Leaving inheritance money for your heirs is a considerate act of generosity. However, if not handled carefully, it can be stressful and problematic. A study by Ameriprise Financial indicates that while 83% of people want to leave an inheritance, only 64% feel they are on track to do so.

This is largely due to the complexity of the task and the emotion it evokes. First, there is a lot of uncertainty regarding whether it’s better to gift the money now or bequeath it at death. Then, there’s self-induced pressure to leave at least an average inheritance. For many, there’s also stress associated with deciding how to divide the money amongst multiple heirs.

Key Facts About Inheritance

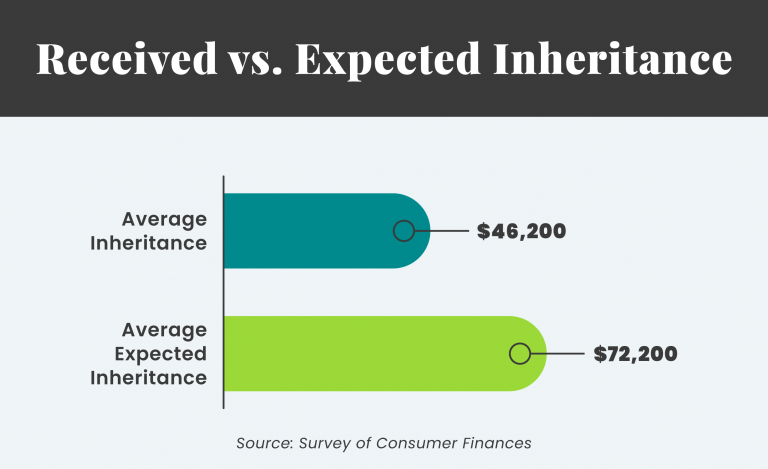

- Between 2016 and 2019, the average U.S. inheritance was $46,200 — with a big disparity between the top 1% ($719,000) and the bottom 50% ($9,700).

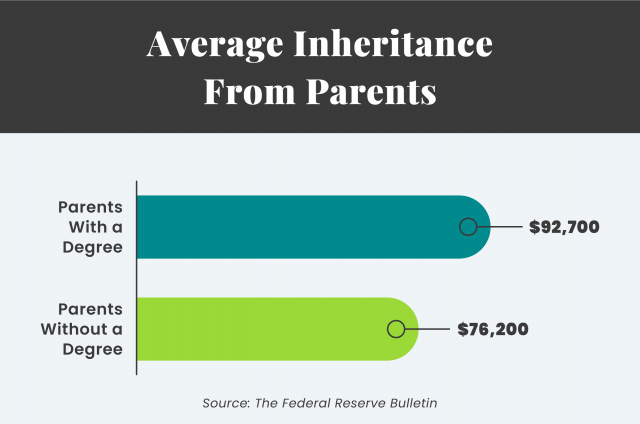

- Between 2016 and 2019, for those who received an inheritance, the median value received from families with a parent with a college degree was nearly $17,000 higher than the median value received from families without a parent that has a college degree.

- For 2023, the annual gift tax exclusion is $17,000 per person. The lifetime gift and estate tax exemption is $12.92 million.

What Is an Inheritance?

An inheritance is an asset or portfolio of assets passed from one individual to another, usually upon the death of the donor. Most inheritances are left for loved ones with the intent of helping them address financial challenges.

“Planning to give or receive an inheritance is a big responsibility and can require up-front planning to make sure it is handled well,” Certified Financial Planner™ professional Stephen Kates told Annuity.org. “For those giving, speak with an estate planning attorney or financial advisor to organize your assets and property for easier distribution. For those expecting an inheritance, plan for how to use the money to set yourself up for long-term financial success, not just short-term celebration.”

Average Inheritance in the U.S.

According to the latest survey conducted by the Federal Reserve, between 2016 and 2019, the average inheritance received in the U.S. was $46,200. The average for the wealthiest 1% of individuals surveyed was $719,000, while the average for the bottom 50% was only $9,700.

