Key Takeaways of How To Tell If a Provider Is Legitimate

- Verify the financial strength of the issuing insurance company by checking ratings from agencies like AM Best, S&P Global, and Moody’s.

- Assess the advisor or broker’s credentials by confirming they hold necessary licenses, such as an insurance license, and by looking for reputable designations like CFP® or RICP®.

- Examine the company’s transparency and reputation by reviewing independent customer feedback for any red flags, ensuring all fees are clearly disclosed, and confirming that the advisor provides multiple options without using high-pressure sales tactics.

Parties in an Annuity Contract

It is important to define all the parties involved in an annuity contract. There are four main parties: the owner, the annuitant, the beneficiary and the issuing insurance company. When looking for a reliable annuity provider, acknowledge a fifth party — the advisor/broker selling the annuity. Understand who is responsible for what when looking for a legitimate annuity provider.

Owners and Annuitants

The owner of an annuity is the person who makes the initial investment, decides when to take income and can change parts of the contract (like the beneficiary designation) at their discretion. This can be an individual or another entity (trust or business).

The annuitant is an individual whose life serves as the measure to determine the benefits paid under the contract. Often you will see the owner and the annuitant are the same. However, the definition requires that the annuitant be an individual.

Beneficiary

Like in a life insurance policy or a 401(k) plan, the beneficiary receives any death benefit when another party dies. The beneficiary cannot alter any features, make any withdrawals or change the settlement options or starting date of payments. The beneficiary can be an individual, trust or other entity.

Issuing Insurance Company (Annuity Provider)

The issuing insurance company manufactures and issues the annuity contract, and is obligated to pay the benefits outlined in the contract. The company decides the options and features available, including interest rates, investment options, crediting policies and fees.

Broker (Annuity Provider)

The broker (or advisor) is a financial professional representing the issuing company and is responsible for selling the annuity and ensuring the product is suitable for the investor. Depending on the annuity, they will have an insurance license and possibly a securities registration. They generally receive a commission for their work.

Choosing an annuity provider is as important as choosing the right type of annuity for your situation. Having the right company standing behind the financial obligations of your income will mean you can be confident in the guarantees on your money.

What Are the Qualities of a Good Annuity Provider?

Since annuities can be a large investment, it is important to understand who is handling your money. Some qualities that can indicate a trustworthy annuity provider include a strong financial strength rating, great independent reviews, clearly disclosed fees and transparent/qualified brokers.

Positive Independent Reviews

A quality issuing company will have a majority of positive reviews. If you see any red flags in the reviews like hidden fees, or difficulty withdrawing funds, it may be best to steer clear.

Clear Statement of Fees

A good issuing insurance company will clearly and simply state all the annuity’s fees. It is tempting to go with the annuity that has the lowest fees, however, it may be better to ensure that you are receiving outsized value for the fees you pay.

It may be the case that an annuity provider that has a higher fee structure is better for you than one with the lowest fees. So, it is important to look at the fees and the benefits provided by the annuity to ensure there is sufficient value.

Transparent Broker or Advisor

A good broker/advisor for annuities will present multiple options and clearly explain the different benefits and fees of each annuity. They will also avoid high-pressure sales tactics.

You won’t hear them say that your annuity is about to expire or have a bait-and-switch technique where they entice you to come in about estate and trust planning, then shift the discussion to an annuity. If you feel pressured to move faster than you want, take a step back and reassess whether this advisor is right for you.

Fiduciary

It is also recommended to ask if the broker is a fiduciary. This means that they are required to act in your best interest. This is different from a requirement to recommend a “Suitable” investment, where the broker is only required to ensure that their recommendations are suitable to achieve your goals, but perhaps not the best product.

Designations & Licenses

Designations are common in the financial industry. But not all are created equal, and some mean very little to the competency of the broker/advisor. It is recommended to look for designations like CFPⓇ (Certified Financial Planner), CAS (Certified Annuity Specialist) and RICP (Retirement Income Certified Professional) when discussing options for annuities and retirement. Even then, ask the broker what these designations are and how they are relevant to helping you choose an annuity.

A broker is also required to have an insurance license in every state in which they operate for fixed and indexed annuities, and an insurance license and securities (investment) registration for variable annuities.

