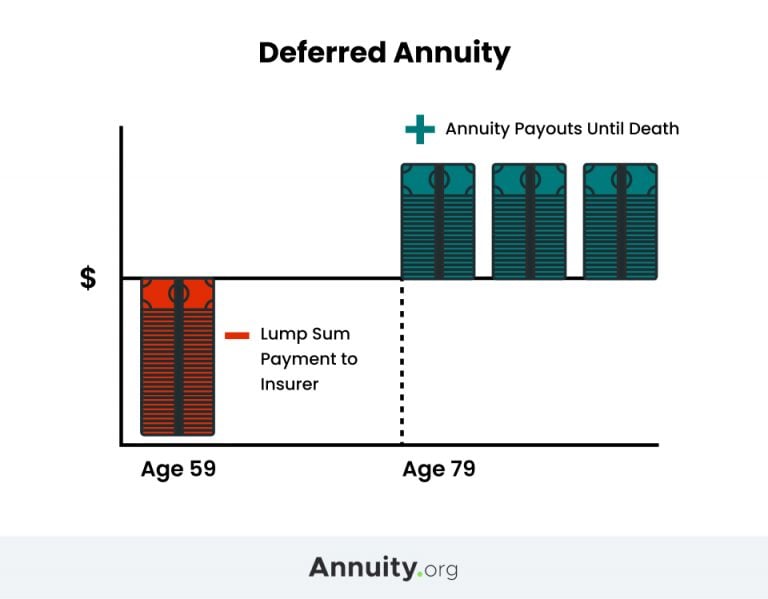

A deferred annuity is a financial contract that allows you to invest money now and receive guaranteed income payments in the future, typically during retirement. This differs from an immediate annuity, which begins making payments right away. Deferred annuities offer the advantage of tax-deferred growth, allowing earnings to accumulate without immediate tax liability until withdrawals begin.

Deferred annuities can be an effective tool for retirement income planning as they offer the potential for growth, tax advantages and the option for a guaranteed income stream for life.

Key Facts About Deferred Annuities

- Deferred annuities allow for tax-deferred growth on your principal.

- You can purchase a deferred annuity with a single lump sum payment or a series of payments made over a specified period.

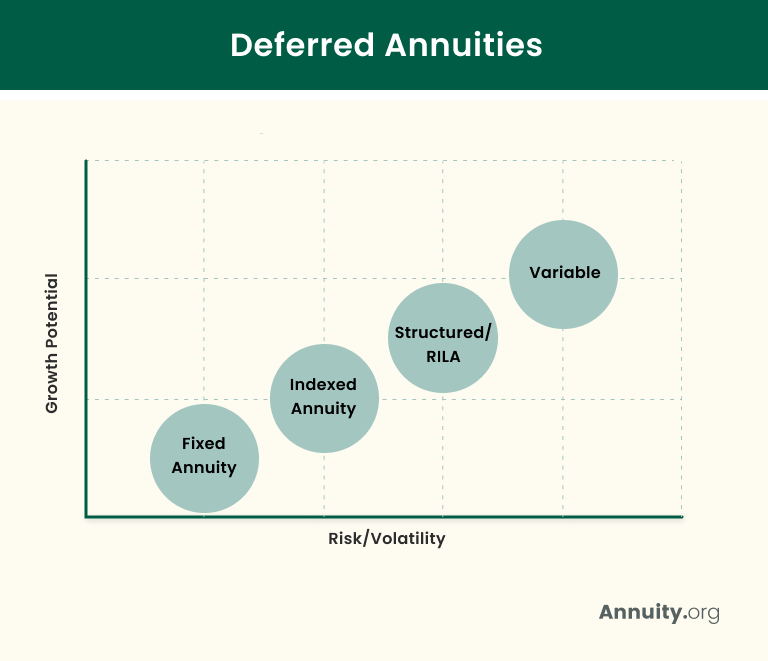

- There are different types of deferred annuities, including fixed, variable and fixed index, each with unique features and benefits.

- Deferred annuities have potential drawbacks, such as lack of liquidity, high tax rates on earnings and additional expenses.

The period of investment growth is known as the accumulation phase, and the period of income payments is known as the annuitization or payout phase. During the accumulation phase, your money grows tax-deferred, meaning you do not have to pay taxes on your investment earnings until you start taking withdrawals during the payout phase.

When purchasing an annuity, decide when you want to receive the payout. If you decide to start receiving payments within a year, an immediate annuity can be the better option. If you wait to collect payments, opt for a deferred annuity.

