Long-term care refers to services and support provided to individuals who require assistance with their daily living activities due to chronic illnesses, disabilities or cognitive impairments. Its purpose is to help people maintain their independence and quality of life when they can’t perform essential tasks on their own. There are many types of long-term care, including home care services, assisted living, nursing homes, memory care facilities, hospices and more.

We’ve put together a list of long-term care statistics for 2024 and tips that can help you plan for your health care needs later in life — explore them in depth here.

Key Takeaways

- Long-term care insurance firms paid out a record $13.25 billion in 2022.

- Today’s 65-year-olds have a nearly 70% chance of requiring long-term care services and support.

- Nursing home care costs about $108,408 per year for a private room.

- The median resident age of assisted living facilities is 84 years old.

- Reports show that 1.4 million Americans have received hospice care in 2023.

Long-Term Care Insurance Facts

Age, health, gender and marital status are all factors that affect how much a person will pay for long-term care insurance. The cost is additionally influenced by the buyer’s desired level of coverage and the insurer.

More long-term care insurance facts:

- In 2022, Medicaid spent about $154 billion on long-term care services. (KFF)

- According to the American Association for Long-Term Care Insurance (AALTCI), long-term care insurance firms paid out a record $13.25 billion in 2022. (AALTCI)

- Long-term care insurance was reportedly paid to about 345,000 policyholders in 2022. (AALTCI)

- About 45% of residents of assisted living facilities utilize Medicaid to pay for their care costs. (Gitnux)

- Premium costs for long-term care insurance are around $950. (AALTCI)

- A 55-year-old male purchasing $165,000 of immediate long-term care benefits could expect to pay $900 a year. (AALTCI)

- Your age and health at the time of insurance enrollment are two factors that affect premiums. As you age, they get more expensive. (USVA)

While statistics are helpful in showing the likely need most people will have for some type of long-term care, when I hear from people who have shared personal experiences of their loved ones needing long-term care, it is no longer a statistical need, it is a very personal and real one. It is so important that people understand that behind the statistics is the reality of the enormous impact that long-term care needs, services and costs have on individuals, families and society in general.

Long-Term Care Demographics

Long-term care demographics provide crucial information about the aging population’s needs and the demand for care services in modern society.

Here are some facts about long-term care:

- Regarding long-term care, women need care longer (3.7 years) than men (2.2 years). (ACL)

- Today’s 65-year-olds have a nearly 70% chance of requiring long-term care services and support during their remaining years. (ACL)

- Among today’s 65-year-olds, one-third may never require long-term care assistance, while 20% will require it for more than five years. (ACL)

- Regardless of lifetime earnings, it is expected that more than 50% of those over 65 will require significant funded long-term service support. (ASPE)

- 80.9% of residential long-term care workers are women. (EPI)

- 56% of residents of assisted living facilities are women, 29% are men and the remaining percentage are unreported. (Gitnux)

- The median resident age of assisted living facilities is 84 years old. (Gitnux)

Nursing Home Statistics

Nursing homes provide comprehensive care and support to older adults with complex medical needs or those requiring extensive assistance in their daily lives.

Check out these nursing home statistics here:

- As of 2023, 1,204,260 Americans were living in nursing homes. (KFF)

- There are currently 26,836 nursing homes in the US. (IBIS)

- Between 2018 and 2023, the U.S. nursing care facilities industry saw an average annual growth rate of 1.5%. (IBIS)

- The States having the most nursing care facilities businesses in the U.S. are California (3,824 businesses), Texas (3,050 businesses) and Florida (1,868 businesses). (IBIS)

- St. Augustine Health Ministries is the largest company in the US nursing care facilities market. (IBIS)

- For a private room, nursing home care costs about $108,408 annually. (US News)

- New York and California have the highest number of residents in certified nursing homes, with a combined total of 90,000 people. (Statista)

- As of 2022, Alaska has 702 nursing home residents, the lowest of any U.S. state. (Statista)

- In 2020, out-of-pocket expenses for nursing care in the U.S. amounted to $45.6 billion. (Statista)

Home Care and Assisted Living Statistics

Assisted living facilities serve as an essential care option for older adults who require assistance with daily activities while maintaining some independence. Read on to learn more:

- Assisted living facilities cost an average of $4,500 a month, or $54,000 a year. (Genworth)

- In the U.S. today, there are over 30,600 assisted living facilities with close to 1.2 million beds that are licensed. (AHCA)

- The market for assisted living facilities in the U.S. was estimated to be worth $91.8 billion in 2022. (Grand View Research)

- From 2023 to 2030, the market for assisted living facilities in the U.S. is anticipated to expand at a compound yearly growth rate of 5.53%, reaching $140.8 billion. (Grand View Research)

- Assisted living facilities experienced the highest occupancy rates in San Jose (83.7%), Portland (83.4%) and San Francisco (83.4%). (Mordor Intelligence)

- According to estimates, the U.S. will require 881,000 new assisted living facilities by 2030, an increase of 9.2% from the number of facilities in 2021. (Gitnux)

- Between 2000 and 2021, assisted care saw the biggest growth in terms of the number of units, with an average annual growth of 3.5%. (Gitnux)

- The median resident age of assisted living facilities is 84 years old. (Gitnux)

Hospice Statistics

The field of hospice care provides comfort, dignity and vital support to individuals with life-limiting illnesses and their families during the end-of-life journey.

