What Is Inflation Risk?

During retirement, your money will not stretch as far as it did when you first left the workforce. This is due to inflation – the economic phenomenon that describes how prices of goods and services increase over time.

Using the Bureau of Labor Statistics’ inflation calculator, you can determine how far your money could go from year to year based on historical inflation rates. Although the calculator can’t predict the future, it provides foundational insight into how much income you are likely to need in the future.

Plugging numbers into the CPI calculator shows you would need $905.48 in July 2023 to have the same buying power you had with $500 in January 2000.

To translate this example into retirement, let’s say you plan to live off of $50,000 a year when you retire. If we assume a regular inflation rate of 3% per year, you’ll need $77,898.37 to match the purchasing power of that $50,000 after 15 years.

Because the cost of living will likely increase each year after you leave the workforce, you must account for this inflation when you’re planning and saving for your retirement.

According to Stephen Kates, “Inflation is one of many financial risks which can never be completely avoided, only managed. Like most risks of investing (or not investing), a balanced strategy can control the severity of the impact to your finances.”

It’s impossible to predict inflation, but that doesn’t mean you should ignore it. Understanding how inflation may affect you and taking steps to protect yourself could be the difference between a successful retirement and running out of money.

How Can Inflation Impact Your Finances in Retirement?

According to a report from the U.S. Bureau of Labor Statistics, inflation soared from 2021 to 2022, reaching a peak of 9.1% in June 2022, which marked the largest 12-month increase in consumer prices since the 1980s.

Since then, inflation has gradually moderated. As of July 31, 2023, the year-over-year inflation rate is 3.2%. While lower than recent readings, this is still notably higher than the U.S. Federal Reserve’s long-term target of 2%.

Even at the 2% target, inflation can erode purchasing power over the long run. The risk is most pronounced for retirees.

Most retirees have minimal flexibility to combat inflation, given their fixed income streams. To make matters worse, most retirees spend an outsized portion of their budget on products and services that are most heavily impacted by inflation, such as healthcare, housing and food. Healthcare is especially troubling, because seniors tend to spend three times more on this category of expense than working adults and five times more than children.

Mapping Out Your Retirement: Are You on Track?

Inflation and Your Savings

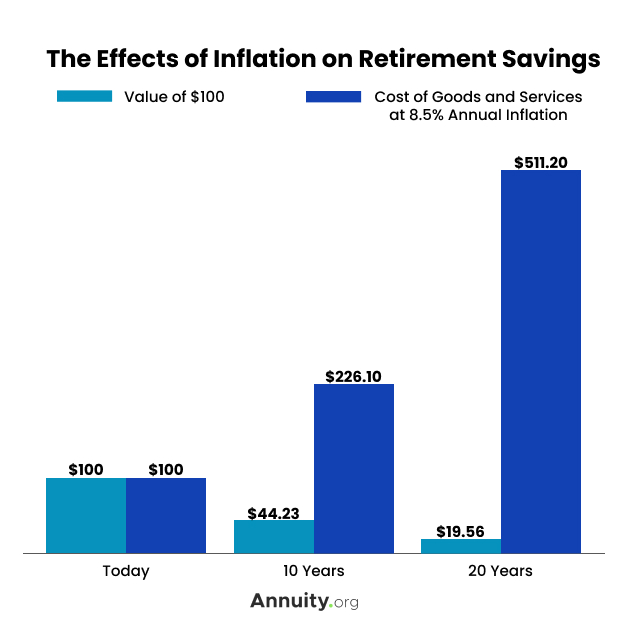

When you’re putting money away for a long time — such as saving for retirement — you must account for how the purchasing power of your money will decrease due to inflation.

If you put money into a savings vehicle, like a savings account or a certificate of deposit (CD), your money will earn interest for as long as it remains in the account. The longer you keep the money in the account without withdrawing it, the more interest your savings will earn.

However, interest rates for these bank products are often too low to keep pace with inflation. As of July 2023, the national average interest rate on savings accounts is 0.42%, and the national average for one-year CDs is 1.72%. Both yields are significantly lower than the current rate of inflation. If you are currently saving money in these vehicles, you are losing purchasing power.

