According to the most recent data, 84% of Americans have at least one credit card. A credit card can be a valuable resource in emergencies and a great way to build a credit history, but it is also a source of financial stress for thousands of Americans.

Recently, credit card debt has reached record heights. Since the end of 2021, Americans’ credit card debt has increased by $130 billion. That 15% increase is the largest jump in over 20 years. Many experts believe that recent high interest rates have made it much harder for Americans to pay off their existing credit card debt.

Understanding how debt accumulates and learning credit card debt statistics can help borrowers review their situation and create a plan to dig out of debt.

Key Takeaways

- The average American has $6,501 in credit card debt.

- Alaska has the most credit card debt of any state, with an average of $7,863 in 2023.

- Iowa has the least debt, with a balance of $5,227 in 2023.

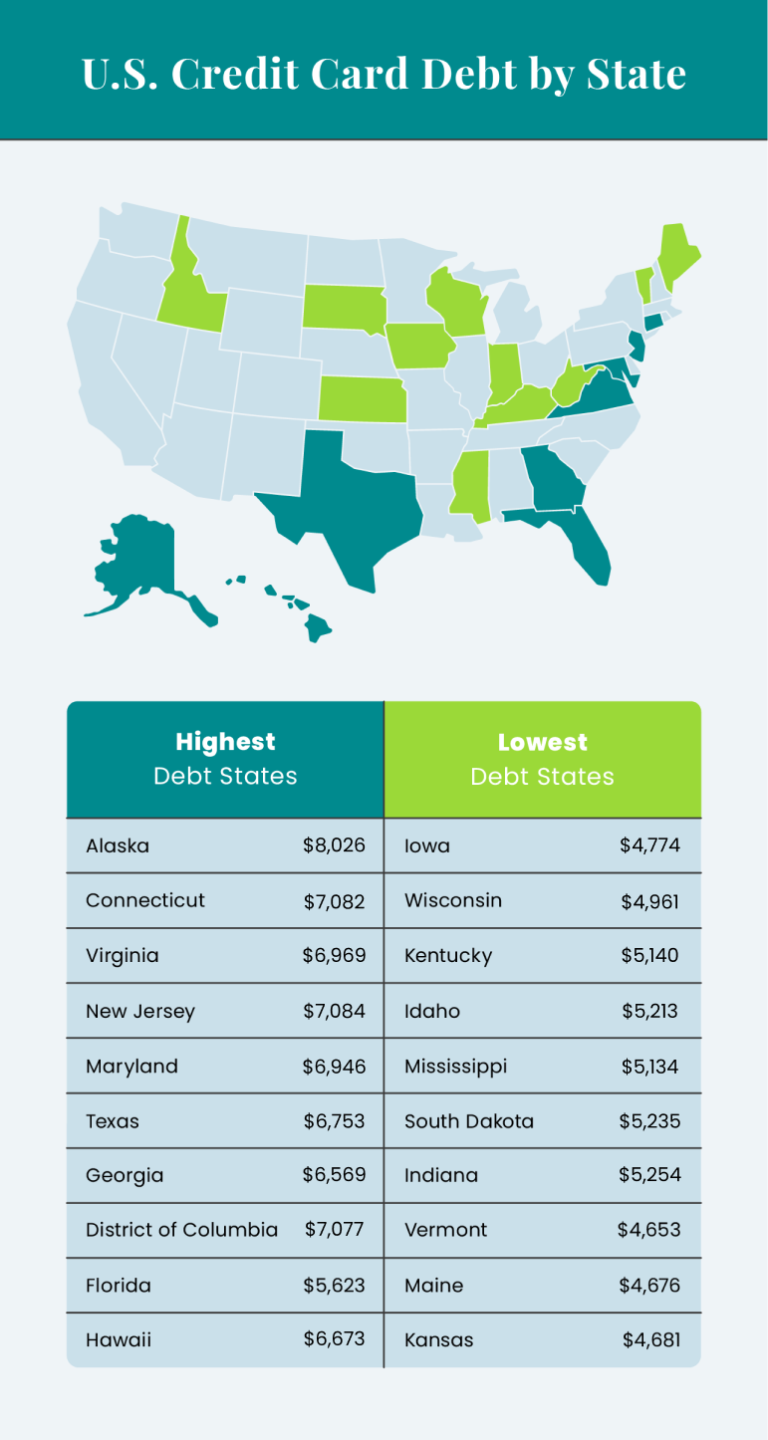

Average American Credit Card Debt by State

The national average credit card balance was $6,501 toward the end of 2023. According to Experian, Alaska had the highest average credit card debt at $8,026.

