The Main Types of Annuities

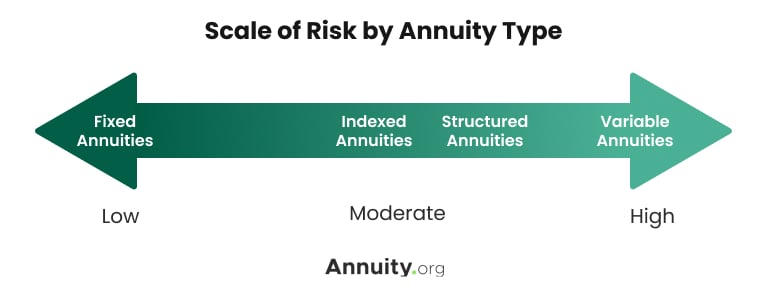

Annuities are diverse products. There are several types, each suited to various financial situations and goals.

Some options, like fixed annuities, are straightforward with few bells and whistles. Other options, like variable annuities, can be much more complex but potentially result in higher returns.

The Main Types of Annuities

- Fixed Annuity

- Fixed Index Annuity

- Variable Annuity

Establishing your goals from the outset can help you narrow your choices as you compare products.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Immediate vs. Deferred

Another thing to note about annuities is whether they are immediate or deferred products.

Immediate annuities are typically purchased with a lump-sum payment and begin an income stream within a year of purchase. Retirement accounts such as a 401(k) often fund immediate annuities, and they are a good option for those who are ready to leave the workforce but still want to maintain a steady income.

With a deferred annuity, you receive payments that start in the future. Typically, this happens when you retire. In the meantime, your investment grows on a tax-deferred basis. In addition to when you start receiving payments, you can choose how long you want to receive them.

Typically, people use annuity payouts to protect against longevity risk. Annuities can provide guaranteed lifetime income so you don’t outlive your retirement savings. But you can also arrange for an annuity to pay out over a fixed period. This can be done through SPIA/DIA, QLAC or income riders.

Some annuity types offer both deferred and immediate options. For example, there are both deferred and immediate fixed annuities.

Fixed Annuities

Fixed annuities are the type of annuity product that generally exposes buyers to the least risk while providing the most predictability.

These annuities include a guaranteed, set interest rate that you lock in when you sign your contract and remains static for the length of that contract. While other investment options might soar or dive, a fixed annuity remains relatively steady, paying out to you exactly what was spelled out in your contract.

This is why fixed annuities tend to be a hit with conservative investors who are either nearing or already in retirement.

But it’s important to keep in mind that there are several types of fixed annuities, and that they can appeal to different audiences. This can be done through SPIA/DIA, QLAC or income riders.

Multi-Year Guaranteed Annuities (MYGAs)

One common type of fixed annuity is a MYGA. It offers a fixed interest rate for a specified time, typically for three to 10 years. It operates similarly to a CD, allowing you to lock in a guaranteed growth rate for your money.

But, particularly in recent years, available rates often outpace that of CDs.

A MYGA is generally best suited for people nearing retirement and looking for a way to defer taxes while guaranteeing a return on their investment.

Worried About Your Retirement Savings?

Single Premium Immediate Annuity (SPIA)

The other common type of fixed annuity is a single premium immediate annuity — or sometimes an income annuity — which, as the name implies, results in immediate payments.

When you purchase a SPIA, you do so with a significant lump-sum payment. This amount is then converted into a guaranteed stream of payments that can last for the rest of your life or a period you set.

You can also structure the annuity to continue to provide payments to a spouse after your death. For period certain annuities, you may also elect a non-spouse as the beneficiary of the income payments.

SPIAs can be a strong option for those who have an existing nest egg that they wish to use to protect themselves from longevity risk.

Fixed Index Annuities

Fixed index annuities are popular products, partly because they provide a middle ground between the complete predictability of a fixed annuity and the market risk of other traditional investments.

The payout you receive from a fixed index annuity can vary because it ties to the performance of a market index. The S&P 500 is a common choice, but some products offer several index options for you to choose from.

However, while you are exposed to some market risk (and potential growth), your principal remains secure, and you are not at risk of losing it.

You can also often establish floors and caps on the potential gains of the index your annuity is tied to. This will cap your growth lower than what you might make from traditional investing but also significantly mitigate your potential losses.

Fixed index annuities are popular among more conservative investors who want to take advantage of a strong market without worrying about the risk of losing their initial investment or coming out behind.

Variable Annuities

Some of the main benefits that draw people to annuities are their built-in safety and principal protection. Variable annuities do not work that way and are suitable for a particular audience.

When you have a variable annuity, your payments fluctuate based on the performance of subaccounts that fund the annuity’s growth. These subaccounts work similarly to mutual funds and include stocks, bonds and money market accounts.

So, if you are mainly interested in annuities for their low risk or predictability, a variable annuity may not make sense.

Variable annuities can make sense for tax-sensitive high-income individuals or for those who already have a set source of guaranteed income and are looking for ways to grow on top of it.

Annuities are a good choice of product in a sound financial plan. I share with my clients the risk and reward calculator and lay out the pros and cons of all three types of annuities prevalent in the market: fixed, fixed index and variable. My experience has shown me that they are all good, but must be tailored to individuals based on age, goals, needs, time horizon, risk tolerance and other important factors. It’s not a cookie cutter approach, it’s calculative. I generally will use all three types and build a portfolio that best fits the consumer’s needs.

Other Annuity Choices

Beyond the most common types, there is a wide variety of annuities. These can be tailored to your specific needs and long-term financial goals.

There are options that allow you to take advantage of tax breaks for qualified retirement accounts, such as traditional IRAs and 401(k) plans. You can also set up annuities to continue payments to beneficiaries after you die.

- Long-Term Care Annuities

- A tax-deferred annuity with a rider that sets up payments for long-term care if you need it in the future.

- Group Annuity Contracts

- Annuities offered through employers as part of a retirement benefits package.

- Charitable Gift Annuities

- Annuities purchased by charities on behalf of donors using the donor’s financial gift to the charity. The donor receives payments until their death, upon which the charity receives the remaining balance.

- Individual Retirement Annuities

- Annuities that provide tax benefits similar to an individual retirement account (IRA).

- Registered Index-Linked Annuities

- A RILA uses a stock market index to determine gains and losses and lets you set the maximum loss you are willing to tolerate.

- Thrift Savings Plan (TSP) Annuities

- An annuity purchased using funds from a TSP account.

Other options include:

Still Not Sure Where to Begin?