A variable annuity is a financial contract between an individual, the contract owner and an insurance company, the issuer. In exchange for an upfront payment or a set of installment payments, the issuer provides a named annuitant (usually the contract owner) a future lump-sum payout or a series of payouts.

This annuity allows your money to be invested in a variety of ways while it grows on a tax-deferred basis. This provides the potential to significantly increase future payments, but unlike other types of annuities, poor investment performance can cause you to lose money.

Variable annuity payouts are usually deferred following a specified accumulation period. The payout frequency is fixed, and the payouts end at a specified point in time. Generally, an annuity lasts a certain number of years or an annuitant’s lifetime.

When you buy a variable annuity, the money paid is allocated to an investment portfolio with a range of options, or sub-accounts. These are usually mutual funds that invest in stocks, bonds, money market instruments or some combination of the three.

Additionally, you may be able to invest some of your money in a fixed account that offers a guaranteed minimum interest rate. The amount of income you receive from the annuity can rise or fall, depending on the performance of your investment selections.

In some cases, the annuity issuer may guarantee a return of premium (ROP). This protects your initial investment but does not guarantee a return on your investment. For guaranteed interest, you must buy a fixed annuity.

Key Facts About Variable Annuities

- A variable annuity has the potential for higher returns and tax-deferred growth, but unlike a fixed annuity, it can lose money.

- The returns of a variable annuity depend on how its underlying investments perform.

- Variable annuities typically offer a range of investment options called sub-accounts that may include stocks, bonds, money market accounts or a combination of all three.

Variable annuities can offer valuable benefits during both the accumulation phase and contribution phase of the contract. It is important to consider your cash flow constraints, time horizon, risk tolerance and tax bracket to determine if a variable annuity is appropriate for your personal situation.

Variable Annuity Fees and Expenses

There are several variable annuity fees, and they can easily amount to 2% to 3% per year collectively.

- Mortality and expense risk fees

- These are levied to support the insurance guarantees and selling expenses of the insurance company.

- Administrative fees

- These are levied to cover ongoing servicing of the annuity contract.

- Investment management fees

- These cover the costs of managing an annuity’s underlying assets, which are often held within mutual funds.

- Surrender charges

- These are another potential fee. They protect the insurance company against the risk of a contract owner making premature withdrawals. The surrender charges are costly, but they can be avoided by prudently planning prior to buying an annuity.

The most common fees and charges include:

Tax Rules

The federal and state tax rules that pertain to variable annuities are complicated. Before investing in one, it is recommended that you consult with a tax professional.

General Tax Guidance

- Variable annuity taxation is tax-deferred, which means you will not pay income tax on earnings until you start withdrawing money from the contract.

- If you invest in a variable annuity through a tax-advantaged retirement plan, you will not receive any additional tax benefit.

- Withdrawals from a variable annuity are available during retirement, beginning at age 59 ½. If you withdraw prior to this age, you may be subject to a 10% withdrawal penalty.

Traditional retirement plans, such as employer-sponsored 401(k) plans and individual retirement accounts (IRAs), offer the same tax-deferred growth potential as variable annuities.

For most investors, it is best to max out contributions to retirement plans prior to investing in variable annuities.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

How Does a Variable Annuity Work?

Generally, a variable annuity is issued with a deferred payout structure. Essentially, this means the buyer must wait a specified number of years before receiving any payments.

The holding period, which is known as the accumulation period, is designed to give the upfront investment time to grow. After the accumulation period ends, payments can be initiated.

Accumulation Phase

The accumulation phase begins when you purchase the annuity and lasts for a specified number of years, often 10 to 15 years. Essentially, this is a liquidity lock-up period designed to endure near-term volatility and allow the value of your investment to grow.

You decide how your funds are invested across sub-accounts, incorporating the degree of diversification and aggressiveness you desire. With some variable annuities, you may be able to invest a portion of your funds in a fixed account, which offers a guaranteed minimum rate of interest.

