Key Takeaways

- Selling all (or part) of an annuity can give you the cash to cover anything from an emergency or paying off debt to making an investment or a major purchase.

- You have three options for selling an annuity: selling the entire annuity, selling some payments or selling a specific dollar amount of the annuity.

- The amount received for selling annuity payments depends on factors such as the discount rate, present value of the annuity, total value and number of payments being sold, economic conditions, and fees and charges.

- Seek advice from a lawyer or financial advisor before accepting an offer to help avoid lowball offers, tax implications and loss of value.

Can You Cash Out an Annuity at Any Time?

You’ll need to know what type of annuity and what type of payment stream you have to determine when you can cash it out.

Cashing out an annuity can be done by withdrawing money from the annuity, borrowing against the cash value, getting your premiums back through a return of premium or surrendering the annuity for its cash value. You may face fees and penalties.

You can cash out variable, fixed rate and fixed-indexed annuities at any point before annuitizing the contract — that’s the point at which you’ve converted the annuity into periodic payments.

You cannot cash out immediate annuities or any annuitized contract until the annuitant’s death. You have to wait until the age specified in the contract before cashing out a qualified longevity annuity. And you have to wait until retirement to cash out a deferred income annuity.

Need to Sell Your Annuity for Cash Immediately?

What Are My Options for Selling My Payments?

People who need cash to pay off debt, put a down payment toward a new home purchase, replace a broken vehicle or cover any other immediate financial need may consider selling all or part of their annuity.

Who Can Benefit from Selling Annuity Payments?

Individuals Facing Medical Emergencies

Those Experiencing Unexpected Job Loss

People In Need of Emergency Home Repairs

Those Undergoing Debt Consolidation

Once you know how much money you need to access from the annuity’s value, there are three options for selling: sell the annuity in its entirety, sell only some of the payments or sell a specific dollar amount of the annuity.

- Option 1: Sell Your Annuity in Its Entirety

- Selling the full value of your annuity contract eliminates all future income payments to you. However, you’ll have access to the full sale amount you agreed to with the buyer.

- Option 2: Sell Some of Your Future Annuity Payments in a Partial Sale

- In the event you need immediate cash, you can sell some payments in exchange for a lump sum. If you decide to sell only a portion of your payments, you’ll continue to receive periodic income and retain the tax benefits.

- Option 3: Sell a Specific Dollar Amount of Your Annuity Payments for a Lump Sum

- Selling a dollar amount value of the annuity allows you to sell a portion of the annuity payments in exchange for a lump sum. This means they receive a specific dollar amount, which will be deducted from future annuity payments.

3 Options for Selling an Annuity

How Much Will I Receive for Selling My Annuity Payments?

How much you will receive for selling your annuity payments depends on several factors. These include the discount rate and the present value of your annuity.

These, in turn, may be affected by still other factors.

Discount Rate

The discount rate is a key factor in determining what a buyer will pay for your annuity. It’s the difference between what your annuity is worth in the long run — and what you’ll receive in cash if you sell it.

Different annuity buyers set their own discount rates. The discount is essentially the tradeoff for the ability to tap into your money immediately. It also allows the purchasing company to turn a profit.

The lower the discount rate, the higher the present value of your annuity — and the more cash you’ll receive. For example, you would keep more of your money if a purchasing company offers a 10% discount rate than you would with a 14% discount rate from another company.

There are several other factors that will affect how much cash you will receive.

Factors that can influence your discount rate include:

- The total value of payments being sold

- The number of payments being sold

- Payment arrival dates

- Current economic conditions

- Interest rates set by the Federal Reserve

- Additional fees and charges

Interested in Selling Annuity or Structured Settlement Payments?

Present Value

The present value of an annuity is the total cash value of all future payments after factoring in the discount rate. You can calculate the present value of your annuity using this formula.

Formula legend:

- PVOA = Present value of an ordinary annuity

- PMT = Cash payment per period

- r = The annuity’s interest rate

- n = Number of payments from the annuity

Some factoring companies may charge higher discount rates and fees than others, resulting in the annuity owner receiving less of the contract’s value. It’s important for you to consider several quotes to gather more options before selling.

How Do I Cash Out An Annuity?

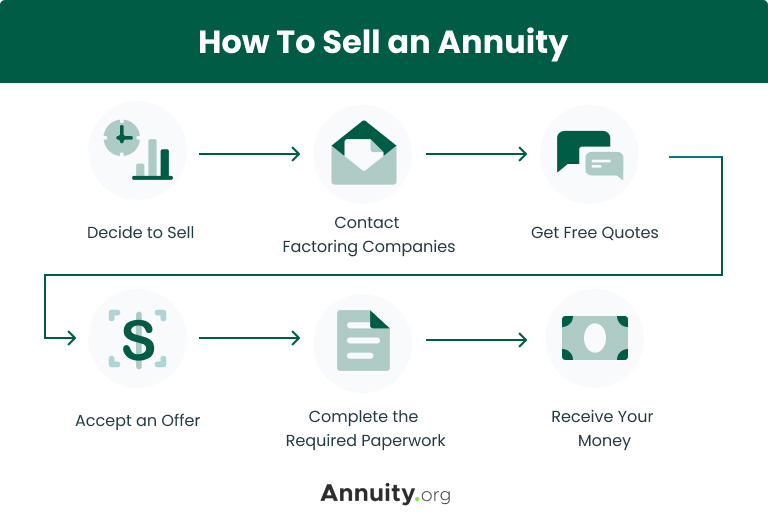

Selling your annuity can be a suitable option for you to gain liquid cash and financial flexibility if your needs change. The process to sell all or part of your annuity can be accomplished in just a few simple steps.

