What Are the U.S. Federal Tax Brackets for 2024 and 2025?

Your bracket is determined by how much taxable income you receive each year and your filing status. There are five filing statuses and seven graduated tax rates for 2024 taxes due in April 2025 and 2025 taxes due in April 2026.

Key Facts About Current 2024-2025 Tax Brackets

- Federal and state tax brackets and rates can change over time.

- You can reduce your federal income tax bill through various tax deductions, credits and income deferment strategies.

- State individual income taxes apply in 42 states, with 14 having flat tax rates and 27 states and Washington D.C. having graduated rates.

- Single

- You can file as single if you are not married or are divorced.

- Head of Household

- You can file as head of household if you are unmarried, divorced, have a qualifying child or dependent and paid more than half the costs of running the household where the child or dependent lived for at least half of the year.

- Married Filing Jointly

- Couples married by December 31 have the option to file a joint tax return for that year.

- Married Filing Separately

- Couples married by December 31 have the option to file separate tax returns for that year.

- Qualifying Widow(er)

- If you become widowed within the year, you can still file jointly or married filing separately. After that, you can file as a widow(er) for up to two years, as long as you don’t remarry and you have a dependent child.

Federal Income Tax Filing Statuses

Each of these filing statuses has its own tax brackets. The brackets are beginning and end points at which your income is taxed at a specific rate. Understanding how tax brackets work – and which bracket your income falls into – can be helpful in your overall personal finance strategy.

2024 Tax Brackets (For Taxes Due in 2025)

| Tax Rate | Single Filers Tax Brackets | Head of Household Tax Brackets | Marries Filing Jointly or Qualifying Widow Tax Brackets | Marries Filing Separately Tax Brackets |

| 10% | $0 to $11,600 | $0 to $16,550 | $0 to $23,200 | $0 to $11,600 |

| 12% | $11,601 to $47,150 | $16,551 to $63,100 | $23,201 to $94,300 | $11,601 to $47,150 |

| 22% | $47,151 to $100,525 | $63,101 to $100,500 | $94,301 to $201,050 | $47,151 to $100,525 |

| 24% | $100,526 to $191,950 | $100,501 to $191,950 | $201,051 to $383,900 | $100,526 to $191,950 |

| 32% | $191,951 to $243,725 | $191,951 to $243,700 | $383,901 to $487,450 | $191,951 to $243,725 |

| 35% | $243,726 to $609,350 | $243,701 to $609,350 | $487,451 to $731,200 | $243,726 to $365,600 |

| 37% | $609,351 or more | $609,351 or more | $731,201 or more | $365,601 or more |

2025 Tax Brackets (For Taxes Due in 2026)

| Tax Rate | Single Filers Tax Brackets | Head of Household Tax Brackets | Marries Filing Jointly or Qualifying Widow Tax Brackets | Marries Filing Separately Tax Brackets |

| 10% | $0 to $11,925 | $0 to $17,000 | $0 to $23,850 | $0 to $11,925 |

| 12% | $11,926 to $48,475 | $17,001 to $64,850 | $23,851 to $96,950 | $11,926 to $48,475 |

| 22% | $48,476 to $103,350 | $64,851 to $103,350 | $96,951 to $206,700 | $48,476 to $103,350 |

| 24% | $103,351 to $197,300 | $103,351 to $197,300 | $206,701 to $394,600 | $103,351 to $197,300 |

| 32% | $197,301 to $250,525 | $197,301 to $250,500 | $394,601 to $501,050 | $197,301 to $250,525 |

| 35% | $250,526 to $626,350 | $250,501 to $626,350 | $501,051 to $751,600 | $250,526 to $375,800 |

| 37% | $626,351 or more | $626,351 or more | $751,601 or more | $375,801 or more |

Marginal Tax Rate

The terms tax rate and tax bracket are often used interchangeably, but they are different things.

The marginal tax rate is the tax rate you pay on an additional dollar of income. The federal income tax’s progressive nature causes the marginal tax rate to increase as your taxable income increases. These different percentage amounts – or tax rates – are broken into seven tax brackets.

A tax bracket is a certain block of your income. Each tax bracket has a different tax rate. Unless your income is in the lowest bracket, your income will fall into multiple tax brackets.

Let’s Talk About Your Financial Goals.

