The demand for long-term care (LTC) services is on the rise as the number of Americans over age 65 grows higher than ever before. Managing the aging population’s daily health and personal care needs on a long-term basis often falls to family members.

Annuity.org surveyed over 1,000 people to find out how much adult children know about their parent’s long-term care plans. Do they have long-term care insurance? Who will cover the cost of the services they need? These are just some of the questions we asked.

Results reveal that many people have not had these conversations with their loved ones, and the thought of taking care of them in later years stresses them out. We also discovered that many Americans are misinformed about the true costs of caring for aging family members.

Below, we’ll walk you through our findings, explain how you can take an active role in helping your parents plan and the steps to setting up long-term care insurance for your parents.

Key Findings:

- 28% of Americans have no idea if their parents have long-term care insurance.

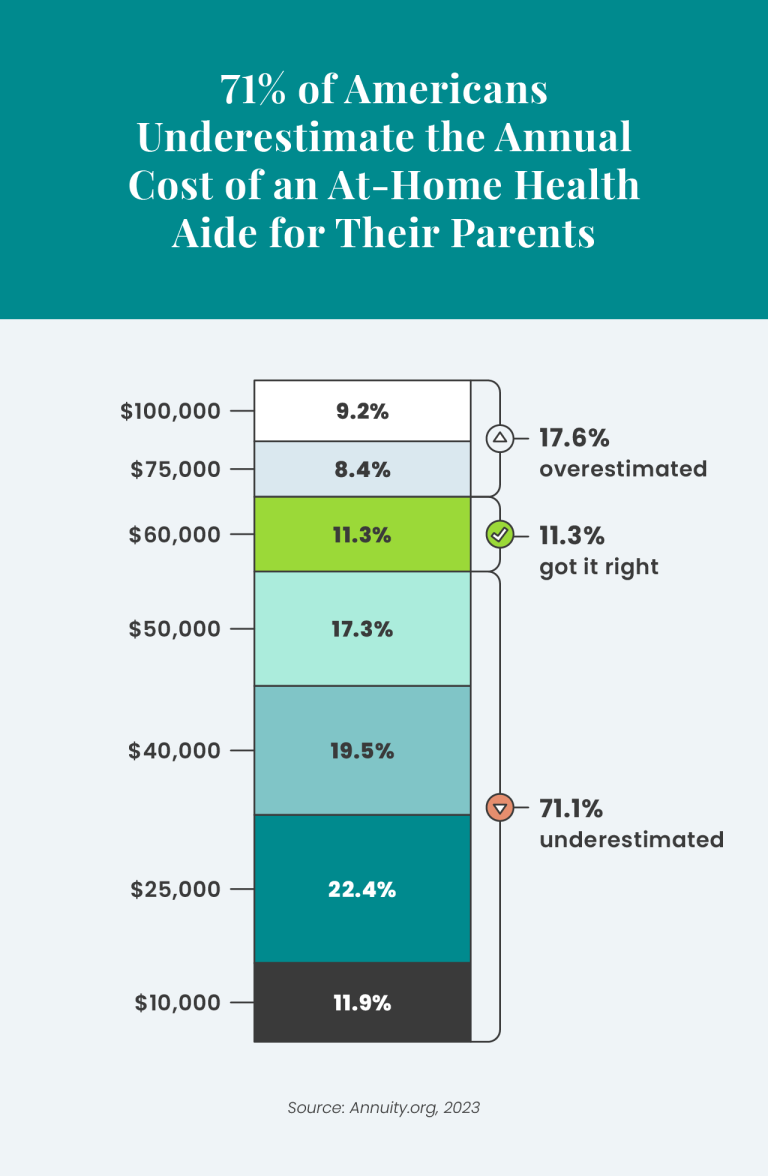

- 71% underestimate the annual cost of an at-home health aide.

