Understanding the Present Value of an Annuity

Understanding the present value of an annuity allows you to compare options for keeping or selling your annuity.

It lets you compare the amount you would receive from an annuity’s series of payments over time to the value of what you would receive for a lump sum payment for the annuity right now.

Key Facts About Calculating the Present Value of an Annuity:

- You will get more money for annuity payment streams the sooner the payment is owed. For example, annuity payments scheduled to pay out in the next five years are worth more than an annuity that pays out in the next 25 years.

- Most states require annuity purchasing companies to disclose the difference between the present value of your future payments and the amount they offer you.

Annuity Payments Over Time vs. One Lump Sum Payment Now

“The present value of an annuity is affected by factors such as the interest rate used to discount future payments, the number and amount of payments and the timing of the payments,” Rhett Stubbendeck, CEO of LeverageRX, told Annuity.org.

It’s critical that you know these amounts before making financial decisions about an annuity. There are formulas and calculations you can use to determine which option is better for you.

Present Value and the Discount Rate

Factoring companies, or companies that will buy your annuity or structured settlement, use discount rates to account for market risks such as inflation and to make a small profit for granting you early access to your payments. A discount rate directly affects the value of an annuity and how much money you receive from a purchasing company.

Standard discount rates range between 9% and 18%. They can be higher, but they usually fall somewhere in the middle. The lower the discount rate, the higher the present value. Low discount rates allow you to keep more of your money.

According to the Internal Revenue Service, most states require factoring companies to disclose discount rates and present value during the transaction process. Always ask for these numbers before you agree to sell your payments so you’ll understand exactly what you’re giving up

State and federal Structured Settlement Protection Acts require factoring companies to disclose important information to customers, including the discount rate, during the selling process.

It’s also important to note that the value of distant payments is less to purchasing companies due to economic factors. The sooner a payment is owed to you, the more money you’ll get for that payment. For example, payments scheduled to arrive in the next five years are worth more than payments scheduled 25 years in the future. Keep this in mind during the selling process.

Need to Sell Your Annuity for Cash Immediately?

Understanding Interest Rates and the Time Value of Money

The present value of an annuity is based on a concept called the time value of money — the idea that a certain amount of money is worth more today than it will be tomorrow. This difference is solely due to timing and not because of the uncertainty related to time.

Simply put, the time value of money is the difference between the worth of money today and its promise of value in the future, according to the Harvard Business School.

Payments scheduled decades in the future are worth less today because of uncertain economic conditions. In contrast, current payments have more value because they can be invested in the meantime.

That’s why $10,000 in your hand today is worth more than $10,000 over the next 10 years.

If you own an annuity or receive money from a structured settlement, you may choose to sell future payments to a purchasing company for immediate cash. Getting early access to these funds can help you eliminate debt, make car repairs, or put a down payment on a home.

Companies that purchase annuities use the present value formula — along with other variables — to calculate the worth of future payments in today’s dollars.

Formula and Calculation of the Present Value of an Annuity

Calculating present value is part of determining how much your annuity is worth — and whether you are getting a fair deal when you sell your payments.

To understand and use this formula, you will need specific information, including the discount rate offered to you by a purchasing company.

The information you need when using the present value formula:

- The dollar amount of each fixed payment

- Number of payments you want to sell

- Discount rate

You can plug this information into a formula to calculate an annuity’s present value.

Present value calculations are influenced by when annuity payments are disbursed — either at the beginning or at the end of a period. Payments disbursed at the end of a period are called “ordinary annuities” while payments disbursed at the beginning of a period are called an “annuity due.”

Formula and Calculation of the Present Value of an Ordinary Annuity

An ordinary annuity is typical for retirement accounts, from which you receive a fixed or variable payment at the end of each month or quarter from an insurance company based on the value of your annuity contract.

To calculate the present value of an ordinary annuity, use this formula:

Formula legend:

- PVOA = Present value of an annuity stream

- PMT = Dollar amount of each annuity payment

- r = Discount rate or interest rate

- n = Number of periods in which payments will be made

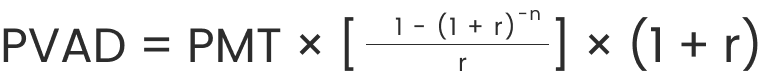

Formula and Calculation of the Present Value of an Annuity Due

Annuity due refers to payments that occur regularly at the beginning of each period. Rent is a classic example of an annuity due because it’s paid at the beginning of each month.

To calculate the present value of an annuity due, use this formula:

Formula legend:

- PVAD = Present value of an annuity due

- PMT = Cash payment per period

- r = The annuity’s interest rate

- n = Number of payments from the annuity

Interested in Selling Annuity or Structured Settlement Payments?

Using an Online Calculator To Determine an Annuity’s Present Value

Many websites, including Annuity.org, offer online calculators to help you find the present value of your annuity or structured settlement payments. These calculators use a time value of money formula to measure the current worth of a stream of equal payments at the end of future periods.

Simply enter data found in your annuity contract to get started. In just a few minutes, you’ll have a quote that reflects the impact of time, interest rates and market value.

What you’ll need to use our calculator:

- Payment type

- Date of next payment

- How much each payment is worth

- Number of payments remaining

- How frequently you receive payments

This estimate is a great first step. It gives you an idea of how much you may receive for selling future periodic payments.

