Key Takeaways

- Structured settlements are a stream of tax-free payments, often issued to an injured party as settlement for a civil lawsuit.

- Structured settlement payments are guaranteed. Unlike stocks, bonds and mutual funds, they do not fluctuate with market changes.

- Spreading out payments over time can reduce temptation, but there’s little you can do to renegotiate after the terms of a structured settlement are finalized.

- Structured settlements are commonly used in cases of personal injury, workers’ compensation, medical malpractice and wrongful death.

- The average discount rate factoring companies use when purchasing structured settlements is between 9% and 18%, according to the National Association of Settlement Purchasers.

Structured Settlements Defined

A structured settlement is a type of court settlement paid out as an annuity instead of a one-time, lump-sum payment. A structured settlement typically provides tax advantages to the person receiving it while also providing some savings to the party paying the settlement.

Structured settlements are relatively simple. Many civil lawsuits result in someone or some company paying money to another party to right a wrong. Those found responsible for the wrong may agree to the settlement on their own, or they may be forced to pay the money (as a judgment rather than a settlement) after they lose the case in court.

Structured settlements are typically voluntary arrangements between the defendant and the injured party — both parties usually have a say in whether to establish a structured settlement or opt for a lump-sum payment.

If the amount of money is small enough, the wronged party may opt to receive a lump-sum settlement. For larger sums, however, a structured settlement annuity is usually arranged. Various factors often influence this decision, including:

- Financial needs and preferences of the recipient

- Future financial planning and tax considerations

- Overall negotiation process between the parties involved

When a structured settlement is ordered, the at-fault party puts the money toward an annuity — a financial product issued by an insurance company that guarantees regular payments over time.

The agreement also details the series of payments the awarded party will receive as compensation for the harm done to them. Spreading the money over a longer period offers a better guarantee of financial security because the recipient cannot spend the stream of payments quickly.

How Do Structured Settlements Work?

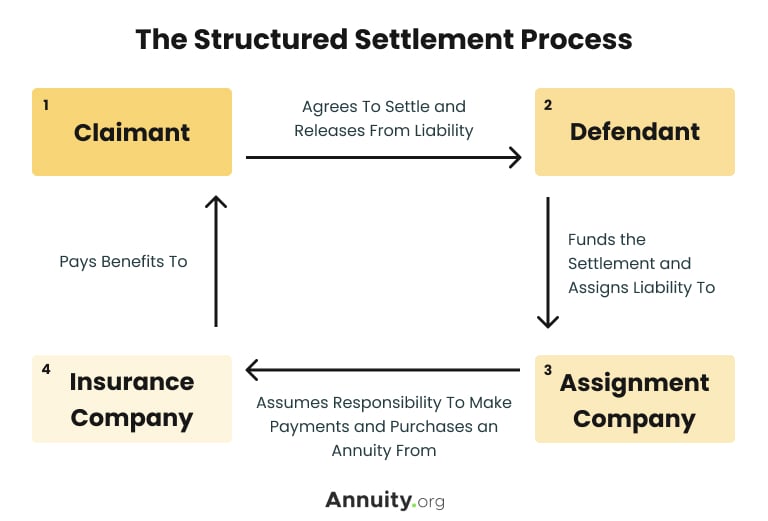

Structured settlements result from legal settlements that are ultimately paid out through insurance companies. But there are four parties involved in making structured settlements work.

- Claimant or Plaintiff

- The injured party. The claimant files a lawsuit against the party who they claim caused the injury.

- Defendant

- The party that the claimant sues. If the defendant loses the case in court — or settles before going to court — they may set up a structured settlement to pay the settlement or judgement.

- Assignment Company

- The defendant — or their insurance company — enters a qualified assignment to transfer their obligations to make periodic payments of the settlement to the claimant. The obligation is transferred to an assignment company that takes on this obligation.

- Insurance Company

- Assignment companies usually work with life insurance companies. The assignment company buys a structured settlement annuity from the life insurance company and issues payments to the claimant for the duration of the annuity’s contract.

Parties Involved in a Structured Settlement

While the arrangement may sound complicated, it is designed to take damages and restitution full circle — back to the claimant.

