Fixed index annuities (FIAs) use interest rate spreads as a key pricing component to determine returns, balancing growth potential with security. Here’s a quick look at how they work and why they matter.

Key Facts About Fixed Index Annuity Rate Spreads

- Interest rate spreads are a pricing feature of fixed index annuities – insurance products that provide investors with limited upside potential coupled with the security of a downside guarantee.

- Like interest rate caps and participation rates, rate spreads restrict the growth potential of indexed annuities. These limiting features exist so that fixed index annuities can exist.

- Generally, the insurance company issuing a fixed index annuity sets a new interest rate spread each contract year. The higher the spread, the lower the potential return.

While rate spreads limit returns, they offer downside protection, making fixed index annuities a solid option for conservative investors. Next, let’s explore how these spreads compare to other pricing features, such as caps and participation rates, and how they affect your potential returns.

Fixed Index Annuities and the Role of Interest Rate Spread

According to the Financial Industry Regulatory Authority, fixed index annuities, which are also referred to as indexed annuities, are riding a notable wave of popularity. This is largely due to the balanced risk-return profile they offer investors.

A fixed index annuity’s returns are tied to the performance of a specified market index, such as the Dow Jones Industrial Average (the Dow), the S&P 500 or the Nasdaq Composite, and interest is credited periodically based on changes in the index of focus. Beyond this foundational construct, there are various interest crediting methods and pricing components that influence how much interest an annuity will earn.

A prominent component is the interest rate spread, which can be characterized as a hurdle that must be cleared before interest is credited to an annuity.

“Annuity crediting amounts can vary from company to company and may change based on the underlying index chosen. One suggestion I consistently offered clients was to back-test or model how an annuity would have performed in multiple past market environments. This ensures a comprehensive understanding of what is possible with a given product.

How Does an Interest Rate Spread Work on an Annuity?

Generally, the insurance company issuing a fixed index annuity sets a percentage for the interest rate spread each new contract year. This percentage is subtracted from the period-to-period change in the specified index before interest is credited to the annuity. The higher the spread, the lower the potential return.

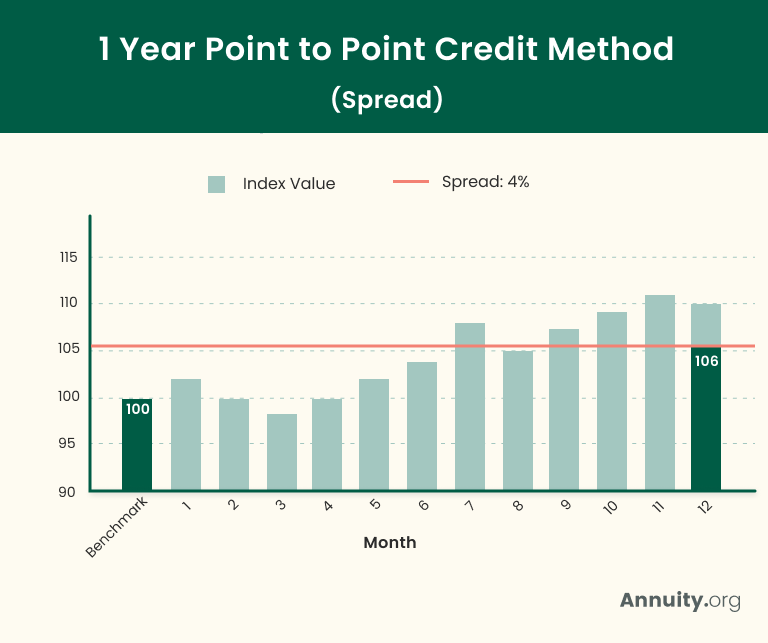

In this example, the difference between the ending value and the benchmark value is 10%. The Spread applied is 4%, which means that the final growth applied to the contract will be 4% lower than the difference between the ending value and the benchmark value.

This results in 6% growth being applied to the contract. If the difference between the ending value and the benchmark value was 4%, the annuity would be credited with 0% growth for the year.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Why Do Rate Spreads Exist for Fixed Index Annuities?

To explain why spreads exist for fixed index annuities, we need to take a step back and contrast them with the other two types of annuities, fixed and variable annuities.

With a fixed annuity, the annuitant’s rate of return is guaranteed, and the annuity issuer assumes all market risk. Conversely, with a variable annuity, the annuitant’s growth potential is limitless, but he or she generally assumes all market risk.

On the risk-return spectrum, fixed index annuities fall between these types of instruments. They can generate higher returns than fixed annuities, but they do not offer as much upside potential as variable annuities.

The returns generated by fixed index annuities can exhibit a fair amount of volatility. However, these contracts provide downside protection via a guaranteed minimum rate of return, which is often referred to as a floor.

The minimum guarantee is good for investors, but it exposes annuity issuers to heightened economic risk. They manage this exposure by restricting the growth potential of fixed index annuities with interest rate spreads, caps and participation rates.

If these limiting features were not included in fixed index annuity contracts, insurers would not be able to sell these instruments profitably – leaving a void between fixed annuities and variable annuities. Ultimately, this would harm consumers looking for limited upside potential coupled with the safety of a downside guarantee.

Interest rate spreads, caps and participation rates exist so that fixed index annuities can exist.

Do Rate Spreads Make Fixed Index Annuities a Poor Investment Choice?

Only the person buying an annuity with a rate spread can attest to whether it is a good investment. All investment decisions are highly personal and should be based on the unique circumstances, investment objectives and risk tolerance level of the investor in question.

That said, if you wish to maximize your money’s growth potential without assuming the downside risk inherent in mutual funds and variable annuities, fixed index annuities can be a sensible part of a retirement strategy.

Just remember, annuities are relatively low-risk, low-returning vehicles that are not ideal for long-term investors focused on capital appreciation. They can be highly beneficial to conservative, hands-off investors who value a predictable stream of income, but they do not make sense for everyone.

If you need help assessing whether annuities are appropriate for you, consult with a financial advisor. He or she can help you establish a holistic wealth management plan.

The typical indexed annuitant is an individual who is not comfortable risking loss of principal in exchange for unlimited upside potential. However, he or she desires to earn more than what is available via a fixed annuity.

Worried About Your Retirement Savings?

Other Frequently Asked Questions About Rate Spreads

Generally, fixed annuities are the safest type of annuity contract you can buy. Fixed index annuities are modestly riskier because their returns can exhibit a fair amount of volatility. Variable annuities are the riskiest type of contract because they expose investors to the possibility of losing their initial investment.

Like an interest rate spread, an interest rate cap is a limiting feature of a fixed index annuity. Essentially, it puts a ceiling on an annuitant’s crediting rate. For example, if a fixed index annuity has a rate cap of 8% and the specified index increases by 12% during a measurement period, the interest credit will be limited to 8%.

A participation rate is another type of limiting feature of a fixed index annuity. It specifies the extent to which an annuitant can participate in the performance of the specified index.

For example, if a fixed index annuity has a participation rate of 80% and the specified index increases by 12% during a measurement period, the interest credit will be limited to 9.6% (0.80 × 12% = 9.6%).

Editor Sierra Campbell contributed to this article.