Key Takeaways

- Seek guidance from financial advisors or attorneys before deciding to sell a structured settlement.

- Court approval is necessary, and judges consider settlement terms, state laws, living expenses and future obligations.

- Factoring companies determine worth based on a formula that considers interest rates, payment dates, market rates and fees. Selling means receiving less money than the original settlement amount.

Why Would You Sell a Structured Settlement?

Selling a structured settlement means getting a lump sum now instead of waiting for smaller payments over time. You might sell because you need money for important and immediate expenses like a medical bill, education or a home. Selling a structured settlement can help you handle debts or invest in opportunities.

Remember, while selling a structured settlement gives quick access to funds, it means getting less money overall. Think about your needs and plan carefully before deciding whether to sell.

It’s a significant decision, so soliciting advice from experts or other financial professionals is always best practice.

How To Sell Your Structured Settlement: Things To Consider

When you’re considering selling your structured settlement payments, there are several important things to remember.

Top Considerations Before Selling Your Structured Settlement

- Consider other options such as a bank loan or help from your family.

- Seek advice from an attorney or financial advisor experienced in the structured settlement market. They can guide you to a reputable factoring company that protects your best interests.

- Review your settlement terms and review state laws. Your ability to sell your payments depends on both.

- Remember that a judge’s approval is required for any sale, regardless of the sale type.

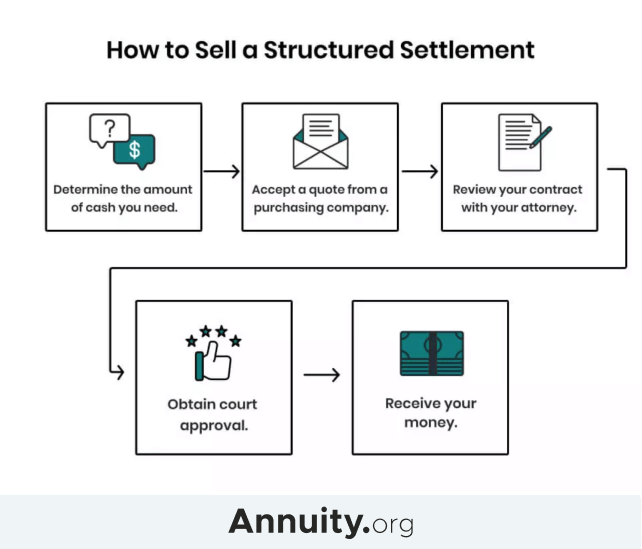

If, after weighing these and other considerations, you decide to sell your settlement payments, there are six steps in the process.

The Five Steps for Selling a Structured Settlement:

- Check with a lawyer and local laws to find out if your settlement can be sold.

- Decide if selling is a good idea, depending on your goals and financial situation.

- Research quotes and pick a trustworthy company.

- Attend your court date.

- Find out if your sale is approved within 45 to 60 days.

Need To Sell Your Structured Settlement for Cash Immediately?

You Will Need Court Approval To Sell Your Structured Settlement

Rules like the Structured Settlement Protection Acts aim to safeguard you from unfair buyers. All structured settlement sales require a judge’s approval.

The judge will consider the terms of the sale — whether you’re selling some of your payments, a portion of each payment or your entire structured settlement. They will also consider your living expenses, future financial obligations and your life expectancy in making a decision on whether you can sell your settlement payments.

Consult your state attorney general’s office or consumer protection division to confirm that the factoring company you choose has no complaints on file.

You May Owe Taxes If You Sell Your Structured Settlement

Whether you get the money through a series of payments or all at once, the money made from structured settlement sales is usually not taxable. However, some special cases have tax consequences.

If your settlement covers lost wages due to unfair treatment or emotional distress not linked to physical injury, you could have to pay taxes. Punitive damages — money awarded to punish someone rather than help the victim — can also be taxed.

Everyone’s situation is different, so it’s important to check if your settlement has special tax rules before you sell it. Talk to a financial or tax advisor before you decide. They can explain things so you’re ready for any taxes that might show up.

Read More: How Does a Structured Settlement Work?

How Much Is Your Structured Settlement Worth?

If you’re considering selling your structured settlement payments, it’s essential to understand how much money you’ll receive.

A factoring company will use a formula to calculate the present value of your payments and determine the discount rate, which typically falls between 9% and 18%. The lower the discount rate, the more money you keep. Factoring companies base their discount rate on several factors.

Factors That Affect the Discount Rate

- Interest rates

- Number and dates of payments

- Current market rates

- Economic conditions such as inflation

- Service fees

A structured settlement calculator can give you an estimate of what you may expect. But keep in mind that it may not account for the specific terms of your contract. Use it as a starting point, but expect quotes to vary among purchasing companies.

Interested in Selling Annuity or Structured Settlement Payments?

What Are the Benefits of Selling Your Structured Settlement?

In certain situations, there may be good reasons to sell your structured settlement. For example, if you require more money quickly for a medical expense, an educational expense or a down payment on a home, then selling your settlement can provide you with a lump sum of cash.

Additionally, selling your settlement could assist in paying off debts or investing in new opportunities. Some individuals prefer having more control over their money in the present rather than waiting for small payments over time.

However, it’s important to keep in mind that while selling your settlement offers quick access to funds, you will receive less money than the original settlement amount.

- Factoring Companies

- An annuity and structured settlement purchasing company that offers a lump sum of cash in exchange for the rights to future income payments.

Learn More: Structured Settlement & Annuity Buyers - Present Value

- The current cash value of an annuity, as calculated using a specific discount rate.

Learn More: Present Value of an Annuity: Formulas, Calculations & Examples - Structured Settlement Protection Act (SSPA)

- Passed in 1997, these state-defined laws originated in Illinois and regulate the secondary market.

Learn More: Structured Settlement Protection Acts

Related Terms

Selling a Minor’s Structured Settlement

Selling a structured settlement that belongs to a minor — someone under 18 — can be a challenging process. Usually, it needs court approval to ensure that the minor’s best interests are protected.

Parents or guardians must demonstrate conclusively to the court that there is an immediate need for cash and that the child would be better served by selling the settlement than by receiving future payments.

Some factoring companies won’t buy structured settlement payments intended to provide for minors.

The objective of this process is to prevent any misuse of funds that are meant for the minor’s future. Although selling a minor’s structured settlement can be more challenging due to the required steps, they are in place to ensure the minor’s future well-being.

Let’s Talk About Your Financial Goals.

Frequently Asked Questions About Selling a Structured Settlement

Yes. You need court approval to sell a structured settlement. Judges may not approve the sale if it’s not in the seller’s or their dependents’ best interest.

You can sell the whole thing and not receive any future payments, or you can sell part of it and still get payments later. For partial sales, you can either sell a specific number of payments or a set dollar amount. The remaining unsold payment will either continue at a lower amount or start up again after the last payment you sold.

In most cases, no. Taxable structured settlement sales are uncommon, but you must review the terms of your contract with your attorney before selling your payments to avoid surprise tax bills.

Factoring companies charge a discount rate on the sale of structured settlement payments. Average discount rates range from around 9% to 18% and are intended to offset the risk the purchaser assumes in the transaction.

The time it will take to sell your payments depends on several factors. But it typically takes about 45 to 60 days to make it through the courts. Your state statutes and the availability of the courts to review and rule on your sale are the main determinants. In addition, any errors in your documentation could delay the sale’s completion.

Download our FREE guide to selling your structured settlement payments.

Download our FREE guide to selling your structured settlement payments.