.”

Drawing on family ties is another strategy.

“Remember what your parents and grandparents did. They were always performing financial literacy principals around you, from meal prepping to side hustles to buying in bulk at the grocery store,” Gonzalez said.

The Internet has also made financial information more readily available over the last 20 years. Mobile banking, investment apps and online resources have helped level the playing field, according to Gonzalez.

“This information is more accessible than ever,” he said. “Now it comes down to someone’s personal motivation to pursue it.”

How the Racial Wealth Gap Formed

The racial wealth gap that exists today can trace its origins all the way back to the end of the Civil War when slavery came to an end.

While millions of African Americans had secured freedom, barriers to ensure that they could not secure wealth along with it sprung up almost immediately.

According to NPR, a strategy had been formed by 1865 to help transfer much of the South’s wealth to newly freed slaves. Union General William T. Sherman devised a plan to redistribute around 400,000 acres of Southern land to African Americans.

Since land ownership was the primary form of wealth at the time, this action would have given millions of African Americans a chance to become immediate participants in the economy.

But, following Abraham Lincoln’s assassination, the plan was nixed, and the land remained in the control of white Americans.

For decades following the end of slavery, there was simply no meaningful avenue for African Americans to build up wealth. They had been denied access to land, laws remained in place restricting their rights and access to education was heavily limited.

While the wealth gap did begin to shrink from its pre-war state as African Americans first entered the workforce, a wide gap remained.

According to the Minneapolis Fed, real progress was strongly felt during World War II, when the wartime economic boom buoyed employment opportunities for Black workers.

The gap narrowed once again following the Civil Rights Movement when equal rights and new legislation led to new opportunities.

But since then, movement has been virtually stagnant, with the wealth gap actually increasing slightly from 1980 to 2020.

The Minneapolis Fed found that a major part of the issue was the fact that the easiest way to build wealth is to already possess it.

Once a family has money, that wealth can easily expand over time, creating virtually guaranteed growth for white Americans over generations and establishing a tough-to-break cycle for Black Americans.

Over many years, Black Americans have been denied access to education and high-paying jobs, meaning they have less wealth. Since they have less wealth, they continue through generations to have fewer opportunities to grow their finances.

White families that have held wealth over generations, meanwhile, see that money continue to expand over time, making it very difficult to close the gap.

What Is the Racial Gap in Financial Literacy?

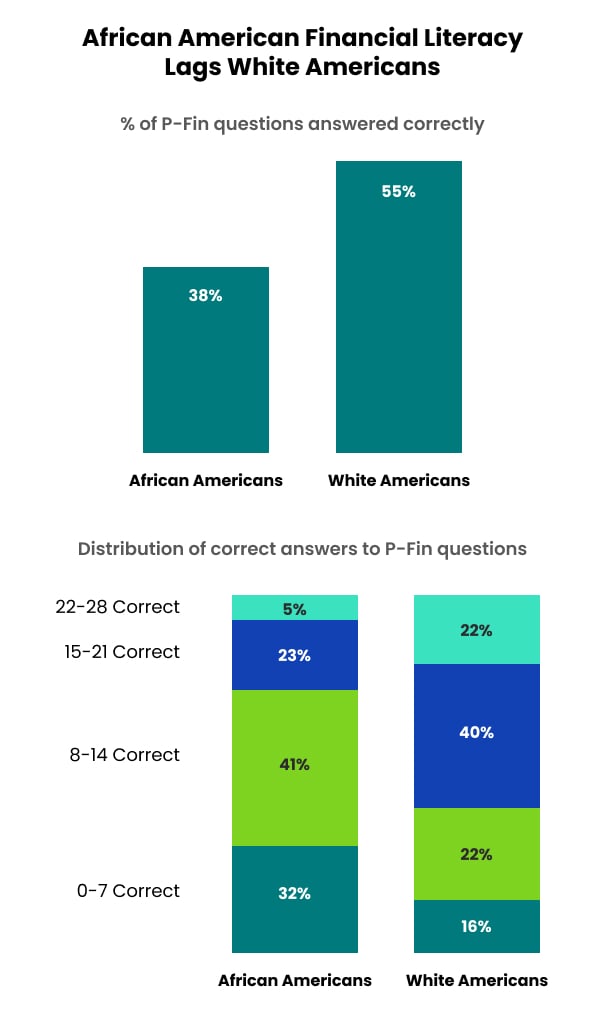

In 2018, just one-third of Americans could correctly answer at least four out of five financial literacy questions on concepts such as mortgages, interest rates, inflation and risk, according to a 2018 study by the Financial Industry Regulatory Authority (FINRA).