However, it isn’t perfect.

Learning the true market value of your annuity begins with recognizing that secondary market buyers use a combination of variables unique to each customer.

That’s why an estimate from an online calculator will likely differ somewhat from the result of the present value formula discussed earlier.

Secondary market buyers consider other variables, including:

- Fees and extra charges

- Current annuity market rates

- Specific company guidelines

- Amount of money left in your annuity

- When annuity payments began

Use your estimate as a starting point for a conversation with a financial professional. Discuss your quote with one of our trusted partners, who can explain the present value of your payments in more detail.

It’s also important to keep in mind that our online calculator cannot give an accurate quote if your annuity includes increasing payments, or a market value adjustment based on fluctuating interest rates.

Email or call our representatives to find the worth of these more complex annuity payment types.

Let’s Talk About Your Financial Goals.

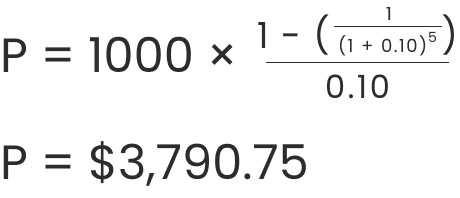

Present Value of an Annuity Example

Let’s say your structured settlement pays you $1,000 a year for 10 years.

If you keep all your payments, you will eventually receive $10,000.

But what if you lose your job and need more than $1,000 a year to cover your expenses?

Let’s assume you want to sell five years’ worth of payments, or $5,000, and the factoring company applies a 10 percent discount rate.

In this example,

- PMT= $1,000

- r = 10%, represented as 0.10

- n = 5 (one payment each year for five years)

Therefore, the present value of five $1,000 structured settlement payments is worth roughly $3,790.75 when a 10% discount rate is applied.

If you simply subtract 10% from $5,000, you would expect to receive $4,500. However, this does not account for the time value of money, which says payments are worth less and less the further into the future they exist. That’s why the present value of an annuity formula is a useful tool.

Factors That Affect the Present Value of an Annuity

There are several factors that can affect the present value of an annuity. Most of these are related to the annuity contract dealing with interest rates, guaranteed payments and time to maturity. But external factors — most notably inflation — may also affect the present value of an annuity.

- Interest Rates

- An annuity’s interest rate is used to discount future payments. The discount rate reduces future cash flow from the annuity. So, the higher the interest rate is, the lower the annuity’s present value will be.

- Payment Amount and Frequency

- Since the present value of an annuity is the value of future payments, the more payments you have and the higher each payment is, the greater your present value will be.

- Time to Maturity

- This is the time until payments are received from the annuity. The longer the wait until payments are received, the more time it has for compound interest to build value in the annuity. This longer time period will increase the annuity’s present value.

- Inflation

- Inflation or other external factors can erode the future value of an annuity. When you take inflation into account, it can reduce the present value of an annuity.

Factors That Affect Present Value

Why Is Knowing the Present Value of an Annuity Important?

It’s critical to know the present value of an annuity when deciding if you should sell your annuity for a lump sum of cash.

“Knowing the present value of an annuity is important because it allows you to understand the value of future payments in today’s dollars,” Stubbendeck said. “This knowledge can help with financial planning, investment decisions and assessing the overall value of the annuity.”

- 1. Understanding the Value of Future Payments

- The present value of an annuity represents the value of the future payments you will receive in today’s dollars. By calculating the present value of your annuity, you can determine how much your future payments are worth in today’s money and make informed financial decisions.

- 2. Evaluating Offers To Sell Your Annuity

- If you are considering selling your annuity, understanding its present value can help you evaluate offers from buyers and determine whether they are fair and reasonable.

- 3. Making Retirement and Financial Planning Decisions

- The present value of an annuity is a key factor in retirement and financial planning. By knowing the present value of your annuity, you can plan your retirement income and make informed decisions about your future finances.

- 4. Understanding Tax Implications

- Knowing the present value of your annuity can also help you understand the tax implications of selling or holding onto your annuity. Depending on the situation, selling an annuity can result in a tax liability, and understanding the present value can help you determine the tax consequences of selling.

4 Reasons You Need To Know the Present Value of an Annuity

Join Thousands of Other Personal Finance Enthusiasts

Present Value of an Annuity FAQs

Annuity calculators, including Annuity.org’s immediate annuity calculator, are typically designed to give you an idea of how much you may receive for selling your annuity payments — but they are not exact.

The actual value of an annuity depends on several factors unique to the individual who’s selling the annuity and on the variables used for the buying company’s calculations.

The present value of an annuity represents the current worth of all future payments from the annuity, considering the annuity’s rate of return or discount rate. Put another way, the present value of an annuity is the amount you’d have to put into an annuity now to get a specific amount of money in the future.

The future value of an annuity is the total amount of money that will build up over time, including all payments into the annuity and compounded interest over its lifetime.

Together, these values can help you determine how much you need to put into an annuity to generate the types of income streams you want to get out of it.

As an example, let’s say your structured settlement pays you $1,000 a year for 10 years. You want to sell five years’ worth of payments ($5,000) and the secondary market buying company applies a 10% discount rate.

Using the formula on this page, the present value (PV) of your annuity would be $3,790.75. This can give you a starting point when considering whether to sell your annuity.