In addition to planning your retirement finances, you should consider how you want to live as a retiree. What kind of lifestyle is going to suit you in your golden years?

What are your retirement goals? Do you want to be traditional, or do you want to chart your own course? Would you prefer to relax, or are you itching to be as active as possible?

Your decisions about what to do in retirement should chart a path toward financial security and physical and mental health.

If it suits you, for example, you can spend time with the grandchildren and just revel in being a grandparent. If you would be happier starting a whole new career, maybe you could try being a consultant or selling your craftwork. Or you could just pursue leisure, hitting the golf course or dropping a towel on the beach.

Some retirees choose gardening, going to the track or tinkering with projects around the house. Travel is always an option. Volunteer work or going back to school can be especially rewarding for others.

Successful Aging

Researchers in Norway identified important factors in successful aging — that is aging with good mental and physical functioning and freedom from chronic disease.

Their main conclusions: keep active and don’t smoke.

The researchers, whose survey results were published in PLOS ONE in July 2019, followed up with 4,497 participants 22.6 years after they’d responded to a population-based health survey. The average age of respondents at the time of the survey (2006 to 2008) was 52.7 years.

The researchers identified the following lifestyle predictors of successful aging:

- Smoking

- Physical activity

- Alcohol consumption

- Obesity

- Social support

According to the study, the participants who met all the criteria for successful aging “were more likely to be women (p<0.001), younger (p<0.001), and to have a higher level of education (p<0.001) compared to those meeting no SA criteria.”

In the United Kingdom, research from the University of Exeter Medical School revealed that adhering to a healthy lifestyle lowers the risk of dementia in older adults who are cognitively healthy.

How Americans Plan to Spend their Retirement

Retirement is what you make of it — as long, that is, as your health and your bank account cooperate.

And don’t be surprised if you surprise yourself.

One senior living community company, Provision Living, surveyed 2,000 Americans between the ages of 22 and 74 about their dream retirement.

The survey found that baby boomers who responded preferred to retire in a home of 1,510 square feet while millennials wanted a little more space, or 1,890 square feet. Boomers thought they needed to have $574,000 saved up to enjoy retirement, while millennials said they needed $687,000.

Boomers reported that their dream retirement age is 64, while millennials dream of retiring at 56.

The surveyors defined millennials as those born between 1981 and 1996. Baby boomers were born between 1944 and 1964. Survey respondents were spread across all ages, with the highest numbers being younger.

Grouped together, the survey queried roughly 1,100 millennials and approximately 360 boomers, with the remaining respondents born between 1964 and 1981.

The same percentage of total respondents — 53 percent — said they will have more sex in retirement as said they will work part-time. And 68 percent planned to volunteer.

Nearly 35 percent said they plan to travel in retirement, while 21 percent said they would spend time with family. More than 14 percent planned to pursue relaxation and leisure, while almost 10 percent planned to spend time on hobbies.

Is An Annuity Right For You?

Unusual Retirement Living

Golfing and spending time with the grandchildren might not be for you. You might be more interested in living an unconventional retirement life.

You might decide to live out your years sailing on a cruise ship. And you won’t be the only senior to take up residence on an ocean liner.

Maybe you’ve always felt the pull of the open road. You’re going to get a trucking license and hit the road, getting paid to see the country.

There are also unconventional retirement communities for people with shared interests, such as star gazing or the arts. People with boats and airplanes can also find communities for fellow travelers.

Jobs for Retirees

Researchers say that social connections are vital to a healthy and happy retirement. For example, a review published in Ageing Research Reviews found that continuing to participate in a community may be a strategy to reduce the risk of mild cognitive impairment and dementia.

Getting a job is one way to fulfill that goal and enhance your finances at the same time. In fact, semi-retirement is becoming a preferable option for many seniors.

Maybe your job was fulfilling, and you’re going to miss it. The interactions with people are hard to give up. Solving problems and helping others made you feel important.

And some research has found that retirees are about two times as likely to experience depression symptoms as working people. Reasons include financial struggles, loneliness and boredom experienced by some retirees.

