Oftentimes, the money from a home sale is used to make a down payment on a new, comparable house, but it isn’t always the case. Some people choose to downsize for retirement or transition to a rental arrangement. In these cases, they are going to be sitting on some cash — potentially, a lot of it.

If you find yourself in this position, you’re bound to have some questions. Should you put the money into a savings account? Should you use it to pay down debt? Should you invest it, and if so, how?

All of these are valid questions that require thoughtful contemplation. Ultimately, the decisions you make should reflect your near-term liquidity needs and your ability to assume risk — both of which are largely dependent on your life stage.

“Optimal investment strategies depend critically upon both individual risk tolerances and financial flexibility,” said David Harrison, the Howard Phillips Eminent Scholar in Real Estate at the University of Central Florida.

“While the market is highly likely to return more than 3%, which is the average mortgage interest rate, per year over the next 30 years, it does expose investors to increased risk.”

How Much Can You Expect to Pay in Taxes When You Sell Your House?

Before deciding what to do with your sales proceeds, a common concern is the extent to which the capital gains tax is going to cut into your take. This federal tax is levied when you sell an asset for more than the price at which you bought it.

Generally, the capital gains tax is applied on a short-term or long-term basis, depending on the holding period of the asset in question. Short-term capital gains pertain to assets held for less than a year. These gains are typically taxed as ordinary income.

Conversely, long-term capital gains pertain to assets held for at least a year. They are usually taxed at an effective rate that falls between 0% and 20%, depending on the circumstances.

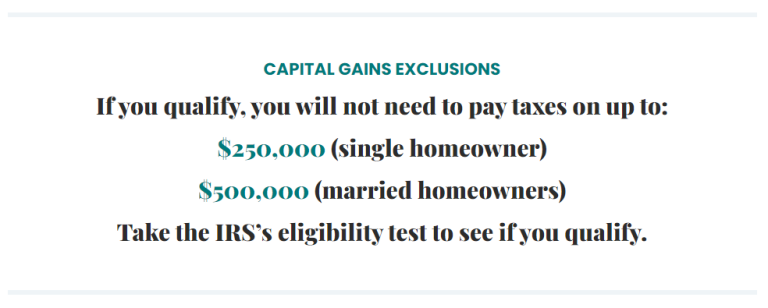

Fortunately, for homeowners, the Internal Revenue Service has granted an exemption for qualifying sales. The exemption, which is known as the Section 121 exclusion, is available if you meet the following two criteria:

- You sell your primary residence, which is defined as a house or condominium you have lived in for at least two of the five years preceding the sale.

- You have not utilized the exemption on another home sale in the past two years.

If you qualify for the Section 121 exclusion, you may still incur a tax obligation depending on the extent of your capital gains. Essentially, for the 2025 tax year, the exclusion applies to gains totaling $250,000 for single filers and $500,000 for married filers.

For example, if you purchased your home for $200,000 and sold it for $300,000, you won’t have to pay any tax on the $100,000 profit.

Regardless of how much you profit, you need to decide what to do with the money. There are various strategies to consider.

Is An Annuity Right For You?

Where Is the Best Place To Put Your Money After Selling a House?

Do you want to use the proceeds to make a down payment on a new home? Do you want to pay down problematic debts? Perhaps, you prefer to invest the money for retirement. Ultimately, determining the best solution depends on your near-term liquidity needs and your tolerance for risk.

Put It in a Savings Account

The simplest approach is to put the money into a savings account, ideally, a high-yield savings account. This is a low-risk option that provides you unrestricted, fee-free access to the cash. The drawback is the possibility of not earning the higher rates of return achievable through a multitude of investments and insurance-based products.

Unfortunately, if you don’t earn adequate interest income on your savings, it will lose its real value due to inflationary pressure. In today’s environment, this is a significant risk. However, the high-yield rates offered by the most competitive financial institutions — currently 3% to 4% — are on the rise, and inflation appears to be slowing.

Pay Down Debt

Another option is to use the proceeds to pay off debts, such as credit card and student loan obligations. According to a study by Experian, the average American consumer currently has $105,056 of debt outstanding, including mortgages, home equity lines, credit cards, as well as auto, student and personal loans.

That’s a sizeable burden, and it can take a toll financially and emotionally. Paying it down can provide some peace of mind and position you for a stronger financial future.

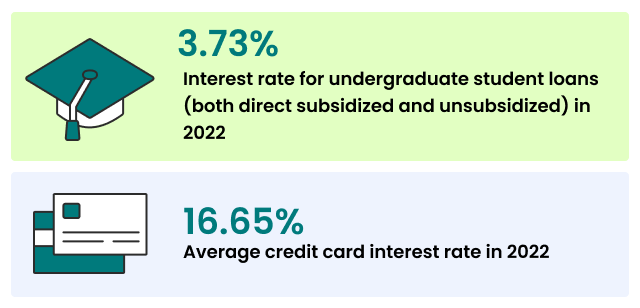

But before doing so, compare the interest rate you’re paying with the amount of interest you could earn on a savings vehicle or relatively safe investment. Unless the rate you’re paying on the debt exceeds the rate you could earn, paying down the debt is not a fiscally minded approach.