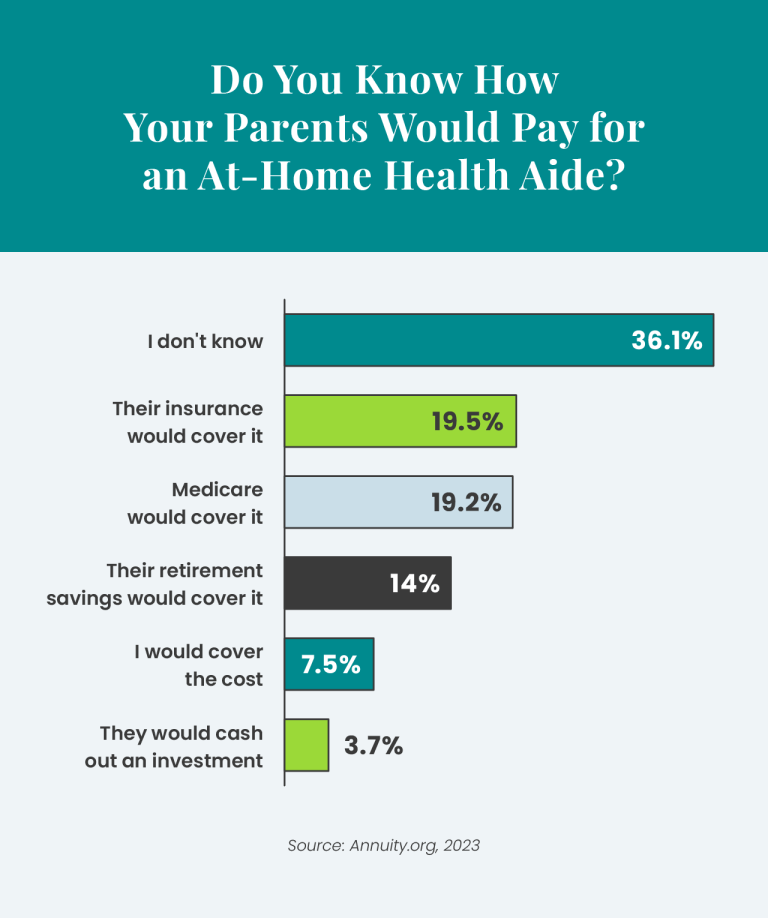

- 36% don’t know how their parents will pay for needed in-home care services.

