What Is a Tax-Sheltered Investment?

To understand the meaning of a tax-sheltered investment, it helps to start with the definition of a tax shelter. A tax shelter refers to any strategy that is used to legally reduce your current or future income tax liabilities. Tax shelters can take various forms and consist of a variety of tax deductions, tax credits and types of investments.

The most commonly used tax deductions and tax credits include deductions for the premiums you pay for employer-sponsored health insurance, deductions for traditional retirement plan contributions, deductions for the interest paid on student loans and the Child Tax Credit.

The amount you can save with these common tax deductions and credits can be considerable, but it often pales in comparison to the savings you can achieve with tax-sheltered investments. A tax-sheltered investment can include a medical savings plan, retirement savings vehicles and other uniquely advantaged assets, such as tax-exempt municipal bonds, real estate investments and annuities.

Read on to learn more about tax-sheltered investments, how you can benefit from them and the risks they may pose.

Will You Be Able To Maintain Your Retirement Lifestyle?

Learn how annuities can:

- Help protect your savings from market volatility

- Guarantee income for life

- Safeguard your family

- Help you plan for long-term care

Speak with a licensed agent about top providers and how much you need to invest.

What Are Common Types of Tax-Sheltered Investments?

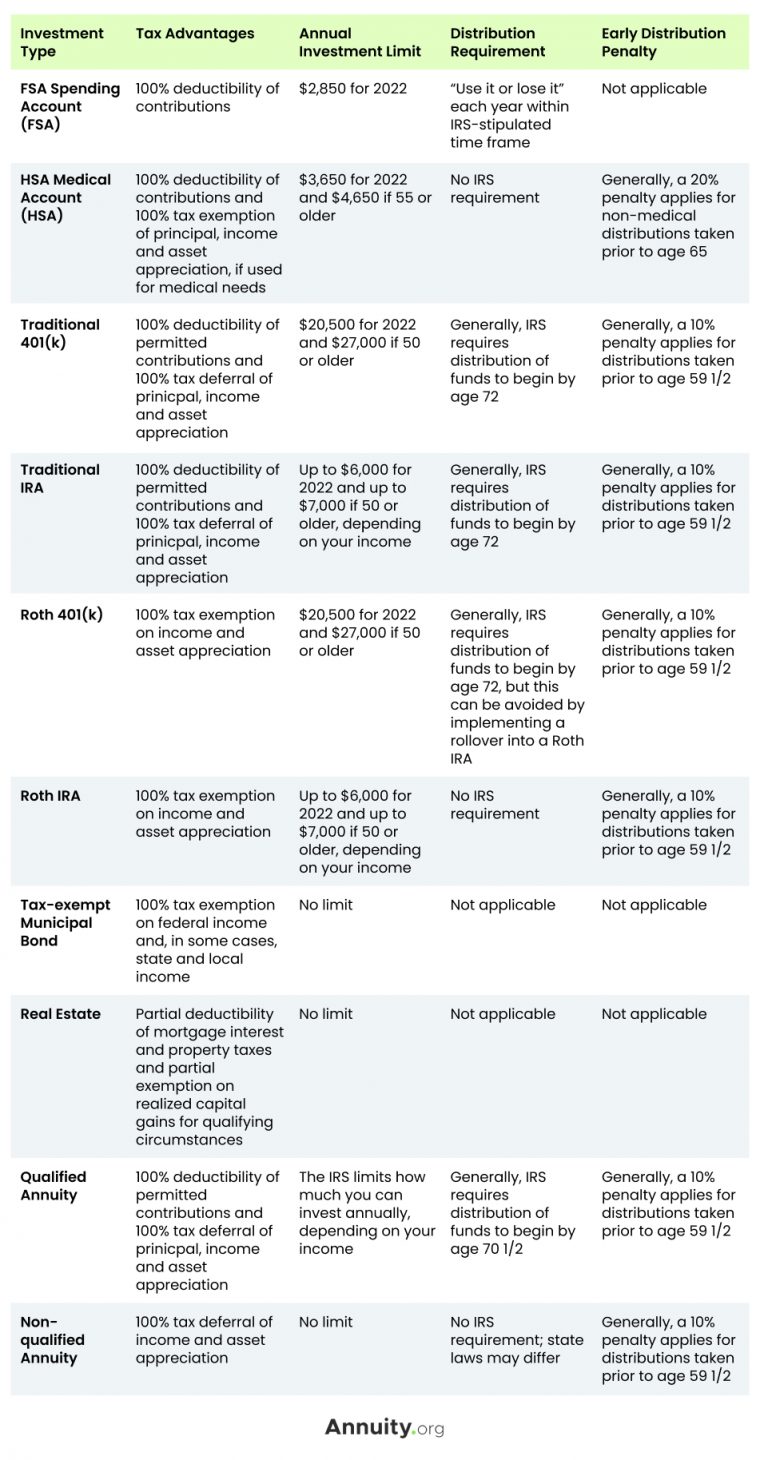

Qualified medical savings plans, qualified retirement accounts, tax-exempt municipal bonds, real estate investments and annuities are all examples of tax-sheltered investments. Each type of investment offers some degree of tax advantage, which generally means you’ll get a tax deduction, a tax deferral or a tax exemption.

What Is Tax Deductibility?

Tax deductibility is the ability to lower your taxable income by using a deduction. To illustrate this concept, let’s examine how a single taxpayer might reduce their 2024 taxable income by $23,000, just by contributing to a traditional 401(k) plan.

Let’s assume a theoretical taxpayer reports a taxable income of $200,000 for 2023, and their effective federal tax rate is 22%. Without a 401(k) deduction, the taxpayer would have a federal tax obligation of $44,000 ($200,000 × 0.22 = $44,000).

However, if the taxpayer contributes fully to a traditional 401(k) (the maximum contribution in 2024 is $23,000), their 2023 taxable income would be reduced to $177,000 ($200,000 – $23,000 = $177,000). Assuming their effective federal tax rate remains at 22%, their federal tax obligation is now $38,940 ($177,000 × 0.22 = $38,940).

While this example scenario may be simplistic, the savings potential is clear, as shown in the figures below.

$44,000 – $38,940 = $5,060

What Is Tax Deferral?

Tax deferral is the ability to allow an investment to grow without being taxed, until the time when the investment is liquidated. A traditional 401(k) is an example of a tax-deferred retirement account, as your contributions and earnings are not taxed until you withdraw money in retirement. Given the power of compounding interest, tax deferral is an incredible savings advantage, especially if you expect to be in a lower tax bracket when it comes time to liquidate the funds in retirement.