Unlike typical annuities in which the person receiving annuity payments owns the annuity, the assignment company — not the claimant — owns the structured settlement annuity. If the claimant wants to sell a structured settlement annuity, they typically have to seek court approval.

Read More: How Does a Structured Settlement Work?

Advantages of Structured Settlements

The biggest advantage of structured settlements is the flexibility in payouts. Payments can be distributed immediately, periodically over time or deferred until a later date. Additionally, the payments are always tax-free, even when you pass away.

Pros of Structured Settlement

- Payments remain tax-free.

- The beneficiary can continue to receive tax-free payments even after the recipient’s death.

- Flexibility in structuring and scheduling payments.

- Possibility of future lump-sum payouts or benefit increases.

- Spreading out payments discourages impulsive spending and ensures future income, which is especially beneficial for long-term care needs.

- Structured settlements provide stability since they are unaffected by market fluctuations and guaranteed by the issuing insurance company.

- A structured settlement often yields, in total, more than a lump-sum payout would because of earned interest.

Another advantage of structured settlements is that they can protect the recipient — or plaintiff — from being pressured by friends or family for money from the settlement, according to Hunter Garnett, managing partner of Garnett Patterson Injury Lawyers in Huntsville, Alabama.

“The plaintiff is much more likely to spend money frivolously or give loans to friends or family,” Garnett told Annuity.org. “By structuring the funds, a client can truthfully tell friends and family that they don’t have enough money available to make loans or gifts to them.”

Disadvantages of Structured Settlements

The biggest disadvantages of structured settlements all involve the fact that once in effect, it is not flexible. You are locked into the agreement, which affects your ability to access the money in the structured settlement annuity and you will lose value if you sell it.

Cons of Structured Settlements

- Limited ability to modify terms once finalized, even if they no longer meet your needs due to changing financial or economic conditions

- Lack of immediate access to funds in case of emergencies.

- Inability to invest a lump-sum payout in (potentially) higher-return investments.

- Selling your payments for immediate cash results in a discounted amount. This means the cash amount you receive from selling the payments will be less than the amount you would have ultimately received from future payments.

- Some states don’t require insurance companies to disclose costs, leading to potential loss of money through undisclosed administrative fees.

Need To Sell Your Structured Settlement for Cash Immediately?

According to California personal injury attorney Martin Gasparian, the fixed nature of structured settlements contributes to their chief disadvantages.

“If the plaintiff requires funds urgently, they will not be able to access them without impacting the annuity contract, potentially causing costly complications,” Gasparian told Annuity.org. “Also, the interest rate remains set and will not increase, which can mean a low rate of return.”

There are several reasons why an individual may receive a structured settlement. The most common cases include personal injury, workers’ compensation, medical malpractice and wrongful death.

- Personal Injury

- In a personal injury case, an injured individual (the plaintiff) files a civil lawsuit seeking money from the party believed responsible for the harm (the defendant). If the plaintiff wins in court or settles with the defendant rather than going to court, a structured settlement provides the plaintiff with funds to cover medical expenses and other costs.

- Workers’ Compensation

- Workers’ compensation pays employees who suffer work-related injuries, providing wage replacement and covering medical treatment and other expenses during periods when injured employees are unable to work.

- Medical Malpractice

- In cases where doctors cause harm instead of helping, injured patients or the families of deceased patients can sue for medical malpractice.

- Wrongful Death

- Structured settlements are commonly used to compensate family members who claim their loved ones were victims of wrongful deaths. With these suits, families may receive a series of tax-free payments to replace lost income after the death of a loved one.

Most Common Structured Settlement Case Types

Legal Structure: Assigned vs. Unassigned Cases

Structured settlements are both financial products and legal judgments. While they function somewhat like private assets, they are also subject to complex regulations. These depend on whether the settlement is an assigned or unassigned case.

In assigned cases, a third-party assignment company collects the funds from the defendant and then purchases the annuity from a different insurance company. That annuity will then fund the periodic payments directly to the claimant. The claimant, or plaintiff, does not control the annuity contract and the third party assumes the responsibility of making the settlement payments.