Generally, states with a high cost of living have higher average credit card debt balances. For example, Alaska, Connecticut, the District of Columbia (D.C.) and Hawaii are in the top 10 highest debt states. While more affordable states like Iowa, Wisconsin and Mississippi rank in the top five states with the lowest average credit card balances.

“It may pose a challenge to avoid carrying any credit card debt while residing in a high-cost-of-living state, such as California or New York. However, establishing a budget and maintaining the discipline to adhere to it can help you manage your credit card balance effectively.

Credit card debt varies significantly by race, generation and state. Understanding methods to reduce your credit card debt can significantly benefit your financial future.”

Credit Card Debt by Age

According to Experian’s latest findings on credit card debt, the average overall debt rose throughout most generations in 2022 — except among the oldest American consumers. A recent New York Life study discovered the highest level of credit card debt among Generation X (individuals between the ages of 43 and 58), with an average of $7,004. This compares to an average credit card debt of $2,876 for Generation Z, $5,928 for Millennials and $6,785 for Baby Boomers.

Credit Card Debt by Age

| Generation | 2022 Debt |

| Generation Z (18-23) | $2,876 |

| Millennials (24-39) | $5,928 |

| Generation X (40-55) | $7,004 |

| Baby Boomers (56-74) | $6,785 |

Generation Z is beginning to graduate from college, a time when the average American gets their first credit card. Therefore, these Americans have fewer cards than older generations and the lowest credit card balance, with an average of $2,876.

Generation X is enjoying their midlife years and has racked up the highest average credit card debt at $7,004.

Generation X and Baby Boomers, on average, possess more than four credit cards. In contrast, young adult consumers (individuals aged 18 to 25) had an average of only two credit cards in 2022.

Let’s Talk About Your Financial Goals.

Average Credit Card Debt by Gender

Men and women have similar debt balances, though men have 2% more credit card debt compared to women. However, when we consider financial gaps by gender, women earned 82.9 cents for every dollar earned by men in 2022.

While men may have a slightly higher credit debt balance, women report a larger financial burden when it comes to managing credit card debt. According to Debt.org, 39% of women report “carrying unmanageable levels of debt,” compared to 31% of men.

Average Credit Card Debt by Gender

| Women | Men |

| $6,232 | $6,357 |

College Students and Credit Card Debt

Young Americans tend to have the least amount of credit card debt of all generations, but they also typically have less income than older generations. Therefore, a few small purchases on a credit card can become expensive financial burdens as interest payments grow month over month.

However, when students cover their necessary expenses with credit cards and pay off the complete balance each month, they can benefit from improved credit scores and credit card rewards without overpaying on interest.

The difference between these two scenarios is intentional spending and proper budgeting. Decide how much you can afford to spend each month and limit your credit use accordingly.

In addition, college students who have already accumulated credit card debt should prioritize repayment before they graduate when they may be faced with student loan repayment.

Credit Card Debt and Families

As Americans develop financial stability, credit cards can be used one of many financial tools which can offer great benefits for strong planners. The better your credit score, the better your credit rewards and the lower your interest rate.

Credit card rewards, when used appropriately, can supplement savings for large life goals like marriage and homeownership. For example, couples planning their wedding frequently cover honeymoon travel expenses with a credit card that offers reward miles.

Using your card to cover monthly bills that you could otherwise pay for in cash can improve your credit score by increasing your credit history. As your credit score improves, you can be eligible for a lower mortgage rate.

That said, credit cards shouldn’t be relied on to plug the holes in your monthly expenses if you can avoid it. Families who need to use a credit card to make it to payday should consider lowering their monthly costs and investing in savings for emergencies and retirement.

Credit Card Debt and Retirement

Excessive credit card debt can make it difficult to save for retirement as interest payments eat at your disposable income. Paying off debt frees excess income to invest in retirement or other wealth-building measures.