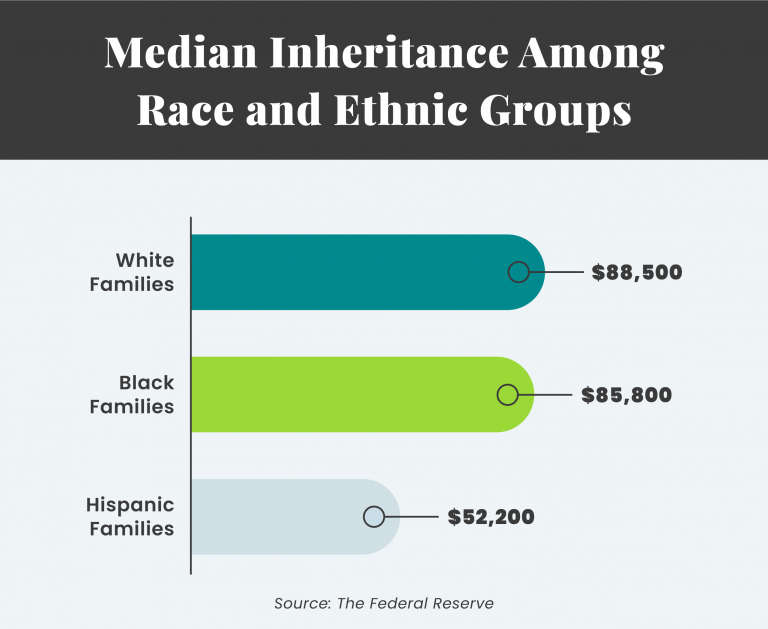

With regard to race and ethnicity, the survey produced the following data points:

- Median inheritance among white families was $88,500 (30% of participants received an inheritance)

- Median inheritance among Black families was $85,800 (10% of participants received an inheritance)

- Median inheritance among Hispanic families was $52,200 (7% of participants received an inheritance)

- Median inheritance among other families was $59,400 (18% of participants received an inheritance)

Inheritance From Parents

According to the most recent data available from the Federal Reserve, for individuals who received an inheritance, the median value received from families with a parent with a college degree was $92,700. This is $16,500 higher than the median value received from families that did not have a parent with a degree.

Data from the Organization for Economic Cooperation and Development (OECD) shows that inherited wealth has accounted for roughly 50% to 60% of total U.S. private wealth since the early 1900s.

Similarly, children of parents with a degree are more likely to expect an inheritance. Only 9.5% of individuals with parents without a college degree expect an inheritance, while 23.6% of individuals who have parents with a degree expect to receive bequeathed assets.

Taxes From Inheritance

Depending on the type of inheritance, taxes vary. Most of the time, inheritances are not subject to taxation. This is because the Internal Revenue Service permits a lifetime gift and estate tax exemption of $13.99 million as of 2025

In addition to the lifetime exemption, there is an annual gift tax exclusion. For 2025, this provision permits a gift exclusion of $19,000 per person per year. The person receiving the gift does not pay taxes on it. The donor is required to file a gift tax return and the amount greater than $19,000 is counted against their lifetime gift tax limit.

If you’re wrestling with the decision of whether to gift or bequeath assets to your loved ones, consult with a financial advisor or a tax professional. He or she can run some scenarios and help you decide on the best option.

Elevate Your Estate Planning with Annuities

What Is Considered a Large Inheritance?

The distinction between a large inheritance and a small inheritance varies widely from person to person. That said, an inheritance of $100,000 or more is generally considered large. This is a considerable sum of money, and receiving such a windfall can be intimidating, especially if you have limited experience managing excess funds.

Before spending it on a new sports car or vacation home, consider how you can make the most of your inheritance. Consider meeting with a financial advisor to go over your long-term options. An advisor can help you understand how much you should put toward debt obligations, how much to invest and how much to spend freely.

They can also advise you on whether purchasing an annuity for guaranteed income in the future is sensible.

What Is Considered a Small Inheritance?

Based on the same Federal Reserve survey, a small inheritance can be characterized as one that falls below the $46,200 average. That said, any inheritance is a blessing and should be graciously accepted, especially when considering how less than 30% of individuals receive one.

5 Tips for Leaving an Inheritance to Your Loved Ones

Planning to leave an inheritance is not an overnight process. First off, you need to determine how much to give to your heirs — be it a large, small or average inheritance. Then, you need to take time to consider who would benefit most by receiving your assets and how well each of your potential heirs handles money. This will help you determine the optimal way to transfer your assets.