The disparity is greatest among African Americans.

According to the 2022 TIAA Institute-GFLEC Personal Finance Index, African Americans answered an average of 37% of the study’s financial literacy questions correctly, whereas white Americans answered an average of 55% percent of questions correctly.

Similarly, 28% of African Americans answered over one-half of the questions correctly, compared to 60% of white Americans.

Other findings from the TIAA study include:

- A lack of financial resilience was more common among African Americans than white Americans.

- Insurance tends to be the greatest knowledge gap among African Americans, followed closely by comprehending risk, investing and identifying reliable sources of financial information.

- Debt management is the area of highest personal finance knowledge among African Americans.

- Among surveyed African Americans, financial literacy is greater among men, older individuals, those with more formal education and those with higher incomes.

Minority financial experts agree that strengthening financial literacy — the ability to use skills to effectively manage money and resources — can be the key for African Americans to achieve a lifetime of financial well-being.

Educating Early

Raising public awareness is important — but so is teaching students financial literacy in public schools.

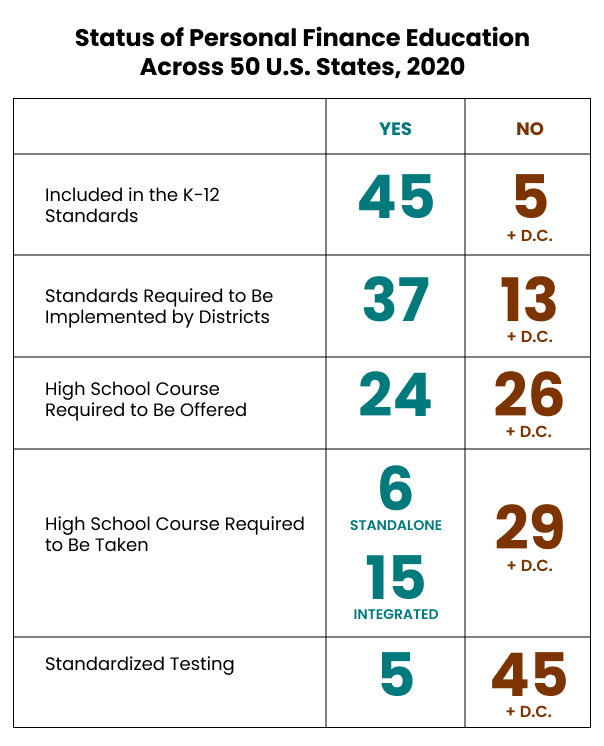

Yet a patchwork of state laws, coupled with funding issues and limited training for teachers, has made financial literacy education in schools inconsistent at best and nonexistent at worst.

Twenty-three states required students to complete a personal finance course prior to high school graduation as of 2022, according to the Council for Economic Education. And 25 states require an economics course to graduate. Some of these states overlap.

However, the size and scope of mandated high school personal finance classes vary. Only six states require students to complete a semester-long, standalone class. Other states offer a shorter course or fold curriculum into a different class.

Research indicates that mandated education requirements make a difference.

College students who undergo state-mandated financial education in high school are more likely to apply for financial aid, more likely to borrow fewer private loans and less likely to carry a credit card balance, according to a study from the National Endowment for Financial Education.

Almost 70 percent of high schoolers graduating in 2019 had at least some access to personal finance, including the option to take at a one-semester elective, according to research from Next Gen Personal Finance, a nonprofit group that creates free curriculum and funds professional training for high school teachers.

However, major gaps in access exist between higher and lower income students, particularly in states where there is no required one-semester personal finance course.

In schools where at least 75 percent of students were eligible for free and reduced lunch — a common measurement of low income — only 3.9 percent of students were required to take a one-semester personal finance course. Another 52.4 percent were at least given the option.

In contrast, in wealthier schools (where less than 25 percent of students were eligible for free or reduced lunch), students were nearly three times as likely to be required to take a one-semester personal finance course (10.5 percent). Another 61.6 percent were at least given the option.

