Lottery Payout Options

If you win a lottery, you can choose between a lump sum or an annuity payment. The lump sum grants immediate cash, while an annuity provides steady and guaranteed income over time.

Key Facts About Selling Lottery Payments:

- Lottery winners have the choice between receiving their winnings as a lump sum or as an annuity.

- A lump-sum payment provides a smaller immediate payout, while an annuity spreads payments over several years for a larger overall amount.

- Selling a lottery annuity can provide a lump sum for immediate financial needs but may result in the sacrifice of future guaranteed income and potential tax advantages.

- Factoring companies and insurance companies are entities that will buy your long-term lottery payouts.

A lump sum is good for funding long-term investments, while an annuity guarantees larger total payouts. Choose based on your financial goals and applicable rules surrounding the specific lottery.

An annuity ensures a larger total payout over years. The structure of your annuity payments will vary based on state rules and the lottery company.

Regardless of which payout type you choose, how you receive your lottery winnings may vary depending on the lottery company’s rules. Payments can typically be made by check or ACH transfer. If you’re unsure which to choose, reach out to the lottery company to see which they recommend to winners.

Both Powerball and Mega Millions offer lump-sum payments. Powerball offers 30 payments over 29 years. Mega Millions uses an increasing rate schedule. This includes an initial payment and 29 annual payouts, each larger than the last.

How the Powerball and Mega Millions Work

Powerball and Mega Millions are both lotteries that involve drawing numbered balls. Powerball drawings are held every Monday, Wednesday and Saturday, while Mega Millions draws on Tuesdays and Fridays. To participate, you can either choose your own numbers on a ticket or have a lottery machine randomly select them for you.

To win the Powerball jackpot, players must match five numbers from 1 to 69 and a Powerball number from 1 to 26. Other prizes are available for matching non-jackpot combinations.

To win Mega Millions, you pick six numbers from two pools: 1 to 70 for white balls and 1 to 25 for the gold Mega Ball. Match all six to win the jackpot. Matching certain numbers of white balls and the gold Mega Ball will win a smaller prize.

Examples of the Largest Powerball and Mega Millions Jackpots

| AMOUNT | LOTTERY | DRAWING DATE | WINNERS & STATE |

| $2.04 billion | Powerball | Nov. 7, 2022 | One winner in California |

| $1.765 billion | Powerball | Oct. 11, 2023 | One winner in California |

| $1.59 billion | Powerball | Jan. 13, 2016 | Split three ways between residents in California, Tennessee and Florida resident |