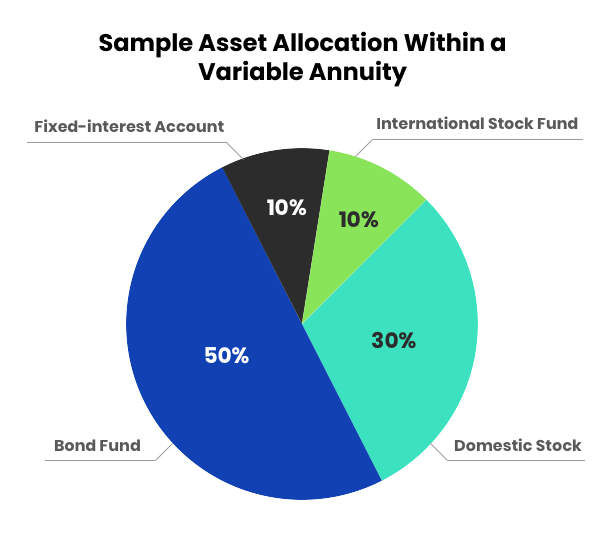

The example below illustrates how your funds could be allocated across various investment sub-accounts.

Throughout the accumulation period, your account balance will increase or decrease, depending on the performance of your sub-accounts. If you want to change your investments, you may be able to do so without tax consequences. However, the annuity issuer may still charge transfer fees.

If your contract allows, your survivors will receive all or some of your annuity’s value if you die during the accumulation period.

Payout Phase

The payout phase, also known as the distribution phase, is when you begin drawing funds from the annuity. This can take the form of a lump-sum payment or, more commonly, a stream of periodic payments.

For periodic payments, you can designate how long they will last. Generally, the expiration date is defined as a certain number of years or the lifetime of the annuitant or annuitants, like in the case of a joint-and-survivor annuity. That said, the longer the potential payout stream, the lower the payment you can expect.

This rule-of-thumb reflects the risk-return tradeoff between an annuity contract owner and the issuing insurance company. A longer payment stream provides greater benefit to the contract owner and higher risk for the issuer. The only way for the latter to equalize the arrangement is to reduce the payment amount.

Who Should Choose a Variable Annuity?

Because variable annuities have market exposure and, therefore, market risk, they are better suited to people who are a decade or more away from retirement. Annuity.org expert contributor Chip Stapleton said that consumers aged 50-55 can benefit from the fluctuating returns of a variable annuity.

“It could be beneficial for them because they have enough time to weather the downs,” said Stapleton, who is a FINRA Series 7 and Series 66 license holder and CFA Level II candidate. “Over a 15-year time period, I don’t think there have been any years in the S&P 500 where 15 years have been negative. So, if they have the time to weather the down markets, that could be beneficial to them.”

Stapleton also suggested that a variable annuity might fit into a retiree’s portfolio if they already have guaranteed income.

“Maybe they have good Social Security or they have a good pension and they’re looking for some additional income. A variable annuity could be beneficial,” Stapleton said. “If the market’s up, they’re getting even more money. But if the market’s down, that’s alright because they have other guaranteed sources of income.”

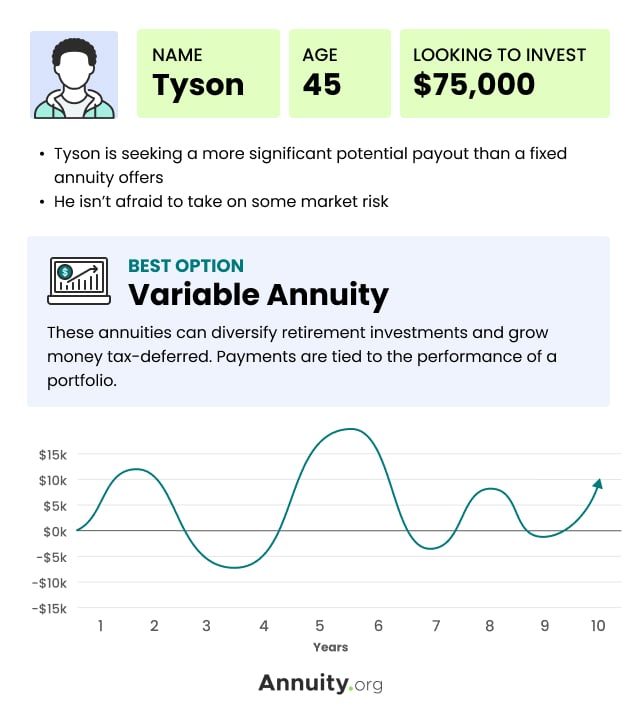

To better understand the financial circumstances of someone seeking a variable annuity, consider this case study example.