It also lowers your total debt, which will benefit your debt-to-income ratio if your income decreases in retirement.

Those in retirement should keep existing accounts open to conserve their credit score and consider opening an additional account if they don’t have one exclusively in their name. If you’re an authorized user on your spouse’s card, you’ll lose access to the account if they die.

Additionally, credit cards can be an asset to your new retirement lifestyle. As many retirees plan to vacation and start checking off items on their bucket list, credit cards can help supplement travel costs.

What Increases Credit Card Debt?

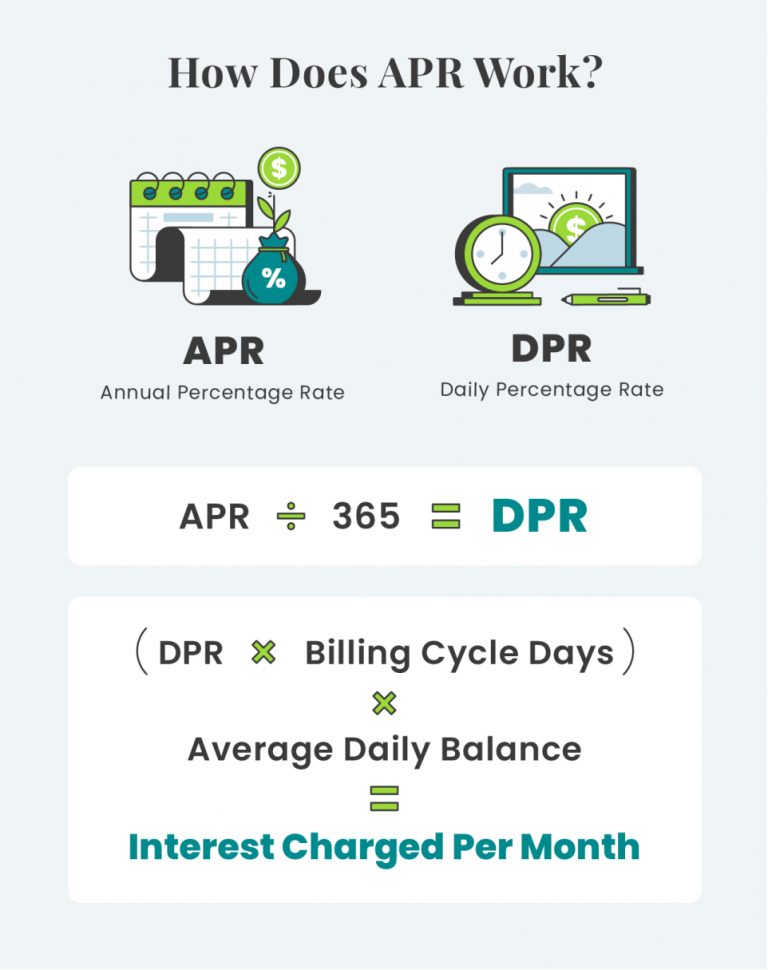

Credit card debt grows as cardholders spend more than they can afford or want to pay off each month. Leftover balances are charged interest each month according to your Annual Percentage Rate (APR).

APR is an annual interest rate, but it’s divided by the number of days in a year and applied to your average daily balance, then multiplied by the number of days in your monthly billing cycle.

Your lender expects a minimum monthly payment that’s either a fixed rate or a percentage of your remaining balance. However, minimum monthly payments often barely cover interest charges. So if you want to get out of debt, you’ll need to pay much more than the minimum balance.

How Can I Reduce Credit Card Debt?

The best way to reduce your current debt balance is to increase your monthly payments. This helps pay off more of your balance instead of just covering interest and also reduces the interest you pay each month.

In addition to paying down existing credit card debt, you need to adjust your finances to avoid taking on any additional debt. This includes funding an emergency savings account and creating savings goals for large purchases you’d otherwise charge to your card.

An effective budget can help you prioritize savings and track where you’re excessively spending. Once you’ve built a budget, you can confidently enroll in auto payments for your monthly expenses, knowing that cash is still available. This reduces your risk of late fees and credit penalties.

Credit cards may have a bad reputation for some, but there are plenty of benefits for consumers of all ages who use them responsibly.

Editor Malori Malone contributed to this article.