1. Manage Your Expectations

The first step in planning an inheritance is to determine how much money to give to your heirs. This entails segregating your retirement savings from the assets you can afford to bequeath.

In doing so, be conservative. Hold on to enough money to avoid the risk of outliving your savings, which is known as longevity risk. This very real threat for retirees has been amplified by rising health care costs and other inflationary pressures.

Don’t overextend yourself because of a desire to be generous. Your loved ones should understand how challenging it can be to manage money, especially in retirement. If they don’t, talk to them about it. Doing so will help ease any anxiety you have about carving out an adequate amount of money for yourself.

Learn About How Annuities Can Bolster Your Retirement Strategy

2. Evaluate the Inheritor’s Understanding of Money

Before giving an heir $1 million dollars or even $50,000, make sure they won’t spend it without some thought and planning. To get a better feel for how your heir will handle a large sum of money, give them a test run with a few thousand dollars.

Observe if the heir invests the money, spends it or pays off debt. This will give you a good idea of how they might use larger amounts of money.

If the heir uses the money wisely, you could bequeath the full amount of the inheritance outright. However, if you doubt the heir’s judgment, you may choose to place the money in a trust or purchase a single-premium deferred annuity in their name.

If a test run isn’t feasible, ask yourself the following questions to get a better sense of your heir’s relationship with money:

- Do they spend money on a whim?

- Do they rely on debt?

- Do they have a stable job?

- Do they stick to a budget each month?

- Do they have money set aside for emergencies?

- Do they invest for the future?

3. Consider Your Options

While you can give an heir a lump sum of money, there are other ways to leave an inheritance.

- Basic trust account

- This is a legal arrangement, whereby the grantor empowers a third party, the trustee, to manage bequeathed assets on behalf of the heir in accordance with the grantor’s wishes.

- Roth IRA

- This is an investment account that offers tax advantages to the beneficiary

- Annual Cash Gift Installments

- Cash gifts can be distributed at regular intervals or annually on a special date. For 2025, gift proceeds totaling $19,000 per person are tax-exempt.

- Grantor Retained Annuity Trust (GRAT)

- This is a type of trust that allows the grantor to transfer wealth to an heir without using much, if any, of the lifetime gift and estate tax exemption. This is designed for very large inheritances.

- Annuity

- This is a financial instrument that can be customized to provide guaranteed income with annuity death benefits.

Consider the following options:

As outlined above, there are numerous ways to leave an inheritance for a loved one. The optimal approach varies from person to person, and formulating an estate plan is prudent.

“An estate plan is essential for everyone regardless of whether they have an inheritance to give,” said Kates.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

4. Manage Your Heirs’ Expectations

It’s easy for your heirs to get carried away when they think there’s a possibility of inheriting any type of asset. However, this can cause disappointment and frustration if you don’t set clear expectations ahead of time.

Consider what expectations they may have and have a transparent conversation with each heir. You don’t have to explicitly disclose what you’re giving to each individual and how much you’re giving to charitable organizations. However, it is important to set realistic expectations.

5. Communicate Clearly

Clear communication can eliminate confusion and hostility between loved ones after you’re gone. How you spend your money and to whom you leave it is up to you. However, if you are leaving an inheritance to multiple heirs and the amounts differ, you may want to provide them with some rationale. Offering some insight into your decision can go a long way.

When To Give Inheritance Money to Your Kids or Grandkids

Deciding when to give an inheritance depends on a variety of factors. Every situation is different and should be handled thoughtfully.

While determining when to leave an inheritance, be cautious of doing so before you pass away. Waiting to release assets until death can help you ensure you have enough money to live comfortably.

If you’re leaving an inheritance for multiple people, the timing could differ for each individual.

For example, if you plan to bequeath $1 million dollars to each of your two children, consider their circumstances, personalities and money management skills. If your older child struggles to maintain a job and is always asking for money, perhaps you should distribute his estate benefits over time. Alternatively, if your younger child has a history of successfully managing finances, you could give them a lump-sum inheritance.

Whether you’re leaving an above-average, below-average or average inheritance, plan it out carefully. You’ve worked very hard to accumulate wealth. Now, make sure it goes as far as possible to help your loved ones. As suggested above, tapping the assistance of a trusted financial advisor can help make the process run smoothly.