“It’s a huge gap,” said Tim Ranzetta, co-founder of Next Gen, to Annuity.org. “To say the numbers are disappointing is an understatement.”

Next Gen and other organizations are trying to narrow the financial literacy gap by focusing on schools in underserved communities.

“It’s a huge gap. To say the numbers are disappointing is an understatement.”

— Tim Ranzetta, co-founder of Next Gen Personal Finance

Last year, Next Gen launched a pilot program providing grants to some of the nation’s largest school districts, which historically have more minority students. The three-year grants help districts cover salary for a personal finance education specialist for three years, Ranzetta said.

Of course, teaching kids about personal finance can take place outside the classroom, too. Podcasts, YouTube videos and free online resources can help teach students — and parents — valuable lifelong lessons about money.

Keeping an open dialogue at home is important, too.

Ranzetta said everyday discussions — like how to save money at the grocery store or how to use an ATM — can spark interest in personal finance for children and teens.

“Talking about money is still seen as a taboo subject in many households,” Ranzetta said. “But it doesn’t need to be a ‘big talk.’ It should just be a part of day-to-day conversations.”

How Financial Literacy Impacts the Black Community

Financial literacy is made of several components. The 2022 TIAA Institute Index study assesses financial knowledge in eight key areas.

8 Areas of Financial Literacy

- Earning

- Consuming, such as budgeting and managing expenses

- Saving

- Investing

- Borrowing and debt management

- Insurance

- Comprehending risk and uncertainty

- Recognizing trustworthy sources of financial information and advice

Borrowing is where African American financial literacy is highest, according to the study, while knowledge about insurance is the lowest.

Borrowing and Managing Debt

Brandy Baxter, an accredited financial counselor and founder of Living Abundantly Coaching and Counseling in Dallas, knows first-hand how a lack of financial education can impact young adults.

When she was in college, Baxter amassed thousands of dollars in credit card debt. She fell victim to enticing offers at a freshman academic fair, a common occurrence prior to 2009 legislation that brought sweeping protections to young credit consumers.

“When I walked onto campus, the first two vendors I saw were for pizza and credit cards,” Baxter told Annuity.org.

Baxter didn’t learn much about borrowing money or building credit growing up.

“All my mom told me is ‘Don’t get a credit card,’” Baxter said. “But I didn’t know why.”

Baxter’s “awakening” happened when she tried to join military after college. She almost didn’t get in because her credit card debt was too high.

“I couldn’t believe it,” she said. “They said my debt-to-income ratio was a potential security risk for the military. I didn’t even know what a debt-to-income ratio was.”

Building a credit score, taking out student loans and paying down credit card debt are aspects of financial literacy many people encounter relatively early in life.

But many Black Americans still struggle with debt. About 54 percent of Black Americans report having no credit or a poor to fair credit score below 640, according to a 2021 survey of 5,000 U.S. adults conducted by Credit Sesame.

In contrast, just 37 percent of white Americans report having poor or no credit.

The survey also found that 30 percent of Black Americans say they were misinformed or tricked in their first interactions with credit, compared to 18 percent of white Americans.

Comprehending Risk and Uncertainty

Financial risk is often a necessary strategy that is seldom understood by most individuals not immediately familiar with finance. Investing money in the stock market is a risk. So is purchasing a home or taking out student loans for college.

When you take a financial risk, you know the potential outcomes in advance. For example, if you buy a stock, you know it might lose value.

Uncertainty is when the potential outcome of future events is completely unknown. For example, no one knows what the U.S. economy will be like in 10 years.

Insurance is a risk management tool and a hedge against uncertainty. It can be used to protect against financial loss.

Yet insuring is the least understood area of personal finance among African Americans, according to the TIAA Index study. Comprehending risk, investing, and identifying go-to sources of financial information follow close behind.

A lack of insurance, or inadequate coverage, can be financially devastating if an emergency arises.

“Risk and uncertainty are inherent in financial decision making, and individuals face a range of choices regarding events to insure and how to structure their coverage. Understanding how insurance works…and what constitutes appropriate coverage is important.”

— 2021 TIAA Institute-GFLEC Personal Finance Index

Black Americans are actually slightly more likely to own life insurance than white Americans, according to a 2020 study by Haven Life, an insurance company.

