Key Strategies for Improving Your Financial Wellness

- Stick to a budget to manage your funds; live within your means.

- Establish an emergency fund.

- Understand your debts and make a plan to pay them back.

- Maintain good credit.

- Diversify your investments and savings options.

What Is Financial Wellness?

Financial wellness is a state of financial well-being in which you can comfortably manage your bills and expenses, pay your debts, weather unexpected financial emergencies and plan for long-term financial goals such as building college funds and saving for retirement.

The U.S. Consumer Financial Protection Bureau defines financial wellness as “the feeling of having financial security and financial freedom of choice, in the present and when considering the future.”

Four Elements of Financial Wellness

| Present | Future | |

| Security | Having control over day-to-day and month-to-month finances | Having the capacity to absorb a financial shock |

| Freedom of Choice | Having financial freedom to make choices that let you enjoy life | Being on track to meet your long-term financial goals |

Your overall wellness depends on several factors including mental, physical and financial health.

Financial wellness is important because it improves your overall health and well-being. It allows you to reduce financial stress and improve the overall quality of your life.

At a high level, there are four principles of financial wellness.

- 1. Budgeting

- Creating and sticking to a budget lays a foundation to build your financial well-being. It enables you to manage day-to-day finances, prepare for financial emergencies and plan for your future.

- 2. Debt

- Managing debt, which includes eliminating high-cost consumer debt, can significantly enhance your ability to save, invest and accumulate wealth. It can also help improve your credit score, giving you access to better borrowing rates for mortgages, auto loans and other large purchases.

- 3. Saving and Investing

- Saving and investing are critical to building financial security and retiring comfortably. Short-term savings provide liquidity to cover home repairs, vacations or other infrequent costs, while long-term investments provide the means to grow wealth.

- 4. Managing Risk

- Growing wealth is an important long-term objective, but preserving your wealth is just as important. Insurance policies and emergency funds are two common ways to protect your finances. Insurance mitigates exposure to catastrophes, such as fires, floods and life-threatening illnesses. An emergency fund, on the other hand, helps you avoid incurring debt or tapping your long-term investments when you encounter temporary financial difficulties, such as struggling to pay your bills after a job loss.

4 Principles of Financial Wellness

Although financial wellness isn’t discussed as often, it’s an important part of financial planning. When working with retirees, I often emphasize that they need to be comfortable with the plan they’ve laid out in order to really enjoy retirement. It’s about using your money in a way that supports you best, without constantly worrying.

Financial Wellness vs. Financial Literacy

Financial wellness is not the same as financial literacy. Financial literacy can help you build your financial wellness, but it does not ensure financial well-being.

- Financial Wellness

- Financial wellness is a state of being in which you can comfortably satisfy your current financial obligations while feeling secure in your financial future and making choices that allow you to enjoy life, according to the U.S. Consumer Financial Protection Bureau.

- Financial Literacy

- Financial literacy is the knowledge and training needed to manage your personal finances — such as learning how to create and manage a household budget, investing money for retirement, or participating in coaching and counseling sessions to determine how to buy a house or start a business, according to the National Council of State Legislatures.

Difference Between Financial Wellness and Financial Literacy

In short, financial literacy is a set of skills, knowledge and tools you can use to achieve financial wellness.

How Do You Improve Your Financial Wellness?

It is possible to take a step-by-step approach to improving your financial wellness. Each step allows you to bolster your personal finances, while providing complementary benefits to other steps.

The more understanding you have, the better suited you will be to feel more secure about your financial situation.

- Create a Budget

- You need to know the sources of your income and the costs you incur each month. Creating a budget can help you live within your means and establish realistic financial goals for your future. Be sure to consider your essential living expenses as well as your discretionary expenditures, including leisure spend.

- Build an Emergency Fund

- As soon as you implement a budget and start saving money, you should build an emergency fund. Ideally, it should represent at least six months of living expenses. The existence of an adequate emergency fund can help cover expenses in the event of a job loss or some other temporary financial strain.