Conversely, in an unassigned case, there is no involvement from a third party. The defendant technically owns the annuity, and they name the injured party as the payee. This also means that the defendant is responsible for making the periodic payments, opening the claimant to the risk of non-payment or default.

Read More: Structured Settlement Loans

Payout Options for Structured Settlements

Several payout options can be arranged for structured settlements. The most immediate choice is when the payments will start and for how long they’ll continue:

- Immediate payments: Immediate payments can be beneficial if you require medical care, for example, or have lost your source of income.

- Deferred payments: You may decide to postpone the payments until a later time, such as after you retire. During the waiting period, the annuity will grow as it earns interest.

You can also determine whether the annuity should be paid for the rest of your life or for a specified number of years, as well as the schedule for receiving payments and the payment amounts and adjustments.

Often, plaintiffs will need money for a variety of expenses before they receive their settlement. If you find your expenses mounting as you await your first structured settlement payment or initial lump sum, consider pre-settlement funding options to tide you over.

- Structured Settlement Payout Options

- Compare and contrast the different ways to accept a cash settlement from a lawsuit.

- Government Support for Structured Settlements

- Learn about how the government uses the tax code to promote their use.

- Structured Settlements for Minors

- Read about why this type of settlement is typically used in cases involving children.

Learn about the process of being awarded a structured settlement annuity as well as the legal protections and advantages on the following pages:

Interested in Selling Annuity or Structured Settlement Payments?

Considerations Before Selling a Structured Settlement

There are several factors to consider before selling — or “cashing out” — your structured settlement payments. It is a major financial decision that could affect your financial stability for the rest of your life, so it’s extremely important to weigh the pros and cons before deciding to sell.

Pros & Cons of Selling Your Structured Settlement

Pros

- Access to a lump sum of cash within months rather than over years

- Ability to pay off debts and reduce interest payments

- Investing the lump sum may yield higher returns than interest on the periodic payments

Cons

- You’re selling future payments at a discount and getting a fraction of the money you would receive over time

- You may make poor investments or costly purchases with access to a lump sum of cash

- You could need the stream of settlement payments in the future

Before deciding to cash out your structured settlement, you can calculate exactly how much you will be losing by discounting your payments over time. You can use a structured settlement calculator to get an idea of how much your settlement may be worth.

Before making any decisions, talk to a financial adviser or other trusted financial professional about the financial and tax implications of selling your settlement and whether this is the best solution for you. A professional may also identify more suitable alternatives to selling your settlement.

The Selling Process

There are five basic steps to sell your structured settlement payments. You will need to shop for a company that purchases structured settlements — called a factoring company — and will generally need court approval for the sale.

How To Sell Your Structured Settlement

- Decide how much cash you need — whether to sell all or a portion of the settlement payments.

- Ask for a quote from a factoring company.

- Review the contract with your lawyer and accept.

- Get the court to approve the sale of your structured settlement payments.

- Receive your money.

It can take a while to receive a lump-sum payment from the buying company. While it usually takes 45 to 60 days to complete the court process, this can vary depending on where you live and how busy the court schedule is.

Choosing a Structured Settlement Buyer

There are plenty of structured settlement buyers that will purchase your payments. But before contacting them, make sure you have a solid understanding of your personal finances.

When shopping for a reputable factoring company, you should never feel pressured to make a decision. Certain qualities set trustworthy structured settlement buyers apart from the rest.

Qualities To Look for in a Legitimate Structured Settlement Buyer

- Advises you to speak with a lawyer or financial professional before making a decision

- Explains a clear timeline for when you will receive money

- Makes a competitive offer

- Has transparent discount rates and fees

- Offers a certain amount of cash upfront

The average discount rate factoring companies use when purchasing structured settlements is between 9% and 18%, according to the National Association of Settlement Purchasers. If a buyer charges more, it may be best to continue shopping around.

Let’s Talk About Your Financial Goals.

Tax Implications of Selling a Structured Settlement

In most cases, there are no tax implications for selling your structured settlement as long as the settlement is for personal injury or illness, medical malpractice, worker’s compensation or wrongful death.

According to the federal Internal Revenue Code, all payments received from a structured settlement are free from federal and state income taxes, the Alternative Minimum Tax (AMT) and all taxes on interest, dividends and capital gains.