Explore some facts and figures about hospice below:

- In the US, 1.4 million people are reported to have received hospice care in 2023. (NCBI)

- Those over the age of 84 make up about 50% of hospice patients, while cancer accounts for the majority of terminal diagnoses at 27.2%. (NCBI)

- Puerto Rico had the lowest percentage of Medicare decedents registered in hospice at the time of death (23%), while Utah had the highest rate (58%). (NCBI)

- Medicare pays about $23 billion annually for hospice care. (OIG)

- By 2030, experts anticipate that the U.S. hospice market will be worth $64.7 billion. (ResearchandMarkets)

- Compared to families who did not get hospice services, those whose loved ones got end-of-life care through a hospice program reported higher satisfaction levels. (NIA)

- Compared to persons who don’t receive hospice care, hospice patients are more likely to have their pain managed and are less likely to undertake tests or receive unnecessary medications. (NIA)

5 Tips for Planning Long-Term Care

Long-term care can be expensive, often placing a significant financial burden on individuals and their families. It is essential to plan for potential long-term care needs through insurance policies, savings or other financial arrangements to ensure that appropriate care is available when required.

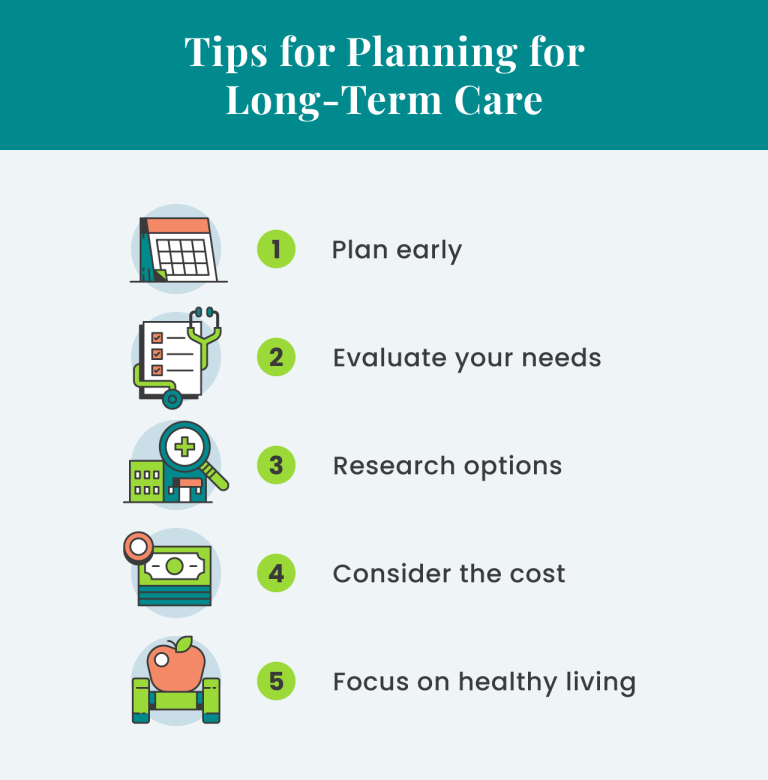

Here are five tips for planning for long-term care below:

- Plan early: Planning for long-term care should ideally start well before you need it. Making decisions without feeling hurried or under pressure is possible when you start early.

- Evaluate your needs: Determine the type of long-term care you could need by assessing your present health and lifestyle. Consider your medical history, your family’s health history and any ongoing chronic conditions.

- Research options: In-home care, assisted living facilities, nursing homes and continuing care retirement communities are just a few of the long-term care alternatives that are available. Examine each choice’s features to determine which suits your requirements and fits best.

- Consider the cost: Understanding the potential expenses associated with various care options is essential because long-term care can be very expensive. Investigate insurance coverage (such as long-term care insurance), governmental initiatives and other funding options.

- Focus on healthy living: Give your health and well-being top priority when you plan for long-term care arrangements. Maintaining a healthy lifestyle that includes regular exercise, a well-balanced diet and social interactions can improve overall well-being and possibly postpone the need for long-term care.

These long-term care statistics can provide essential insights into the growing need for care services among elderly populations. Long-term care planning is a complex process, and, in addition to the tips mentioned, professional financial and legal advice can help ensure your plan is comprehensive and suitable for your unique circumstances.

Contact a retirement financial advisor today to help you prepare for a comfortable retirement.