- Protect Your Assets

- An emergency fund provides near-term protection against small- to mid-size financial challenges. For significant financial challenges, such as the loss of your home or a permanent physical disability, insurance is a more appropriate risk-mitigating measure. Auto, home, health and life insurance can offset large, sudden and unexpected losses, expenses and life challenges.

- Reduce or Eliminate Debt

- You need to know the amount and nature of your various debts. The more debt you have, the less money you can save and invest to accumulate wealth. Strategically pay off debts to improve your financial position and boost your credit score credit score.

- Save and Invest

- With a sound budget in place and a minimal debt load, you should be able to start consistently saving money. Look to maximize the yield earned on your money. High-yield savings accounts, money market funds and certificates of deposit are usually great options. As you accumulate savings, be sure to assume a long-term perspective. This means investing in growth-oriented assets and longer-term fixed-income instruments. If your company has a 401(k) or other retirement savings plan, contribute to it as soon as possible. If your employer matches a portion of your contributions, it’s free money toward your future.

- Plan for Retirement or Other Long-Term Goals

- The sooner you can begin contributing to a tax-advantage retirement vehicle the better. The tax advantages, coupled with the power of compound interest, can have a powerful effect on your wealth. Familiarize yourself with any plans offered by your employer, as well as individual retirement savings options, such as IRAs and annuities. Understand how different types of retirement income sources, like Social Security, retirement accounts, and annuities, can work together to provide a holistic retirement solution..

6 Steps to Achieving Financial Wellness

Let’s Talk About Your Financial Goals.

Financial Wellness at the Organizational Level

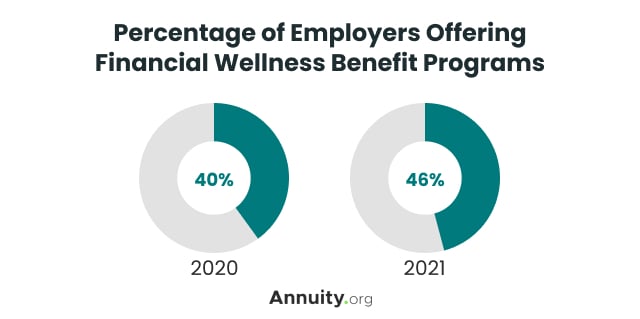

Managing your financial wellness isn’t necessarily a self-guided endeavor. According to a 2021 survey by Bank of America, since 2011, financial wellness programs have become an increasingly prominent fixture in many employers’ benefit offerings since 2011, according to a 2021 survey by Bank of America.

More than eight in 10 employers surveyed believe workplace-based financial wellness programs result in:

- Greater employee productivity

- More engaged employees

- More satisfied employees

- More loyal employees

These findings underscore the perception that workplace benefits increase as workers’ financial stress levels decline. This is an intuitive argument that makes even more sense when employee perspectives are considered.

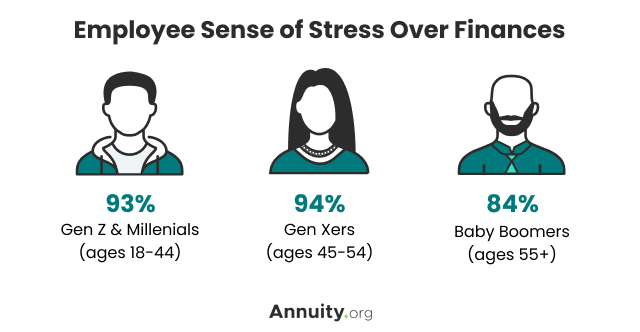

According to the Bank of America survey, a solid majority of workers in the United States report feeling stressed when they think about their financial situation. The numbers are highest among younger workers.

The survey also found that 95% of employers feel “a sense of responsibility for the financial wellness of their employees” — with 56% indicating that they feel “an extreme sense of responsibility.” That was the highest level ever recorded over the past 11 years.

Read More: Financial Guide to Divorce with Kids