What Is Tax Exemption?

Depending on the situation, tax exemption can be even more advantageous than tax deferral. Whereas tax deferral simply pushes a tax liability out into the future, tax exemption means that no tax will ever be paid on the earnings generated by an asset.

It’s important to note that tax-exempt investments usually do not offer tax deductibility, while tax-deferred investments often allow for an upfront deduction. Nevertheless, the ability to avoid all future taxation can more than make up for this limitation, especially if you expect to be in a higher tax bracket when it comes time to liquidate the funds.

Tax exemptions are most commonly used with Roth-style 401(k) plans and individual retirement accounts (IRAs). With these types of investment vehicles, retirement contributions are made using after-tax dollars, or money that has already been taxed. Any income received—and price appreciation experienced—on the underlying investments is never taxable, assuming withdrawals are made following IRS guidelines for holding periods.

A Closer Look at Tax-Sheltered Investments

Let’s examine in more detail the most common types of tax-sheltered investments.

Many other types of tax-sheltered investments exist besides those summarized in the chart, including a variety of life insurance products; less-common, IRS-endorsed retirement vehicles; and debt and equity investments in certain socially beneficial endeavors, such as oil and gas exploration, renewable energy generation and medical research and development.

Risks of Tax-Sheltered Investments

Given the complexity of the U.S. tax system and fluctuations in the economy, every tax-sheltered investment comes with some degree of risk. The most common risks are outlined below.

- Unanticipated costs associated with management fees and regulatory compliance

- Unclear or unrealistic expectations of returns due to complex and ambiguous structures

- High sensitivity to inflation, especially for bond and bond-like investments

- Elevated levels of illiquidity due to IRS-enforced holding periods and/or inefficient markets

Another notable risk relates to tax evasion, which is the practice of using illegal means to avoid paying taxes. While IRS-backed investment vehicles are always legal, there is a fine line between tax minimization and tax evasion. This fine line is especially important to consider when dealing with untested, complex investment vehicles that lack transparency.

If you’re thinking about getting started with a tax-sheltered investment, be sure you fully understand what you’re investing in and how it can affect your personal finance situation. The IRS does not take tax evasion lightly, and tax offenders can face steep penalties and criminal prosecution for their mistakes. To be safe, enlist the help of a financial investment advisor or tax professional to ensure you’re in compliance with all IRS rules and regulations.