To see the history of your broker/advisor, use FINRA’s BrokerCheck.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Strong Financial Strength Ratings as an Indicator

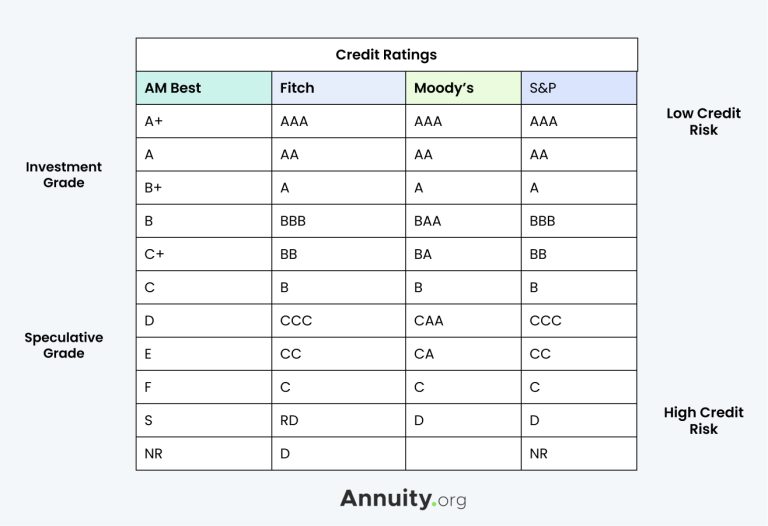

One of the best ways to check if the company issuing the annuity is legitimate is by checking its credit ratings. S&P Global Ratings, AM Best, Fitch and Moody’s are agencies that provide credit ratings for various companies.

Look for a Long History

The better the rating, the more financially secure the company. They are likely to maintain a positive relationship with the annuitant/owner and meet financial obligations, such as paying their debts and taking care of claims. Given the long-time horizon of annuities (at least 6-7 years to get past the surrender period itself), a company with a long history of strong financials is desired.

Check Ratings Continually

Some companies, like AM Best, update financial strength ratings every six months. If your research and timeline to buy an annuity spans several months, be sure to check a provider’s ratings at different points in the process.

How Ratings Are Calculated

When calculating credit ratings for an insurance or annuity company, net income, policyholder surplus and combined ratio are taken into account. The net income is the total earnings of the company and policyholder surplus is essentially the net worth of the company. The combined ratio refers to whether the company is making more in premiums than they are paying in claims.

If a provider has a credit rating near the top of this chart — like AAA, AA or A— they are likely reliable and trustworthy. They are likely to meet obligations.

If its rating is further down the alphabet and this chart — like C or CC — it might not be as legitimate. Companies with these ratings are likely financially vulnerable and your money may not be secure. Investing with these companies might not result in peace of mind. Changes in the economy or the underwriting process could have negative effects on the provider and, if you invest with them, you.

Consider doing extensive research to see if you could trust a company that has a lower rating with your money and future investments.

Average Ratings of Legitimate Providers

The best annuity companies and providers often have the highest ratings.

Popular Annuity Providers and Credit Rating

- American National Insurance Company: A

- John Hancock: A+

- MetLife: A+

- Mutual of Omaha: A+

- New York Life: A++

- Nationwide: A+

- IAA: A++

Source: Credit ratings from AM Best

Be Aware of Common Annuity Scams

Unfortunately, there are bad actors in the annuity space looking to take advantage of the unsuspecting public, especially the elderly.

These annuity scams could include targeting terminally ill seniors to purchase an annuity, high-pressure tactics like “today-only deals” and contract signing bonuses, annuity twisting and secondary market scams. Look out for these phrases when finding an annuity provider.

Overwhelmed by Safe Retirement Options?

Who Can Help You Check a Provider’s Legitimacy?

If you need help checking the legitimacy of an annuity provider, there are many options:

Who To Contact

- Your state’s insurance department

- FINRA’s BrokerCheck

- A trusted financial advisor and fiduciary

You can also speak to friends and family members to see if anyone has any provider recommendations.

If you feel that you have been scammed, speak up. Talk to your state regulators and FINRA. Also, talk to an attorney about the best next steps.

Editor Samantha Connell contributed to this article.