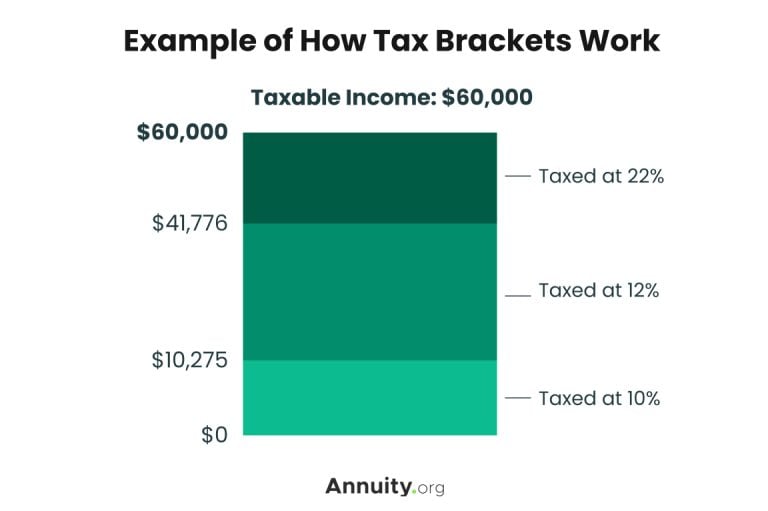

How Do Tax Brackets Work?

The federal income tax is a progressive system. People who make higher incomes are taxed at progressively higher rates.

The federal government divides your income into blocks of money. Each block is a tax bracket. Each bracket of income is taxed at a progressively higher rate.

Not all of your income is taxed at the highest rate for your income. Each block of income is taxed at the rate for that particular bracket.

Take a look at the 2024 tax brackets if you filed single with $60,000 in taxable income.

2024 Tax Rates and Tax Brackets

| Tax Rate | Tax Bracket | Tax Owed |

| 10% | $0 to $11,600 | 10% of taxable income |

| 12% | $11,601 to $47,150 | $1,160 + 12% of the amount over $11,600 |

| 22% | $47,151 to $100,525 | $5,426 plus 22% of the amount over $47,150 |

How To Reduce Your Tax Bill

There are steps you can take to legally reduce your tax bill by getting into a lower tax bracket. These generally work best if you are on the edge of a higher tax bracket where slightly lowering your income could keep you from crossing that line.

- Tax deductions

- Tax deductions such as charitable contributions can lower your taxable income, reducing your tax bill and possibly keeping you in a lower tax bracket.

- Earned income tax credit (EITC)

- The EITC helps low to moderate income taxpayers with a tax break. People who qualify can use the credit to reduce their tax liability and this may move them to a lower tax bracket.

- Child tax credit

- You can claim the child tax credit worth up to $2,000 for each dependent child. This reduces your tax liability on a dollar-for-dollar basis and may add up to enough to move your taxable income to a lower tax bracket.

- Other strategies

- If you delay income until after the first of the year, this may keep that income from being taxed at a higher rate this year. You can also make last-minute contributions to tax-deferred or tax-exempt accounts such as a health savings account, 401(k) or individual retirement account (IRA) to lower your taxable income.

Options To Move Into a Lower Tax Bracket

You may be able to use multiple strategies, credits and deductions to significantly reduce your tax liability, keeping your taxable income within a lower tax bracket. Tax preparation software and professionals may also help you find additional tax breaks that can help reduce your tax bill.

State Tax Brackets

Individual income taxes accounted for 33% of all state tax collections in 2023, according to the U.S. Census Bureau. But state income tax brackets – and state income tax laws – vary from state to state.

State Income Taxes by the Numbers

- In 2025, 42 states collect individual income taxes.

- Forty-one states tax only wage and salary income.

- One state (Washington) only taxes capital gains income.

- Eight states collect no state income taxes.

- Fourteen states that collect income taxes have single rates applying to all taxable income.

Source: Tax Foundation

The eight states that collect no state income taxes have no state tax brackets.

States With No Income Tax

- Alaska

- Florida

- Nevada

- South Dakota

- New Hampshire

- Tennessee

- Texas

- Wyoming

- Washington

Source: Tax Foundation

The tax rate differs among the 14 states that collect a flat rate on income from salaries and wages. Washington includes capital gains income for high earners.

States With a Flat Income Tax Rate

- Arizona

- Colorado

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kentucky

- Louisiana

- Michigan

- Mississippi

- North Carolina

- Pennsylvania

- Utah

Source: Tax Foundation

Of the 27 states and the District of Columbia that have graduated-rate income taxes, the number of tax brackets vary widely. Hawaii has 12 brackets, the most of any state.

The Federation of Tax Administrators provides links to the state tax agencies for all 50 states plus Puerto Rico and the District of Columbia. You can contact your state tax agency to find more information about your state’s income tax brackets and income tax rates.