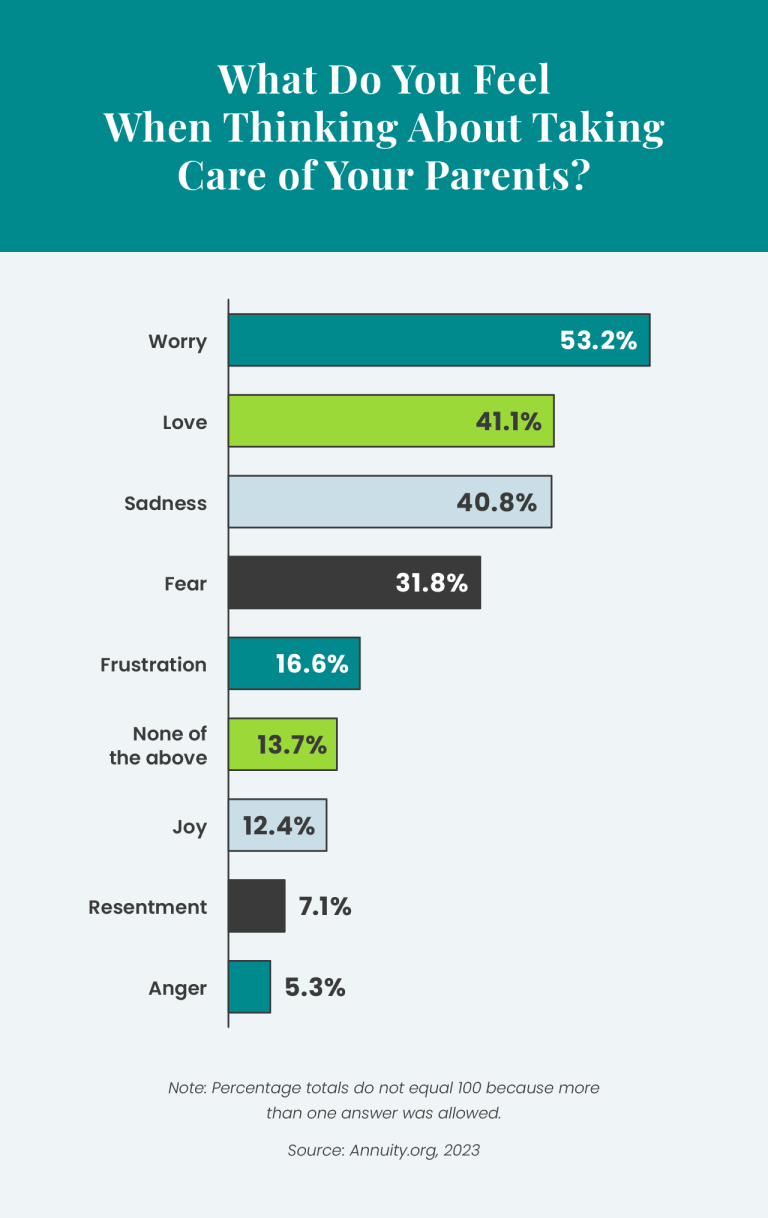

- 53% feel anxious about having to care for their aging parents.

American Families Are Not Prepared for Long-Term Care

Long-term care statistics show that more than 50% of people over 65 will most likely need significant — and costly — long-term services and support. With the need so high, it’s startling that 28% of Annuity.org’s survey respondents don’t know if their parents have a long-term care insurance policy. Of the people who were unsure, women seemed to be in the dark more often, representing 58% of those respondents compared to 41% being men.

When asked to estimate the potential financial burden for some of the care older adults may require, we discovered that most Americans are unaware of the potential costs they could be facing. 71% of respondents underestimated the annual cost of an at-home health aide. Only 11% selected the correct answer of approximately $60,000. According to the Genworth Cost of Care Trends & Insights, the 2021 median yearly cost of in-home care in the U.S. was $61,776 for a Home Health Aide.

Unfortunately, many people will either not start, or prematurely stop, necessary long-term care planning conversations based on what they consider a too distant need or a too immediate expense.

However, in doing so, they don’t realize that this need can come instantly and the future expense can be exponentially larger than any long-term care insurance policy or related planning may cost at present. Failure to have discussions and make plans for such care can ultimately lead to unbearable financial, emotional and physical burdens for both the individuals needing care as well as their loved ones.

1 in 3 Have No Idea How Their Parents Will Cover LTC Costs

Just over 36% of respondents replied with “I don’t know” when asked if they knew how their parents would pay for an at-home health aide if they needed one right now. Adults ages 30-44 were most likely to be unclear on what their parents would do to manage these costs, representing 34% of the people who selected this answer.