According to the Bureau of Labor Statistics, the number of seniors in the workforce declined in 2018 after years of increases among people aged 65 to 74. The BLS had not released full workforce participation numbers for the COVID-19 pandemic years as of 2022.

Labor Force Participation Rate

| Age Group | 2001 | 2011 | 2018 |

|---|---|---|---|

| 55 and older | 33.2% | 40.2% | 38.4% |

| 55 to 64 | 60.4% | 64.2 | 64.6% |

| 65 to 74 | 19.7% | 26.4% | 25.8% |

Government analysts expect the trend to continue through 2024, while workforce participation for most other age groups is not expected to change.

Officials say the reasons for this are varied. In addition to being healthier and having a longer life expectancy than previous generations, today’s retirement-age adults are better educated and, therefore, more likely to continue working. Changes to Social Security and other financial challenges also contribute to the need for seniors to generate income.

Some retirees continue in their previous career, ratcheting down their hours or serving as a consultant, freelancer or mentor.

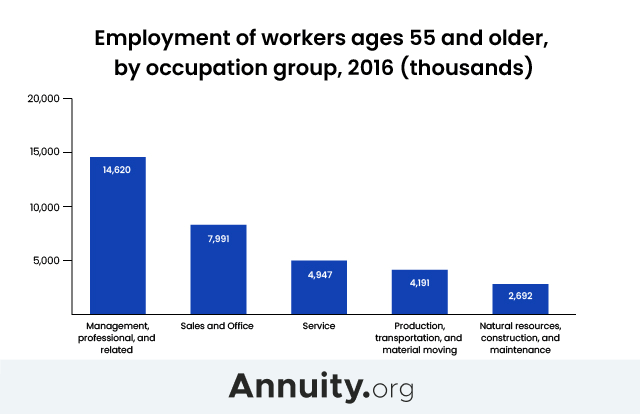

According to government statistics, the largest concentration of jobs held by seniors falls into the category of “management, professional and related occupations.”

Many seniors choose to run for office, and workers aged 55 and older make up at least 33 percent of bus drivers, archivists, jewelers, property managers, realtors and travel agents.

Where to Retire

One decision you’ll make is where to retire. Since you’re no longer tethered to your job, you can choose whether to move or stay where you are. And if you move, you might relocate to a different city, state or country. You can live closer to family to have a better retirement living environment or to pursue a different dream.

One expert says that it’s beneficial for older people to live among others their own age. Environmental gerontologist and social geographer Stephen Golant wrote on the University of Florida website that older Americans tend to stay put, with just 2 percent of older homeowners and 12 percent of renters moving each year.

When they do move, Golant wrote, older people avoid communities that skew younger. Significant numbers, he wrote, move into “age qualified” communities that exclude younger residents. These communities include active adult communities, age-targeted subdivisions and high-rise condominiums and low-rent senior housing.

While some advocates find this age segregation troubling, Golant said people naturally gravitate toward socializing with others of similar ages and experiences.

“In fact,” Golant wrote, “studies show that when older people reside with others their age, they have more fulfilled and enjoyable lives. They do not feel stigmatized when they practice retirement-oriented lifestyles. Even the most introverted or socially inactive older adults feel less alone and isolated when surrounded with friendly, sympathetic, and helpful neighbors with shared lifestyles, experiences, and values — and yes, who offer them opportunities for intimacy and an active sex life.”

In addition, when older people live in senior communities, it’s easier for service providers and government officials to identify and respond to their needs. This helps them avoid having to move into nursing homes.

Most American Retirees Plan to Stay in the United States

Nearly 79 percent of respondents in the Provision Living survey said they planned to live in the United States, while a little more than 21 percent said they planned to live abroad. For that second group, Italy was the top choice.

Among those who said they would stay in the United States, the top cities were:

- Miami

- San Diego

- Denver

- New York

- Orlando

A lot of factors weigh into picking the right location.

After a pressure-filled career, you might want to kick back and relax. Catch up with some reading and just take a deep breath and enjoy your surroundings.

Read More: Essential Retirement Statistics for 2023