You can pursue a strategy combining the advantages of immediate and deferred annuities by purchasing a split-funded annuity.

Deferred annuities are a great and cost-effective way to make sure you don’t run out of money if you live longer than expected. If payments are set to begin near the end of your life expectancy you have a safety net in place.

Pros and Cons of Deferred Annuities

Deferred annuities have many benefits, but they may not be right for everyone. When considering purchasing any annuity, it is important to weigh the pros and cons.

Pros

- Tax-Deferred Investment

Deferred annuity owners do not pay taxes during the accumulation phase. Taxes apply once the distribution phase begins and the owner starts to receive income payments.

- Guaranteed Against Loss

Most deferred annuity contracts have built-in guarantees against loss of principal and some offer guaranteed rates of return. However, loss of capital is possible with variable annuities.

- Lifetime Benefits

Depending on how you structure your deferred annuity, it’s possible to receive guaranteed income payments for life.

- Death Benefits

Many deferred annuity contracts include a death benefit component. This ensures that your surviving heirs receive any remaining assets if you die before the end of the annuity contract.

- No Contribution Limits

Unlike IRAs and 401(k)s, the IRS places no limits on the principal amount you can contribute to a deferred annuity.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Cons

- Lack of Liquidity

Generally, annuitants cannot withdraw most of the money from their annuity during the contract’s first several years unless they pay a surrender charge for withdrawals. Many companies do allow you to withdraw up to 10% of the contract without penalty. In addition, the IRS imposes penalties for withdrawals before you are 59 ½.

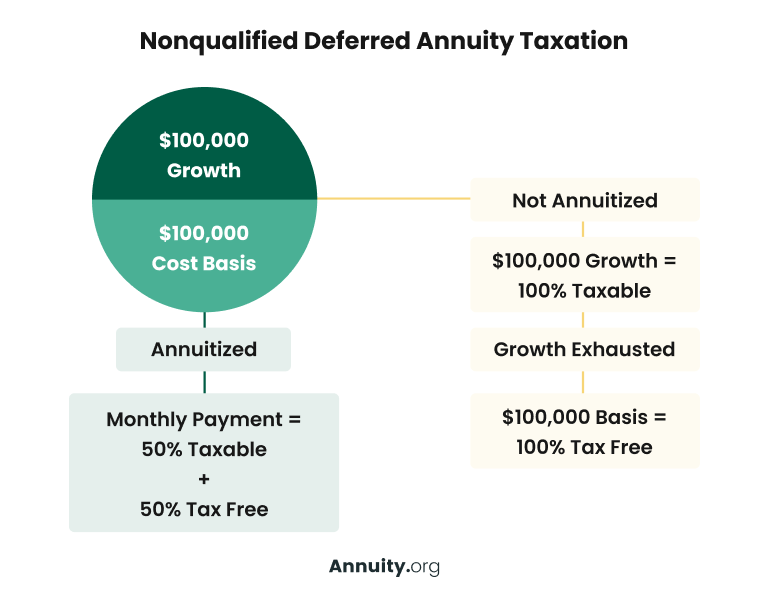

- High Tax Rates on Earnings

Because deferred annuity contracts grow on a tax-deferred basis, the IRS taxes annuity earnings at the ordinary income rate. That rate may be higher than the capital gains rate applied to stocks, mutual funds and exchange-traded funds.

- Additional Expenses

Maintaining a deferred annuity contract can be expensive due to possible administrative fees, funding expenses, charges for special features and riders and commissions.

Deferred Annuity Case Study

Name: Peggy

Age: 60

- $250,000 available investment for annuity

- Maxes out IRA contributions each year

- Plans to work until age 70

Best Option: Deferred Annuity

Because Peggy is 60, she can withdraw IRA and 401(k) savings without an early withdrawal penalty and invest it in a deferred annuity. She can also invest excess money beyond her annual IRA limit toward the annuity. The deferred annuity can be set up to pay out once she retires at 70 while continuing to accumulate wealth while she keeps working.

Annuity buyers are typically in their 60s, but if you are a younger investor, a deferred annuity allows you to accumulate wealth as you work. Then, in retirement, you can achieve a guaranteed lifetime income stream.

However, a deferred annuity limits your ability to repurpose your retirement savings and can be very difficult to reverse if you change your mind because you will have to wait for your annuity income. If you need more near-term liquidity, you may be better suited to consider an immediate annuity.

You can also consider contingent deferred annuities (CDAs), which can be canceled at any time, unlike most annuity contracts. Keep in mind that CDAs are sold by only a few companies and may be illegal in some states in the U.S., including New York.

