Key Takeaways

- Before advancing any pre-settlement funding, the funding company will decide how likely you are to win your case.

- If approved, you’ll typically receive between 10% and 20% of the amount it expects you to win.

- You generally won’t have to repay the advance if you lose, but will face expensive fees and high interest rates on your advance if you win.

- Regulations on pre-settlement funding vary by state.

- It’s wise to discuss the option with your lawyer before seeking a pre-settlement advance.

What Is Pre-Settlement Funding?

Pre-settlement funding is a financial arrangement that allows the plaintiff in a legal case to receive a portion of their expected settlement before the case is resolved. This funding is often used to cover living expenses, medical bills and legal fees.

According to a recent Fidelity report, 72% of Americans have experienced a financial setback in the past year, with 46% of them tapping into savings to cover their expenses. Pre-settlement funding can be a lifeline for those facing financial hardship while awaiting a court’s decision.

But these financial products are controversial, especially in states where they’re not strictly regulated.

The U.S. Chamber of Commerce Institute for Legal Reform, a prominent critic of the practice, explains that third parties like hedge funds can invest money in lawsuits in exchange for a percentage of the settlement or judgment. Without regulation, they warn, the arrangement could spur unnecessary lawsuits among other ethical concerns.

Types of Pre-Settlement Funding

Pre-settlement funding falls into various types, each with unique characteristics and considerations. Understanding these types can help you make an informed decision that aligns with your needs and case specifics.

- Non-Recourse Funding

- Non-recourse funding is contingent on the outcome of the case. If the plaintiff loses, they are not required to repay the funds. This provides a level of financial security and can be less risky for the borrower, as the obligation to repay is directly tied to a successful legal outcome. This is traditionally the most common type of pre-settlement funding.

- Recourse Funding

- Recourse funding requires repayment regardless of the case’s outcome. Whether the plaintiff wins or loses, repayment of the funds is required. This type of funding may be suitable for those who are confident in their case’s success or who have the means to repay the funds regardless of the outcome.

- Hybrid Options

- Some providers offer options combining both non-recourse and recourse funding, allowing for more flexible terms tailored to individual needs and case specifics.

Pre-Settlement Funding Types

Get a free, pre-settlement loan quote

Qualifying for Pre-Settlement Funding

Qualification for pre-settlement funding is a multifaceted process that involves a thorough evaluation of both the case and the plaintiff. The funding company assesses the strength of the case, the likelihood of a favorable outcome, the expected settlement amount and other relevant factors.

Funding companies may also consider the plaintiff’s financial situation, legal representation and overall credibility. This thorough qualification process aims to ensure that the funding aligns with the strength of the case and the plaintiff’s needs, minimizing risks for both parties.

You rarely need a good credit score to qualify for pre-settlement funding. This is because pre-settlement funding is not the same as a loan and pre-settlement funding companies usually don’t require repayment if you lose the case.

Without Attorney’s Consent

You aren’t required to ask permission from your attorney to get pre-settlement funding. Attorneys do not have the authority to stop their plaintiffs from receiving litigation advances.

While it is possible to apply for pre-settlement funding without an attorney’s consent, it’s wise to ask your attorney’s advice on anything pertaining to your legal case — including the decision to seek a litigation advance. An attorney’s insights can provide valuable guidance and prevent potential pitfalls.

The settlement funding company will likely contact your attorney before approving you for the advance, so your attorney may know you’re seeking pre-settlement funding whether or not you discuss it with them.

Cases That Qualify for Pre-Settlement Funding

Personal injury law encompasses many types of cases. It’s important to know which ones can get pre-settlement legal funding. Here are some of the main types of cases eligible for this kind of financial support:

