The year 2023 was a record-breaking year for annuity sales, and 2024 could see even more Americans choosing annuities for their retirement income needs. The industry trade group Limra recently reported that an estimated $350 billion in individual annuity premiums were sold in the U.S. in 2023, up from the 2022 total of $313 billion.

Fixed annuities made up an estimated $140 billion of 2023’s annuity sales, according to Limra. The trade group attributed the explosion in fixed annuity sales to a rising interest rate environment, which saw rates triple over the last 18 months.

When interest rates rise, annuity providers can offer more competitive crediting rates on fixed annuities.

Another influence on 2023’s massive annuity sales was a sense of unease among many consumers regarding the stock market. The market mostly bounced back after a poor performance in 2022, but the overall volatility has left many Americans hesitant to invest heavily in equities.

“After 2022, the word ‘guarantee’ means something again,” Nick Pangakis, a financial advisor with Capitol Financial Solutions, told Annuity.org. “All of a sudden, people like the word ‘guarantee’, and they used to not like it when fixed rates were in the 2 [percent range] and the S&P was doing 20%.”

The combination of high crediting rates and trepidation over market volatility contributed to Americans pouring more money than ever before into principal-protected annuities.

Annuities in 2024

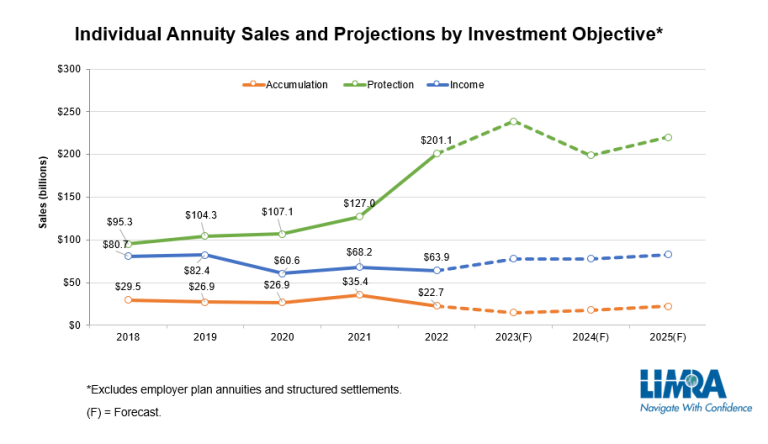

In addition to offering sales projections for annuities in 2023, Limra’s report also forecasted what the demand for different types of annuities might look like in 2024.

Fixed Annuities

After a few very strong years, demand for fixed annuities may decline by as much as 30% in 2024. Limra attributed the expected decrease in demand partly to the competition with other principal-protected retirement solutions, such as bank CDs.

The steadily rising rates that have catapulted fixed annuities into increased popularity may also be on the decline in 2024. Experts predict that the Federal Reserve will cut rates this year, and some forecast even steeper cuts in 2025.

Despite the expected decline in demand, Limra estimated that sales of fixed annuities will likely exceed $100 billion in 2024 and 2025.

Indexed Annuities

Limra forecasted a decrease in demand for indexed annuities in 2024 and 2025. The trade group cited declining interest rates as an influence that might lead more consumers to choose less protection-based solutions.

Annuity providers invest the premiums from indexed annuities into low-risk securities like Treasury bonds, and the returns on these investments determine the indexed annuity’s crediting rate. So when interest rates go down, like Limra expects them to, the crediting rates that indexed annuities offer become less competitive.

While Limra expects lower demand for indexed annuities in 2024 and 2025, the report still estimated sales of almost $100 billion in 2025.

Income Annuities

Much like fixed and indexed annuities, demand for income annuities is driven by interest rate environments. As such, Limra expects income annuity sales to dampen slightly if interest rates decline.

However, Limra’s report also found that over 3 million Americans will reach the typical age range for purchasing single premium immediate annuities (SPIAs) in 2024 and 2025. The trade group’s predictions forecast overall growth in the demand for income annuities, with projected sales of $15 billion in 2024 and a record-breaking $18 billion in 2025.

Registered Index-Linked Annuities

Registered index-linked annuities (RILAs) are relatively new to the annuity market and have recently exploded in popularity, charting record-breaking sales for five consecutive years. Limra’s report predicted that this trend will continue through 2025.

Limra forecasted strong equity market growth and declining interest rates in 2024, which could make RILAs an advantageous choice for investors who want to capitalize on market gains over interest-credited options like fixed or indexed annuities.

Limra’s projections estimated RILA sales to reach $52 billion in 2024 and $57 billion in 2025.

Variable Annuities

Sales of variable annuities declined somewhat in 2023. Limra reported total sales of $39.1 billion in the first three quarters of the year.

Limra primarily attributed the slower sales of variable annuities in 2023 to “regulatory headwinds.” Variable annuities might also be facing competition from the popular up-and-coming RILAs, which offer similar market exposure but usually with lower fees.

“Even the most expensive RILAs [have fees] in the 1% range,” Pangakis said, noting that many traditional variable annuities have fees between 2% and 2.5%.

Limra did not expect these influences to significantly reduce sales of variable annuities in 2024. If the equity market performs as strongly as Limra expects it to, demand for these products will increase. According to Limra’s projections, variable annuities will bounce back from a slight decline in sales in 2023, potentially growing sales by 10% to $60 billion in 2024.

Guarantee financial freedom with an annuity.

Guarantee financial freedom with an annuity.