If you shop around, you may find annuities with a minimum investment of as little as a few thousand dollars, according to Joe Liekweg, an agent at Insuractive. “For MYGAs, which is a multi-year guaranteed annuity, some are $2,500,” Liekweg said. “But I’d say for most fixed annuities, you’re looking at anywhere from a minimum of $5,000 to $10,000.”

Some types of annuities may require a much higher minimum, ranging from $50,000 to $100,000.

For deferred annuities, you can continue investing up to $1 million or $2 million — or more if you get a special exception from the company that sells you the annuity, Liekweg told Annuity.org.

In the case of deferred annuities, the minimums are often lower and, at times, comparable to the minimums of CDs or individual fixed income bonds—common alternatives for conservative or guaranteed investments. Different companies establish different minimums, so if you have a limited amount to invest, it’s advisable to shop around and find a company that can accommodate your investment.

Minimum Amounts Based on Annuity Type

As mentioned above, different types of annuities have varying minimum investment amounts due to their unique purchase structures, payout methods and goals for the product.

“It’s based on your liquidity and what you need to have accessible to you at all times because an annuity does lock up your money,” Liekweg said.

Consider how much money you must invest overall and how an annuity fits your long-term financial plans before buying an annuity.

Fixed Index Annuities

You can open a fixed index annuity for as little as $5,000 with some companies.

A fixed index annuity bases your payout on the performance of a market index, such as the Dow Jones Industrial Average or the S&P 500.

Flexible Premium Annuities

You can open a flexible premium annuity for an initial minimum investment of $5,000 with some companies.

Flexible premium annuities are deferred annuities purchased through a series of payments over a long period of time. They offer protection from losses and the potential to earn interest based on market index changes.

Single Premium Immediate Annuities

Single premium immediate annuities (SPIAs) are purchased with a single lump-sum payment. They include immediate annuities that are typically purchased close to retirement and single premium deferred annuities that you can purchase well before you plan to withdraw money, allowing wealth to accumulate over time. Minimum investments can be as low as $25,000.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

How Annuity Rates Affect Your Minimum Annuity Investment

Your minimum annuity investment is influenced by annuity rates, reflecting how the contract’s value grows over time. Fixed annuities guarantee a steady interest rate, while variable and index annuities see growth tied to market performance.

Securing an annuity with favorable rates is crucial for optimizing your investment. A higher interest rate allows you to achieve the same payout with a smaller investment.

“The interest rates paid on investments in an annuity contract determine how much future income the annuity will provide,” said R.J. Weiss, Certified Financial Planner™ professional and founder of the personal finance site The Ways to Wealth. “The higher the rate, the more income the annuity will pay.”

Higher interest rates make annuities more appealing investments in such periods. For instance, in the first five months of 2022, the average immediate annuity payout increased by 11% for men and 13% for women, according to CANNEX Financial Exchanges Limited. Multiple interest rate hikes from the Fed, aimed at addressing inflation, drove the increases.

How Fees, Commissions and Rates Affect Your Annuity Investment

Understanding the impact of annuity fees and commissions on your investment is crucial when considering a purchase. These fees, which vary among companies and annuity types, play a significant role in determining how much of your investment actually goes toward securing the annuity and can influence your eventual returns.

“For instance … [with] variable annuities … you’ll see investment fees, expense ratios and the [mortality and expense] fees that could easily be 4% to 6% per year, which is drastic,” Chip Stapleton, the financial advisory manager at airCFO, told the Annuity.org Podcast.

Variable annuities have the highest fees among the different types.

And if you withdraw your money before a certain time, you must pay a surrender charge. This can start as high as 5% to 25% of the withdrawn amount in the first year. The percentage drops each year, but surrender fees may apply for as long as 15 years.

Case Study: Maximizing Annuity Payouts Over Minimum Annuity Investment

Generally, the more money you put into an annuity, the more you will receive in your payout. Going with the minimum annuity investment will result in lower monthly payments than if you put a larger sum of money into an annuity.

John is a 67-year-old retiree at the full Social Security benefits age, navigating the landscape of annuity investments to secure his financial future. In this case study, we explore the impact of John’s investment decisions on his monthly annuity payouts.

Background

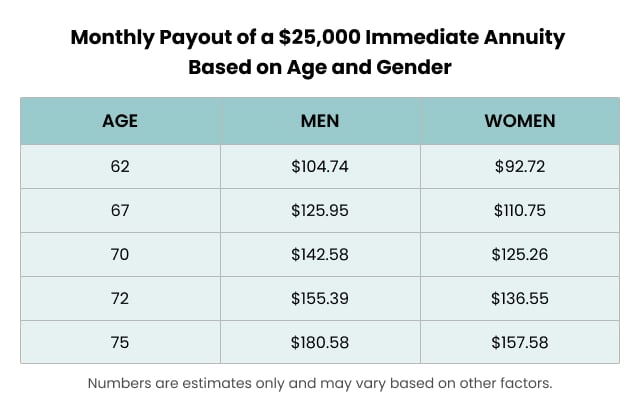

John makes a minimum investment of $25,000 in an immediate annuity. Based on the annuity rate and his life expectancy — determined by his gender and age — his decision guarantees him a modest monthly payout of $125.95 for the rest of his life in this scenario.

But John’s twin sister, June — who bought the same annuity at the same rate and the same time — would receive lower monthly payments. The case study highlights the impact of life expectancy, with women generally experiencing longer lifespans, leading to a distribution of lifetime payouts over more years.

Alternative Scenario

Opting for a larger investment of $125,000 — with the same annuity rate and life expectancy the same — John’s monthly annuity payout soars to $629.74. This adjustment showcases the direct correlation between the investment amount and the resulting monthly income.

Key Factors

For immediate annuities, John’s age, gender and investment amount are pivotal factors influencing the monthly payout.

Considerations

When deciding on an annuity investment, one must consider factors such as annuity type, interest rates, age and retirement age. A tailored approach aligned with personal financial goals and circumstances is necessary.

Conclusion

Though John may have the minimum investment amount for an annuity, his journey highlights the need for strategic planning and informed decision-making to maximize retirement income through carefully calculated annuity investments. You can use an annuity calculator to see how different investment amounts will affect your return.

Calculate Your Returns Based on Today’s Best Rates

Frequently Asked Questions About Annuity Investments

Minimum investments for annuities vary. Fixed annuities can start at $1,000, while others have different minimums. Some providers may require much higher minimums.

Annuity rates play a crucial role in determining the minimum investment needed and the resulting payouts. Higher interest rates can allow investors to achieve the same annuity payout with a smaller investment, making it essential to understand how rates affect long-term financial outcomes.

Several factors influence the decision of the minimum annuity investment, including annuity type (fixed, fixed index, immediate, etc.) and individual financial goals. Strategic thinking is necessary to align your investment with your long-term financial plans. A financial advisor can help you decide on the best strategy.