Variable annuities are a good fit for people like Tyson, who is seeking a more significant potential payout than a fixed annuity offers — and who isn’t afraid to take on some market risk.

Variable annuities can help diversify Tyson’s retirement investments and grow his money tax deferred. It can be an excellent option if he’s already maxed out his yearly 401(k) contributions.

This type of annuity is usually recommended for younger investors with longer time horizons and higher risk tolerances.

Variable annuities may also be attractive if you want more control over your investments because you can pick and choose your underlying stocks and bonds.

There are a few reasons to choose a variable annuity as opposed to investing directly in the market. Stapleton cited the tax-deferred growth of variable annuities as an advantage over traditional brokerage accounts.

“You’re not going to pay any taxes on growth,” Stapleton said, “whereas in a non-qualified brokerage account, there’s often taxes you have to pay every single year.”

Variable annuities typically charge more fees than investment accounts like IRAs, but these annuities often come with additional benefits not offered by other options. Stapleton said that for some investors, the death benefit or living withdrawal benefit of variable annuities makes them a better choice than other investment vehicles. “If there’s outsize value provided by those fees, then it makes sense.”

Variable Annuities in 2025

Sales of traditional variable annuities declined slightly in 2023, with total sales of $39.1 billion in the first three quarters of the year. The trade group LIMRA hypothesizes that “regulatory headwinds” may have contributed to a down year for these products.

However, in the first quarter of 2024 variable annuity sales totaled $13.7 billion, a 7% increase from the first quarter of 2023.

Though inflation remains a factor, LIMRA projects continued growth for traditional variable annuities in 2025. Interest rates are expected to fall, creating a more favorable climate for variable annuities specifically.

Additionally, a surge in population over the age of 64 is expected to further drive annuity sales since the average annuity buyer is around 65 years old.

Death Benefit and Other Features

A variable annuity has other valuable features, such as a death benefit and an array of living benefits.

Death Benefit

All competitive annuity providers offer a death benefit on variable annuities. Essentially, this is a guaranteed payout to a named beneficiary if an annuitant dies before taking payments on a variable annuity. The beneficiary is guaranteed to receive the premiums paid or the current value of the contract, whichever is greater, minus any withdrawals and fees.

Example:

You own a variable annuity with a death benefit equal to or greater than the account value or total contributions, minus withdrawals and applicable fees. You have made contributions totaling $350,000, and you have not withdrawn any money. Unfortunately, due to investment losses and $5,000 in fees, your current account value is only $295,000.

Living Benefits

The death benefit is a standard offering, but it is not the only feature variable annuity issuers offer. The best providers offer a selection of optional features, or riders, which are collectively referred to as living benefits. Some of these benefits are only available during the accumulation phase of an annuity contract.

- Long-term care insurance or chronic care rider

- This pays for home health care or nursing home care, if you become seriously ill.

- Guaranteed Minimum Income Benefit (GMIB)

- This is a rider that protects variable annuity holders from the market risk inherent in these products. It guarantees a minimum monthly payment that is not affected by market performance.

- Guaranteed Lifetime Withdrawal Benefit (GLWB)

- This guarantees a minimum number of annuity payments, even if you do not have enough money in your account to support the payouts (perhaps, due to investment losses).

Common Riders

Overwhelmed by Safe Retirement Options?

Variable Annuity Pros and Cons

As with any financial instrument, the benefits and risks of variable annuities should be carefully considered prior to investment. Variable annuities offer the potential for higher returns than fixed annuities, but, as noted by the Financial Industry Regulatory Authority (FINRA), they pose several risks that warrant caution.

Pros & Cons

Pros

- Possible Inflation hedge – If your investment selections perform well, variable annuity payments will increase, enabling you to better keep up with inflation. Variable annuities are similar to CDAs as they provide policyholders access to stock and bond market investments, which could potentially result in higher returns over time.