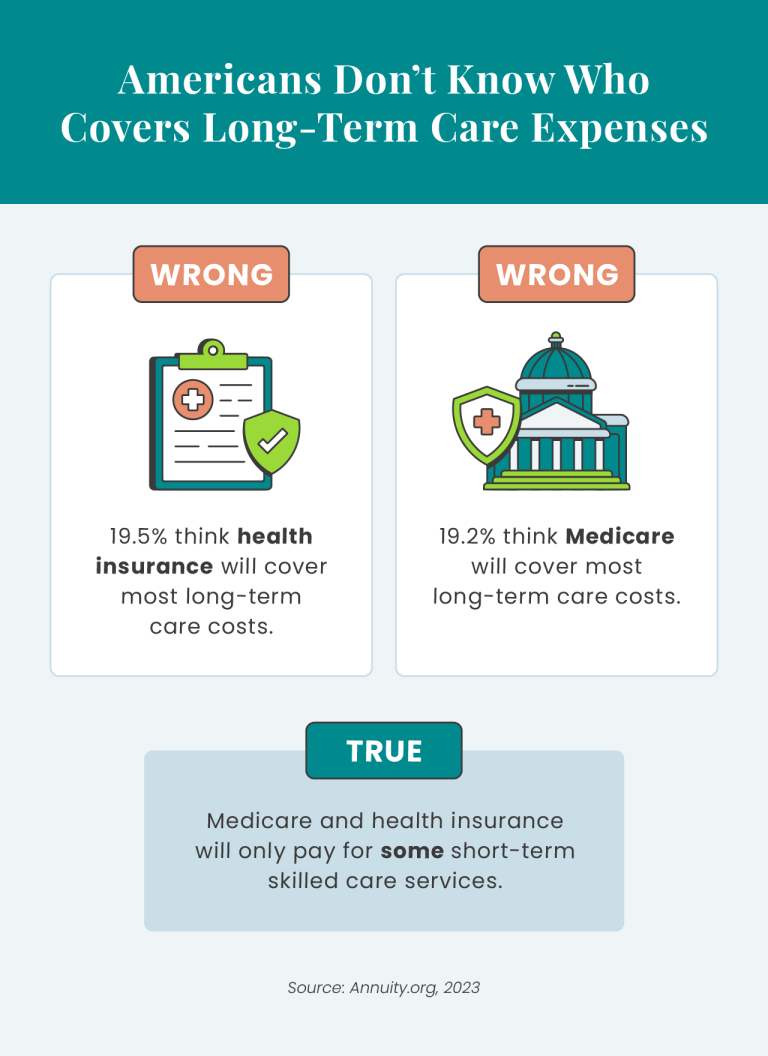

The survey results also revealed a knowledge gap regarding who is responsible for the costs associated with long-term care. Almost 20% of respondents mistakenly assumed traditional health insurance would cover these costs, while another 19% mistakenly assumed it would be Medicare’s burden. In truth, both Medicare and most private health insurance only cover some limited LTC services.

53% Are Worried About Caring for Aging Parents

Caring for aging family members is a responsibility intertwined with many emotions. We asked respondents about the feelings that come up when they think about caring for their parents in their elder years, and the most common emotion was worry. Over half of people surveyed (53%) are worried about helping their parents navigate their senior years. Perhaps that’s less surprising based on the potential financial challenges we just discussed.

The other emotions this question brought up most often were love and sadness, both selected by 41% of respondents. The thought of giving back to our parents by taking care of them can easily stir up strong sentiments of love. And the thought of eventually losing our parent or parents keeps the sadness close by.

Is Long-Term Care Insurance for Your Parents Necessary?