| $1.58 billion | Mega Millions | Aug. 9, 2023 | One winner in Florida |

| $1.54 billion | Mega Millions | Oct. 23, 2018 | One winner in South Carolina |

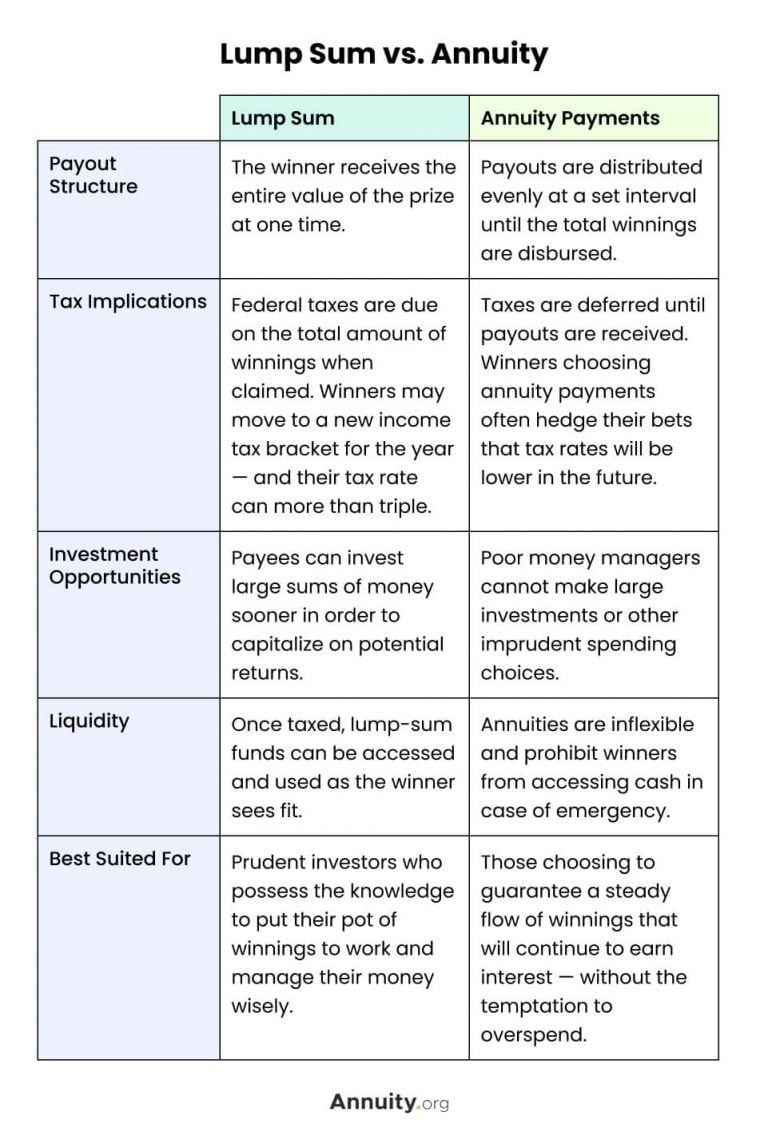

Lump Sum vs. Annuity for Lottery Winners

There are benefits to both the lump-sum and annuity options for lottery payouts. This choice can affect how much the winner gets by millions of dollars.

For example, in the October 2023 Mega Millions jackpot, the winner took the one-time lump sum of over $877 million. However, the winner could’ve done an annuity, which would have paid out the full $1.54 billion winnings in payments over 30 years, according to the New York Times.

Choosing between lump sum or annuity payments for your winnings has trade-offs. The lump sum can allow for immediate investments, while annuities lack this flexibility.

The lump sum provides a significant amount of immediate cash. Many opt for this option to avoid long-term tax implications.

Annuity payments offer tax benefits and can prevent overspending lottery winnings. They provide guaranteed income and can lead to more money in the long run.

Ultimately, it depends on individual preferences and financial goals.

Lump Sum vs. Annuity

| Lump Sum | Annuity Payments | |

|---|---|---|

| Payout Structure | The winner receives the entire value of the prize at one time. | Payouts are distributed evenly at a set interval until the total winnings are disbursed. |

| Tax Implications | Federal taxes are due on the total amount of winnings when claimed. Winners may move to a new income tax bracket for the year — and their tax rate can more than triple. | Taxes are deferred until payouts are received. Winners choosing annuity payments often hedge their bets that tax rates will be lower in the future. |

| Investment Opportunities | Payees can invest large sums of money sooner to capitalize on potential returns. | Poor money managers cannot make large investments or other imprudent spending choices. |

| Liquidity | Once taxed, lump-sum funds can be accessed and used as the winner sees fit. | Annuities are inflexible and prohibit winners from accessing cash in case of emergency. |

| Best Suited For | Prudent investors who possess the knowledge to put their pot of winnings to work and manage their money wisely. | Those choosing to guarantee a steady flow of winnings that will continue to earn interest — without the temptation to overspend. |

Lottery Winners Face Tax Issues

It’s also important to factor in state and federal taxes when making a decision on which option to take. If you fall into the highest federal tax bracket you will have to pay a 37% tax rate.

Lottery agencies will generally withhold 24% of any lottery winnings of more than $5,000 for federal taxes. This can be a significant chunk of money with a lump-sum lottery payout.

An annuity has the advantage of each payment being taxed based on the current federal and state rates. Those who select the annuity option for tax purposes are essentially betting on the possibility of future tax rates being lower than the present rates. However, if they change their minds about the annuity payout, lottery winners can sell their annuity payments for a lump sum that is lower than the amount of lottery winnings still owed to the winner.

This article helped me understand the aspects of putting winnings into an annuity instead of [a] lump sum, which I would rather do. With this choice, winnings would generate on a yearly basis, most likely easing the tax burden and assessments. Upon my death, the winnings would generate income for my children and grandchildren. Thank you.

Remember to consider tax implications if you join a pool to buy lottery tickets. You’ll still be taxed on your portion of the prize if everyone splits it.

To avoid gift tax, create documentation to clarify that the entire win is not just yours but belongs to all members of the pool. Put a written contract in place which defines each person’s share in the pool and provide it to the IRS if needed. Failing to take these steps can result in serious consequences, according to tax preparation company Intuit.

State Income Taxes on Lottery Winnings

Eight states do not tax lottery winnings — but the tax rate on lump-sum or annuity payments varies in the others.

States That Do Not Impose State Income Taxes on Lottery Winnings

- California

- Florida

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Source: World Population Review

In other states, the tax rate on lottery winnings ranges from a low of 2.9% in North Dakota to a high of over 8% in Maryland.