However, the national survey also shows the median value of life insurance policies held by Black Americans is substantially lower at just $50,000, compared to a median coverage amount of $150,000 for white Americans.

Years of discriminatory practices have fueled this gap, according to survey researchers. Without adequate life insurance, Black families may struggle to pass along wealth to the next generation.

“There’s a lot of confusion about insurance vehicles and a lack of education,” Baxter said. “You have to know how to protect your assets.”

Socioeconomic and Cultural Barriers

Socioeconomic and cultural influences can make financial literacy seem out of reach to members of the Black community.

Grammy award-winning rapper, 21 Savage, grew up in some of Atlanta’s poorest neighborhoods. The 29-year-old reportedly didn’t open his first bank account until he became a rapper.

“I knew there had to be a way to understand how to make and save money— but no one was teaching me that in my Atlanta schools,” 21 Savage wrote in an August 2020 op-ed for Time Magazine.

The rapper notes the persistence of myths surrounding wealth and distrust of financial institutions as hurdles to closing the racial wealth gap.

In 2018, 21 Savage launched a financial literacy campaign called “Bank Account,” a nod to his 2017 hit.

Two years later, he partnered with Chime, a mobile bank, to further expand financial literacy resources to young people. The online course features lessons in banking, budgeting, managing credit and more.

For the popular rapper, financial literacy is a gateway to success and stability.

“It can help free youth to focus on the more important things in life,” 21 Savage wrote in 2020.

Join Thousands of Other Personal Finance Enthusiasts

Retirement Confidence

Institutionalized racism has eroded the earnings, savings, home values and overall wealth of many Black Americans. Those inequities don’t disappear when people retire.

About 83 percent of Black seniors do not have the assets they need for retirement, according to the Center for Global Policy Solutions, a nonprofit think tank.

In the past, many workers could rely on pensions, guaranteed sources of retirement income funded and managed by employers.

But the retirement landscape has shifted in recent decades toward defined contribution plans, such as 401(k)s, which require workers to invest in the stock market.

Research shows Black Americans are less likely to participate in these plans than white Americans.

In general, Black Americans also have lower incomes than white Americans, which means less money to invest for retirement. Many also work for employers who don’t offer 401(k) plans.

Among middle-aged families, 65 percent of white families have some type of retirement account, according to Federal Reserve data, compared to just 44 percent of Black families.

Even wealthier Black households are much less likely to own stocks than white Americans, according to the Associated Press.

“In the Black community, there’s a fear with investing that you’ve worked so hard for this money, you don’t want to lose any of it in the stock market,” said Baxter, the accredited financial counselor in Dallas. “Yes, there are risks. But investing is also a way to make your money work for you and your future.”

Baxter said teaching people about financial literacy concepts like compounding interest and picking investments to align with their risk tolerance can help encourage retirement confidence among Black Americans.

Research from the National Bureau of Economic Research shows that more financial knowledge increases people’s likelihood of planning for retirement.

“We’ve been taught by our parents and grandparents that traditional savings accounts are the best place to save,” Baxter said. “We rarely learn about the many other savings vehicles out there, and those can really make a big difference.”

How To Make a Difference

When combating the wealth gap, it’s important to remember that many of these issues cannot be addressed at an individual level. Truly closing the gap would likely require systemic change and significant legislation to help lessen or remove the barriers that Black Americans face.

But there are ways that financial literacy can help individuals to better understand and secure their own financial futures.

One major way to make a difference is education.

Having a stronger understanding of financial literacy can help individuals to avoid common financial mistakes and be better prepared to take advantage of and grow the wealth they have.

Even if you didn’t learn financial literacy in school, there are many ways to get that information now. There are numerous personal finance and financial literacy courses available online, and many of them are free.

It can be a simple and straightforward way to develop a better understanding of your finances and avoid simple mistakes.

The potential advantages of holding a degree can also be very valuable.

When people think of college, they often jump to a bachelor’s degree that you look to earn directly out of high school that will cost a significant sum of money and potentially put you into debt.

But any kind of degree, even one earned later in life, can make a difference.

According to the U.S. Bureau of Labor Statistics, the average American who held an associate degree earned more than $8,000 over the course of a year than the average American with a high school diploma.