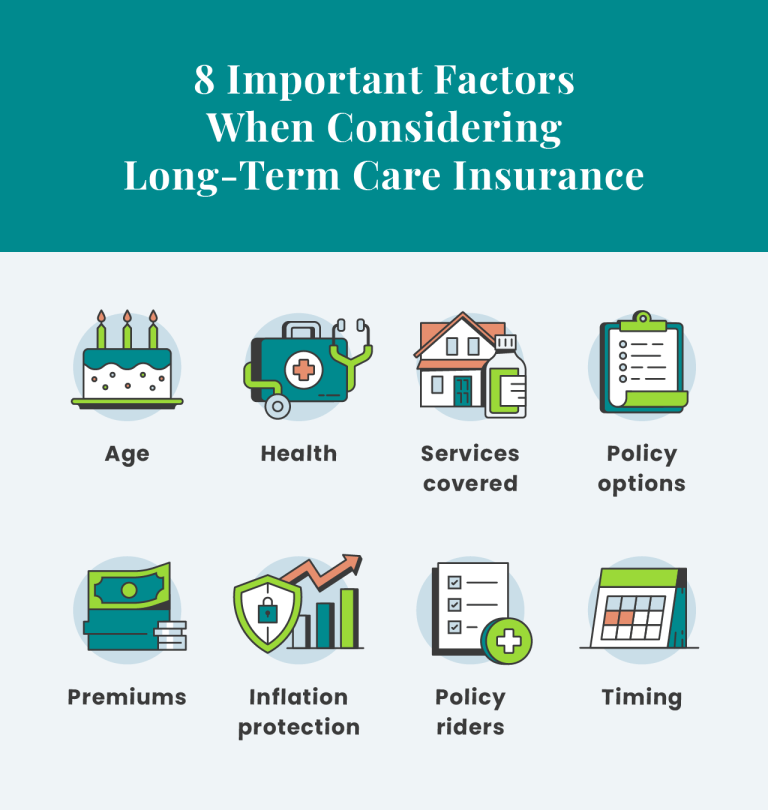

Recognizing it’s time to start talking to your parents about their long-term care is an important step toward ensuring their financial and emotional well-being during their retirement years. To determine if long-term care insurance suits them, you and your parents should carefully evaluate several key factors.

Their Age and Health

Generally, the older your parents are, the more likely they may require long-term care. Their overall health is a critical factor to consider as well. If your parents have a history of chronic illnesses, it may increase their chances of needing long-term care sooner. Join them for consultations with their healthcare providers to get a clearer picture of their health outlook.

Coverage Options and Benefits

Policies can vary widely in terms of what they cover and the benefits they provide. Research different policies and providers to find one that aligns with your parents’ specific needs and budget.

Affordability

Long-term care insurance premiums can be expensive, so it’s essential to consider your parents’ financial situation. Familiarize yourself with their monthly and annual budgets to see if they can comfortably afford the premiums. Remember that premiums tend to increase with age, so purchasing a policy when they are younger may be more cost-effective.

Inflation Protection and Policy Riders

Inflation can erode the value of your parents’ long-term care coverage over time. Look for policies that include inflation protection so the benefits keep pace with rising costs. Additionally, explore policy riders that can customize the coverage to better suit their specific needs. Long-term care riders like shared care, which allows spouses to share benefits, can be particularly valuable.

Knowing When To Buy

It’s usually more cost-effective to buy a policy when your parents are younger and healthier. Waiting until health issues arise could lead to higher premiums or even disqualification. Striking a balance between affordability and timing is the primary goal.

How To Buy Long-Term Care Insurance

In order to secure the best coverage for your family, you and your parents will need to work together to find the policy that suits their needs. These steps are a starting point for the journey.

1. Assess Your Parents’ Needs

Start by evaluating your parents’ health, finances and potential care requirements. Take into account their age, existing health conditions and financial resources. This initial assessment will guide you in figuring out the right coverage and budget.

2. Compare Policies

Explore multiple long-term care insurance providers and compare their policies. Look for reputable companies known for good customer service and financial stability.

3. Choose the Coverage Type

Decide on the type of care coverage your parents need, such as in-home care, assisted living or nursing homes. Opt for a policy that matches their specific needs and preferences.

4. Understand Policy Features

Be sure to thoroughly read and comprehend all of the policy features, including benefits, waiting periods and any additional options. Consider factors like inflation protection to ensure coverage keeps up with rising costs.

5. Get Multiple Quotes

Request quotes from various insurance providers to compare premiums and terms. Prepare to share your parents’ health history and relevant information for accurate quotes.

6. Consult a Professional

Connect with a financial advisor or insurance specialist experienced in long-term care planning. Their expertise can help you navigate complex policies and make more informed decisions.

Many people are unaware of the details of their parents’ plans, which can lead to unexpected challenges down the road. By opening up conversations, seeking professional guidance and taking proactive steps like securing long-term care insurance for your parents, you can help them navigate the complexities of long-term care planning with confidence. Remember, it’s an act of love and responsibility that can provide peace of mind for your entire family’s future.

Methodology:

The survey of 1,074 U.S. adults 18+ was conducted via SurveyMonkey Audience for Annuity.org on September 5, 2023. Data is unweighted, and the margin of error is approximately +/-3% for the overall sample with a 95% confidence level.