- Medical malpractice claims

- Slip and fall claims

- Nursing home neglect

- Employment discrimination

- Car accidents

- Animal bites

- Personal injury claims

How Pre-Settlement Funding Works

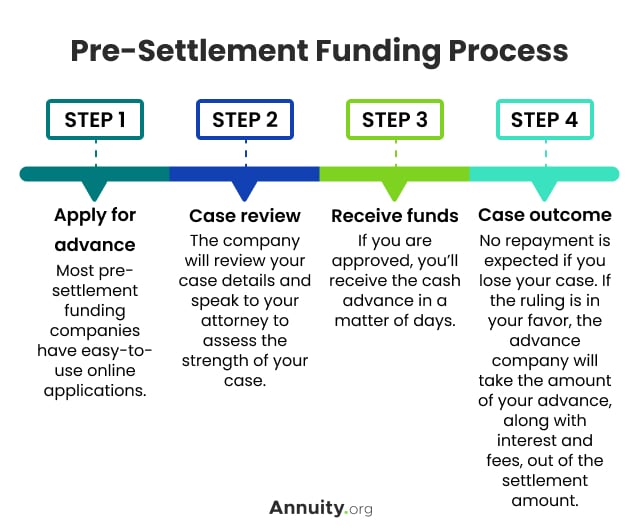

To get pre-settlement funding, a plaintiff will apply to a company with their case details. This includes legal documents and their attorney’s information.

The company will check things like the case’s nature, the defendant’s ability to pay, and the attorney’s history. If approved, the plaintiff receives up to 20% of the expected settlement. Approval takes 24 hours to a week.

Pros and Cons for the Plaintiff

Pre-settlement funding can help people who aren’t able to make ends meet cover their living expenses while they await the results of a lawsuit. But there are significant drawbacks to litigation advances that may overshadow the benefits for some people. It’s important to fully consider the pros and cons of pre-settlement funding before moving forward.

Pros

- You receive money that can help to cover living expenses

- Advanced funding affords you time to negotiate a better settlement

- Typically, no repayment is required if the court rules against you

Cons

- High interest rates apply to repayment amounts if you win your case

- Funding fees can be expensive

- You may not qualify based on the strength of your case

Companies Offering Pre-Settlement Funding

Traditional banks and credit bureaus do not give loans based on expected settlements. A private settlement advance company can help you through the process.

Hundreds of companies specialize in pre-settlement funding. Before you choose a company, ask for a quote and review the details to understand what the interest rate and terms of the advance will be. Look for a reputable pre-settlement funding company that will provide an easy-to-understand quote and a simple interest rate between 15% and 20%.

Some popular pre-settlement funding companies include:

- Capital Now Funding

- Citrus Legal Funding

- High Rise Financial

- JG Wentworth

- Oasis Financial

- Prime Case Funding

Get a free, pre-settlement loan quote

Consumer Protection Guidelines

Consumer protection in pre-settlement funding involves transparency in contracts, clear disclosure of terms and adherence to state regulations. These measures ensure that the plaintiff’s rights are safeguarded and that the funding process is conducted in line with legal requirements.

Some states have enacted legislation to protect consumers in these transactions. The Alliance for Responsible Consumer Legal Funding (ARC) supports laws that provide specific protections, such as requiring plain English and transparent contracts that clearly show the consumer’s rights and obligations.

According to ARC, states with a high level of protection include Maine, Ohio, Nebraska, Oklahoma and Vermont. Indiana has legal protections, but also limitations on the availability of these financial products. ARC is critical of laws enacted in Tennessee and Arkansas, specifically.

The American Bar Association’s Commission on Ethics 20/20 published a white paper warning lawyers to be on the lookout for red flags that point to ethical issues in their clients’ pre-settlement funding arrangements. The paper recommends that attorneys ensure a client’s confidential information is protected and that the client understands the terms of entering into an agreement with the loan or advance provider.

Educating the plaintiff about their rights, responsibilities and the intricacies of pre-settlement funding is part of consumer protection. Providing clear information, offering resources for further learning and ensuring that the plaintiff fully understands the terms are all responsible funding practices.

Frequently Asked Questions About Pre-Settlement Funding

You can apply for pre-settlement funding from a firm that specializes in granting cash advances to plaintiffs in pending lawsuits.

The amount you will receive as an advance is generally a percentage of your settlement’s estimated value. Between 10% to 20% of the settlement’s value is a typical amount for an advance.

Most pre-settlement funding companies will not check your credit score when determining if you qualify for an advance.

A trusted pre-settlement funding company will generally charge interest rates between 15% and 20% for a litigation advance.

Writer Anna Baluch contributed to this article.