How Do Interest Rate Caps Work?

An interest rate cap is a limiting feature of a fixed index annuity -also known as an indexed annuity- contract. It enables an annuity provider to put a ceiling on an annuitant’s crediting rate, and most contracts allow the annuity issuer to revise the cap at the beginning of each new annual term.

Key Facts About Rate Caps

- Rate caps allow insurers to cover operational costs, satisfy interest crediting needs and retain an adequate margin for investors.

- Like interest rate spreads and participation rates, interest rate caps restrict the growth potential of fixed index annuities.

- Interest rate caps can change at the beginning of each contract year. The lower the cap, the lower the return

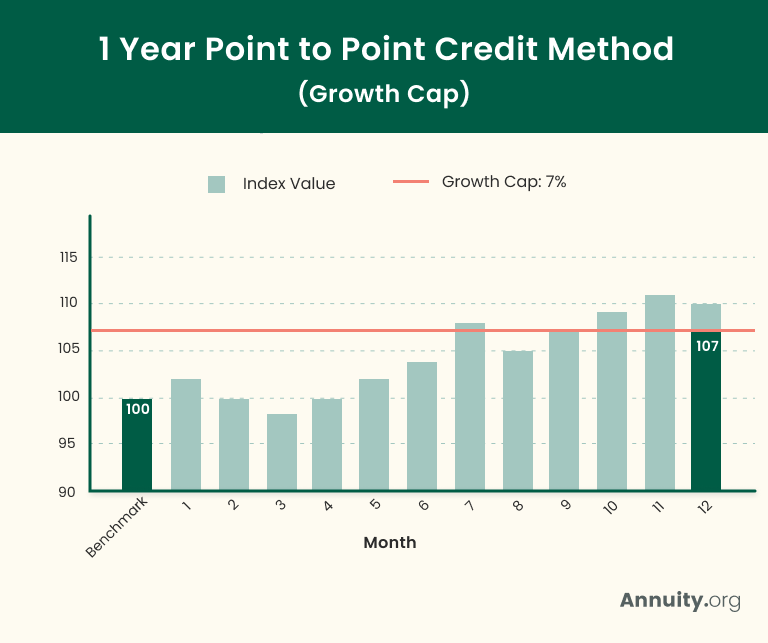

For illustrative sake, consider the following example:

After calculating the difference between the ending value and the benchmark value of the point-to-point crediting, the growth cap is applied if the percentage increase exceeds the cap. In this example the difference between the ending value and the benchmark value is 10%. However, the growth cap on this particular annuity is 7%, which means only 7% growth will be applied for this year. Point-to-point crediting does not exceed the cap, then the entirety of the growth is applied.

Read More: Current Annuity Rates

You can think of rate caps as a type of fee or cost (though they’re not technically a fee). If you want to transfer the downside risk to the annuity company, there is a cost associated. In the case of fixed index annuities and RILAs, the cost is the cap on interest rates.

Why Do Rate Caps Exist for Fixed Index Annuities?

An insurer that sells fixed index annuities must run a profitable operation to maintain and grow its book. Doing so means investing in a manner that enables the insurer to satisfy its interest-crediting obligations, cover its administrative costs, and retain an adequate margin for investors.

Operating profitably is tough for any business. For fixed index annuity issuers who guarantee their customers no risk of loss, the challenge is significantly elevated.

This is where interest rate caps come into play. These pricing levers enable insurers to mitigate their economic risk by limiting annuitants’ upside potential and establishing a more equitable risk-return tradeoff. In down market years, insurers will suffer financial losses, but they can make up for them in up market years.

Interest rate caps, interest rate spreads and participation rates exist so that fixed index annuities can exist. Without them, investors would not be able to passively participate in positive markets with no downside risk.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Do Rate Caps Make Fixed Index Annuities a Hard Investment Choice?

Interest rate caps do restrict fixed index annuities’ growth potential, allowing annuity issuers to provide downside protection. However, this does not make fixed index annuities inferior to other investments.

These caps serve as a pricing lever that allows insurers to sell this type of annuity. When you purchase an indexed annuity with a rate cap, you are agreeing to accept a lower return in exchange for principal protection. You do give some upside potential up, but the annuity provider has assumed all the downside market risk.

If you do not want to forgo potential returns, you might want to invest in diversified stock funds, a real estate investment trust (REIT) or a variable annuity. You should speak with a fiduciary financial advisor to discuss your unique situation and find the best investment option for you.

Other Frequently Asked Questions About Rate Caps

Fixed annuities are typically the safest type of annuity contract you can buy. They provide a fixed rate of return and exhibit zero volatility. Fixed index annuities are modestly riskier because their returns can fluctuate.

Variable annuities are the riskiest type of annuity contract; they entail investment positions in volatile assets, which expose investors to the possibility of loss of principal.

An interest rate floor is the guaranteed minimum rate of return provided on an annuity. Stated as a percentage, it is the minimum amount of interest you can expect to be credited to your annuity for any given contract year.

Like an interest rate cap, an interest rate spread is a limiting feature of a fixed index annuity. It is a hurdle that must be cleared before interest is credited to an annuity contract.

For example, if an indexed annuity has a rate spread of 4% and the specified index increases by 13% during a measurement period, only 9% will be credited to the annuity’s value (13% index performance less the 4% rate spread).

A participation rate is a type of limiting feature of fixed index annuities. Stated as a percentage, it specifies the extent to which an annuitant can participate in the performance of the index specified in the annuity contract.

For example, if a fixed index annuity has a participation rate of 75% and the specified index increases by 16% during a measurement period, the interest credit will be limited to 12% (75% × 16% = 12%).

Some fixed index annuities with rate caps are also subject to participation rates or interest rate spreads, which can further restrict growth potential.

For example, if a fixed index annuity has a rate cap of 11% and a participation rate of 75% and the specified index increases by 20% during a measurement period, the interest credit will be limited to 11%. The participation rate implies a credit of 15% (75% × 20% = 15%), but the cap limits the credit to 11%.

Editor Sierra Campbell contributed to this article.