Planning for Retirement With Inflation in Mind

The good news is most retirees don’t have their savings stockpiled in low-yield savings accounts. Prudent investors devote a portion of their retirement portfolios to generate the growth necessary to keep pace with or outpace inflation, thereby mitigating longevity risk.

That said, inflation doesn’t stay the same from year to year, and it’s impossible to predict when prices might spike dramatically as they did in 2021 and 2022. As a result, forethought is essential when constructing your strategic asset allocation. Moreover, a flexible stance is invaluable.

How To Track Inflation Rates

The Bureau of Labor Statistics (BLS) tracks monthly average prices of consumer goods to establish the current Consumer Price Index (CPI), which the bureau defines as “a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.”

The change in the CPI from one period to another is what determines the rate of inflation. The BLS traditionally tracks the CPI of one population group, urban wage earners and clerical workers, as a measure known as the CPI-W.

CPI-W measurements are used to dictate the cost-of-living adjustments (COLA) made by the Social Security Administration. However, because retirees spend most of their money on goods and services with more rapidly increasing costs — primarily healthcare and housing — they face cost-of-living increases that tend to exceed the national averages reported by the CPI-W.

Because of this, the BLS created an unpublished, experimental inflation measure focused on older Americans. It is known as the CPI-E, and it reflects estimated spending patterns of Americans ages 62 and older.

Although inflation has increased at an unusually brisk pace in recent years, financial advisors generally suggest assuming an annual 3% inflation rate when planning for retirement, which is conservatively higher than the Federal Reserve’s long-term target of 2%.

Historical Average Annual Rate of Inflation: CPI-W vs. CPI-E

| Year | CPI-W | CPI-E |

| 2022 | 9.0% | 7.6% |

| 2021 | 5.3% | 4.3% |

| 2020 | 1.2% | 1.4% |

| 2019 | 1.9% | 1.9% |

Investment Options and Annuities

One way to keep inflation from affecting your ability to maintain your lifestyle in retirement is to invest in assets that keep pace with inflation or even surpass it in growth.

But there is usually a cost associated with any investment that has the potential for higher returns. It might be the fact that the investments, such as stocks, carry higher risks of losing value. Or it could be that the cost of the investment is higher than the same investment without inflation protection.

Examples of investments that may protect against inflation include annuities, inflation-protected treasury securities, Series I Savings Bonds and real estate.

Annuities

An annuity is an insurance product that converts a lump-sum premium into a stream of income payments.

Some annuities are inflation-adjusted, which means their payment amounts will increase according to increases in the CPI. Most inflation-adjusted annuities have a limit on how much the amount can increase each year, known as a cap.

Another effective way that buying an annuity can help you combat inflation involves a concept known as laddering.

It is possible to buy multiple annuities, and splitting up the amount you’re looking to invest into different purchases can play a role in outpacing inflation later in life.

When you ladder annuities, you buy each product at a different time, taking advantage of different market conditions. You can time these annuities so that each of their guaranteed income streams begins at a different date, stretched over years.

The older you get, the more payments you will receive as each annuity matures.

So, as you age and inflation grows, you will continuously receive new streams of income to help you stay ahead of rising costs.

Treasury Inflation-Protected Securities (TIPS)

Another investment option is Treasury Inflation-Protected Securities (TIPS), which the federal government issues. Payouts rise with inflation as measured by the Consumer Price Index. These bonds pay interest at a fixed rate two times each year. The principal may be increased if the CPI warrants it, with the interest rate applied to the higher principal.

Series I Savings Bonds

Besides TIPS, the Treasury’s Series I Savings Bonds are another great product to invest in for inflation protection. Essentially, we’re talking about a completely risk-free investment issued directly by the U.S. Treasury Department. You can’t lose your principal investment on these bonds, and you are hedged against inflation. All things considered, there is no other investment in the world that currently offers a comparable risk-adjusted return.

Real Estate

According to an article from EquityMultiple, experts say real estate investing can be a hedge against inflation because the scarcity of real estate gives it intrinsic value. Demand for real estate doesn’t decrease as inflation increases, and the ability to generate rental income from the property also increases at a rate that compensates for inflation. For these reasons, real estate has proven to be a reliable hedge through historic periods of inflation.