- 1. Find a Company to Sell to

- Research factoring companies who buy your type of annuity. Consider their reviews and ratings.

- 2. Get Free Quotes

- Request quotes from multiple buyers. Compare offers from the different companies you’ve contacted.

- 3. Review the Offers

- Consider the offers you’ve been given, and their terms. Take into consideration the reputations of the companies who made the offers. Begin to narrow down which offers align with your financial goals.

- 4. Contact an Expert

- Speak with a financial advisor to discuss your financial situation. They can help you select the offer that aligns closest with your financial goals.

- 5. Accept an Offer and Sign the Contract

- The factoring company will send you paperwork to complete the sale. Sign the paperwork to agree to the terms, and send it back.

- 6. Receive your Money

- Once the paperwork is processed, the factoring company will send you your cash.

6 Steps To Sell an Annuity

Having direct access to your money can allow you to pay off debt, put a down payment toward a new home purchase, replace a broken vehicle or cover any other immediate financial need. No matter your reason to sell, having the flexibility to use your money can help reduce your financial stress.

Selling all or some of your future annuity payments may also be less costly than taking a 401(k) loan or IRA withdrawal. Be sure to speak with your financial advisor to compare options for your cash flow.

Let’s Talk About Your Financial Goals.

Can You Take Money Out Of An Annuity Without Penalty?

Instead of selling a portion of your annuity, you may be able to take some money out of it without a penalty. You’ll need to check the exact terms and conditions of your annuity contract to determine whether it’s possible to withdraw money without paying penalties.

Typically, annuities contain surrender periods during which early withdrawals may be subject to fees or penalties. These surrender periods can run from five to 10 years, and the surrender charges may get lower with time.

But some annuities may permit withdrawals without penalties in particular situations, such as when a specific portion of the account value is available each year.

Other clauses that may allow you to withdraw money without a surrender clause include:

- Return of premium allows you to get back your premium, minus any withdrawals or fees.

- Health-related waivers allow you to withdraw money if you enter a nursing home or need long-term care.

You may still face a 10% penalty tax if you withdraw money before you turn 59½. To understand the exact guidelines and potential penalties related to withdrawals from your particular annuity, check the terms of your annuity contract or speak with a financial advisor.

Selling Other Monthly Payment Streams

You can sell other financial products besides annuities. These include life insurance or viatical settlements and mortgage or business notes. Life insurance policyholders can sell their policies in a life settlement or viatical settlement.

In each case, you sell periodic payments for a lump sum of cash.

Life Settlements

You can sell your life insurance policy — known as a life settlement — directly to a company or use a broker who earns a commission from the buyer.

The buyer becomes the new policy owner and pays the premiums. They receive the death benefit when the insured person passes away.

Reasons to sell your policy may include changing financial needs, reducing premiums, or accessing a lump sum for expenses.

Viatical Settlements

Viatical settlements offer terminally ill people a way to cash out their life policies to pay immediate expenses such as medical bills. Generally, you must have a life expectancy of less than two years to get a viatical settlement. They tend to have more specific conditions for eligibility than life settlements.

You can sell a viatical settlement to a third-party buyer for a lump sum payout. When the insured person passes away, the buyer collects the death benefit.

Mortgage Notes

Lenders use mortgage notes to enforce the repayment of a mortgage loan. The note pledges the property as collateral, allowing the lender to repossess it if the loan isn’t repaid.

You can sell a mortgage note to a new owner or a mortgage note brokerage. You can sell the entire note for a one-time cash payout or sell a portion, either as a percentage of its value or a specific dollar amount.

Business Notes

Business owners use business notes as alternative financing when selling their businesses. The note specifies the assets, sale price and repayment terms for the buyer.

Similarly to mortgage notes, buyers make installment payments according to the note’s terms.

You can sell all or part of a business note you own to a third-party business note buyer or broker. You won’t receive the note’s full value because the buyer imposes a discount rate to cover expenses and generate profit.

Read More: Structured Settlement Loans

Consult a Professional Before You Accept an Offer

Although it may cost you, seeking sound advice from your lawyer or financial advisor may save you thousands of dollars during the selling process.

Your advisor can warn you about a lowball offer or save you money in taxes. They can also calculate how much value you stand to lose through the sale.

Join Thousands of Other Personal Finance Enthusiasts

Frequently Asked Questions About Selling Annuity Payments

You can start by researching annuity purchasers who can buy all or some of your remaining payments. Next, obtain and compare quotes. Then submit your paperwork to initiate the cash-out process.

It can take up to four weeks to withdraw money from an annuity. It depends on how quickly the insurance company with which you have the annuity and the factoring company you are selling it to can complete the process.

If you cash out your qualified annuity — one funded with pre-tax dollars — before you turn 59½, you will have to pay a 10% penalty tax. If you withdraw money from a non-qualified annuity — funded with money you’ve already paid income tax on — the 10% penalty applies only to the earnings, but not on the principle. You may also face additional taxes, penalties and surrender fees.

You can withdraw a lump sum or a single payment from an annuity in most cases. But you may have to pay a penalty depending on the type of annuity it is. A lump sum may also be less than the value of the annuity over time.

Casinos and lotteries typically pay out large jackpots through annuities. They can usually be sold for a lump sum. Some states may not allow the sale of lottery annuities. You should check with your state’s lottery commission. You will receive less than the face value of the annuity and may be subject to additional taxes if you sell a casino annuity or lottery annuity payment.