“Using the proceeds to pay down debts often makes sense, as the costs associated with many types of consumer credit exceed the expected risk-adjusted returns on financial investments,” Harrison says.

“Paying off debt also increases financial flexibility and allows borrowers to potentially increase the amount of future mortgage financing they may be able to qualify for.”

Increase Your Stock Portfolio

If you do not have any significant near-term liquidity needs and your outstanding debt carries a relatively low interest rate, investing the home sale proceeds is the best course of action. That said, investing calls for an understanding of your time horizon.

The longer the time horizon, the greater your growth potential and the more risk you can comfortably assume. The shorter the time horizon, the lesser your growth potential and the less risk you can comfortably assume.

If you have a relatively long horizon (seven years or more), you should put the money into a diversified portfolio of stocks — ideally, low-cost, fund-style vehicles. Over the long run, this approach offers you the highest, risk-adjusted return on your money.

The drawback is the relatively high degree of volatility exhibited by stocks, particularly over the short term. Therefore, a long investing horizon goes hand-in-hand with stock investments. It gives you the ability to confidently endure choppy markets, while amplifying your potential to accumulate wealth.

That said, stock investing calls for some basic knowledge. If you need some guidance, consult with a financial advisor. For budget-conscious investors, a robo-advisor may be ideal.

“In general, high-quality, diversified portfolios of stocks or stock funds provide the most insulation against idiosyncratic risk and volatility for individual investors,” Harrison says. “As such, the typical investor is likely to find index funds attractive for long-run investment purposes.”

Learn About How Annuities Can Bolster Your Retirement Strategy

Invest in Real Estate

An alternative to investing in stocks is investing in a real estate property, such as a vacation rental. The benefits are twofold — you can generate consistent income and you can benefit from price appreciation, assuming the real estate market remains buoyant.

As Ebony J. Howard, CPA, explains, “One could build wealth by investing in multiple properties. They could start out by investing in one property and, over time, use the built-up equity from that property to invest in several other properties or multi-family units. Once the individual has a portfolio of properties and can effectively manage them, their wealth will reach peaks.”

Of course, if the real estate market declines, you could earn less income than anticipated and you could experience price deterioration rather than appreciation. In a worst-case scenario, the cost of managing and maintaining a property exceeds the rent revenue it generates.

Supplement Your Retirement with Annuities

As the cost of retirement continues to increase, a growing number of people are worried about comfortably navigating through this phase of life. Many are worried about outliving their savings and don’t have the ability or desire to manage their investments.

Annuities are a great option for them. Annuities offer unlimited purchases, tax-deferred growth and guaranteed income (for life, if elected). The drawbacks are relatively high commissions and fees, contractual complexity and relatively modest returns.

An annuity could be a nice complement to your retirement plan, but it may not be in your best interests. To determine whether it makes sense, a holistic assessment is necessary. Usually, this warrants the counsel of a fiduciary financial advisor. Ultimately, the goal is to ensure you will have adequate retirement income.

Interested in Learning More About Your Annuity Options?

Acquire Permanent Life Insurance

Permanent life insurance can be a wise way to enhance your retirement plan. Fundamentally, it’s a risk management tool that provides financial protection to your loved ones in the event of your death. However, it also serves as an investment vehicle.

Essentially, a portion of the premiums paid into a permanent life insurance policy can be invested and are allowed to grow on a tax-deferred basis, creating a cash value reserve. The funds can be borrowed against as a loan or permanently withdrawn. Generally, permanent withdrawals result in a reduction of the policy’s death benefit, and taxes are levied on any accumulated earnings.

Purchase Long-Term Care Insurance

The U.S. Department of Health and Human Services predicts that 70% of retirees will require some type of long-term care, and that on average, women will need it longer than men.

This could strain many people’s savings, especially considering the average annual cost of a private room in a nursing home is currently $127,752, while the cost of a home caretaker is $75,504, according to CareScout’s 2024 Cost of Care Survey.

One way to mitigate the possibility of spending all your money on long-term care is to purchase a long-term care policy. This is an insurance contract that provides medical and non-medical care to an individual who is unable to perform basic daily activities, such as bathing, dressing and eating.

Long-term care insurance can be obtained for individuals of any age, but it is usually purchased for elderly people, oftentimes, to enhance their retirement plans. Incidentally, Medicare and most health insurance plans do not pay for long-term care.

Policyholders can select a range of care options and benefits to obtain the appropriate services, which can be provided in a variety of settings, including personal residences, community organizations and assisted living facilities.

Long-term care insurance can provide peace of mind, but the product is relatively new and can be difficult to assess. Pricing is also somewhat unpredictable and determining coverage needs can be challenging. If long-term care insurance appeals to you, be sure to weigh the pros and cons.