Partial Sale: Selling Several Future Payments

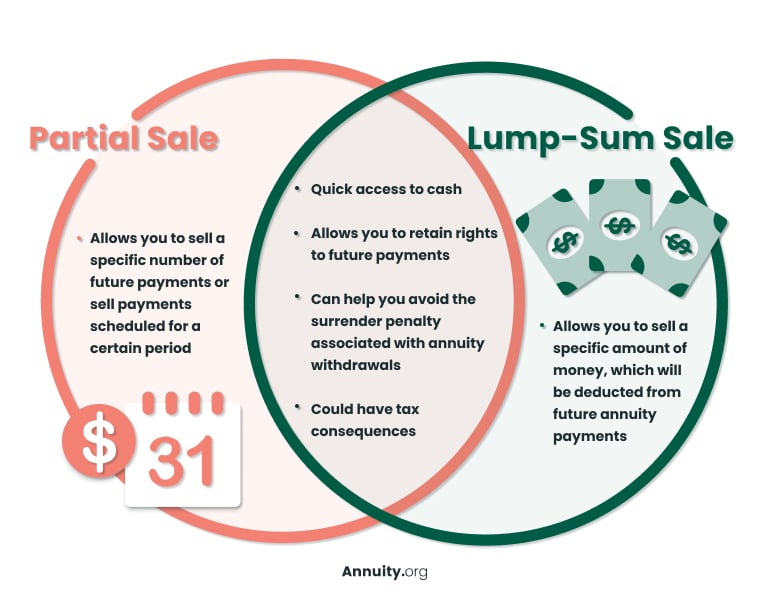

In a partial sale, you can sell a specific number of future payments or sell the payments that are scheduled for a certain period.

As an example of a partial sale based on a timeframe, say you bought a 15-year period certain annuity, but you need enough money now for a down payment on a house. You could sell one to three years of payments in exchange for cash. For those three years, you won’t receive payments, but they will resume when the period ends.

Key Facts About Partial vs. Lump-Sum Sales:

- Consider the costs associated with selling before cashing out your annuity.

- A lump-sum sale is sold by a specific dollar amount, and a partial payment is sold by a number of payments or payments within a certain time period.

- Selling the rights to your future payments can help you avoid withdrawal consequences and penalties.

As an example of a partial sale based on a designated number of payments instead of a timeframe, let’s say your structured settlement annuity pays out $1,000 per month and an additional $5,000 every year for 20 years, and you decide to go back to college. To finance the tuition, you could sell your first five annual payments, in which case you wouldn’t receive payments until year six.

The term “lump sum” is used to refer to the single cash payment you’ll receive when you sell your payments in a partial sale. This should not be confused with a lump-sum sale, which also provides a single payment — a lump sum — in exchange for a deduction from future payments.

A partial sale allows you to avoid the surrender penalty associated with annuity withdrawals.

Partial selling rules vary depending on the type of annuity you have, how many payments you’ve received, which payments you’re looking to sell and when the disbursement period ends. Reach out to a licensed financial advisor before completing a partial annuity sale to ensure you’re making a wise financial decision.

Read More: Cashing Out Your Annuity Payments

Lump-Sum Sale: Selling a Dollar Amount of Your Settlement or Annuity

Lump-sum sales allow you to receive a specific amount of money — $20,000, for example — instead of a certain number of payments that might not equal the amount you need. You’ll receive a specific dollar amount, which will be deducted from future annuity payments.

The factoring company overseeing the lump-sum sale will charge a discount rate. Make sure to account for the discount rate when requesting a specific dollar amount.

For instance, say you need $85,500 to move your parents into a nursing home. If the factoring company you work with uses a discount rate of 10%, then you will need to sell $95,000 of your annuity.

Discuss your options with the factoring company that purchases your annuity. And keep in mind that it’s always preferable to sell only what you need. This will mitigate your financial loss.

Need to Sell Your Annuity for Cash Immediately?

Comparing a Partial and Lump-Sum Sale

Partial and lump-sum sales have a lot in common: They both allow access to cash, retention of your future payment rights and the ability to avoid annuity withdrawal penalties, and they both have potential tax consequences.

So, you may be wondering which is the best option for you. If you need an exact dollar amount, consider a lump-sum sale. If you can last a specific number of years or number of payments without your annuity’s income, consider a partial sale.

There is a third solution if neither the partial-sale or lump-sum option fits your needs — you can choose to sell your entire annuity.

Selling Your Annuity in Its Entirety

You can sell the full value of your annuity contract. Doing so will liquidate the asset, and you will no longer retain the rights to any future income payments.

The cash you receive for selling your entire annuity will be less than if you kept your original payment schedule. You should only consider selling your entire annuity if you have a dire need for a large amount of cash or no longer need to rely on the steady payment stream of your annuity.

When it comes to structured settlement annuities, partial sales are more common than selling the entire annuity.

Taxes on Annuity Sales

The money you collect from selling an annuity can have tax consequences, according to the U.S. Securities and Exchange Commission. Whether you pay taxes on payment sales depends on the tax status of the annuity.

Just as with annuity withdrawals, when you sell payments from an annuity that was purchased with after-tax money, taxes are applied only to interest and earnings. For example, if you buy a $50,000 fixed or variable annuity and the value grows to $75,000, the first $25,000 you sell is taxable. The remaining $50,000 is not subject to taxes.

The Periodic Payment Settlement Act and Internal Revenue Code Section 130 allow tax exemptions for structured settlements, making it unlikely for you to have to pay taxes on a structured settlement annuity sale.

Selling Additional Payments

One of the biggest advantages to selling a part of your payments is the ability to sell more in the future if needed.

If you’ve already sold a portion of your payments but another financial emergency arises, you have the option of selling additional payments.

As long as you have not depleted your annuity funds, you can make as many transactions as you need to. But keep in mind that each new transaction will result in additional fees.

Interested in Selling Annuity or Structured Settlement Payments?

Partial and Lump-Sum Annuity Sale FAQs

If you have an urgent need for cash, it could be worthwhile to sell a part or all your annuity. However, a secure stream of income is typically more beneficial than a quick lump sum. Make sure to consult with a financial advisor before selling your annuity payments.

The factoring company will send you your money as agreed. If you sold only a portion of your payments, you would still receive income payments as specified in the terms of your agreement.

Once you decide to sell your payments, the factoring company will handle the paperwork and send you a lump sum in exchange for the rights to your payments.

You only need court approval to sell an annuity if your contract is the result of a structured settlement.

The money you receive from selling a part of or all your annuity may be taxable. It would be in your best interest to discuss the potential tax consequences of a partial or lump-sum sale with a tax professional.