- Tax deferral growth – The money invested in a variable annuity is allowed to grow on a tax-deferred basis. You will not pay taxes on the earnings until you begin taking money out of the annuity.

- Initial investment protection – Oftentimes, the issuing company will guarantee you can access your initial investment, regardless of how poorly your investment selections perform.

- Death benefit – If you die before you start receiving payments, your beneficiary will receive a payout from the annuity company.

- Payments for life – You have the option of receiving payments for the rest of your life, regardless of how your investment selections perform. However, you will likely have to pay extra for this option.

Cons

- Complexity – Variable annuities are complicated, and their various provisions and terms can be confusing to the average person. This is problematic, especially when careless salespeople push these products without considering the unique financial needs of individual investors.

- No guaranteed return – Unlike fixed and fixed index annuities, there is no guarantee you will earn interest on your investment. If your investment selections perform poorly, this will affect the value of your annuity.

- Taxed as income – When you withdraw money from an annuity, the earnings are taxed as ordinary income, not at the more favorable capital gains tax rate levied on profits from securities disposals.

- Surrender charge – If you take money out of an annuity earlier than the contract allows, you will have to pay a surrender charge. Early in the contract, it can be as high as 10%. That said, some annuities allow you to withdraw small amounts in early years. Typically, this amounts to up to 10% of the current value, annually.

- High fees – Variable annuities are costly relative to other annuities and financial securities. Purchasing one entails a commission. Then, you will incur ongoing mortality and expense risk charges, administrative fees and fund management fees associated with your investment selections. Collectively, the ongoing fees can easily amount to 3% to 4% per year.

Learn how an investment today can provide guaranteed income for life.

Variable Annuity vs. Fixed Annuity

Predictability and risk are the biggest differences between variable and fixed annuities. Fixed annuities offer predictability & stability.

Variable annuities are not nearly as predictable. They can exhibit a lot of volatility. Accordingly, they also offer much higher return potential than fixed annuities.

Fixed annuities share similarities with bank certificates of deposit (CDs). You deposit a sum of money and receive a guaranteed rate of interest over a specified period. Variable annuities, on the other hand, involve taking investment positions in financial securities, which can fluctuate in value, sometimes, wildly.

Generally, a fixed annuity is sensible for an investor with a short time horizon and very little tolerance for volatility. A variable annuity is more suitable for an investor with a long horizon and the capacity to endure some volatility.

Read More: Variable Annuities vs. Stocks

Next Step: Find the Right Annuity Company

Other Frequently Asked Questions About Variable Annuities

A “free look” period is the length of time following an annuity purchase (oftentimes 10 days) in which you can cancel the contract without incurring any fees. If you decide to terminate the contract, your premium will be returned to you, but the amount may be affected by the performance of your investments during the “free look” period.

Yes. Variable annuities are exposed to the performance of financial securities, which can fluctuate in value. For this reason, fixed annuities are a safer product.

An accumulation rate is a share owned in the separate account of a variable annuity during its accumulation phase. It can be likened to a share of an investment fund. If the value of a variable annuity’s investments decline, the value of an accumulation unit also declines.

An assumed interest rate is the growth rate used by a variable annuity issuer to estimate future payments to an annuitant. Actual payments may be higher or lower, depending on the actual rate of return achieved by your investment selections.

A bonus credit is a special feature present in some variable annuity contracts. With this perk, the issuer adds extra money to your account based on a specified percentage (typically, 1% to 5%) of purchase payments. For example, assume you purchase a variable annuity with a bonus credit of 3% on each purchase payment. Your initial purchase is $200,000. With the bonus credit, the issuer will automatically add another $6,000 to your account. Bonus credits are appealing, but annuities that offer them usually impose higher fees and expenses. The additional expense can outweigh the benefit.

States provide varying degrees of protection from creditors for variable annuities. Some offer full protection, while others offer none. For example, California’s statute claims protections for annuities are the same as for life insurance cash value, if an annuity is deemed insurance and not an investment. This excludes variable annuities, which are classified as securities.

Editor Lena Borrelli contributed to this article.