Can I Sell My Lottery Annuity?

If you want to sell your annuity payments, get in touch with your lottery company first to check if it’s possible. While a majority of states allow after-market sales of lottery annuities for a lump-sum payment, some do not. It’s important to check your state’s lottery laws before deciding to sell your payments.

If you decide to sell some or all your future payments, the terms of the sale can be negotiated, including the exact amount you want to sell. But keep in mind that court approval is needed in most states for the transaction to proceed. A judge will determine whether the sale is advantageous for you.

Pros & Cons of Selling Lottery Annuity Payment

Selling your annuity payments can have advantages and disadvantages.

Among the pros, selling can give you a lump sum of money that you can use for immediate financial needs or investments. You’ll have control over your money and access to larger amounts than the periodic annuity payments.

Among the cons, consider that you will be sacrificing future guaranteed income and potential tax advantages. The lump sum may also be subject to taxes and fees.

It’s crucial to carefully evaluate your financial goals and consult with a financial advisor before making your decision.

Need to Sell Your Annuity for Cash Immediately?

The Process of Selling Lottery Annuity Payments

When selling a lottery annuity, there are five key steps to follow:

- Gather all your annuity documentation, including the original contract and supporting paperwork.

- Research reputable annuity buyers and compare their offers. Consider factors like reputation, fees and terms.

- Request quotes from multiple buyers and negotiate the best possible deal.

- Once you’ve chosen a buyer, complete the necessary paperwork and submit it for review and approval by a judge. You may have to appear in court.

- Once approved, finalize the transaction and receive your lump-sum payment.

It’s important to consult a financial advisor throughout the process to ensure you make informed decisions.

Who Buys Lottery Payments?

There are two types of companies that typically purchase long-term lottery payouts — factoring companies and insurance companies.

These companies typically also buy mortgage notes and structured settlements from those who reach personal injury settlements.

Factoring companies offer less immediate cash than what you would receive if you kept the total annuity payments. Choose a company with experience, free quotes and clear explanations. And make sure you understand everything about the sale and agree with the terms before signing anything.

Read More: Reasons for Selling Your Structured Settlement

Tax Obligations of Selling Lottery Payments

You may have federal and state tax obligations if you sell your lottery annuity for a lump sum. You are responsible for paying taxes on your lottery receipts in April.

Adding the lump sum to your other income could push you into a higher tax bracket. Speaking with a tax professional before selling your lottery payments can help you understand the tax consequences.

How Much Is My Lottery Annuity Worth?

When you sell your lottery annuity, the amount of money you receive depends on the discount rate that the buyer sets. The discount rate is what they’ll subtract from the total value of your annuity. This lets the company make a profit and cover its costs.

The present value of your annuity is the total amount of money you’ll receive after the discount rate is applied.

A lower discount rate means a higher present value for your annuity, which means you’ll receive more cash. For instance, choosing a buyer with a 9% discount rate would leave you with more money than one with a 15% discount rate.

If you want an estimate of the value of your lottery annuity, you can enter the information from your contract into an annuity calculator to get a custom quote.

Read More: How To Find the Present Value of an Annuity

What Happens to My Lottery Annuity When I Die?

Lottery annuities can usually be inherited, but some companies only allow transfers after the owner’s passing.

The remaining assets may go to the estate or a living beneficiary. Some lotteries may cash out the annuity prize for an estate, but only if it’s permitted in the state where the original lottery ticket was purchased.

For example, Powerball annuities are period certain, meaning payments will continue for a specific period whether you’re alive or not. They will be just like any other asset you leave behind for your heirs.

Your options can vary based on what the law permits in the state where you purchased the winning lottery ticket.

Interested in Selling Annuity or Structured Settlement Payments?

Frequently Asked Questions About Selling Lottery Payments

The lottery cash out option can be great for those looking to avoid long-term taxes. It allows you to invest in assets like real estate or stocks. On the other hand, if you prefer to receive payments over time rather than a lump sum, annuities are a popular option. They can help you avoid paying large tax bills all at once.

If you want to sell your lottery payments, you have two options: a full or partial sale. A full sale involves a lump-sum payment after deducting fees and taxes. On the other hand, a partial sale allows you to sell some of your lottery payments but still receive the rest of your scheduled payments.

More than 90% of lottery winners choose a lump sum payment over the annuity option, according to CNBC. This is despite the fact that the annuity option typically gives the winner around twice as much – or more – over several years.

Editor Malori Malone contributed to this article.