Generally, if you don’t have to pay taxes on your structured settlement, the money you receive from selling it is also untaxed. This typically applies to settlements applying directly to physical injuries.

But some settlements, such as those for defamation, mental anguish or discrimination, may be taxable. Punitive damage settlements — those designed to punish the wrongdoer — may also be taxable unless involving wrongful death.

In these cases, an attorney or tax professional can advise about exactly how selling your structured settlement might affect your tax liability.

Alternatives to Selling a Structured Settlement

Alternatives to selling a structured settlement vary widely and depend on why you need a lump sum of money. Here are some alternative options based on your situation:

- Debt relief: If you’re thinking about selling a structured settlement to pay off debt, you can consider credit counseling, debt management or loan consolidation. In some situations, even bankruptcy may be a better financial solution.

- Starting a business: If you need money for starting a business, you can consider small business loans or grants first.

- Daily expenses: If you need money for day-to-day expenses, seeking government benefits, finding a better-paying job or selling assets may be wiser financial options than selling a structured settlement depending on your situation.

Talk to a financial advisor or other professional about alternatives available to you and how they compare to the potential loss of both money and long-term security that could result from selling your structured settlement.

Join Thousands of Other Personal Finance Enthusiasts

History of Structured Settlements in the U.S.

The U.S. has a rich history of structured settlement use. Modern adoption of these payments can be traced to Canada in the 1960s when a medication called thalidomide caused birth defects in thousands of children. Rather than receiving a singular payment from the at-fault pharmaceutical company, the claimants needed a series of payments over a longer time span to cover future medical bills.

Structured settlements were first issued in the U.S. in the 1970s when similar cases arose. In that decade, the IRS issued Revenue Ruling 79-220 to provide tax benefits for the recipient, citing that settlement payments to the injured party did not count towards their gross income, and thus they were not required to pay taxes on any money received. Likewise, after the recipient passed away, payments to the estate continue to be excluded from taxation.

Structured settlements gained popularity in the 1980s after the U.S. Congress passed the Periodic Payment Settlement Act of 1982. The Act served as the federal government’s buy-in with the earlier IRS ruling and extended restrictions to the state governments, barring them from taxing structured settlement income from personal injury cases.

By 1985, the National Structured Settlements Trade Association was formed to preserve and promote structured settlements to injury claimants through education and advocacy.

Over a decade later, the Small Business Job Protection Act of 1996 set limitations on the types of personal damage cases eligible to receive tax benefits. As a result, only damages from “personal physical injuries or physical sickness” can exclude payments from gross income. Payments from punitive damages were no longer eligible for tax exclusions.

Today, structured settlements remain a trusted source of financial security, with an estimated $10 billion in annual payments issued to over 30,000 recipients.

Read More: Structured Settlement Protection Acts

Frequently Asked Questions About Structured Settlements

An alternative to a lump-sum payout, structured settlements are periodic payments typically made to a plaintiff who wins or settles a personal injury lawsuit. Instead of paying the plaintiff a lump sum of money to compensate the plaintiff for their damages, the defendant makes a series of scheduled payments to the plaintiff over time.

A structured settlement follows a court process, and it is a stream of payments determined through negotiations between a plaintiff and a defendant. An annuity is a financial product that guarantees regular payments over time from an insurance company. Contrary to a structured settlement, an annuity itself does not require litigation.

You can sell your structured settlement payments to a reputable factoring company, otherwise known as a purchasing company. It is important to do your research and compare quotes from multiple trustworthy settlement buyers.

Selling a structured settlement is not a dollar-for-dollar exchange. The purchasing company will charge a discount rate, which typically ranges between 9% and 18% of the settlement’s worth. You can calculate the present value — or the cash value if you sell your future payments — if you know the discount rate, the dollar amount of each payment and the number of payments you wish to sell.

Structured settlements don’t come with the tax implications of lump-sum payments. If you invest the money from your lump-sum settlement, you have to pay taxes on the interest, dividends and capital gains you earn. But payments from your structured settlement and the interest it earns are free of state and federal taxes.

Writer Elizabeth Rivelli contributed to this article.