Median Weekly Earnings by Education

- Master’s Degree: $1,574

- Bachelor’s Degree: $1,334

- Associate Degree: $963

- Some College, No Degree: $899

- High School Diploma: $809

Source: U.S. Bureau of Labor Statistics

College also does not need to be an expensive, multi-year, on-campus experience. There are many programs available online that could be cheaper, including ones that can be completed in just a year.

Getting higher on the chain of degrees can have an immediate impact on the jobs and earnings available to you.

Another way individuals can do more with their finances is to talk with a financial advisor or professional. This doesn’t have to be a major expense. There are organizations that offer free and low-cost financial consultations.

The Financial Planning Association, for example, offers pro bono financial planning services to low-income families and individuals.

Financial advice does not need to be expensive, and it can help you find ways to potentially grow your money.

The Impact of Systemic Changes

While there are avenues for individuals to improve their financial literacy and potentially grow their finances, there are still many systemic issues that impact Black Americans.

Education can make a huge difference in someone’s finances. But the Center for Public Integrity found that Black college graduates have on average $25,000 more in student loan debt than white graduates.

There are simply more systemic disadvantages that Black Americans face that can’t be solved on an individual level.

But promotion of financial literacy and education can help to make a difference.

The Role of Black Financial Advisors

There is a significant lack of Black representation in the financial planning industry. In 2020, less than 2% of U.S. Certified Financial Planner™ professionals (CFPs) were Black.

While other financial designations exist, such as accredited financial counselors and brokers, data on minority representation in these professions is virtually nonexistent, making it difficult to track the industry’s overall progress on racial diversity.

Increasing the number of Black financial advisors is important, experts say. One potential benefit is attracting new customers from minority communities who may feel more comfortable working with an advisor of the same race.

“If you’re Black and you walk into an institution where no one looks like you and people are using technical terms you don’t understand, the entire experience can feel intimidating and demeaning,” Baxter said.

After serving in the military, Baxter was inspired to grow her financial knowledge, and ultimately started her own financial advisory company.

But she soon realized, “I wasn’t meeting a lot of people in my field who looked like me.”

In 2017, Baxter co-founded Black Girl Financial Magic, an organization dedicated to promoting women of color in the personal finance industry. Baxter said building a professional network has been beneficial to both advisors and their clients.

But knowing when and how to pick a financial advisor can be daunting.

“In Black culture, people aren’t used to paying for trusted financial education,” Baxter said. “Often they don’t understand the benefit.”

Baxter recommends people start with their banking institution.

“You already trust this place to hold your money,” she said. “You can trust them to teach you about money, too.”

Major banks — such as Bank of America Corp, Fifth Third, JPMorgan Chase & Co. and others — offer financial literacy programs and initiatives, from free online resources to hands-on programs for high school students.

Baxter also recommends seeking out certified financial advisors to further your education. Many professionals offer free discovery sessions to identify your goals and explain the services they offer.

“Don’t be afraid to interview these people,” Braxton said. “You can Google questions to ask a financial professional, so you go into the meeting prepared.”

It’s also important to check a financial professional’s credentials. Anyone can call themselves a financial advisor, but those with legitimate certifications undergo specific training and education requirements.

If you want to find a Black financial professional to work with, you can use the Association of African American Financial Advisors’ Find a Financial Advisor tool.

Enter your contact information, ZIP code, and any expertise you’re looking for — such as investing or retirement planning — and the tool will provide a list of financial advisors in your area. There’s also an option to search for professionals who offer virtual advising.

Additional Resources

- FDIC’s Money Smart for Young People

- The Federal Deposit Insurance Corporation’s Money Smart for Young Adults program includes four free age-appropriate curriculum products for students K-12. Lesson plans for educators along with guides for parents teach the basics of handling money, including how to build positive relationships with financial institutions.

- Y4Y Financial Literacy for All Resources

- Interested in starting an after-school financial literacy program? This resource page from You 4 Youth offers numerous links to government and nonprofit resources to help educators and community leaders implement personal finance lessons into after-school programs.

- Million Bazillion Podcast for Kids

- Million Bazillion is a podcast about money for kids and their families from NPR’s Marketplace. The program features engaging episodes that answer questions like “What is the stock market?”, “Why is money green?” and “Why can girls’ things cost more than boys’ things?”