Payout Options for Deferred Annuities

Once an annuitant reaches the distribution phase of their contract, which typically begins when they reach the age of 59 ½, they can receive payouts from the annuity in one of three ways.

- Lump Sum

- In a lump-sum disbursement, an annuity is distributed as a one-time, taxable single payment.

- Systematic Withdrawals

- When funds are dispersed via systematic withdrawal, the annuity is disbursed through periodic taxable payments. Any remaining money continues to earn interest until the account has been depleted.

- Annuitization

- Under an annuitization distribution plan, an annuitant receives monthly, quarterly or yearly payments for a designated amount of time, until the annuitant’s death or until the annuitant’s spouse dies.

Deferred Annuity Payout Options

Death Benefits

If you die during the accumulation period, a deferred annuity includes a basic death benefit that pays some or all of your annuity’s value to your beneficiaries. If you die during the payout phase, your beneficiaries may not receive anything unless you have a specific provision in your annuity contract for your beneficiaries to be paid.

Overwhelmed by Safe Retirement Options?

Types of Deferred Annuities

Deferred annuities come in a few different varieties, each with different features and benefits. The most common types of deferred annuities are single premium deferred annuities and flexible premium deferred annuities.

Single premium deferred annuities are purchased with one lump sum of money. There are both advantages and disadvantages to this type of annuity. For example, a single premium deferred annuity might tie up more of your money than you ultimately could afford to put into it, ultimately costing you a surrender fee.

A flexible premium annuity is a type of deferred annuity purchased with a series of payments. These payments can be scheduled as specific amounts — known as scheduled premium deferred annuities — or they can be adjustable. When the payments are adjustable, the vehicle is commonly referred to as a flexible premium deferred annuity.

How Does a Deferred Annuity Differ from Other Types of Annuities?

“A deferred annuity is an annuity that allows you to delay receiving payments until a later date,” says licensed insurance agent Linda Chavez. During the deferral period, also known as the accumulation phase, the annuity contract earns interest and increases in value.

An immediate annuity is structured differently and does not have an accumulation phase. Immediate annuities undergo annuitization as soon as the contract is signed, which means the income payments can begin immediately. That said, many immediate annuity owners elect to initiate the payment stream up to a year after purchase.

Accumulation and Payout Phases of a Deferred Annuity

As mentioned, there are two distinct phases to a deferred annuity: the accumulation phase and the payout phase.

During the accumulation phase, the annuity accumulates interest on a tax-deferred basis. During the payout phase, the annuity distributes income.

The accumulation phase works differently depending on the annuity type.

- Fixed Deferred Annuity

- If you have a contract for a fixed annuity, your financial investment will accrue interest at a guaranteed fixed rate.

- Variable Deferred Annuity

- A variable annuity allows you to invest your premiums in mutual funds comprised of stocks, bonds and/or short-term money market instruments. Your rate of return depends on the performance of these investments.

- Fixed Index Deferred Annuity

- A fixed index annuity accrues interest based on the performance of a specified index, such as the S&P 500. This type of contract guarantees you will receive a minimum rate of return regardless of how the referenced index performs. However, your upside performance is usually capped.

Accumulation Based on Type of Annuity

Regardless of the type of accumulation your deferred annuity uses, you do not pay taxes on those earnings during the accumulation phase. Taxes are not due until you reach the payout phase. This is true for federal income taxes and any applicable state premium taxes.

Join Thousands of Other Personal Finance Enthusiasts

Frequently Asked Questions About Deferred Annuities

Payments are usually deferred until the annuitant reaches retirement age. Your age when you purchase the annuity will affect how long it stays in the accumulation phase.

A fixed deferred annuity earns interest based on a guaranteed fixed rate. This differs from fixed index or variable annuities, which accrue interest based on the performance of indexes (in the case of fixed index annuities) and underlying investments (in the case of variable annuities).

With a deferred annuity, you do not owe any tax until you begin receiving payments from the annuity. You will only be taxed on the portion of the payment that is accumulated interest.

A fixed annuity earns interest at a guaranteed rate, while the value of fixed index and variable annuities is tied to market performance.

You can lose money if you withdraw funds from your deferred annuity before the payout phase begins. If you have a variable deferred annuity and the market performance is poor, you could lose some of the value of your annuity over time.

The amount you invest into an annuity depends on the type of annuity you want and your goals. For a single-premium deferred annuity, your minimum investment could be as low as $25,000.

A deferred annuity is different from an immediate annuity because it accumulates value before the contract is annuitized. An immediate annuity, as the name implies, immediately annuitizes into a stream of income payments.